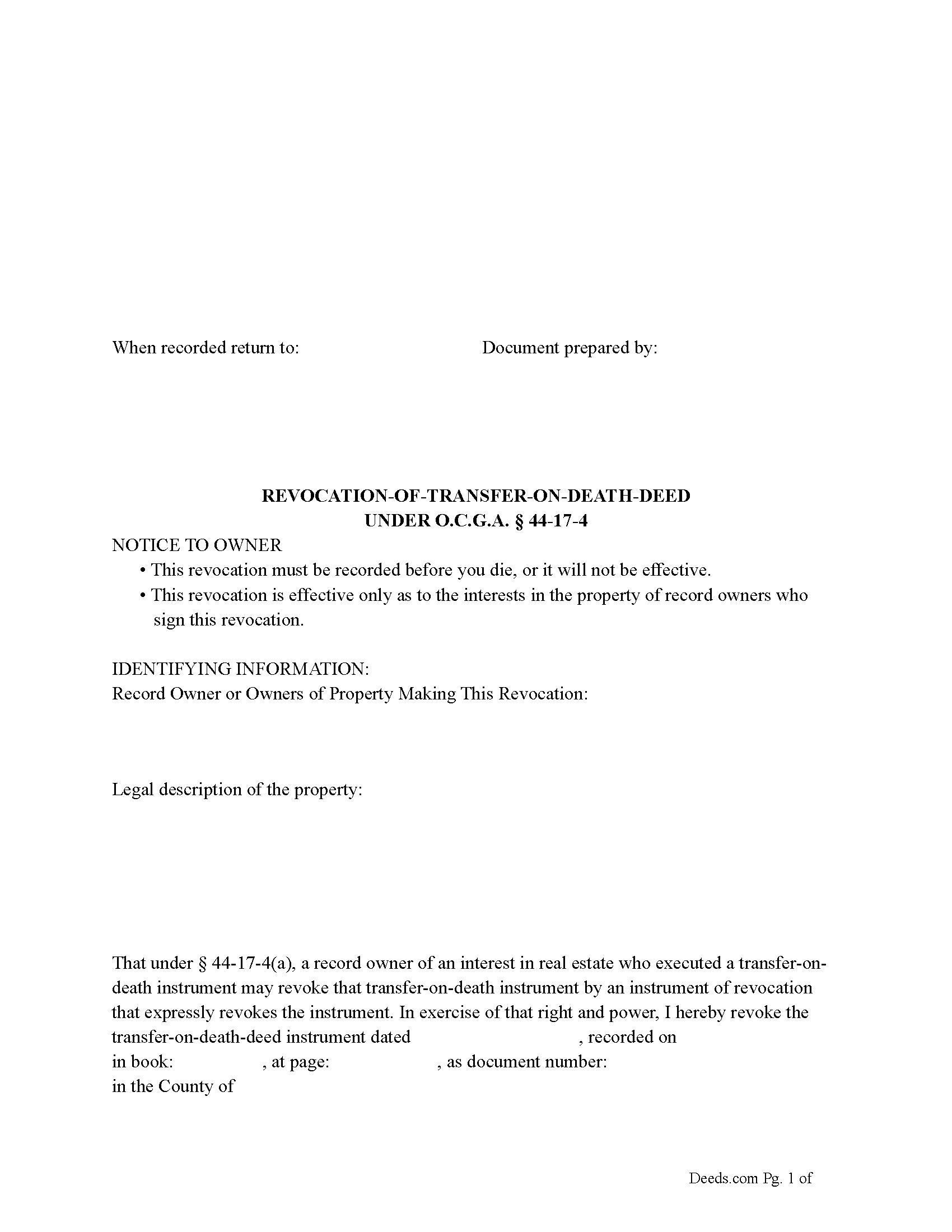

Wheeler County Revocation of Transfer on Death Deed Form

Wheeler County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

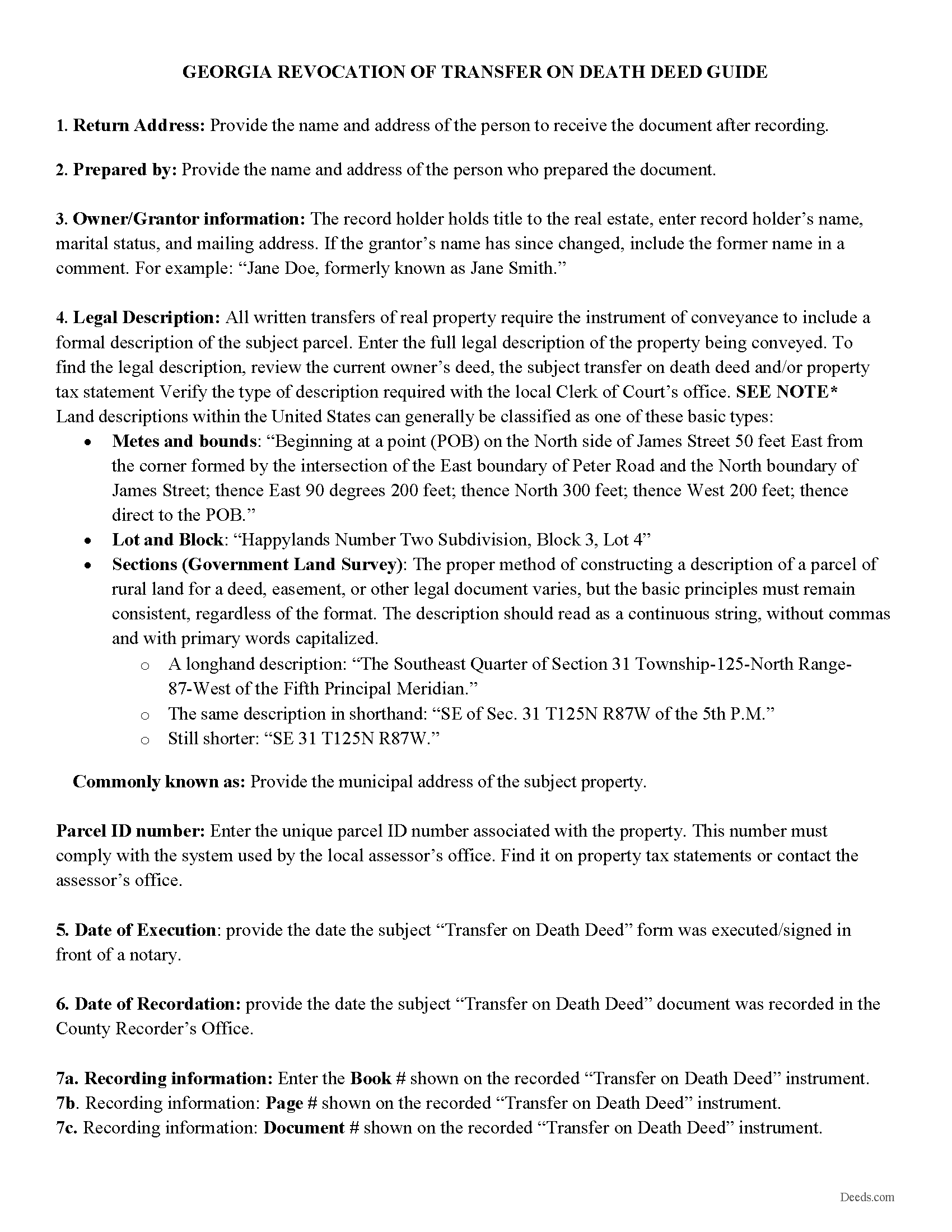

Wheeler County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

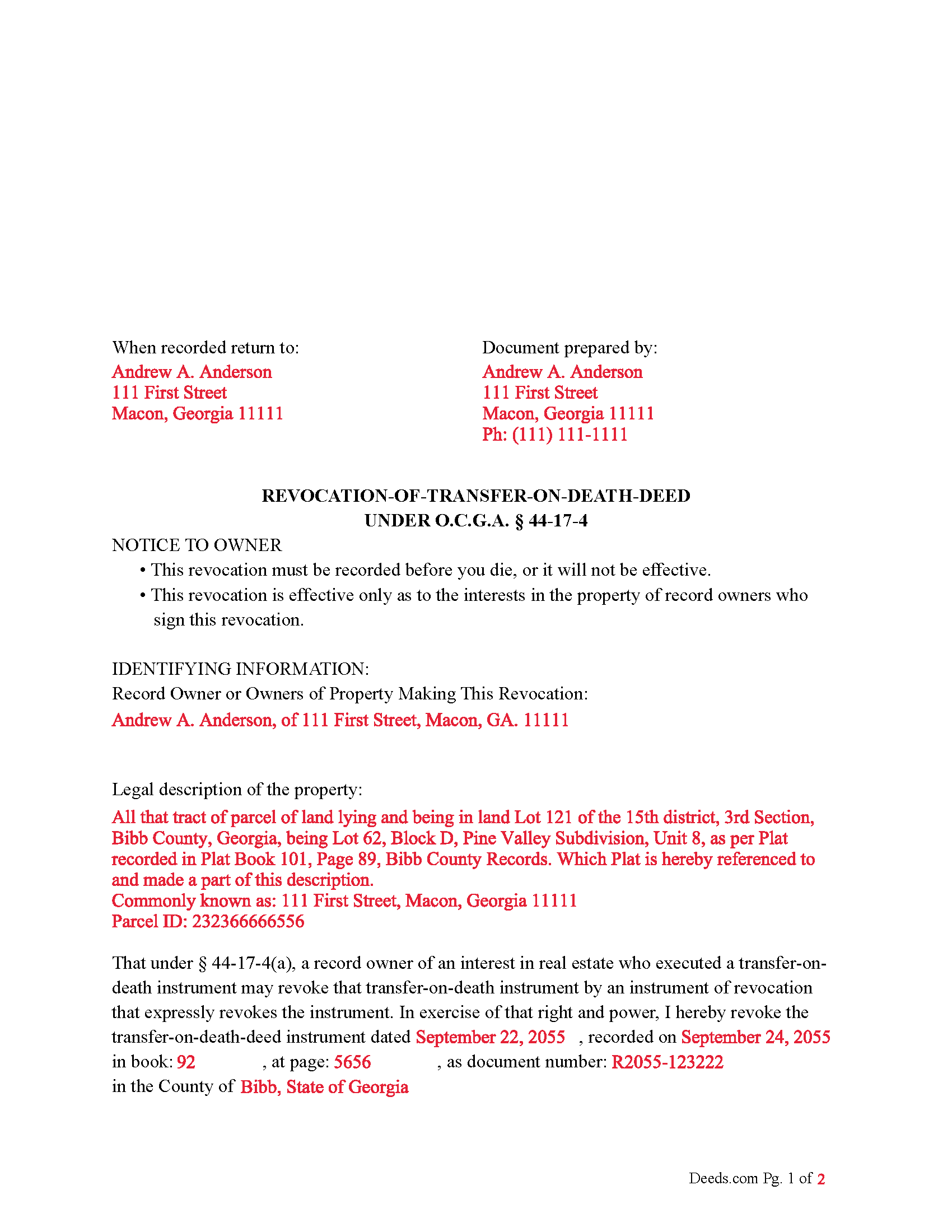

Wheeler County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Wheeler County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Alamo, Georgia 30411

Hours: 8:30am - 5:00pm Monday - Friday

Phone: (912) 568-7137

Recording Tips for Wheeler County:

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Wheeler County

Properties in any of these areas use Wheeler County forms:

- Alamo

- Glenwood

Hours, fees, requirements, and more for Wheeler County

How do I get my forms?

Forms are available for immediate download after payment. The Wheeler County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wheeler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wheeler County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wheeler County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wheeler County?

Recording fees in Wheeler County vary. Contact the recorder's office at (912) 568-7137 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Wheeler County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Wheeler County.

Our Promise

The documents you receive here will meet, or exceed, the Wheeler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wheeler County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

William S.

June 26th, 2022

