Lemhi County Affidavit of Successor Form

Lemhi County Affidavit of Successor Form

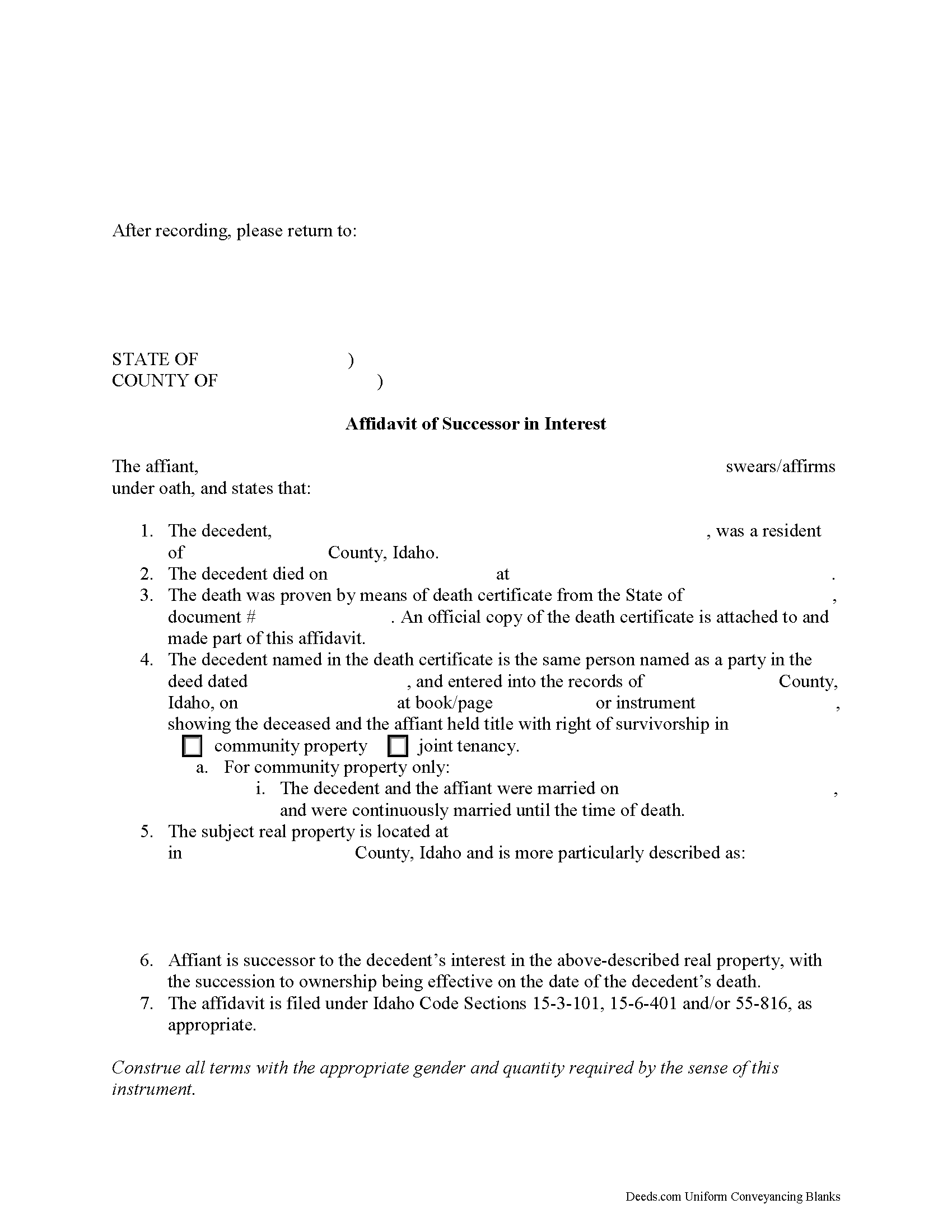

Fill in the blank form formatted to comply with all recording and content requirements.

