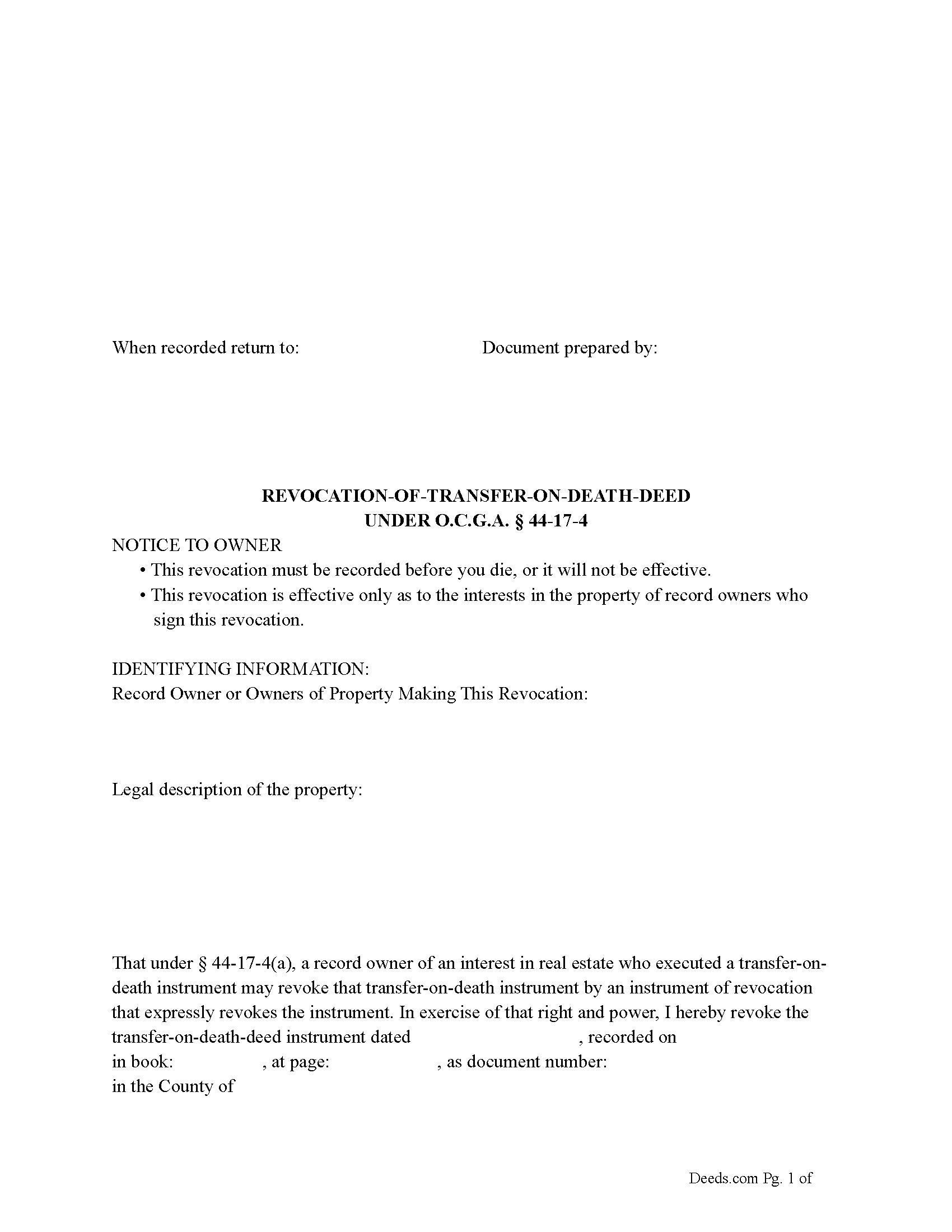

Houston County Revocation of Transfer on Death Deed Form

Houston County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

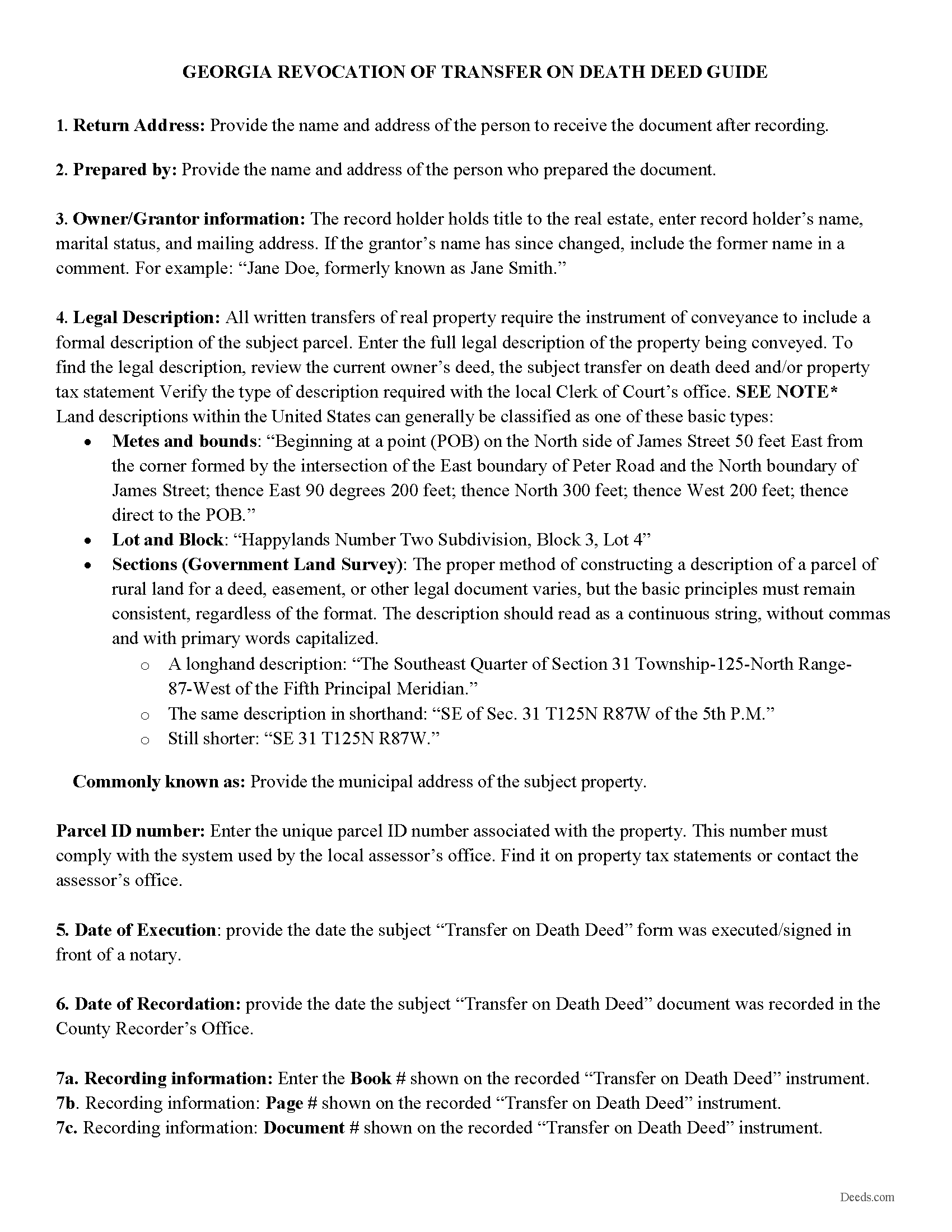

Houston County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

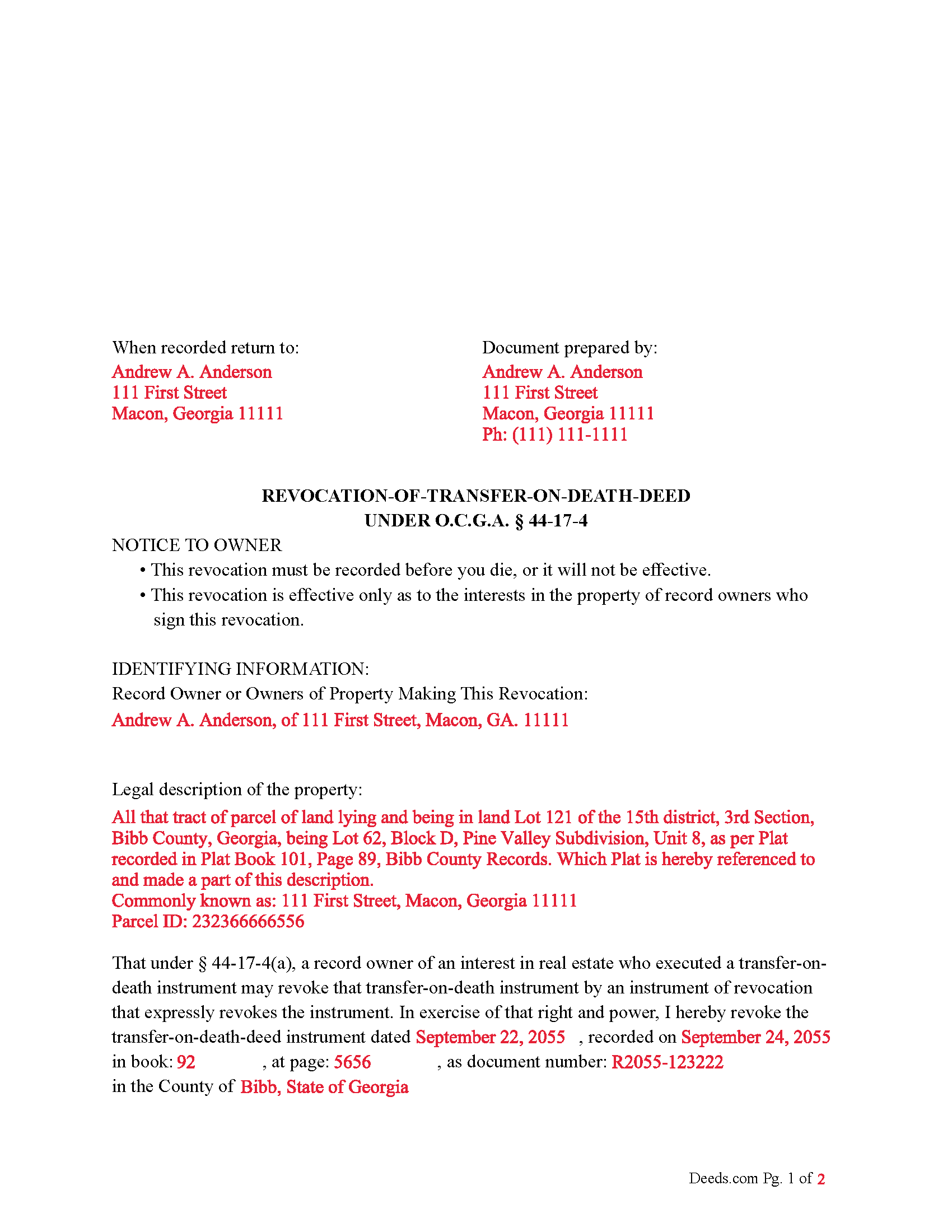

Houston County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Houston County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Perry, Georgia 31069

Hours: 8:30am-5:00pm M-F

Phone: (478) 218-4720

Recording Tips for Houston County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

Cities and Jurisdictions in Houston County

Properties in any of these areas use Houston County forms:

- Bonaire

- Centerville

- Clinchfield

- Elko

- Kathleen

- Perry

- Warner Robins

Hours, fees, requirements, and more for Houston County

How do I get my forms?

Forms are available for immediate download after payment. The Houston County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Houston County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Houston County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Houston County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Houston County?

