Brantley County Revocation of Transfer on Death Deed Form

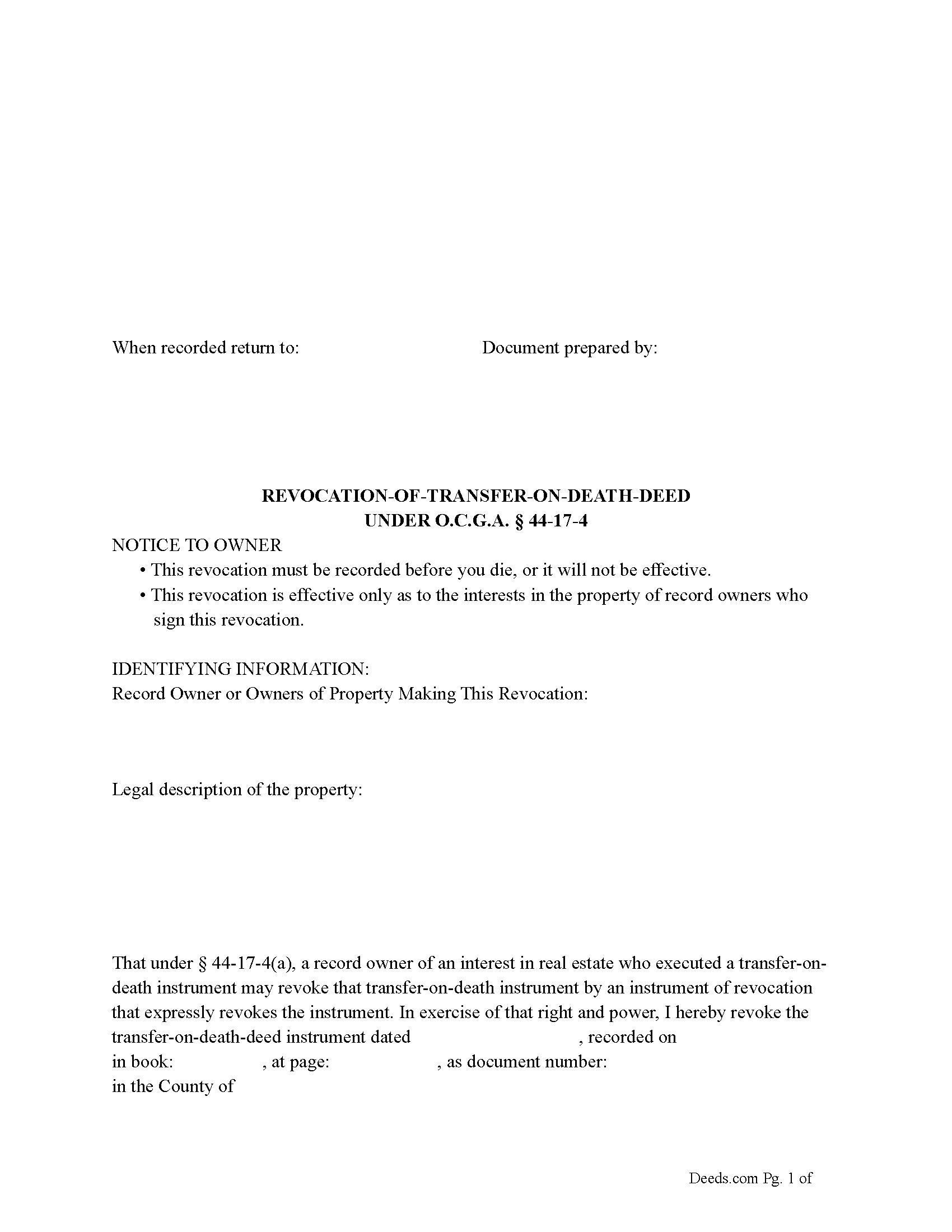

Brantley County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

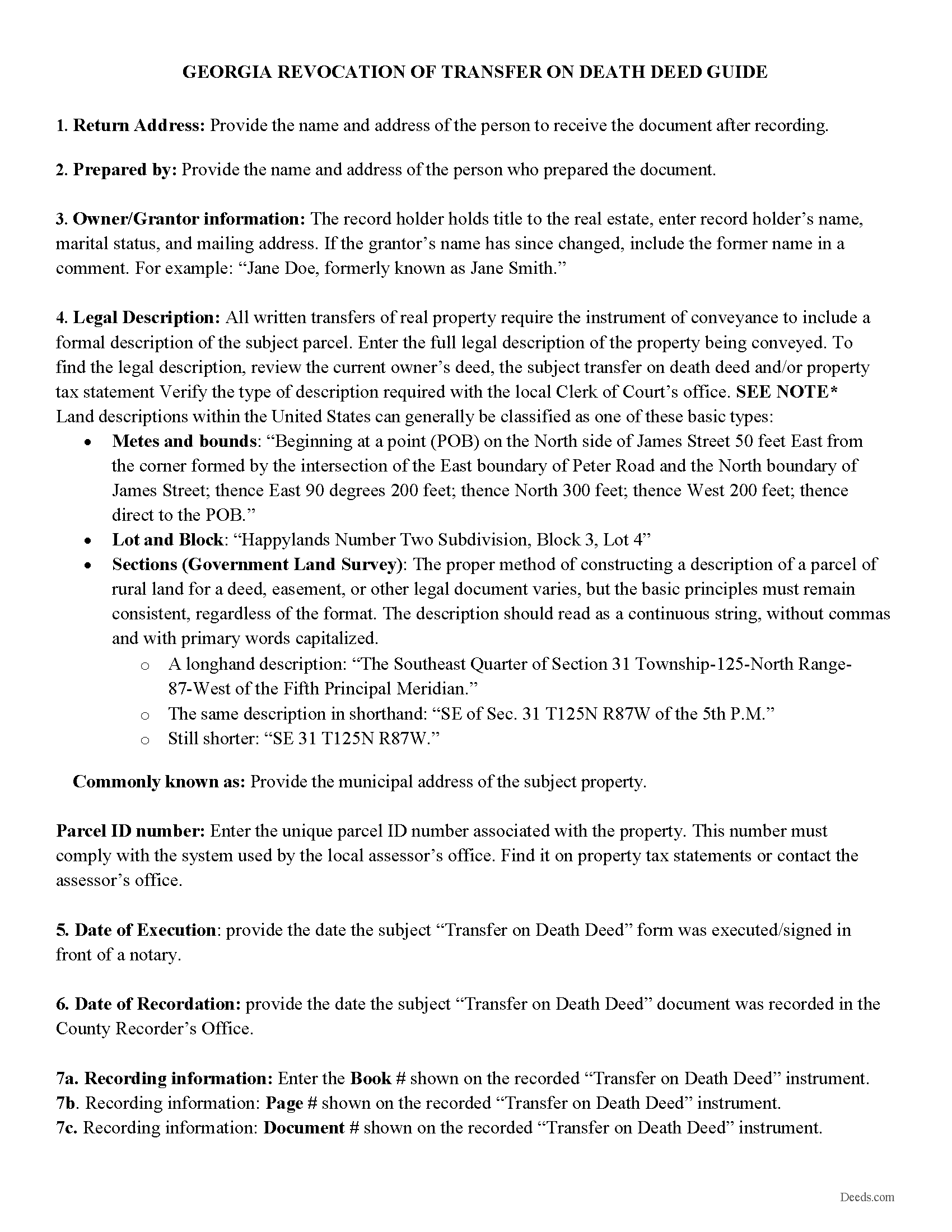

Brantley County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

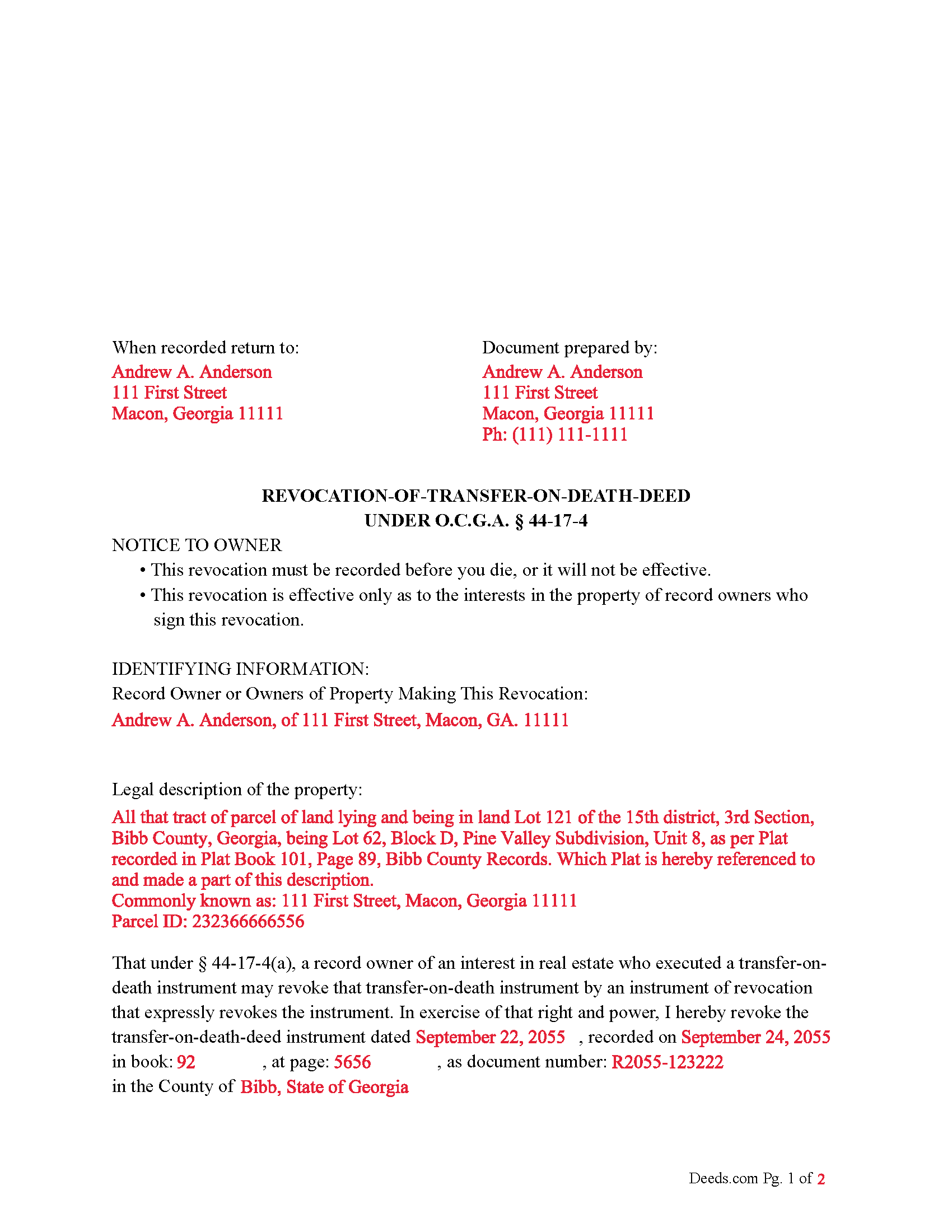

Brantley County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Brantley County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Nahunta, Georgia 31553

Hours: 8:00am-5:00pm M-F

Phone: (912) 462-5635

Recording Tips for Brantley County:

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Brantley County

Properties in any of these areas use Brantley County forms:

- Hoboken

- Hortense

- Nahunta

- Waynesville

Hours, fees, requirements, and more for Brantley County

How do I get my forms?

Forms are available for immediate download after payment. The Brantley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Brantley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Brantley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Brantley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Brantley County?

Recording fees in Brantley County vary. Contact the recorder's office at (912) 462-5635 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Brantley County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Brantley County.

