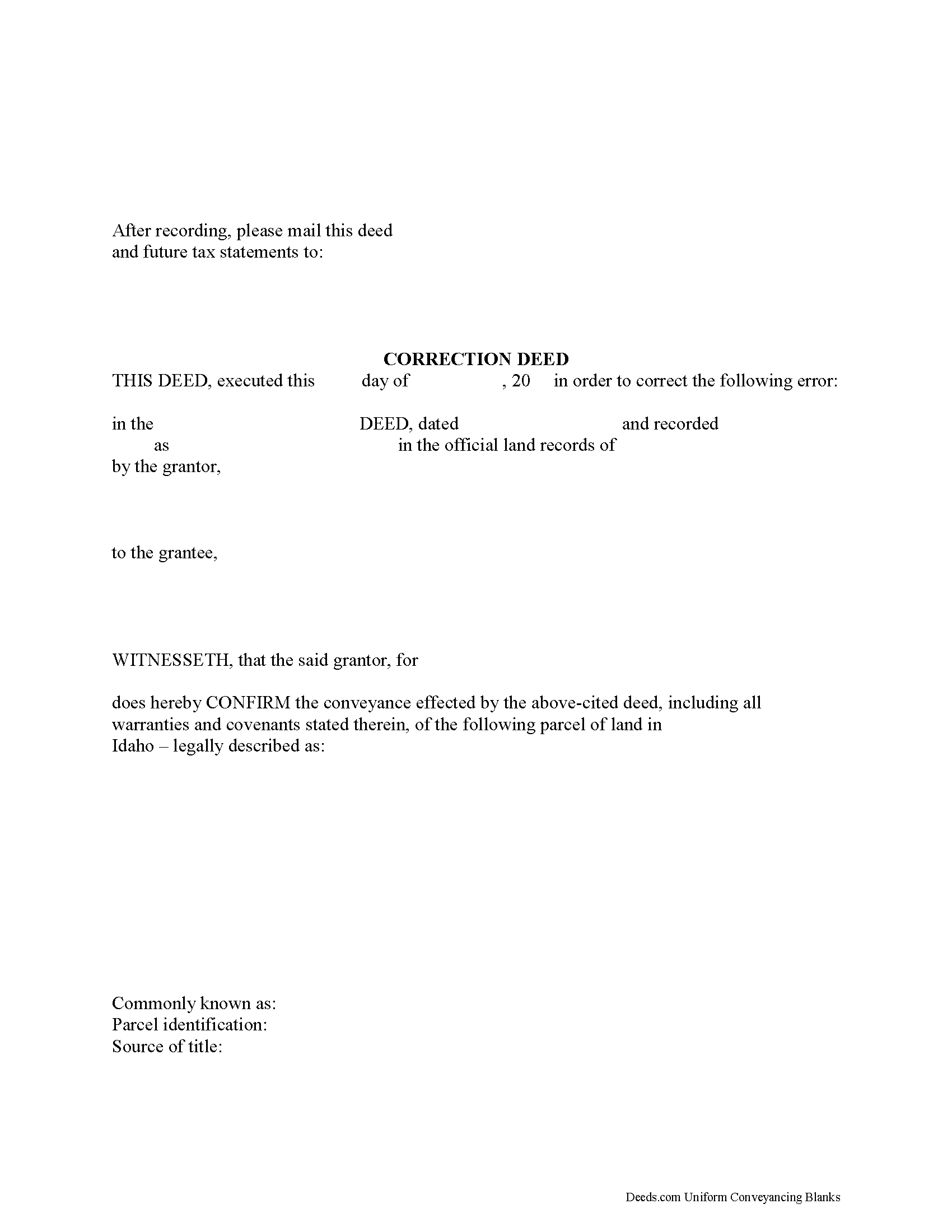

Canyon County Correction Deed Form

Canyon County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

