Lemhi County Correction Deed Form

Lemhi County Correction Deed Form

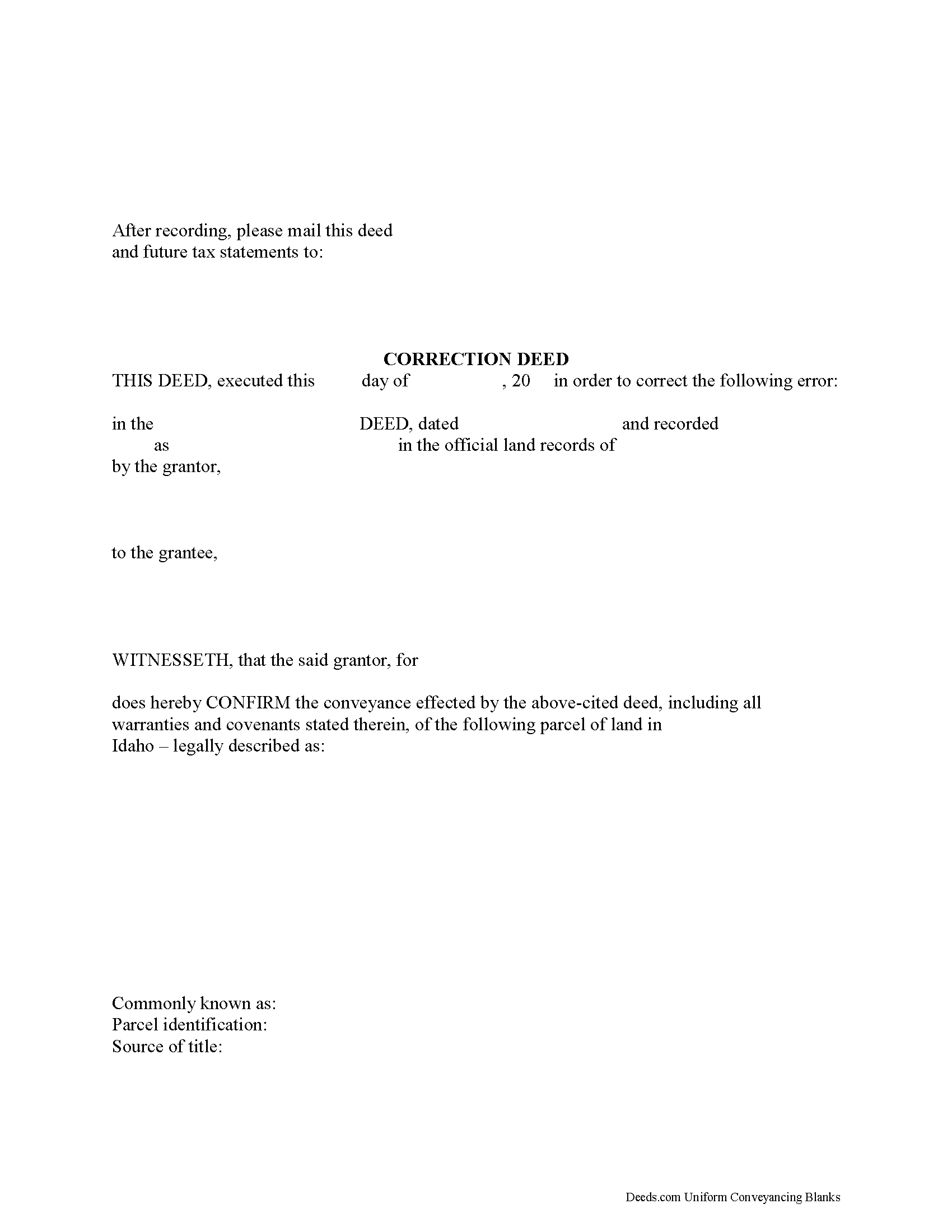

Fill in the blank form formatted to comply with all recording and content requirements.

