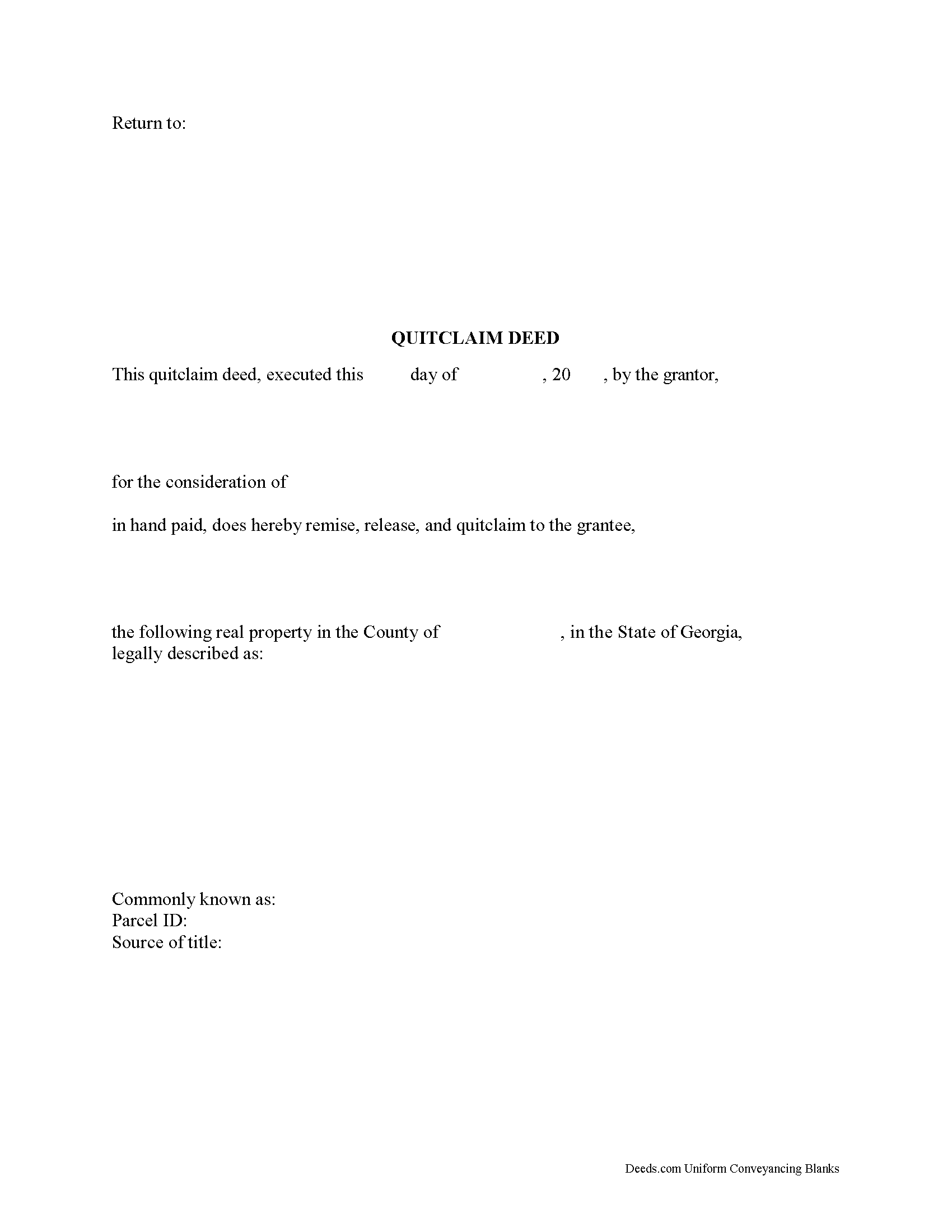

Cook County Quitclaim Deed Form

Cook County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Georgia recording and content requirements.