The forms worked well for entering information. I have finished without much trouble. Since the forms are Adobe PDF files you need the free app to use them but you can't edit unless you have the paid Adobe program. And, it was a reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

susanne y.

July 13th, 2020

wonderful service, docs recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina P.

July 28th, 2023

Fantastic!! The gals at Deeds really seem to have their stuff together! Great Forms, easy, exhaustive, and most importantly... accepted at the recorder the FIRST TIME!

Thank you so much for your review! Your feedback is highly appreciated, and we look forward to assisting you again in the future!

Raecita H.

March 19th, 2022

This was the first time I had ever had to fill out a Warranty Deed, so if it was not for your example form on how to fill one out, I would be still be here completely lost. I had originally gone to another site for a Warranty Deed & they wanted double the amount of your price & their website had no examples forms. I am so happy with your site & service. Thank you for giving us the opportunity to be able to download the forms as much as we need to because as many mistakes I made,I had to print quite a few to be able to get it done right.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Duane S.

June 5th, 2019

Really glad to find your site. Made filing so much easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina H.

December 29th, 2022

I appreciate having forms available and not having to go to a business supply or attorney. This is great. However, there are two individual quit claim deed forms and I don't know which one is appropriate.

Thank you for your feedback. We really appreciate it. Have a great day!

Steve F.

July 9th, 2021

Fast Service, Easy to use. Highly Recommend!

Thank you!

Christian M.

June 11th, 2019

Easy to find the necessary documents needed

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James A.

June 18th, 2024

Very easy to navigate and start your process.

Thank you for your positive words! We’re thrilled to hear about your experience.

Michelle G.

April 26th, 2021

EXCEPTIONAL CUSTOMER SERIVCE!!! THANK YOU!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Jill S.

June 27th, 2023

This was highly convenient and successful.

Glad to hear we could help Jill, thanks for the kind words!!

Theresa J.

June 16th, 2021

I thank you for your service. I received the needed information.

Thank you!

Ginger L.

May 29th, 2022

Excellent full set of documents with example and guidelines on how to do it ourselves without paying a lawyer. Or, we save legal fees by completing it ourselves and having a lawyer review it. Love that I can save the pdf and fill it out whenever I want. Thank you for having this available!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly M.

January 5th, 2019

GREAT FORMS. THANK YOU.

Thank you!

Daniel L.

February 11th, 2022

You could make instructions clearer on the download process and when download is complete. You could also group things together for 1 or 2 "big" downloads.

Thank you for your feedback. We really appreciate it. Have a great day!