Recording fees in Houston County vary. Contact the recorder's office at (478) 218-4720 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Houston County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Houston County.

Our Promise

The documents you receive here will meet, or exceed, the Houston County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Houston County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Richard T.

January 21st, 2019

This was a complete set of the necessary forms, with instructions. It will be very useful. Instant download was great.

We appreciate your feedback Richard. Have a wonderful day!

John D.

June 3rd, 2019

Forms were easy to complete, with the instructions that were provided. Very satisfied!

Thank you!

Alicia S.

August 17th, 2021

It's been a difficult time during my divorce. Glad I was able to get the house related documents easily here.

Thank you!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barry B.

November 19th, 2020

I was very impressed on how simple the process was to record the documents I needed recorded. Thank you for all of your help.

Thank you!

Ralph S.

June 30th, 2023

Excellent deed correction experience and guidance!!! Thank you! R. Scott.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelleen A.

May 11th, 2022

Very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BARBARA S.

November 22nd, 2020

Easy to use; great back-up documentation; reasonably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jayne S.

August 24th, 2023

Very prompt and excellent service!

Thank you for your feedback. We really appreciate it. Have a great day!

Kelly Y.

September 1st, 2022

The document was easy to locate, pay for and download. I hope it will be this easy to process by the County!

Thank you!

Robin G.

February 1st, 2024

Very user friendly. I was totally amazed. Thank you so much.

We are delighted to have been of service. Thank you for the positive review!

Gary Steve N.

February 4th, 2021

Very user-friendly and easy to understand directions.

Thank you for your feedback. We really appreciate it. Have a great day!

Darlene T.

August 4th, 2024

Worth the cost. Quick and easy!

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

JOSE E.

March 19th, 2019

Thanks

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.