Oglethorpe County Revocation of Transfer on Death Deed Form

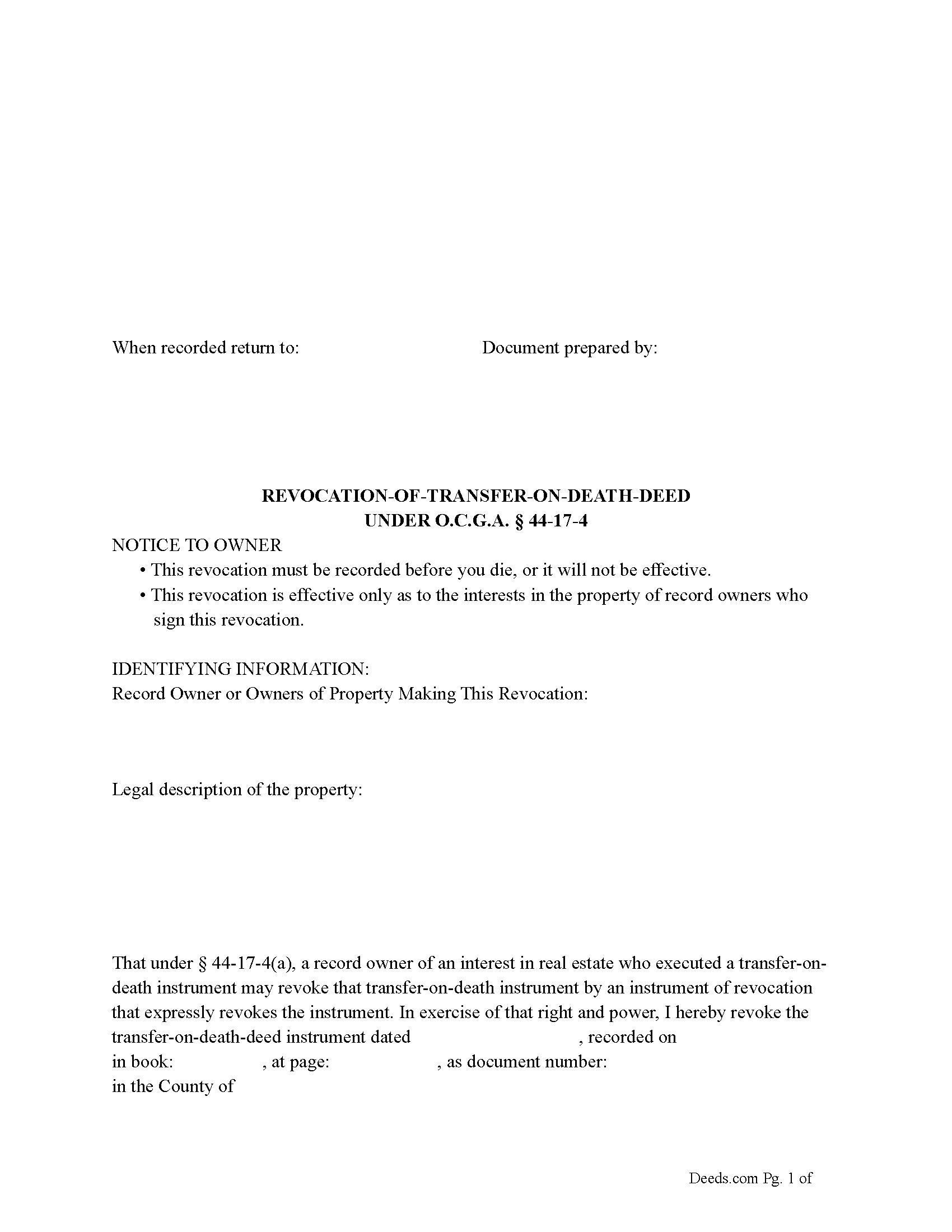

Oglethorpe County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

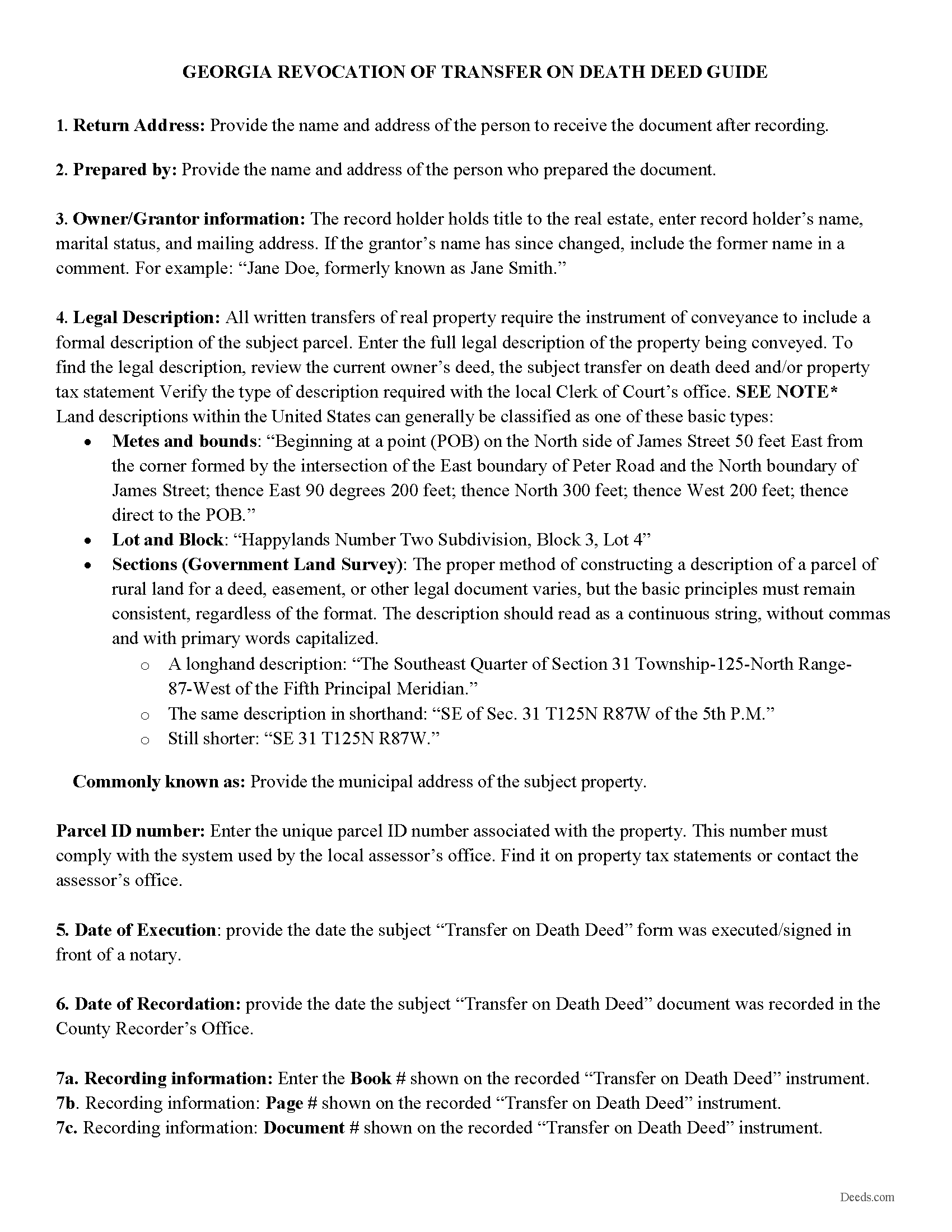

Oglethorpe County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

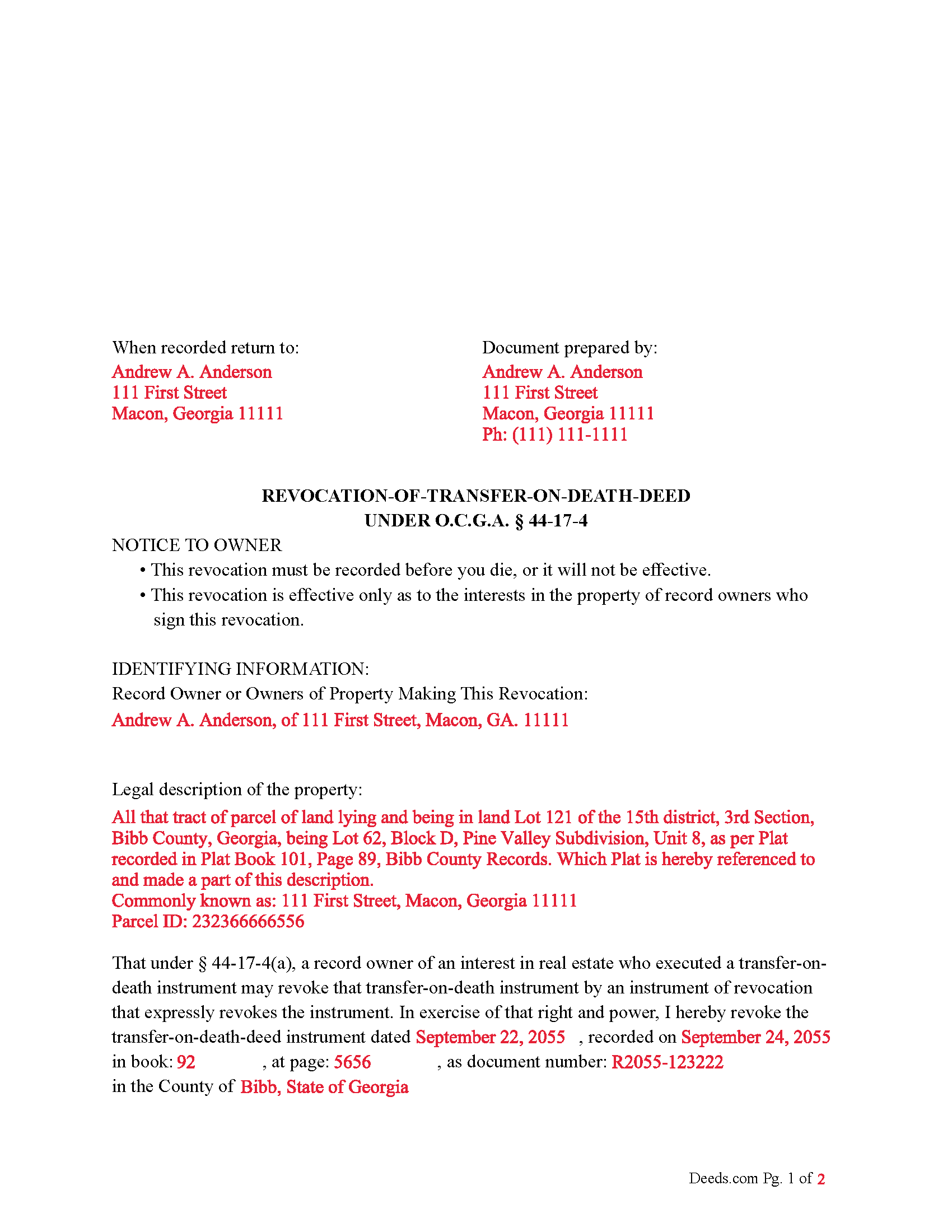

Oglethorpe County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Oglethorpe County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Lexington, Georgia 30648

Hours: 8:00am-5:00pm M-F

Phone: (706) 743-5731

Recording Tips for Oglethorpe County:

- White-out or correction fluid may cause rejection

- Ask about their eRecording option for future transactions

- Recording fees may differ from what's posted online - verify current rates

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Oglethorpe County

Properties in any of these areas use Oglethorpe County forms:

- Arnoldsville

- Crawford

- Lexington

- Maxeys

- Stephens

Hours, fees, requirements, and more for Oglethorpe County

How do I get my forms?

