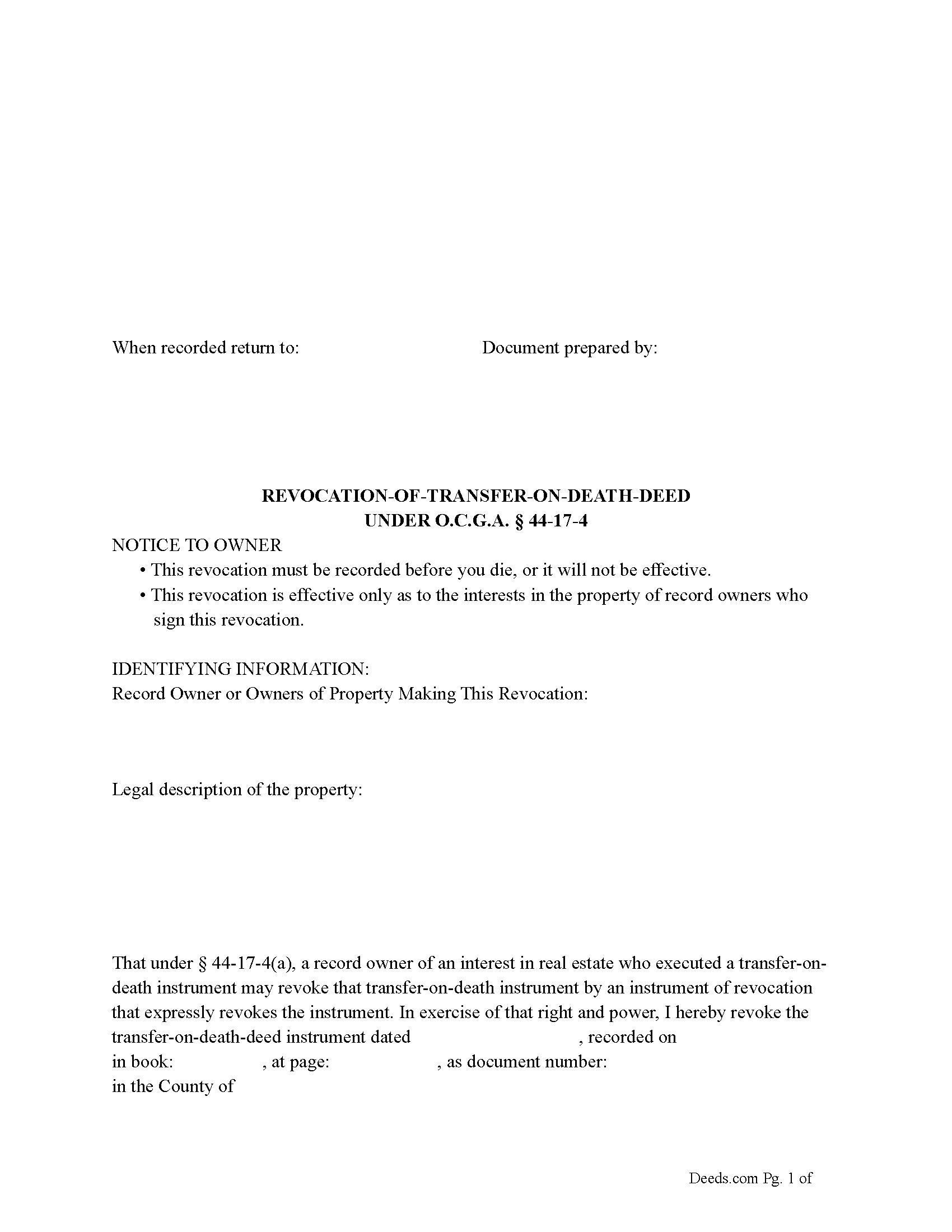

Bryan County Revocation of Transfer on Death Deed Form

Bryan County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

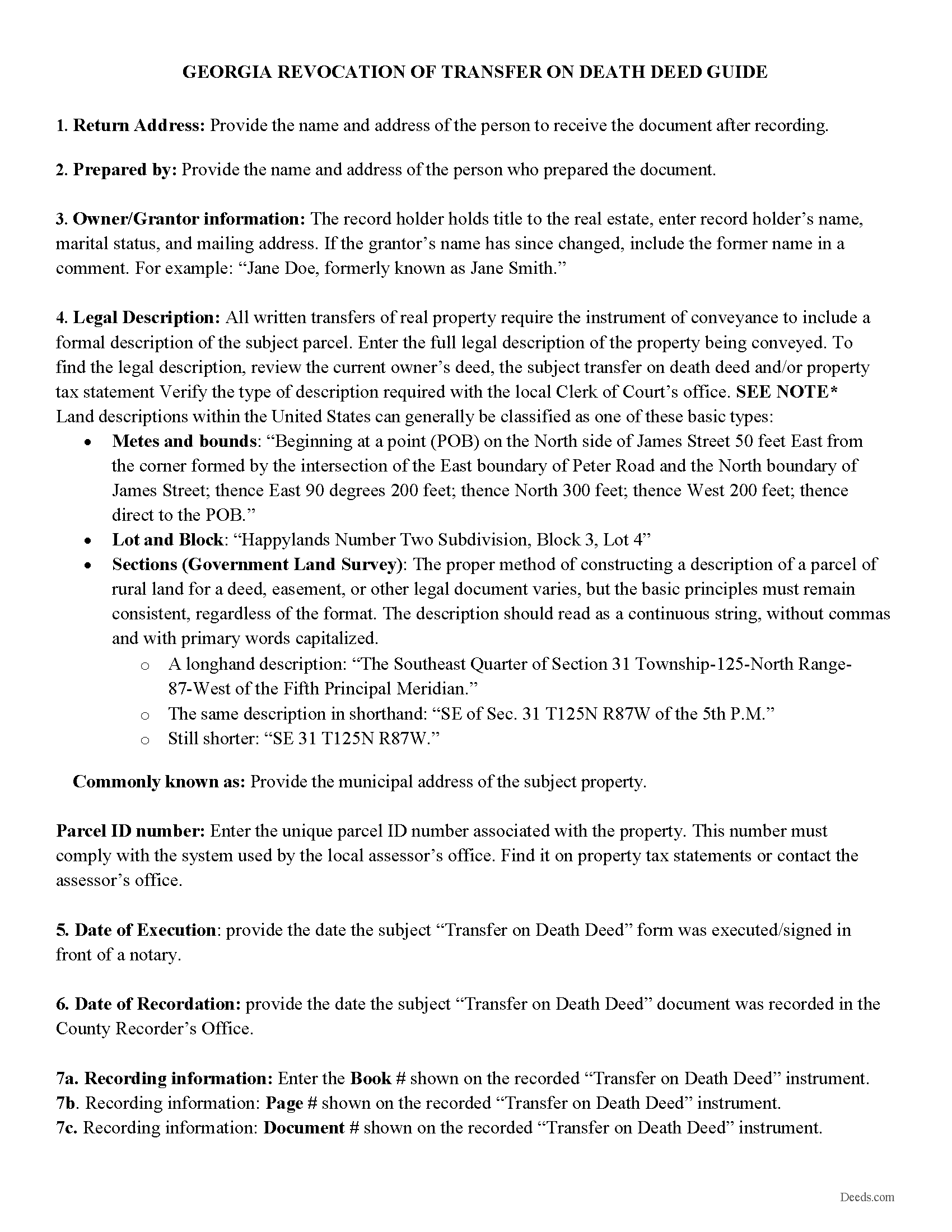

Bryan County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

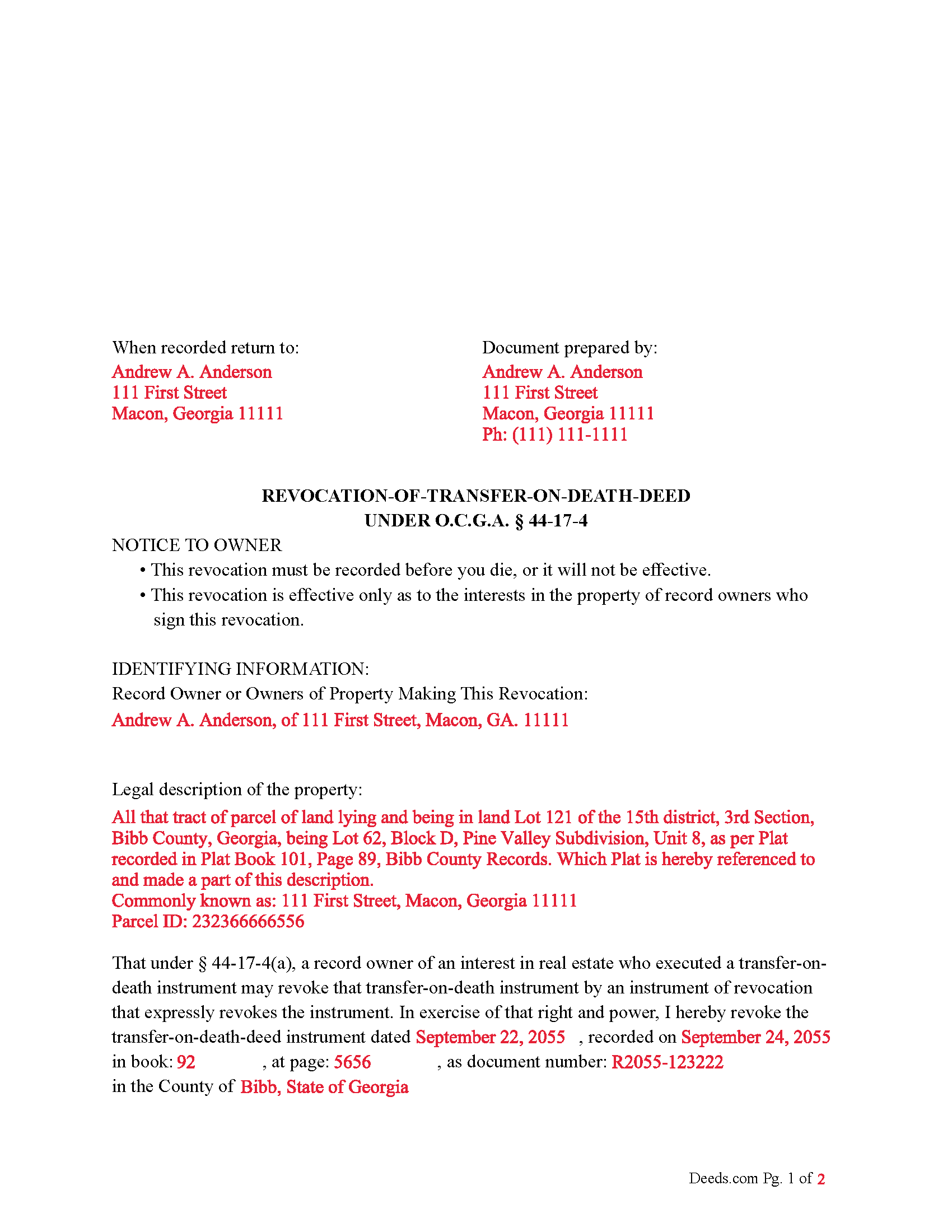

Bryan County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Bryan County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court, Real Estate Division

Pembroke, Georgia 31321

Hours: 8:00am-5:00pm M-F

Phone: (912) 653-5256

Recording Tips for Bryan County:

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Bryan County

Properties in any of these areas use Bryan County forms:

- Ellabell

- Pembroke

- Richmond Hill

Hours, fees, requirements, and more for Bryan County

How do I get my forms?

Forms are available for immediate download after payment. The Bryan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bryan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bryan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bryan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bryan County?

Recording fees in Bryan County vary. Contact the recorder's office at (912) 653-5256 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Bryan County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Bryan County.

Our Promise

