Download Idaho Disclaimer of Interest Legal Forms

Idaho Disclaimer of Interest Overview

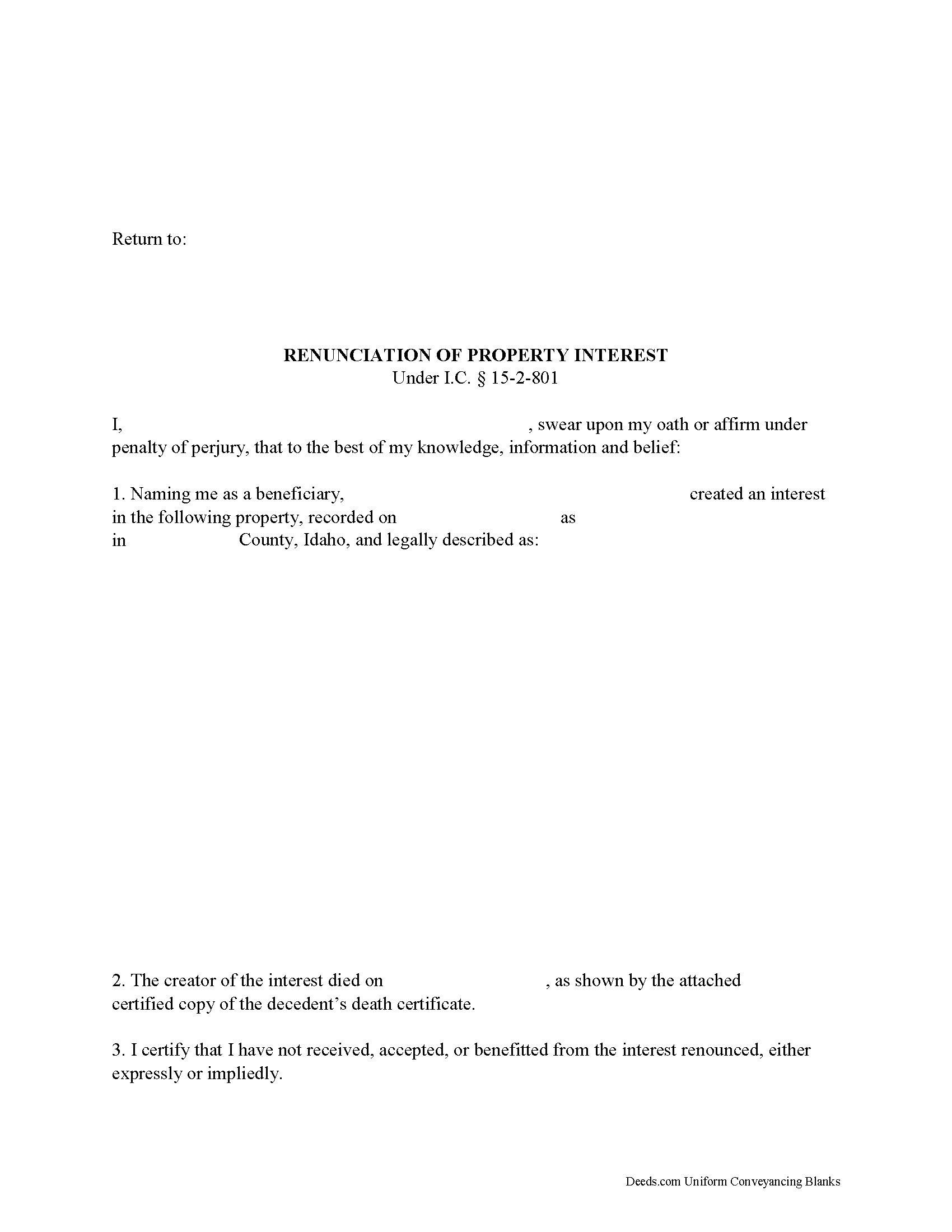

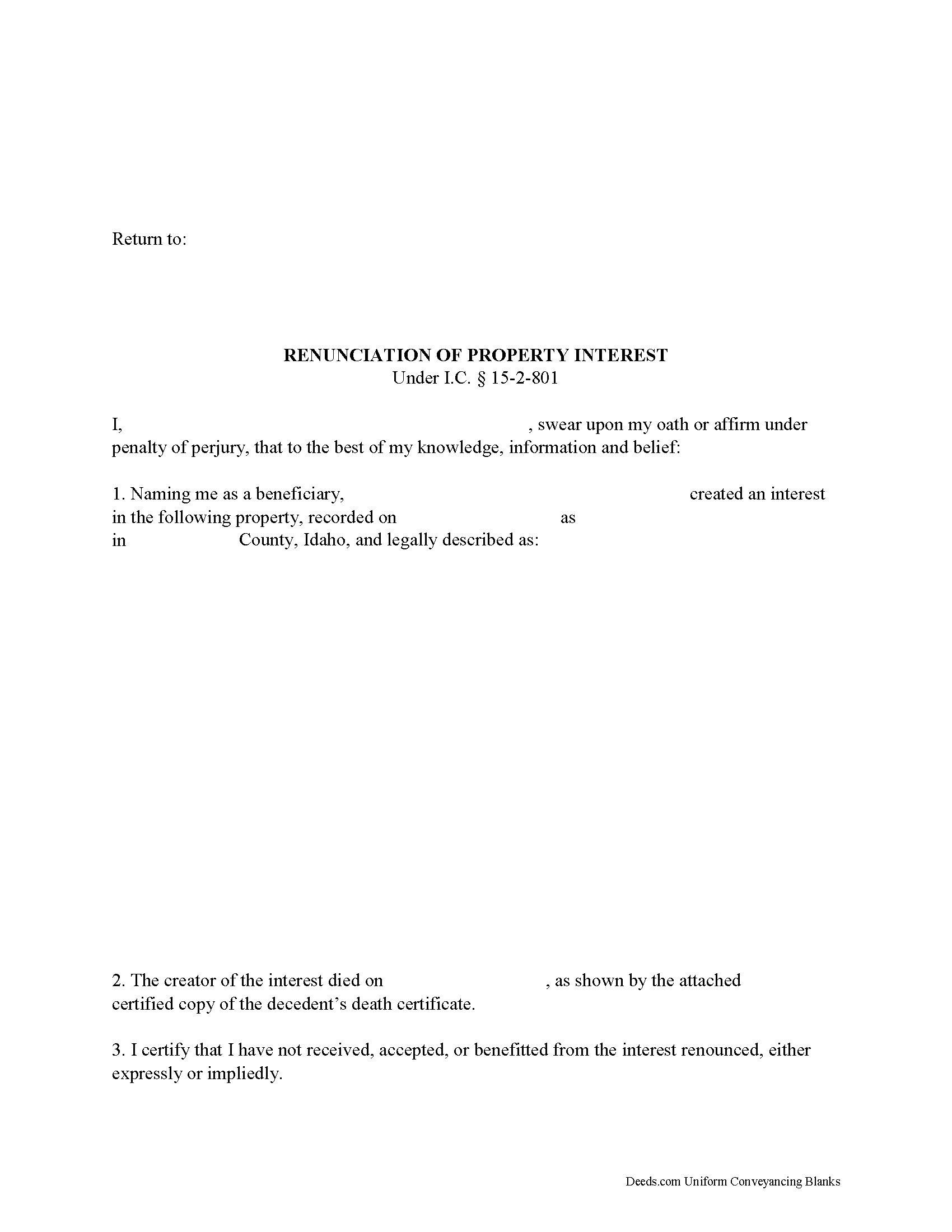

Idaho Renunciation of Property

Under the Idaho Statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (I.C. 15-2-801). Note that the option to renounce is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (15-2-801 (4)).

The document must be in writing and include a description of the interest, a declaration of intent to renounce all or a defined portion of the interest, and be signed by the renouncing party (15-2-801 (1) (b)).

Deliver the document within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the trustee. It must also be filed in the court of the county where proceedings concerning the decedent's estate are or would be pending (15-2-801 (2)). If real property is involved, record a copy of the document at the recorder's office in the county where the property is located in order to avoid any ambiguity regarding the chain of title.

A renunciation is irrevocable and binding for the renouncing party and his or her creditors (15-2-801 (6)), so be sure to consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited property. If the renounced interest arises out of jointly-owned property, seek legal advice as well.