Lemhi County Correction Deed Guide

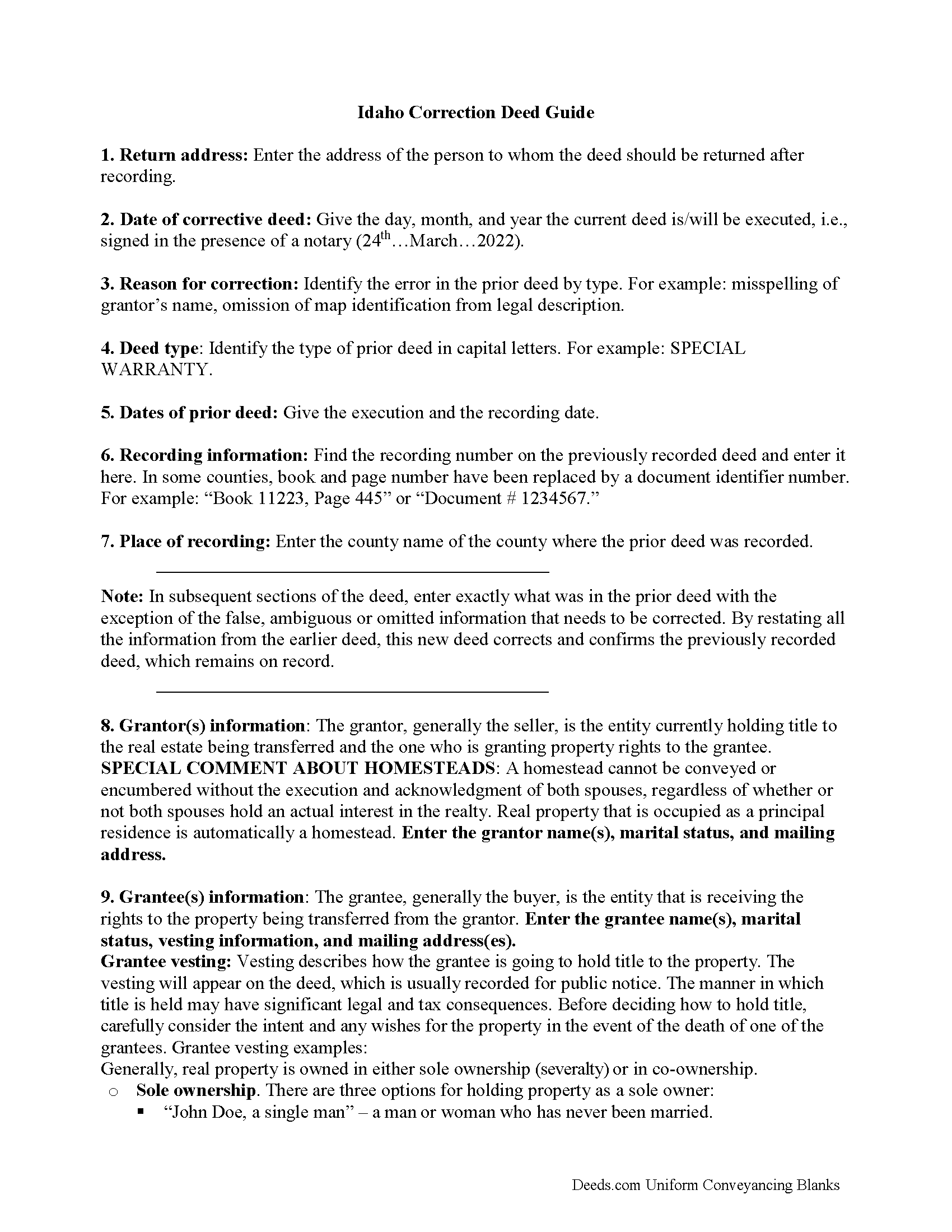

Line by line guide explaining every blank on the form.

