Teton County Personal Representative Deed Form

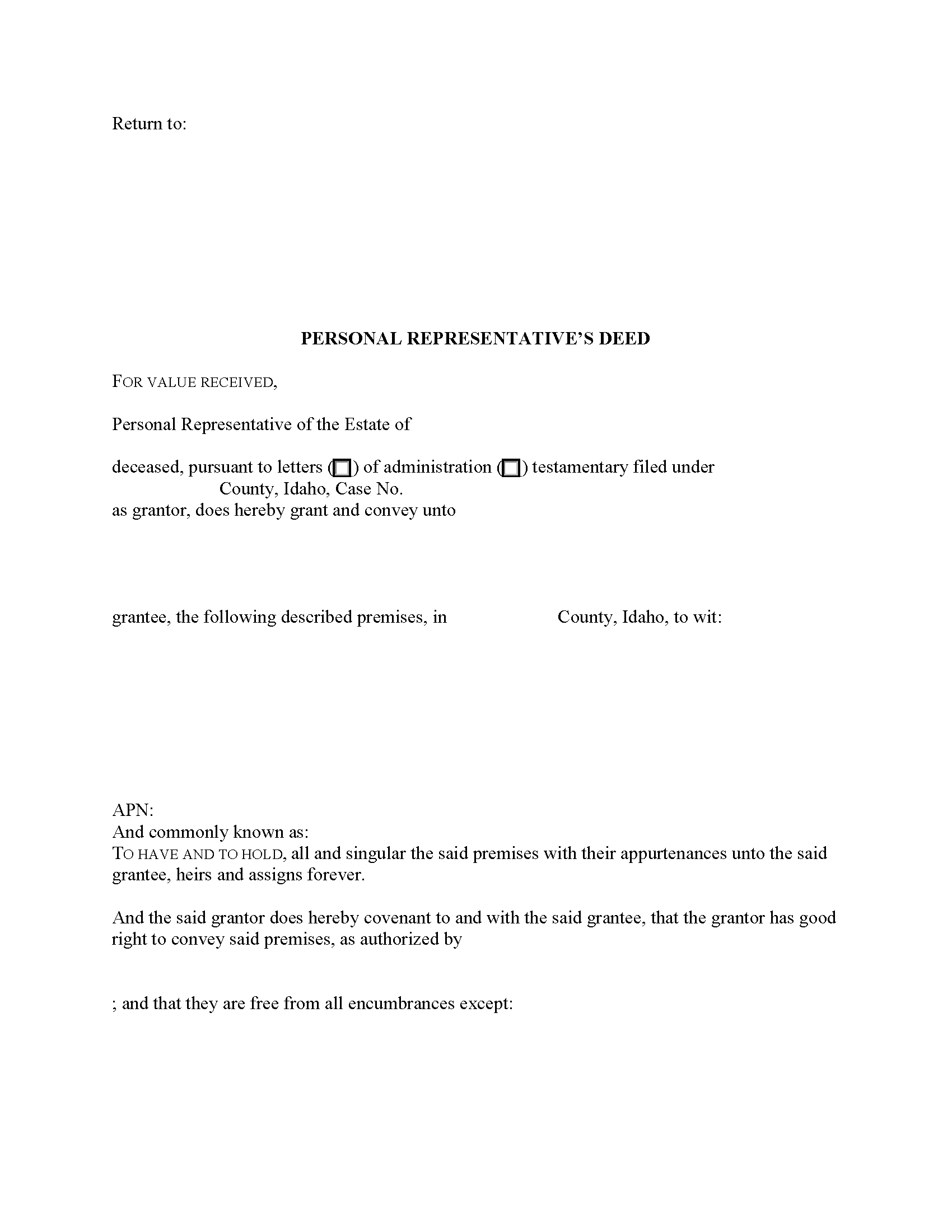

Teton County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

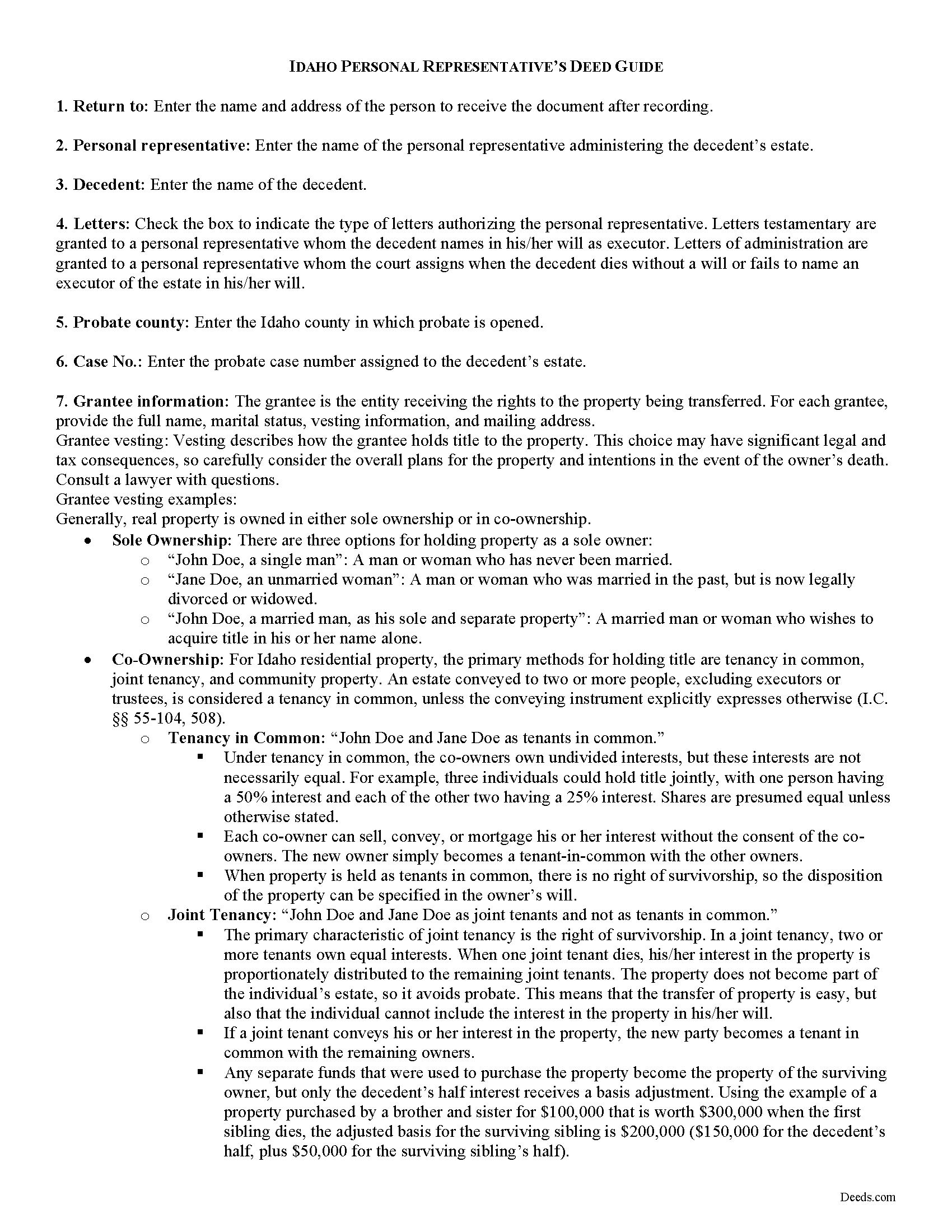

Teton County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

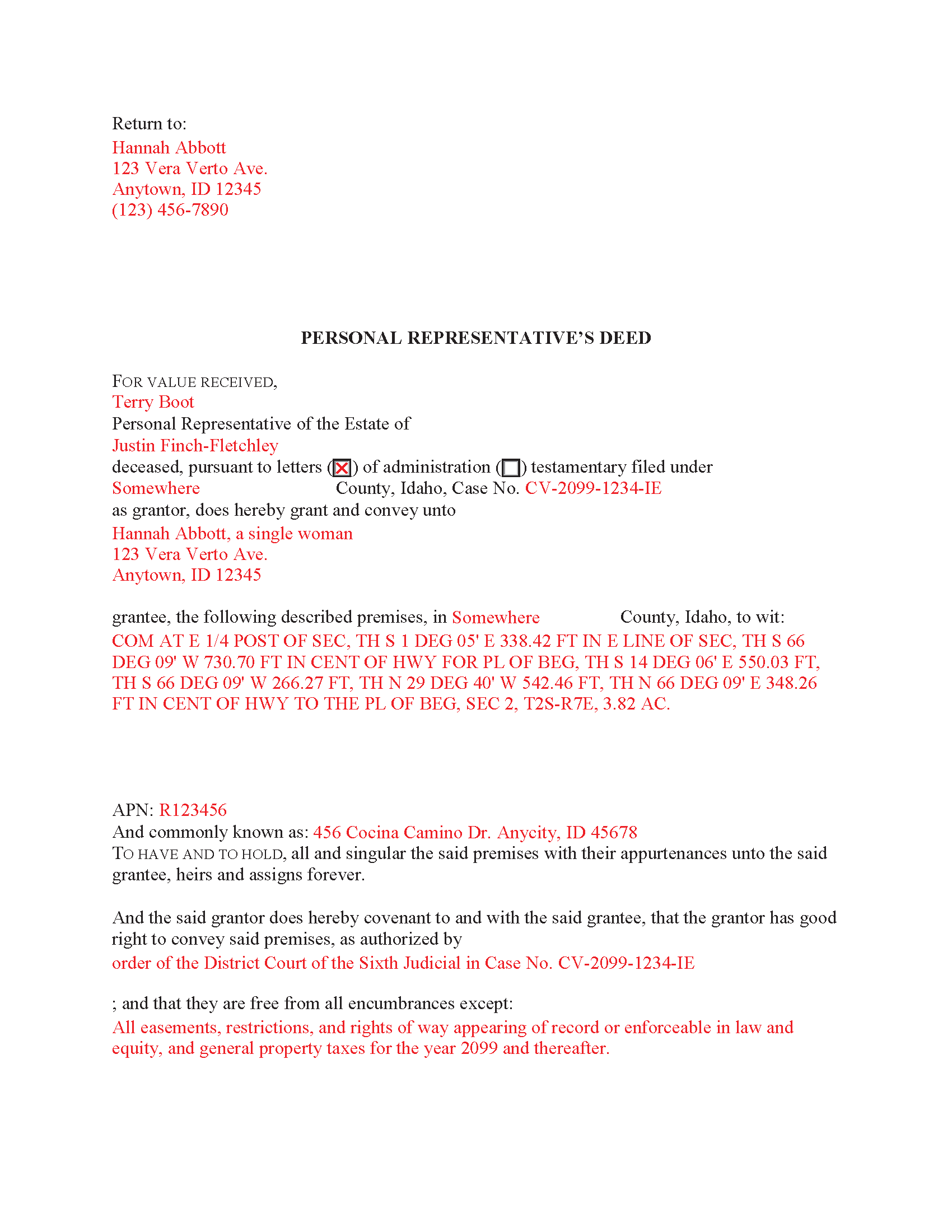

Teton County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Teton County documents included at no extra charge:

Where to Record Your Documents

Teton County Clerk-Auditor-Recorder

Driggs, Idaho 83422

Hours: 9:00am to 5:00pm M-F

Phone: (208) 354-8780

Recording Tips for Teton County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Teton County

Properties in any of these areas use Teton County forms:

- Driggs

- Felt

- Tetonia

- Victor

Hours, fees, requirements, and more for Teton County

How do I get my forms?

Forms are available for immediate download after payment. The Teton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Teton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Teton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Teton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Teton County?

Recording fees in Teton County vary. Contact the recorder's office at (208) 354-8780 for current fees.

Questions answered? Let's get started!

A personal representative (PR), appointed or authorized by the relevant probate court, uses a personal representative's deed to convey title to someone who is not the decedent's heir. The PR may need to sell the decedent's real property to pay the estate's debts or to liquidate the estate for ease of distribution to beneficiaries.