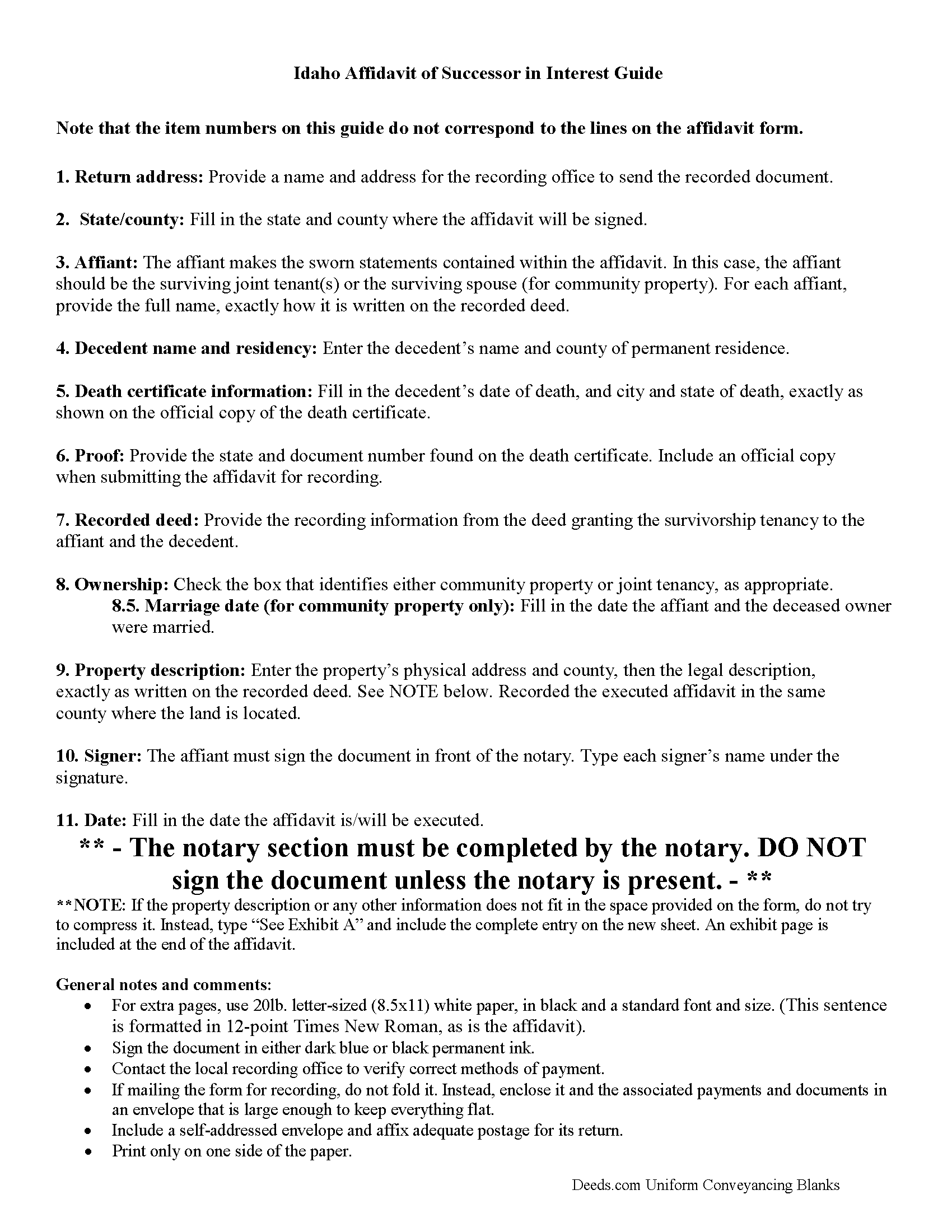

Lemhi County Affidavit of Successor Guide

Line by line guide explaining every blank on the form.