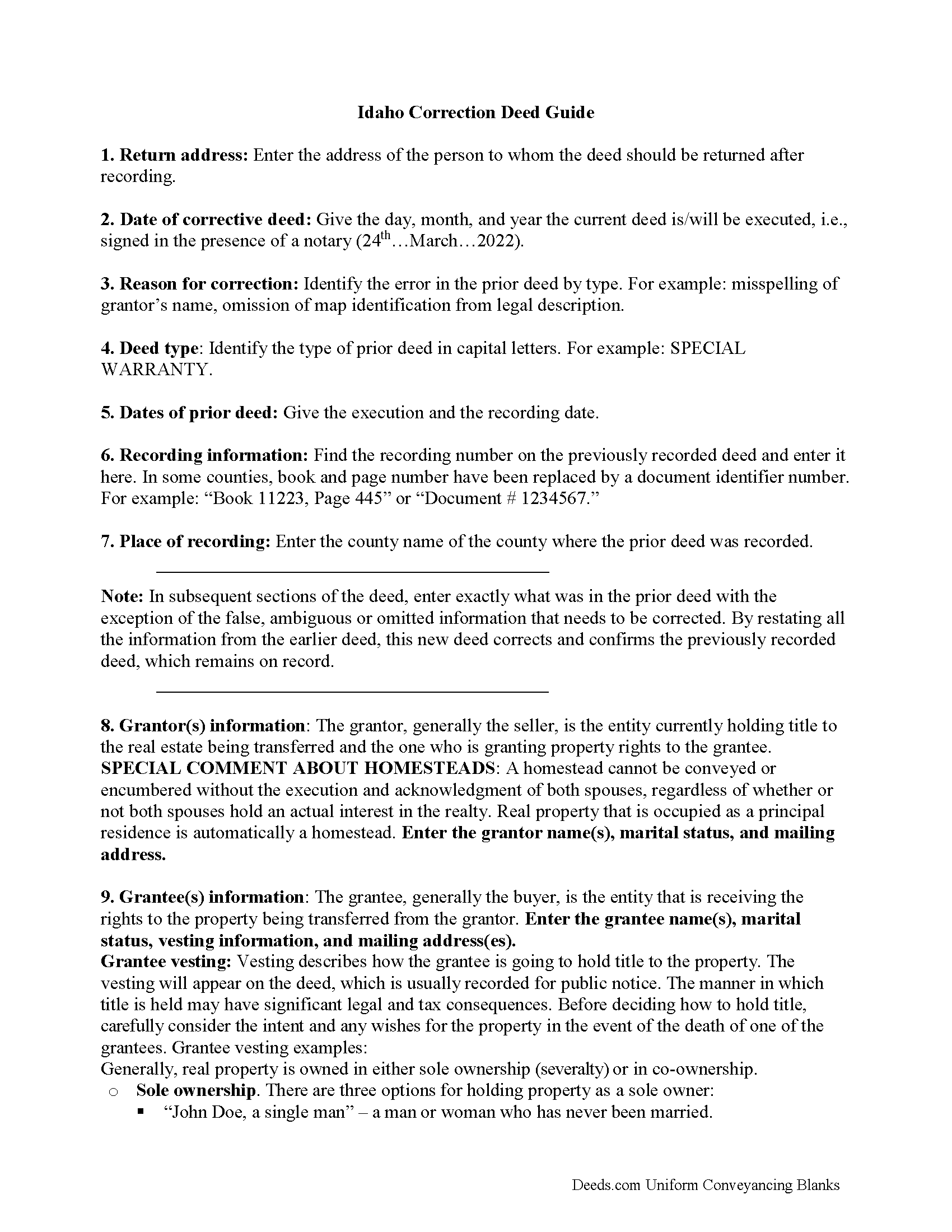

Canyon County Correction Deed Guide

Line by line guide explaining every blank on the form.