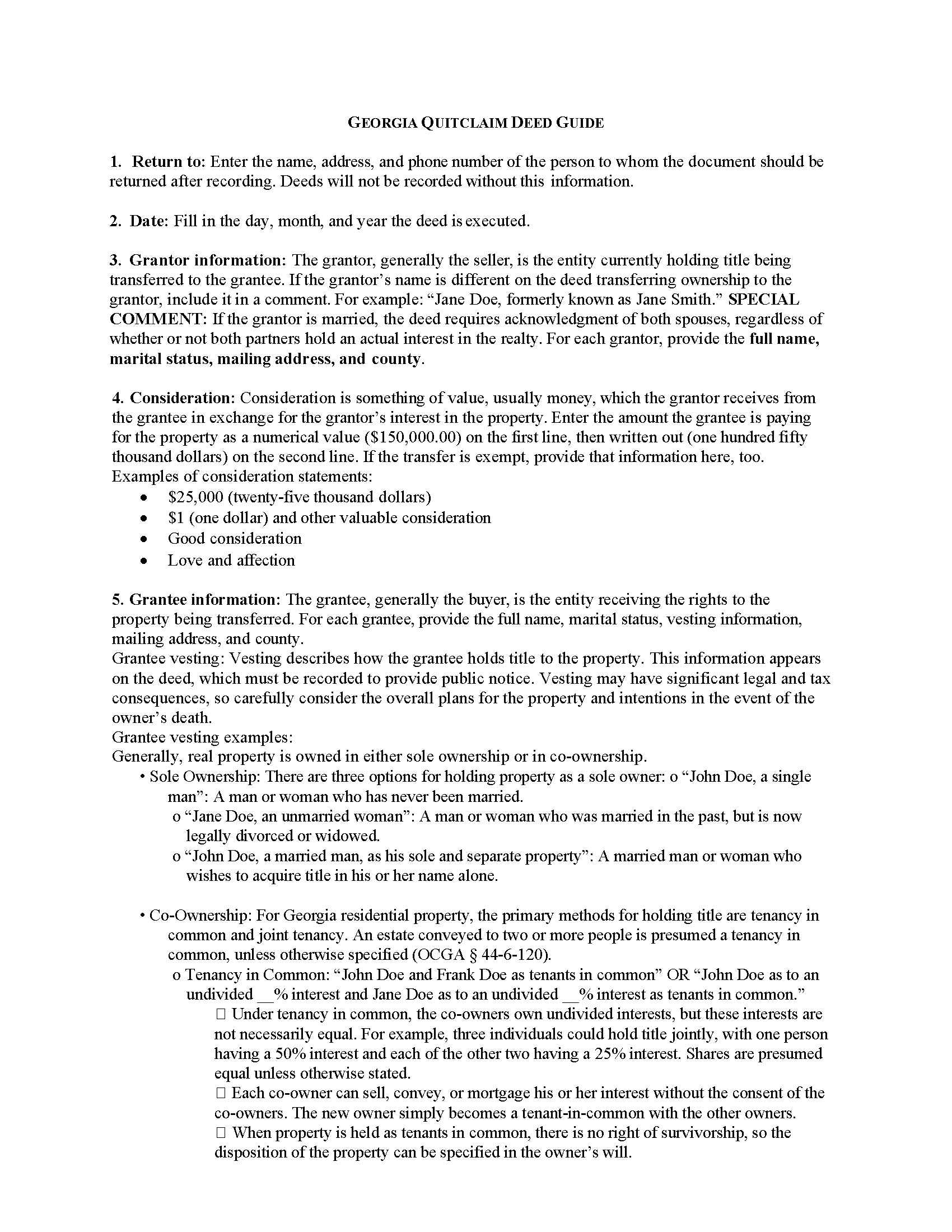

Cook County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

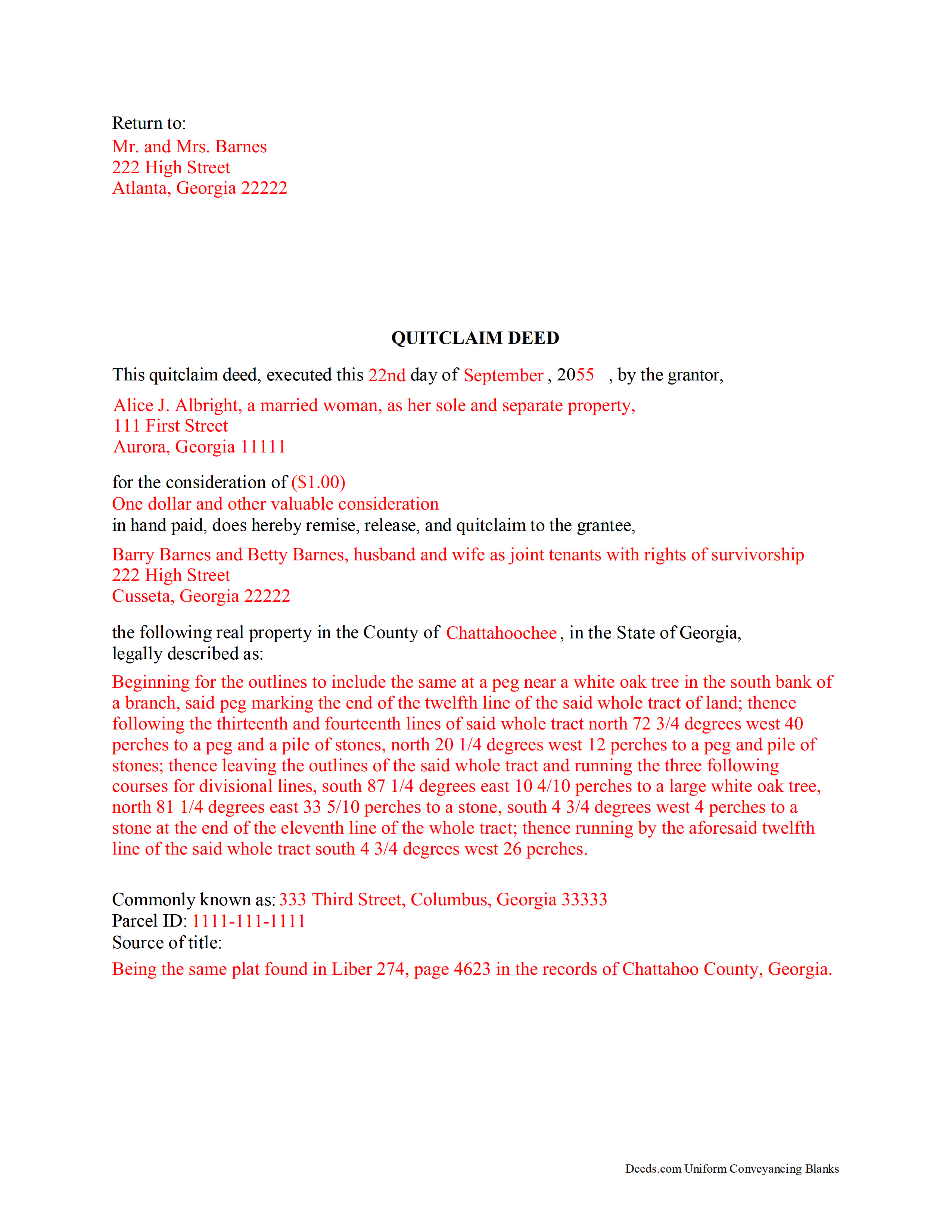

Cook County Completed Example of the Quitclaim Deed Document

Example of a properly completed Georgia Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Cook County documents included at no extra charge:

Where to Record Your Documents

Cook Clerk of Superior Court

Adel, Georgia 31620

Hours: 8:00am - 5:00pm Monday - Friday

Phone: (229) 896-7717

Recording Tips for Cook County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Cook County

Properties in any of these areas use Cook County forms:

- Adel

- Cecil

- Lenox

- Sparks

Hours, fees, requirements, and more for Cook County

How do I get my forms?

Forms are available for immediate download after payment. The Cook County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cook County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cook County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cook County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cook County?

Recording fees in Cook County vary. Contact the recorder's office at (229) 896-7717 for current fees.

Questions answered? Let's get started!

