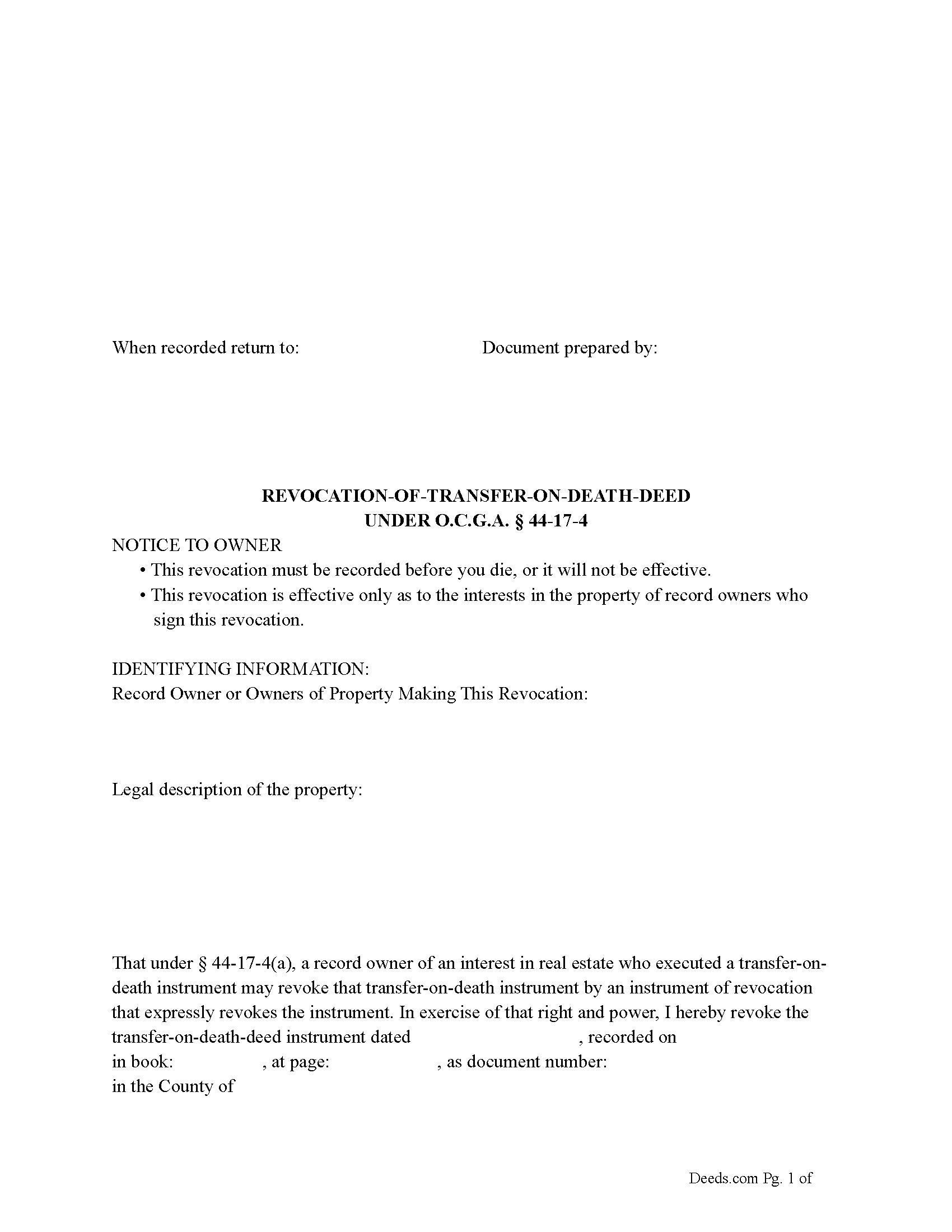

Hancock County Revocation of Transfer on Death Deed Form

Hancock County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

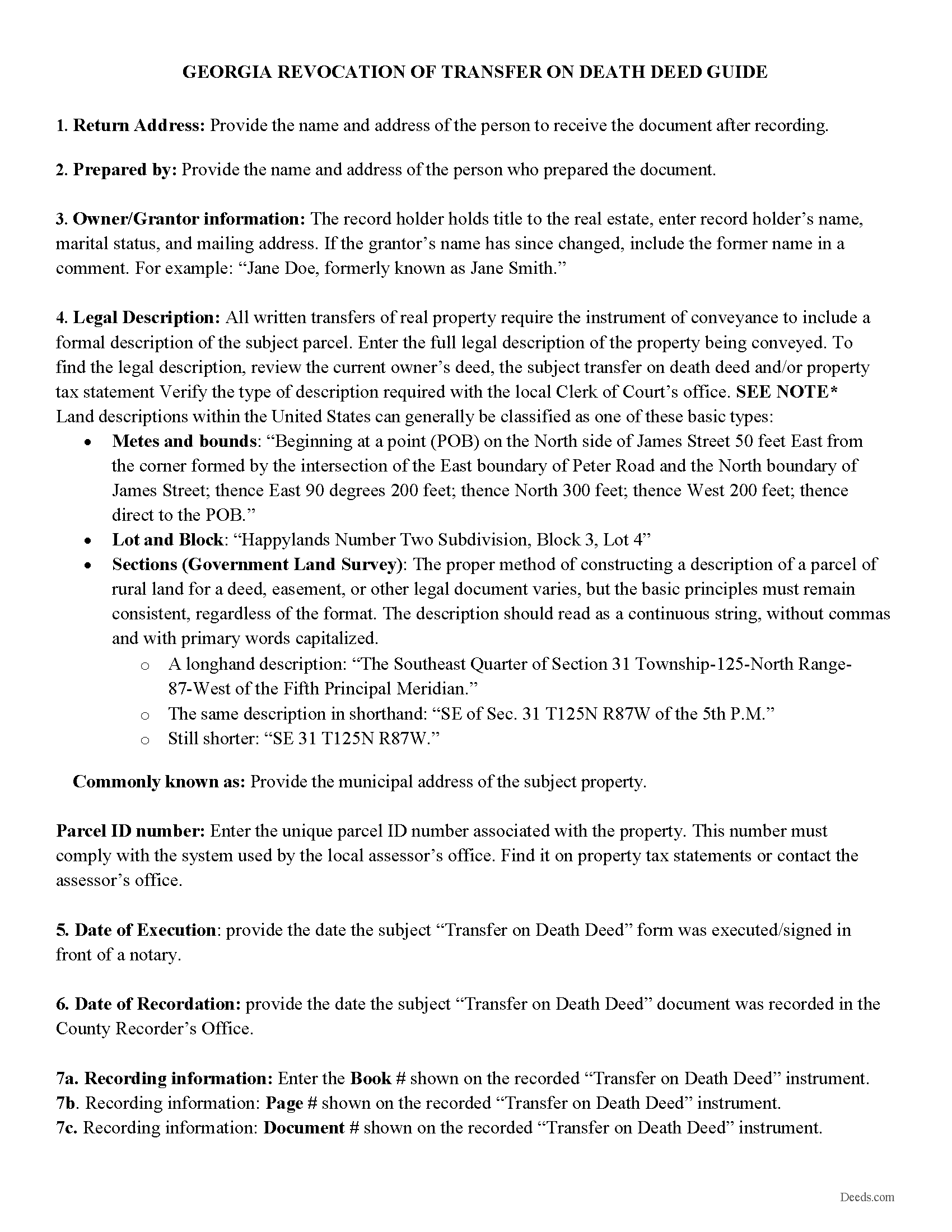

Hancock County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

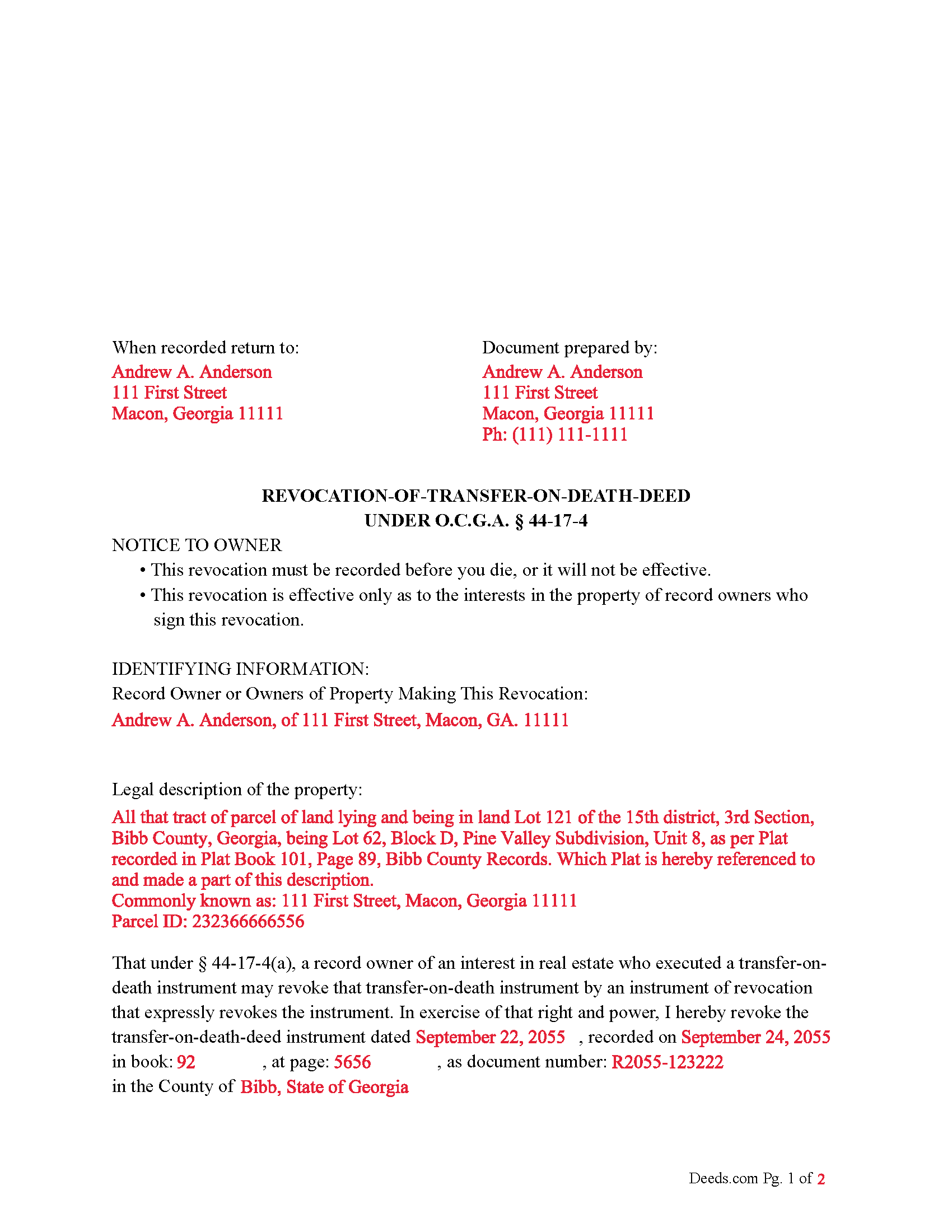

Hancock County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Hancock County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Sparta, Georgia 31087

Hours: 9:00am to 5:00pm M-F

Phone: (706) 444-6644 Ext. 2009 / 2010 / 2012

Recording Tips for Hancock County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Hancock County

Properties in any of these areas use Hancock County forms:

- Sparta

Hours, fees, requirements, and more for Hancock County

How do I get my forms?

Forms are available for immediate download after payment. The Hancock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hancock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hancock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hancock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hancock County?

Recording fees in Hancock County vary. Contact the recorder's office at (706) 444-6644 Ext. 2009 / 2010 / 2012 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Hancock County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Hancock County.

Our Promise

The documents you receive here will meet, or exceed, the Hancock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hancock County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

CHARLES S.

March 7th, 2021