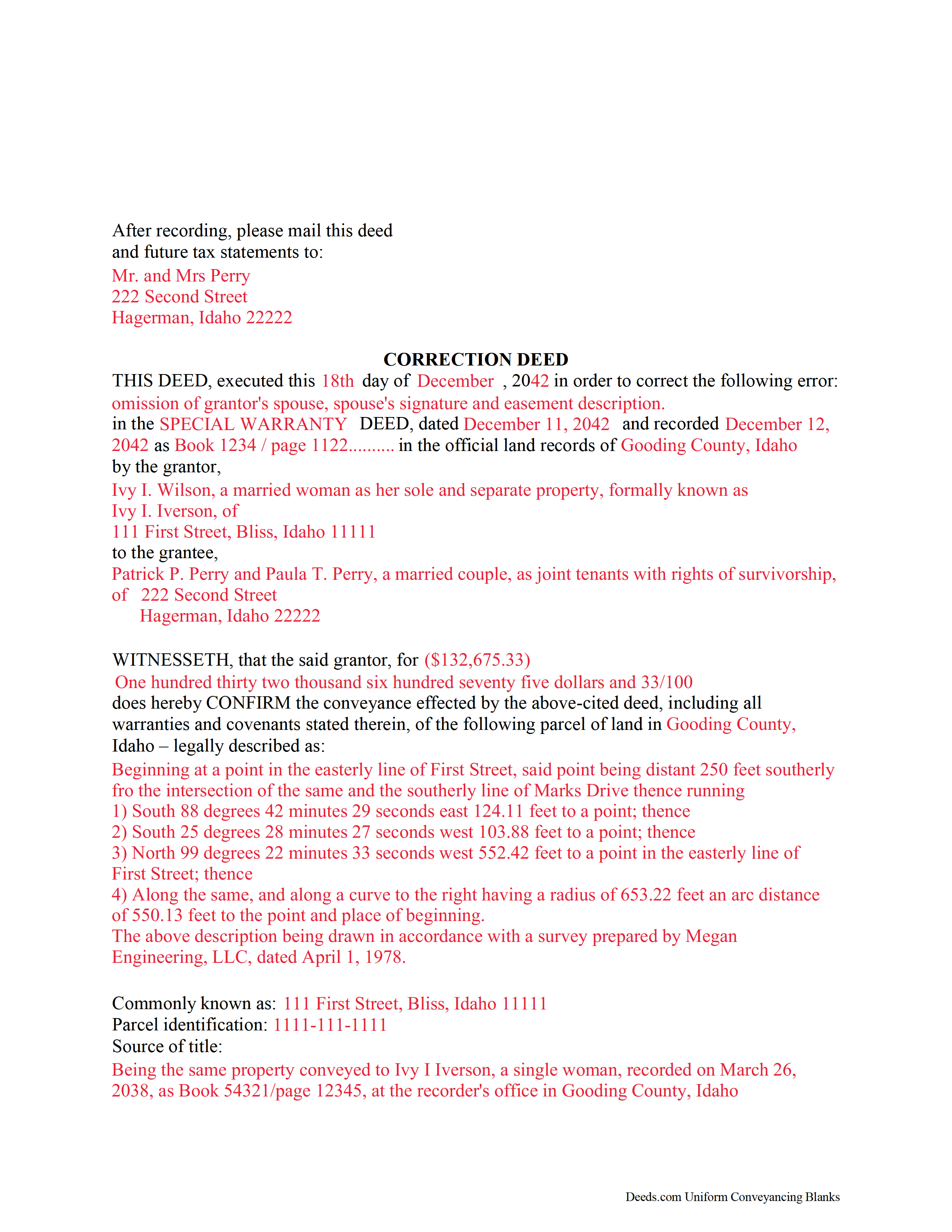

Canyon County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Canyon County documents included at no extra charge:

Where to Record Your Documents

Canyon County Clerk-Recorder

Caldwell, Idaho 83605

Hours: 8:00am-5:00pm M-F

Phone: (208) 454-7555

Recording Tips for Canyon County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Canyon County

Properties in any of these areas use Canyon County forms:

- Caldwell

- Greenleaf

- Huston

- Melba

- Middleton

- Nampa

- Notus

- Parma

- Wilder

Hours, fees, requirements, and more for Canyon County

How do I get my forms?

Forms are available for immediate download after payment. The Canyon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Canyon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Canyon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Canyon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Canyon County?

Recording fees in Canyon County vary. Contact the recorder's office at (208) 454-7555 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct an error in a previously recorded quitclaim, warranty or grant deed in Idaho.

Errors in a previously recorded deed can be corrected by re-recording the corrected deed or by preparing and recording a new correction deed. This helps to prevent title flaws, which may cause problems when the current owner attempts to sell the property. The correction deed does not convey title but confirms the prior conveyance.