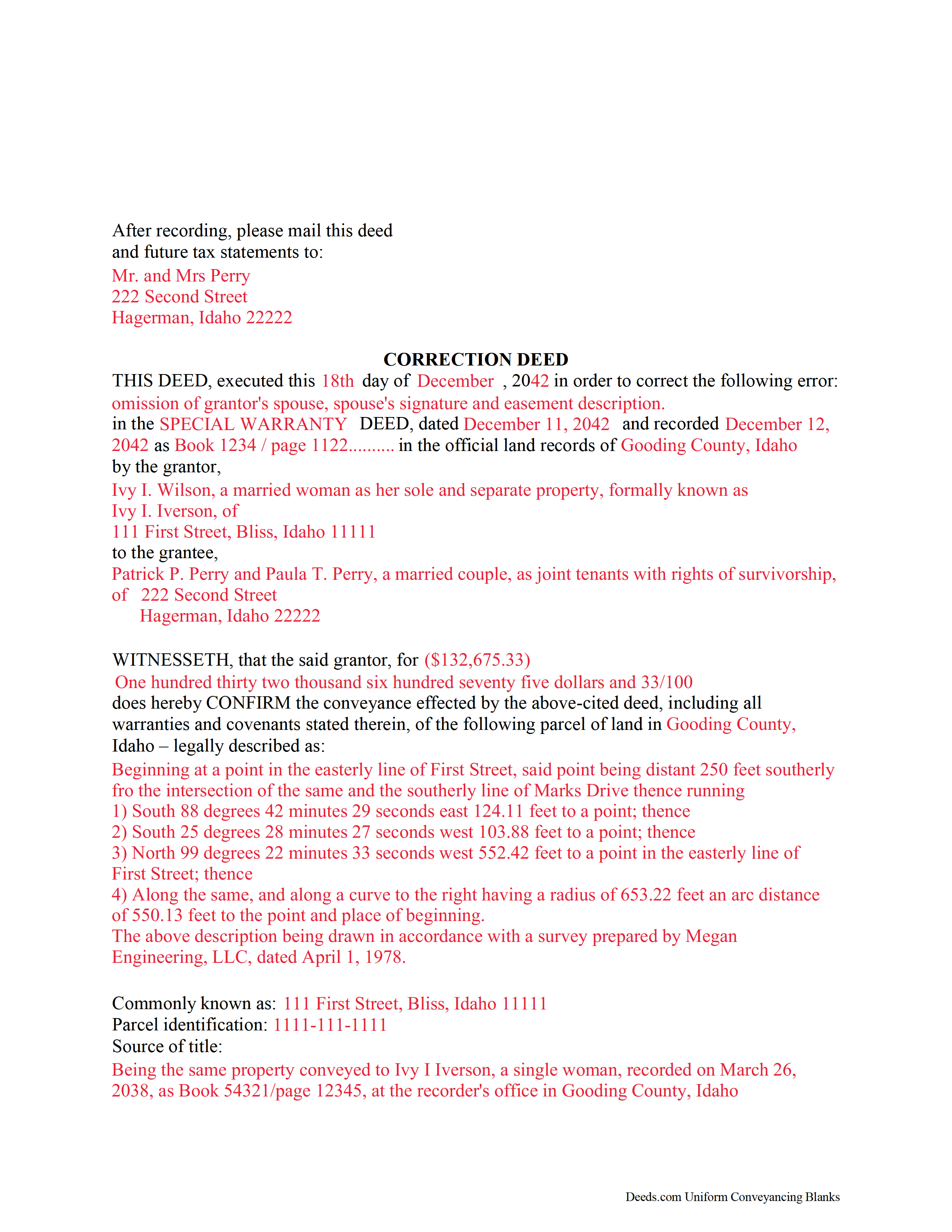

Lemhi County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Lemhi County documents included at no extra charge:

Where to Record Your Documents

Clerk/ Auditor/ Recorder

Salmon, Idaho 83467

Hours: Monday through Friday 9:00 AM through 5:00 PM

Phone: 208-756-2815 Ext. 1665

Recording Tips for Lemhi County:

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Lemhi County

Properties in any of these areas use Lemhi County forms:

- Carmen

- Cobalt

- Gibbonsville

- Leadore

- Lemhi

- May

- North Fork

- Salmon

- Shoup

- Tendoy

Hours, fees, requirements, and more for Lemhi County

How do I get my forms?

Forms are available for immediate download after payment. The Lemhi County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lemhi County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lemhi County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lemhi County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lemhi County?