Easy to purchase and a reasonable price. Documents were easy to add information. Examples proved handy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Altaray S.

January 14th, 2019

Really fast turn around time, and was provided exactly what I was looking for this time. This is my first experience with this site. It would have been cool to also get a document depicting/describing a property line, but like I said before, exactly what I was looking for this time.

Thank you so much for your feedback Altaray, we really appreciate it.

Chuck M.

May 30th, 2019

Easy to use service. However, the product that I purchased did not meet my needs. No fault of the company.

Thank you for your feedback Chuck. We certainly don't want you to purchase something you can not use. We have canceled your order and payment. Have a wonderful day.

Celeste F.

November 24th, 2020

Great experience. No hassle. It kept me out of a government office.

Thank you for your feedback. We really appreciate it. Have a great day!

David B.

December 23rd, 2021

I found the information very helpful. Had problems producing a professional looking document due to the limited active fields on the PDF form. Finally I just typed it.

Thank you!

Shonda S.

April 5th, 2023

This is my first time using the site for business and I must say this site made it so easy for me. I was so lost, thank you so much.

Thank you!

Jacqueline G.

October 10th, 2019

Great site, user friendly. Exactly what we needed and the detailed instructions/completed sample were a nice touch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

Keith H.

May 18th, 2021

These forms were helpful and comprehensive. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis M.

April 24th, 2022

Deeds was responsive and got back to me right away suggesting I go to the county and retrieve copies of the deed there. It's a couple of hundred miles away so was hoping I could do it online. A pretty good website though. Sorry we couldn't do business.

Thank you for your feedback. We really appreciate it. Have a great day!

Debora A.

May 23rd, 2023

Website easy to use and explanations available

Thank you!

Virginia P.

December 10th, 2019

Not user friendly despite additional guide. There are other products out there that are superior. A waste of $20.

Sorry to hear that Virginia. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Jules S.

May 6th, 2020

I can't believe I haven't been using this service since inception. The only thing I would recommend is to allow us to delete an erroneous upload. I accidentally uploaded the same document twice but I saw no way for me to correct my mistake other than to send an email.

Thank you for your feedback. We really appreciate it. Have a great day!

Victor W.

March 9th, 2022

Once I was able to get the code Number, it all went well. I was able to easily download and print off what I needed for my lawyer. thank you.

Thank you!

Greg R.

January 17th, 2024

Great service especially living out of state for the documents in the state I required. Easy to use, understand forms with instructions and examples.

Thank you for your feedback. We really appreciate it. Have a great day!