For small errors, corrections can be made directly on the original deed and initialed by the signors before the deed is re-recorded. For lengthier errors, the best option is to prepare and record a new corrective deed, executed from the original grantor to the original grantee. Apart from supplying the corrected information, it must identify the reason for correcting and reference the prior deed by date, recording number and title.

When correcting the legal description or plat identification, both the grantor and the grantee should sign the corrective deed. If the original grantor is not available for some reason, an affidavit, signed by the grantee and indexed under the name of both the grantor and grantee, may be the best way to effect a correction.

For certain types of changes, however, a correction deed may not be appropriate. Adding or removing a grantee, for example, or changing the manner in which title is held, or making material changes to the legal description, especially deleting a portion of the originally transferred property, may all require a new deed of conveyance instead of a correcting the original deed. When in doubt about how to correct an error, consult with a lawyer.

Important: Your property must be located in Canyon County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Canyon County.

Our Promise

The documents you receive here will meet, or exceed, the Canyon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Canyon County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Mary B.

December 2nd, 2020

I was very pleased with my experience on Deeds.com. I hand purchased the wrong papers and they credited my account so I could purchase the correct papers. I will use them again

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl C.

February 23rd, 2023

my only problem is the cost of the form I downloaded. A bit cheaper would be nice

Thank you for your feedback. We really appreciate it. Have a great day!

Lee C.

February 10th, 2021

Quick, easy and reasonably priced.

Thank you!

Richard G.

August 28th, 2022

I was not able to add more linea to the deed and add up to four people and their addresses. The document should be able to be expanded.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheryl Kae Y.

September 23rd, 2021

Really good forms, no complaints.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ELOISA F.

May 27th, 2021

Once I had everything right;the recording was fast and easy. I was updated at every juncture and apprised of my mistakes in order to fix and record my deed. To improve service: I think that several different examples and scenarios would have helped. If you have different names from your children; birth certificates and marriage certificates are a requirement in Clark County, NV. If you want to add anyone to the deed in a Quit Claim Deed; you have to add yourself as a grantee even if you are the grantor along with the other grantees.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas N.

May 9th, 2019

TODD Form would not print surveyor degrees character (superscript "o") in Exhibit A. It also would not print the "Return Address" or "Prepared By" entries with my middle name as your example showed.

Thank you for your feedback. We really appreciate it. Have a great day!

LAWRENCE P.

December 7th, 2021

How about a single button zip download of the files displayed instead of downloading them one at a time?

Thank you for your feedback. We really appreciate it. Have a great day!

Samantha A.

April 19th, 2023

This company is a super time saver for our firm and our client! Their website was easy to use and their staff was fast and efficient. Their fees are very reasonable. I would most certainly use their services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dwayne H.

November 3rd, 2020

The Oregon TODD transfer on death deed template worked great and was easy to use. They had instructions and a guide that had good pointers to filling everything out. It took about 2 weeks to mail in my filled TODD and receive it back from the county with their stamp. Would definitely use this service for other documents

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sue C.

December 1st, 2023

Very helpful. Easy to use. Able to avoid the cost of having an attorney prepare the document I needed.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Gertrude F.

April 24th, 2022

I like that DEEDS.com has a variety of forms tht I may need. However, I was disappointed that I am not able to save the PDF forms after I fill in the spaces. If I need to edit anything, I have to go back to the blank form and redo the whole thing. Perhap I am doing something wrong.

Thank you!

Timothy G.

June 3rd, 2019

Downloadable documents, instructions and a completed sample form were just what I needed. Very pleased and easy to use. Deeds.com will be my first stop for any future documents I may need. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judy F.

December 29th, 2018

I thought your site was focused on my specific county, but it wasn't. Therefore, I did not complete a transaction.

Thank you for your feedback Judy. Our site is national, we focus on all jurisdictions. Have a great day.

SueAnn V.

July 22nd, 2021

Thanks so much for the TOD Beneficiary Deed with the explanation, supplementary forms and great example! I just filed it today for the state of Colorado, in my county and it was accepted by the Clerk/Recorder. I really appreciate the thorough work that Deeds.com does. I definitely will use this site again and also recommend it to family and friends. Thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!