Recording fees in Lemhi County vary. Contact the recorder's office at 208-756-2815 Ext. 1665 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct an error in a previously recorded quitclaim, warranty or grant deed in Idaho.

Errors in a previously recorded deed can be corrected by re-recording the corrected deed or by preparing and recording a new correction deed. This helps to prevent title flaws, which may cause problems when the current owner attempts to sell the property. The correction deed does not convey title but confirms the prior conveyance.

For small errors, corrections can be made directly on the original deed and initialed by the signors before the deed is re-recorded. For lengthier errors, the best option is to prepare and record a new corrective deed, executed from the original grantor to the original grantee. Apart from supplying the corrected information, it must identify the reason for correcting and reference the prior deed by date, recording number and title.

When correcting the legal description or plat identification, both the grantor and the grantee should sign the corrective deed. If the original grantor is not available for some reason, an affidavit, signed by the grantee and indexed under the name of both the grantor and grantee, may be the best way to effect a correction.

For certain types of changes, however, a correction deed may not be appropriate. Adding or removing a grantee, for example, or changing the manner in which title is held, or making material changes to the legal description, especially deleting a portion of the originally transferred property, may all require a new deed of conveyance instead of a correcting the original deed. When in doubt about how to correct an error, consult with a lawyer.

Important: Your property must be located in Lemhi County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Lemhi County.

Our Promise

The documents you receive here will meet, or exceed, the Lemhi County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lemhi County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Julia M.

March 9th, 2019

Your PDF form Personal Representative's Deed was exceedingly helpful.

Thank you Julia. Have a fantastic day!

thomas C.

July 7th, 2020

Thank you for being there for me when I couldn't get it done myself. I was a little confused with the operation at first but then became easy. I will definitely be using you again and again. Even after the pandemic is over.It's approximately 15 miles one way to downtown Orlando to do what you did for me sitting at my house

Glad we could help Thomas, have a great day!

Donna W.

November 7th, 2023

This is an amazing place to come for all your deed help. I had looked on several other sites without luck, but deeds.com got everything I needed quickly and they are very inexpensive! Love this site and will be recommending it to anyone needing this type of help.

Thank you for your positive words! We’re thrilled to hear about your experience.

Cathy P.

March 18th, 2021

I purchased the La St. Tammany Parish Quit Claim Deed as a gift for a friend. Currently waiting on a lawyer to draft his second version of what a La Quit Claim should look like. I have downloaded this St. Tammany La packet for simplicity and double protection for my friend. So far, I really like what I see from Deeds.com, short and to the point. It's truly a breath of fresh air. Thank you so much. Layperson Cathy for a friend.

Thank you for your feedback. We really appreciate it. Have a great day!

Daron S.

July 2nd, 2019

A download in word format would be a lot better than the pdf download.

Thank you for your feedback. We really appreciate it. Have a great day!

Sylvia Y.

September 2nd, 2020

Fantastic forms! So nice to have them formatted correctly for our county, the recorder here can be very picky with the margins. No issues at all.

Thank you for your feedback. We really appreciate it. Have a great day!

Raymond N.

September 7th, 2023

The process of obtaining the forms that I wanted was very easy and the cost reasonable. The site is easy to follow and explains everything. Thank you for being here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DAVID K.

April 6th, 2019

Already gave a review Great site and help

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alberta P.

April 14th, 2019

form was east to use...instructions came in handy.

Thank you for your feedback. We really appreciate it. Have a great day!

Maureen F.

January 27th, 2021

Forms were delivered quickly and were easily filled out. State specific!

Thank you!

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

Arthur S.

July 19th, 2019

It is great and fast you get 5 stars from me

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ronnie y.

May 22nd, 2019

well worth the money thank you

Thank you!

Michael D.

August 19th, 2019

Your Guide is very good but does not explain precisely where one can find the Instrument Number for the originally filed Claim of Lien.

Thank you for your feedback. We really appreciate it. Have a great day!

Devra R.

May 30th, 2022

A refreshingly easy service to use. They offer auxiliary forms as a courtesy. Theres no "gotcha" capitalism. You pay the reasonable fee and the needed forms are accessible instantly to download. I've used it twice so far and it worked perfectly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!