The Personal Representative's Deed is named for the acting fiduciary, but is functionally equivalent to a limited warranty deed. A limited warranty deed in Idaho contains covenants that the grantor has not previously conveyed the same title, and that the estate is free from encumbrances made by or under the grantor ( 55-612).

In addition to meeting the standard state and local standards for deeds in Idaho, personal representative's deeds might need additional information about the decedent, the representative, the court case, etc. Record the executed deed, along with any supporting documentation and fees, with the office responsible for maintaining land records in the county where the property is situated.

Probate can be complicated, so consult an attorney with questions regarding estate administration and conveyances of real property in Idaho.

Important: Your property must be located in Teton County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Teton County.

Our Promise

The documents you receive here will meet, or exceed, the Teton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Teton County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Gerald G.

September 16th, 2020

I am researching forms required to change deed from joint owners to individual. Subsequently, forms required when/after a trust is established for real property.

Thank you!

Michael D.

June 14th, 2024

Quick and easy!

Thank you!

DEBORAH H.

January 22nd, 2024

This is my fourth try, and I hope my form is complete and acceptable.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Carolyn G.

September 1st, 2021

I was extremely pleased with this experience, which literally took a minimum amount of time. One recommendation: make certain that when documents are uploaded that they have been received in the appropriate file. The lack of clarity caused me to upload twice or three times. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary S.

January 25th, 2019

I am so excited to find this site. Thank you

Thank you Mary. We appreciate your enthusiasm, have a great day!

Betty Z.

June 21st, 2023

Thank you so much for giving us a service so important to many. I will pass on this pertinent process to all who need it. again, thank you. bz

Thanks so much Betty. We appreciate you. Have a spectacular day!

Tracey T.

January 20th, 2022

I downloaded the Lady Bird deed. The process was quick and easy to download. Just select your county, fill out the form. You will need the property description from your original deed. In my case I had to go downtown Wayne County (Detroit). (Make an appt online). 1st you will have to get the property tax certified to ensure all taxes are paid to date (5th floor at the Wayne County Treasurer office). Give them the form you just filled out and they will stamp certified $5. After that take the form to the Register of Deeds (7th floor) appt needed. $18. Make sure it is properly notarized and all signatures completed. Once approved, they will scan it, stamp it, give it back with a receipt and mail a copy also. All Done. Worked beautifully. My co worker go a lawyer and paid over $250. I just used deeds.com and total for forms and going downtown with notarizing was less than $40 Yea!

Thank you for your feedback. We really appreciate it. Have a great day!

Terrill B.

May 10th, 2019

I found it very difficult to find this website, had my accountant search for me. Instructions are invaluable through guide and example. Thank you for them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Taylor W.

February 2nd, 2021

This was the quickest NOC recording i have ever done. I will definitely be using deeds.com from here on out for recordings!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

john m.

June 17th, 2020

its a bit confusing for a novice computer user. I would prefer to print out the forms, fill them out on paper, then attach them to an email to discuss the accuracy of the forms with a friend, and then take the completed forms to the County office to be recorded

Thank you for your feedback. We really appreciate it. Have a great day!

Randy H.

May 12th, 2019

Love this has all forms you need

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Justin H.

June 10th, 2021

Couldn't pull a simple deed for a legal description.

Thank you for your feedback Justin. We do hope that you were able to find something more suitable to your needs elsewhere. Have a wonderful day.

Rose H.

March 22nd, 2021

I am so glad I found this resource! As the Executor of a family members estate I wanted to save money by bypassing a lawyer as it seemed pretty straight forward to tranfer a Life Estate to the remainderman. (I had original deeds). But talking with 3 different states and 4 different counties - none of which seemed to need the same documents, I was almost ready to dump this in a lawyer's lap. This resource makes it simple!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel S.

February 11th, 2019

It was easy to find the forms I was looking for and the guided steps and examples of how to use the form were beneficial.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen U.

December 5th, 2020

This is another great deal that has come out of the quarantine for covid. Saved me hours and days of time. and provides a way to file deeds that really isn't done effectively anyway else. It was also very inexpensive that you would not expect. I didn't even have to leave home.

Thank you for your feedback. We really appreciate it. Have a great day!