Forms are available for immediate download after payment. The Oglethorpe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Oglethorpe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Oglethorpe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Oglethorpe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Oglethorpe County?

Recording fees in Oglethorpe County vary. Contact the recorder's office at (706) 743-5731 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Oglethorpe County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Oglethorpe County.

Our Promise

The documents you receive here will meet, or exceed, the Oglethorpe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Oglethorpe County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Lynn S.

July 22nd, 2020

Great service. I did not have to put much thought into the process!!! Worth the $15.00 extra!!

Thank you for your feedback. We really appreciate it. Have a great day!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!

Debra H.

April 11th, 2019

I find this site easy to use and every form I may need. Now to figure out how to fill in on line. :)

Thank you for your feedback Debra. Be sure to download the forms and fill them out on your computer, they should not be filled out "online". Have a great day.

ARNOLD E.

May 3rd, 2019

SO FAR SO GOOD! I AM STILL COMPLETING THE QUIT CLAIM DEED. THANKS....ARNIE

Thank you Arnold, we really appreciate your feedback.

James K.

January 12th, 2023

Gave me exactly what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Nicole T.

February 9th, 2021

Absolutely Amazing Service! I learned about Deeds.com, created my Account, uploaded my documents into my Recording Package, paid my Invoice and received my Three Recorded Deeds all in less than two hours! Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eileen B.

April 5th, 2022

I was quoted $525 to do the exact same thing from Deeds.com for only $25. Seems like a no brainer to me!

Thank you for your feedback. We really appreciate it. Have a great day!

Cleatous S.

December 9th, 2020

The deed form is hard to fill in. There is no way to fill in the county in the "reviewed by" section. Also, there is no place for the Grantee's address on the form. I had to include it in the fill-in space for the legal description.

Thank you!

linda l.

August 10th, 2020

I was very impressed with the Mineral Deed form, especially with the instructions to fill it out AND a copy of a completed for to compare against. This definitely saved me money for an attorney. The one thing I don't understand, though, is why I could not save the completed Deed to my hard drive. I did have to change a few things after the fact and I had to re-type the entire page to make the corrections. If not for this, I would definitely rate the forms and instructions as a 5 star.

Thank you for your feedback. We really appreciate it. Have a great day!

SANTTINA W.

August 13th, 2022

IT WAS SO VERY HELPFUL AND EASY TO DO WILL RETUN TO THE SITE AGAIN.

Thank you for your feedback. We really appreciate it. Have a great day!

Beryl B.

January 5th, 2019

This was an easy and convenient site to obtain documents. I really appreciated the fact that after paying the fee, the site stayed available to me for access to samples, examples, forms, etc

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Billie M.

November 15th, 2023

My overall experience was positive. Little trouble uploading documents but resolved. I had two mineral deeds to file in Arkansas, two different counties, exactly the same form, only difference being property description; one was completed, one was canceled. I emailed to inquire why and the reply was in an automatic email indicating that email address was not monitored and if further action would be taken on Deeds.com part, I would be notified. Other than that, I would recommend their services to avoid using snail mail.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary L M.

November 1st, 2022

Your website was very helpful & easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Dakota H.

December 19th, 2021

Brilliant idea. Beats working with an attorney who charges $250+ per hour. Thanks.

Thank you!

Sandra B.

February 15th, 2022

Easy to navigate through. Documents were in orderly fashion. Highly recommend. Step by step instructions

We appreciate your business and value your feedback. Thank you. Have a wonderful day!