Wayne County Transfer on Death Deed Form

Wayne County Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

Wayne County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

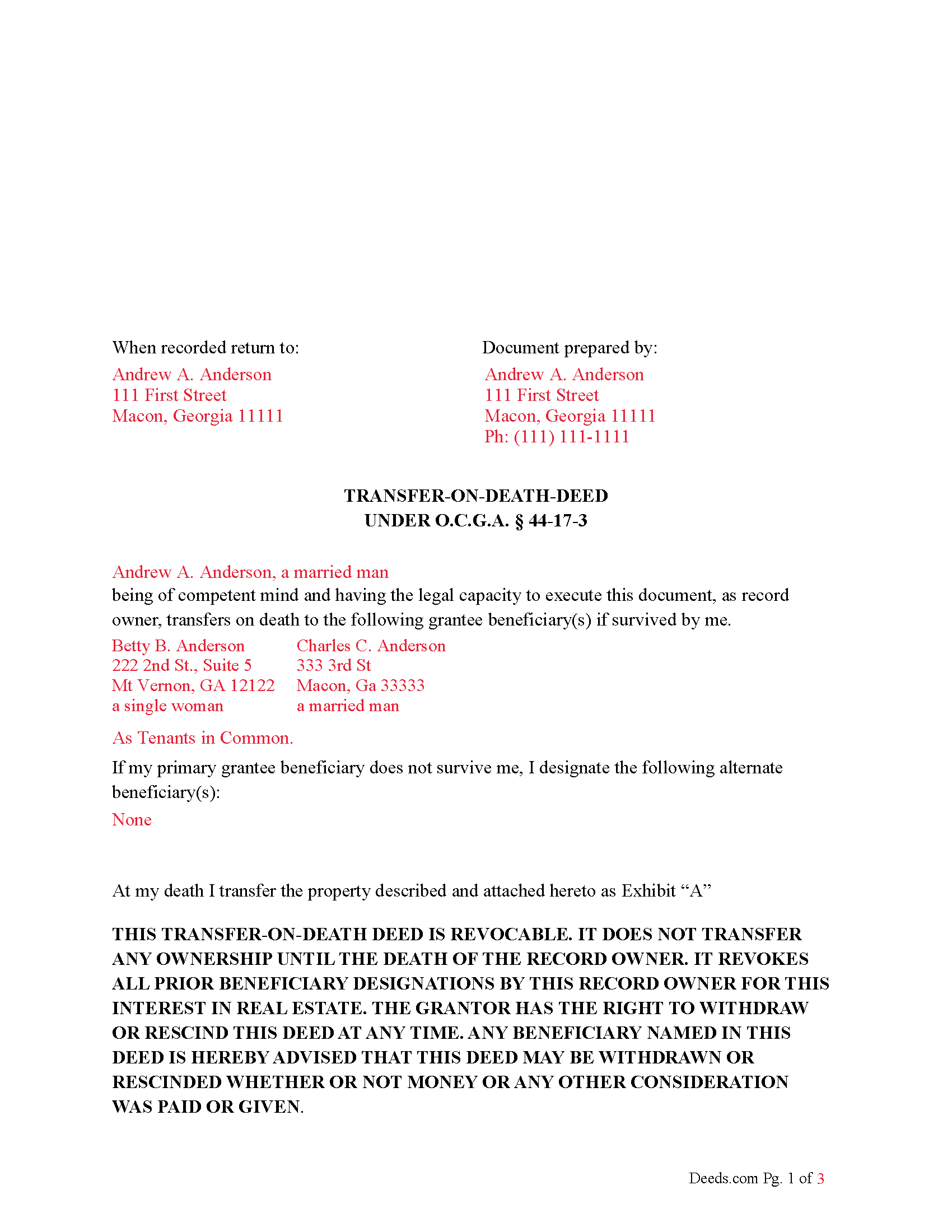

Wayne County Completed Example of the Transfer on Death Deed Document

Example of a properly completed Georgia Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Wayne County documents included at no extra charge:

Where to Record Your Documents

Clerk of Courts

Jesup, Georgia 31546

Hours: 8:30 to 5:00 M-F

Phone: (912) 427-5930

Recording Tips for Wayne County:

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Avoid the last business day of the month when possible

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Jesup

- Odum

- Screven

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (912) 427-5930 for current fees.

Questions answered? Let's get started!

Georgia Law 496, effective July 1, 2024, introduced Chapter 17 regarding Transfer on Death (TOD) deeds. This new chapter affects the creation, execution, and enforcement of TOD deeds in the state. Here's how Chapter 17 affects TOD deeds:

Creation and Execution of TOD Deeds:

Property owners can now create a TOD deed to designate a beneficiary who will receive the property upon the owner’s death. The TOD deed must be executed with the same formalities as a regular deed, meaning it must be signed, witnessed, and notarized. The deed must clearly state that the transfer is to occur upon the owner’s death.

Recording Requirements: To be effective, a TOD deed must be recorded in the county where the property is located before the owner’s death. Failure to record the TOD deed properly may result in it being invalid, and the property would then be subject to probate.

Revocability: The owner retains the right to revoke the TOD deed at any time during their lifetime. Revocation must be executed and recorded in the same manner as the TOD deed itself. The revocation can be made by executing a new TOD deed that expressly revokes the previous one or by recording an instrument of revocation.

Effect on Ownership and Rights: During the owner’s lifetime, the TOD deed does not affect the owner’s rights or the property’s ownership. The owner retains full control of the property and can sell, mortgage, or otherwise manage the property without the beneficiary's consent. The TOD deed only takes effect upon the owner’s death.