The documents you receive here will meet, or exceed, the Bryan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bryan County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Robyn D.

July 28th, 2020

Excellent service, knowledgeable and helpful representatives via the messaging service. Reliable information provided by reps, overall excellent experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Resa J.

April 11th, 2019

Seamless. Excellent.

Thank you for your feedback Resa. Have a wonderful day!

Joey S.

March 5th, 2022

This is the easiest process ever!

Thank you!

Paula V.

April 15th, 2025

Fast, easy, helpful instructions. I’ll use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

John H.

September 16th, 2022

Response was timely, even though unsuccessful in locating a requested deed. Deeds very courteously and professionally cancelled my order and cancelled its charge to my credit card.

Thank you for your feedback. We really appreciate it. Have a great day!

Annette L.

July 6th, 2023

Wow -- amazingly fast turnaround and excellent customer service and communication. Thank you for saving me hours of time and effort!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sara D.

September 25th, 2019

Would have been beneficial to have more information about the previous sale history of the property. The report was received in a very timely manner.

Thank you for your feedback. We really appreciate it. Have a great day!

brenda S.

March 1st, 2019

Excellent instructions very easy to follow!

Thank you!

Tyler F.

December 14th, 2020

worked great!!!

Awesome, great to hear. Thank you.

Larry B.

May 18th, 2021

Poor quality document. Deed did not contain space for mandatory rax info required.

Thank you for your feedback Larry. We do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

MARIO D S.

March 7th, 2020

Well worth the $20.00 for the Transfer on Death Deed, if you are willing to do the leg work to notarize and record the deed. Money well spent and money well saved. The value is in the short, bullet type instructions and State specific forms and requirements.

Thank you!

FLORIN D.

December 3rd, 2020

Excellent service, will use in the future and will recommend to anyone that needs to record documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheila P.

May 17th, 2023

What a great service to provide with excellent directions! At first I thought I would need an attorney, but I walked through the steps and now I have it finished! Saved a ton of money. Thanks Deed.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Neira S.

January 20th, 2019

No problem with Recorders Office using your document. It is now completed and recorded.

Thank you Neira, have a wonderful day!