Georgia Quitclaim Deed Form Content:

Quitclaim deeds in Georgia are not specifically defined by statute. In fact, according to O.C.G.A 44-5-33, the deed must merely contain sufficient information to clearly represent the grantor's intention. As such, a heading of "Quitclaim Deed" alerts the recorder or title reviewer to the purpose of the conveyance. Quitclaim deed documents do not contain a guarantee title for the grantee. In fact, O.C.G.A. 44-5-61 declares that there is no implied warranty of title in any deed for land.

O.C.G.A. 44-5-30, provides the minimum requirements for deeds conveying real property, stating that a deed conveying land must be in writing; signed by the grantor; witnessed by two people who are not parties to the quit claim deed---one witness may be the notary or other official who acknowledges the grantor's execution of the document; and information about the consideration (value, usually money) given in exchange for the property. Deeds must also contain a name and return address at the top of the first page. In addition to these requirements, include the following information to ensure clarity of ownership: the full names and addresses of all parties (grantors and grantees); the grantee's marital status and vesting choice (how the grantee intends to hold title), and a complete legal description of the land.

Recording:

Georgia follows a "race-notice" recording statute. This means that according to O.C.G.A 44-2-1, 44-2-3, all documents changing how land is titled must be recorded in the office of the clerk of the superior court in the county where the land is located. By recording the instrument, the transfer is entered into the public record and serves as notice to future bona fide purchasers (buyers for value). There is no time limit for recording a quit claim deed, but if the same grantor conveys a parcel of land to one grantee, who fails to record the deed, and conveys it again to another grantee who records it, the earlier grantee generally loses the property. Interestingly, Georgia places the burden of recording on the grantee, as stated in O.C.G.A 44-5-47. So, by recording the quit claim deed as soon as possible after execution, the grantee protects the interests of all parties involved as well as preserving a clear chain of title (ownership history), which will simplify future conveyances.

(Georgia Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Cook County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Cook County.

Our Promise

The documents you receive here will meet, or exceed, the Cook County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cook County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4573 Reviews )

David L.

March 9th, 2021

You did refund my payment, but were unable to provide the deed i needed.

Thank you!

ROBERT L.

April 1st, 2019

I got a blank, a sample and detailed instructions, I'm happy. If the recorder's office had a form as they like to see, with your name as they like to see, and the property name as they like to see, no one would ever pay a lawyer for this but a little time to look up the exact names and this package you're all set. I recommend this because, while it isn't difficult, making a mistake could be very bad so getting the details right for a particular county is well worth the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ralph B.

November 25th, 2023

My needs were met quickly and efficiently with very little wait. Deeds.com made it easy to understand and use their program and I couldn't be more happy with the results!

It was a pleasure serving you. Thank you for the positive feedback!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Laurie F.

February 24th, 2019

I am so glad I found Deeds.com. You had exactly what I needed and made it easy to download. I have bookmarked you in the event of further inquiry. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy S.

June 12th, 2021

The Quit Claim form was submitted, accepted, and processed by Davidson County with no hiccups. Recommended service!

Thank you!

Patrick S.

March 4th, 2019

Excellent!

Thank you!

Marilyn W.

April 25th, 2022

The Mineral Deed transfer form was pretty good. Could have used more info in the guide about where to find legal property descriptions and source of title. Also more space on the pdf for entering return addresses - there was room for only one; I needed three. I will be sending the form to the County Courthouse soon. I hope it works.

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

Dale A C.

January 31st, 2019

Deeds.com was a very efficient and simple website to use in preparing my documents needed to complete a real estate closing. I highly recommend this website, as it is easy to use, inexpensive, and effective.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raymond M.

January 11th, 2020

It would be really nice if you had an example of the document full size that can be examined/read before having to pay. I was gambling that it was the exact document that I needed when I paid my fee. Fortunately, it was, and I commend you for that.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph S.

June 30th, 2023

Excellent deed correction experience and guidance!!! Thank you! R. Scott.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leatrice K.

February 24th, 2021

I am how simple this site is to use. I am so thankful to be able to do this and not have to worry about traveling downtown. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Theresa B.

September 10th, 2019

Will review after I attempt to complete. I like your site. Im very nervous to try this Hope not outdated information. Will let you know if filing goes okay.

Thank you!

Jayne S.

December 20th, 2023

Simple and quick -- just what we needed!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!