Impact on Spouses and Joint Owners: If the property is jointly owned with right of survivorship, the TOD deed will only take effect after the death of the last surviving owner. Both joint owners must sign the TOD deed to ensure it accurately reflects their intentions. In the case of sole ownership, the consent of the non owning spouse may not be legally required but is advisable to prevent potential legal challenges based on marital property or homestead rights.

Priority and Creditor Claims: The TOD deed does not shield the property from the owner’s creditors. Any liens or debts must be settled before the beneficiary can take full ownership of the property. The property remains subject to any existing mortgages or liens, and the beneficiary will inherit the property subject to these encumbrances.

Homestead Rights: Georgia’s homestead rights and exemptions may affect the TOD deed. It’s essential to consider these rights, especially in cases where the property is the primary residence and may involve spousal consent.

Probate Avoidance: The primary advantage of the TOD deed under Chapter 17 is the avoidance of probate. Upon the owner’s death, the property transfers directly to the designated beneficiary without the need for probate proceedings.

Chapter 17 of Georgia Law 496, which governs Transfer on Death (TOD) deeds, includes definitions critical to understanding the application and implications of the law. Here are the explanations for the terms as used in this chapter:

((1) 'Interest in real estate' means any estate or interest in, over or under land, including surface, minerals, structures, fixtures, and easements. (GA 44-17-1(1))

This term is broadly defined to include any type of ownership or stake in real property. It encompasses:

Surface: Ownership or rights related to the surface of the land, including any structures or improvements on it.

Minerals: Subsurface rights, which can include the extraction of minerals, oil, or gas.

Structures: Any buildings or permanent improvements attached to the land.

Fixtures: Items that were once personal property but have been attached to the land or structures in a way that they are considered part of the real estate (e.g., a furnace or built-in cabinetry).

Easements: Rights to use another person’s land for a specific purpose (e.g., utility easements or access roads).

This broad definition ensures that TOD deeds can apply to a wide range of real estate interests, not just traditional ownership of land and buildings.

((2) 'Joint owner' means a person that owns an interest in real estate as a joint tenant with right of survivorship.) This term specifically refers to a person who co-owns an interest in real estate with one or more other people, where the ownership includes the right of survivorship.)

Joint Tenancy with Right of Survivorship: A form of co-ownership where each owner (joint tenant) has an equal share in the property. Upon the death of one joint tenant, their share automatically passes to the surviving joint tenant(s), rather than being distributed according to a will or through probate.

This definition is important for TOD deeds because it clarifies how ownership interests are managed when there are multiple owners. In the context of a TOD deed, if the property is owned as joint tenants with right of survivorship, the TOD deed would only take effect after the death of the last surviving joint owner. Both joint owners must agree and sign the TOD deed to designate a beneficiary who will receive the property upon the death of the surviving owner. (44-17-1(2))

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Lana B.

August 25th, 2019

Was very helpful!

Thank you!

Brady D.

October 17th, 2023

I would give you a zero if possible. The webpage is as cumbersome has all get out. I am on web pages all day every day and this one is by far the hardest one to get around in.

Thank you for sharing your feedback regarding your experience with our website. We are truly sorry to hear that navigating our site proved to be a challenge for you. Your insights are invaluable, and we will definitely take your comments into consideration as we work towards improving our online platform.

We wish you all the best in your future endeavors.

Sandra K.

April 29th, 2019

Seems fairly simple with forms and instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Ruth R.

January 31st, 2020

Very pleased with the service, solved an immediate problem for me and at good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

Angeline P.

April 29th, 2020

Great service! I downloaded the Quit Claim Deed package and I'm so grateful I did. It contained detailed directions on how to fill out all the forms, an example of a finalized copy, and excellent customer service. Also, if you choose to use their digital service, they will digitally submit the documents into the County Recorder's Office for you. Going through DEEDS.COM for the service I chose saved me over $300. Recording my new deed was a breeze. Thank you again DEEDS.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa D.

February 3rd, 2020

Love this site! They are very fast in retrieving information. Will use this site again. Thank You for this service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine W.

January 24th, 2019

I was impressed by the completeness of the package of forms PLUS instructions. Particularly helpful is the filled in sample, which enables you to see what a correct, completed deed ought to look like.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kristopher K.

October 22nd, 2021

Process is easy but system would not accept 3 different credit cards on first day. No phone number to call. Sent message and response was all 3 cards must have been declined. However, next day one of those cards went through with no problem.

Thank you for your feedback. Unfortunately we have no control over which payment get approved or declined.

Teri A S.

November 21st, 2019

Received the quit claim form as ordered. Seemed clear and concise, easy to follow instructions and the completed example was helpful.

Thank you Teri, have a great day!

Marilyn O.

March 9th, 2021

Good resource. Got what I needed easily

Thank you for your feedback. We really appreciate it. Have a great day!

Chelsie F.

April 3rd, 2020

Super customer service and communication! Fast service and more informative than expected! Can't say thanks enough.

Thank you!

James R.

July 4th, 2019

Easy to understand instructions. Love the examples. Info on the deeds purpose easily comprehendible. Able to Kiosk record without difficulty. Am I pleased? Oh Yeah!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jo Ann P.

August 19th, 2025

Was hoping I would be sent copies on paper so I can fill them out without a desk computer

We appreciate your feedback. Our forms are delivered instantly as digital files, so customers can download and print as many copies as they need. This way, you have the flexibility to complete them by hand if you prefer.