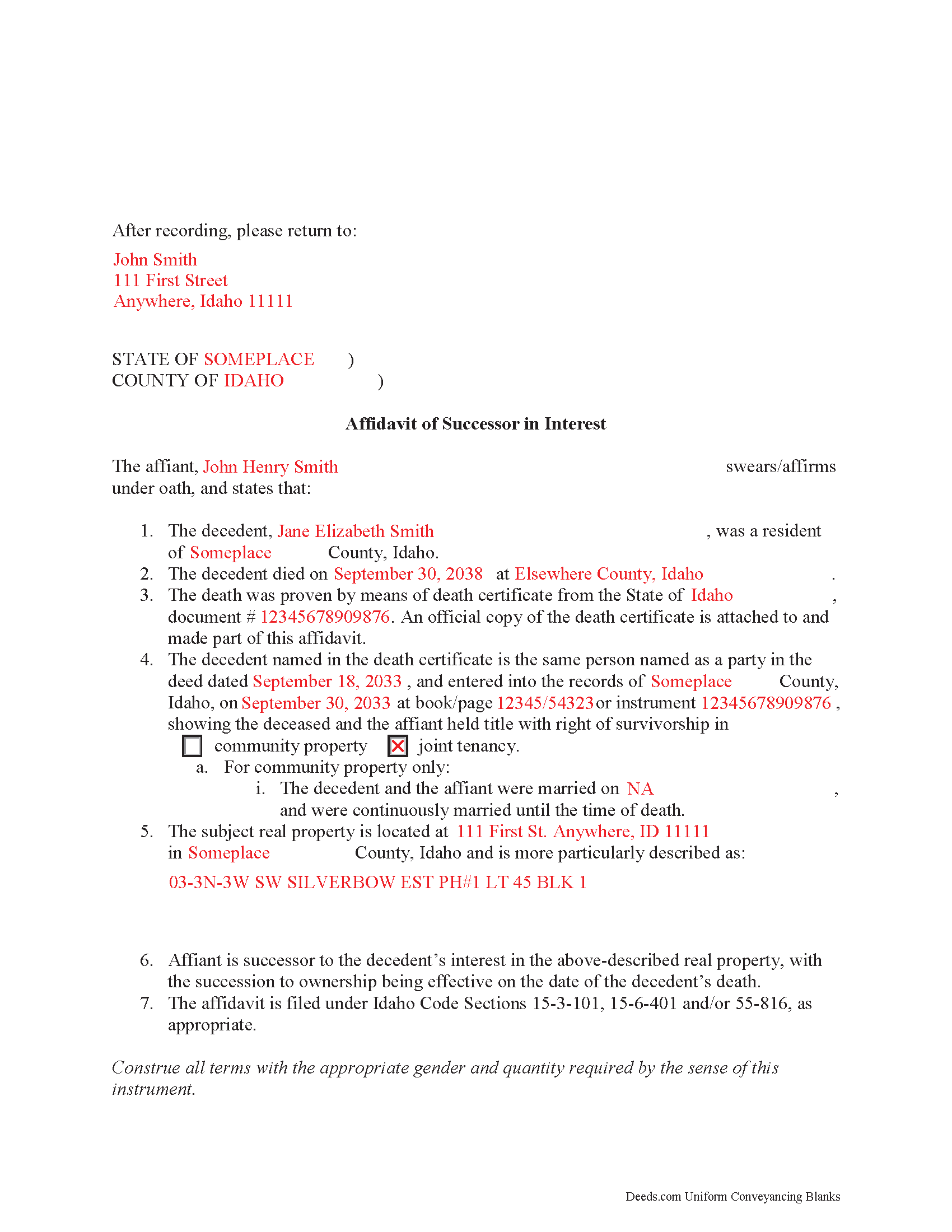

Lemhi County Completed Example of the Affidavit of Successor Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Lemhi County documents included at no extra charge:

Where to Record Your Documents

Clerk/ Auditor/ Recorder

Salmon, Idaho 83467

Hours: Monday through Friday 9:00 AM through 5:00 PM

Phone: 208-756-2815 Ext. 1665

Recording Tips for Lemhi County:

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Lemhi County

Properties in any of these areas use Lemhi County forms:

- Carmen

- Cobalt

- Gibbonsville

- Leadore

- Lemhi

- May

- North Fork

- Salmon

- Shoup

- Tendoy

Hours, fees, requirements, and more for Lemhi County

How do I get my forms?