Our Promise

The documents you receive here will meet, or exceed, the Brantley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Brantley County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

Pamela D K.

August 5th, 2020

very helpful. Was unable to find what I needed, but did everything they could to help. Will try them again in the future, if need be.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet J.

August 11th, 2020

They quickly advised they could not record a death certificate for me.

Thank you!

Matthew M.

February 15th, 2023

Needed copy of deed in trust. Found info here, paid on line and then printed the docs. Easy to use, no driving to city offices, No parking fees, no waiting in line. Done fast and easy. Love it.

Thank you for your feedback. We really appreciate it. Have a great day!

Shelby D.

May 1st, 2021

Not very helpful since I am married and the example provided is for single person. Nevada homestead requires spouse to sign off on quit claim deed but no guidance provided as to where this acknowledgment is placed on template form. There should be example for married person as well. Had to use another service. Waste of $21.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

June 15th, 2022

Very helpful and efficient

Thank you!

Rebekah T.

February 8th, 2021

Easy to use especially with instruction page and examples. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Bonnie A.

September 27th, 2021

I wish you could send copy in mail

Thank you for your feedback. We really appreciate it. Have a great day!

JESUS G.

June 13th, 2020

Easy And fast to use just scan upload and pay the fee and they take care of the rest.

Thank you!

RICHARD H.

October 29th, 2020

Wonderful

Thank you!

Pouya N.

November 6th, 2020

THEY ARE AWSOME. MAKE IT REALLY EASY AND EFFICIENT TO WORK. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

GISELLE G.

May 26th, 2022

Quick and easy. I will definitely use this services again.

Thank you!

Julie A.

November 23rd, 2021

This process was so easy. I am pleased with efficiency and ease of it all.

Thank you!

Allan S.

September 19th, 2024

Using this sofftware was a piece of cake! Donload was fast and simple. Using the guide supplied I did the Beneficiary Deed in no time. Would certainly use this service again without hesitation.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

deborah k.

April 7th, 2022

was very easy to fill out the directions were very helpful

Thank you!