Forms are available for immediate download after payment. The Lemhi County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lemhi County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lemhi County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lemhi County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lemhi County?

Recording fees in Lemhi County vary. Contact the recorder's office at 208-756-2815 Ext. 1665 for current fees.

Questions answered? Let's get started!

Idaho's statutes allow three primary methods for co-ownership of real estate: tenancy in common, joint tenancy, and community property. See Idaho Code Section 55-104.

Holding title as tenants in common means that each owner has title rights to a separate portion of the property. The owner may sell or otherwise convey the share independently from the others, and it may be included in his/her will.

Joint tenancy and community property, on the other hand, include the right of survivorship, meaning that when one owner dies, his/her share of the property is distributed amongst the survivors. Note that community property is only available to married couples and often requires a recorded community property agreement for full effect.

To formalize the transfer, remaining owners may use an affidavit of survivorship. By executing and recording this document, along with an official copy of the deceased owner's death certificate, the property and taxation records are updated to show the new status. This helps to maintain a clear chain of title (ownership history), which is important for future transfers of the property.

Each situation is unique, so seek legal advice for complex situations or with specific questions.

Important: Your property must be located in Lemhi County to use these forms. Documents should be recorded at the office below.

This Affidavit of Successor meets all recording requirements specific to Lemhi County.

Our Promise

The documents you receive here will meet, or exceed, the Lemhi County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lemhi County Affidavit of Successor form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

SheRon F.

March 21st, 2022

It was a quick and easy process and deeds.com was very helpful and dealt with a very stressful situation, painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy Z.

November 11th, 2022

Great site !! Very easy to navigate and explanations are clear and simple to understand. Thank You!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cyndi H.

December 9th, 2020

Excellent! Great communication through the process and quick response.

Thank you!

Ardelle P.

January 2nd, 2019

Extremely happy with this. Easy to use and very professional looking form when completed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Francine H.

April 18th, 2023

Somewhat confusing, but I'm really not sure what I need. I have not complete4d the document.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelly S.

November 12th, 2021

was fairly easy to work through the forms but needed better information on what goes on a few of the lines

Thank you for your feedback. We really appreciate it. Have a great day!

Susan J.

June 6th, 2023

I was pleased that I could send the documents this way rather than having to mail it or take time out of my day to go down to the records office.

Thank you for taking the time to leave your feedback Susan, we really appreciate you. Have an amazing day.

Garrison T.

April 24th, 2021

Excellent service & very easy to use.

Thank you!

Mike M.

October 27th, 2020

Get Rid of the places to initial each page on the Trust Deed. The Co. Recorder (Davis) does not require that each page be initialled... If I and the "borrower" had initialed each page, then I would have to use US Mail to get the form from AZ to UT because scans of initials are not acceptable, but only a notarized signature from the borrower is...

Thank you for your feedback. We really appreciate it. Have a great day!

JESSICA B.

June 25th, 2020

easy to move through the site and create an account.

Thank you!

Donnajean L.

October 9th, 2024

The site is user friendly and uncomplicated.

Thank you!

Donald S.

March 16th, 2021

Guidelines somewhat helpful. Forms fillable but not editable unless you buy an Adobe conversion service subscription. End product looks crude and amateurish. Fields can't be reduced or enlarged to accommodate unique data. Very disappointing.

Thank you for your feedback. We really appreciate it. Have a great day!

Terry S.

March 23rd, 2022

Worked well for us except for not being able to edit. Got it completed and recorded with the county clerk! Having the instructions and example made it easy!

Thank you for your feedback. We really appreciate it. Have a great day!

RAUL G.

October 14th, 2019

Very pleased with the service, easy to download and print

Thank you for your feedback. We really appreciate it. Have a great day!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!