Elmore County Quitclaim Deed Form

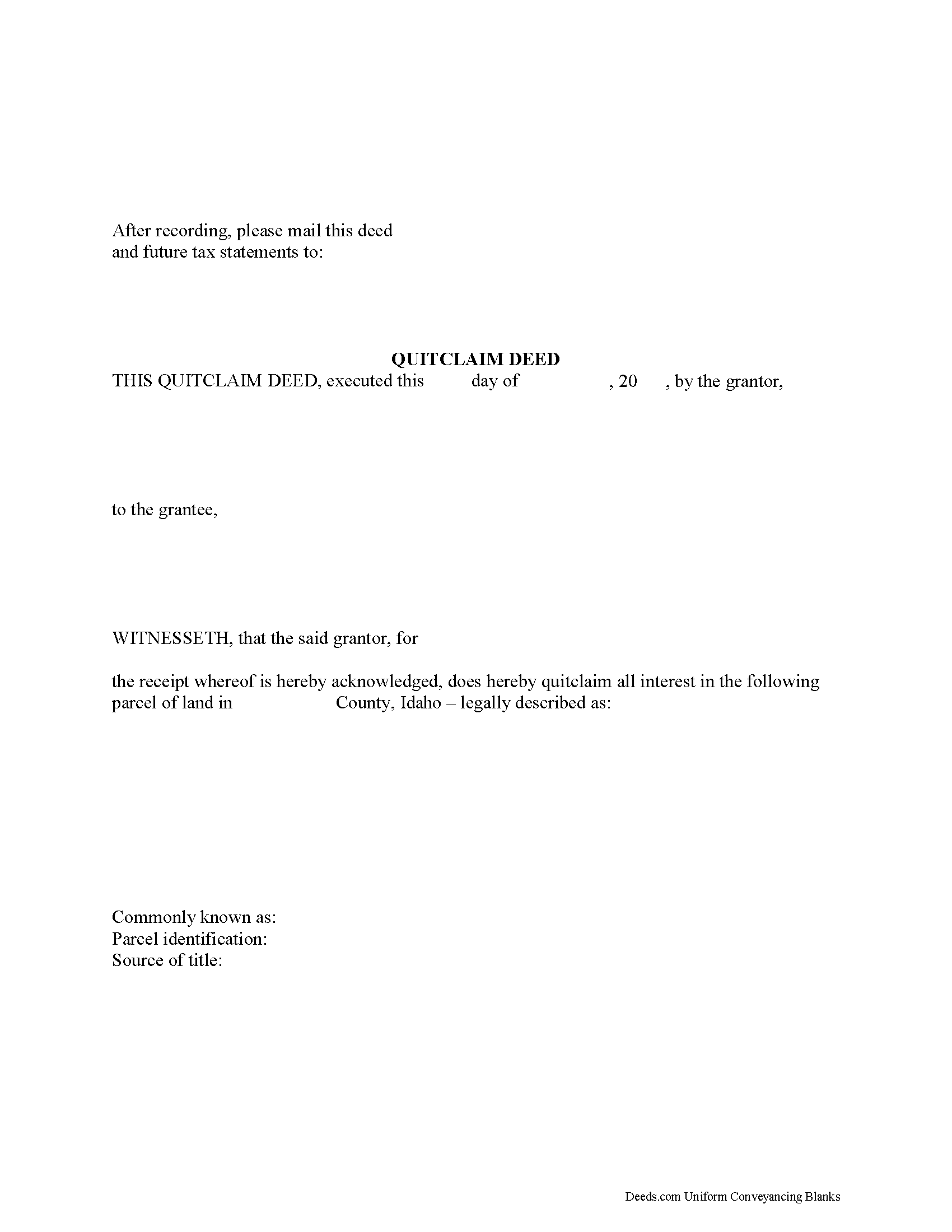

Elmore County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Idaho recording and content requirements.

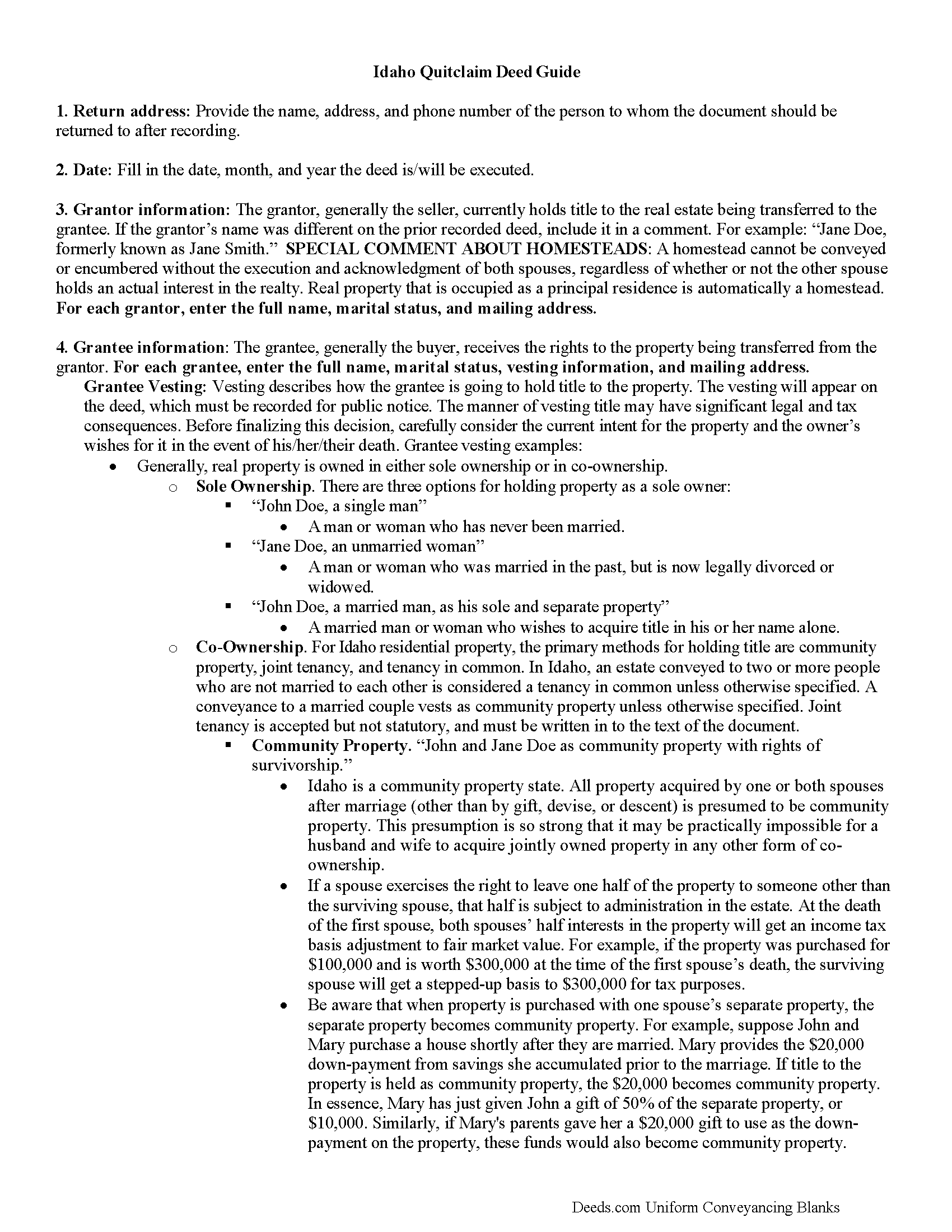

Elmore County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

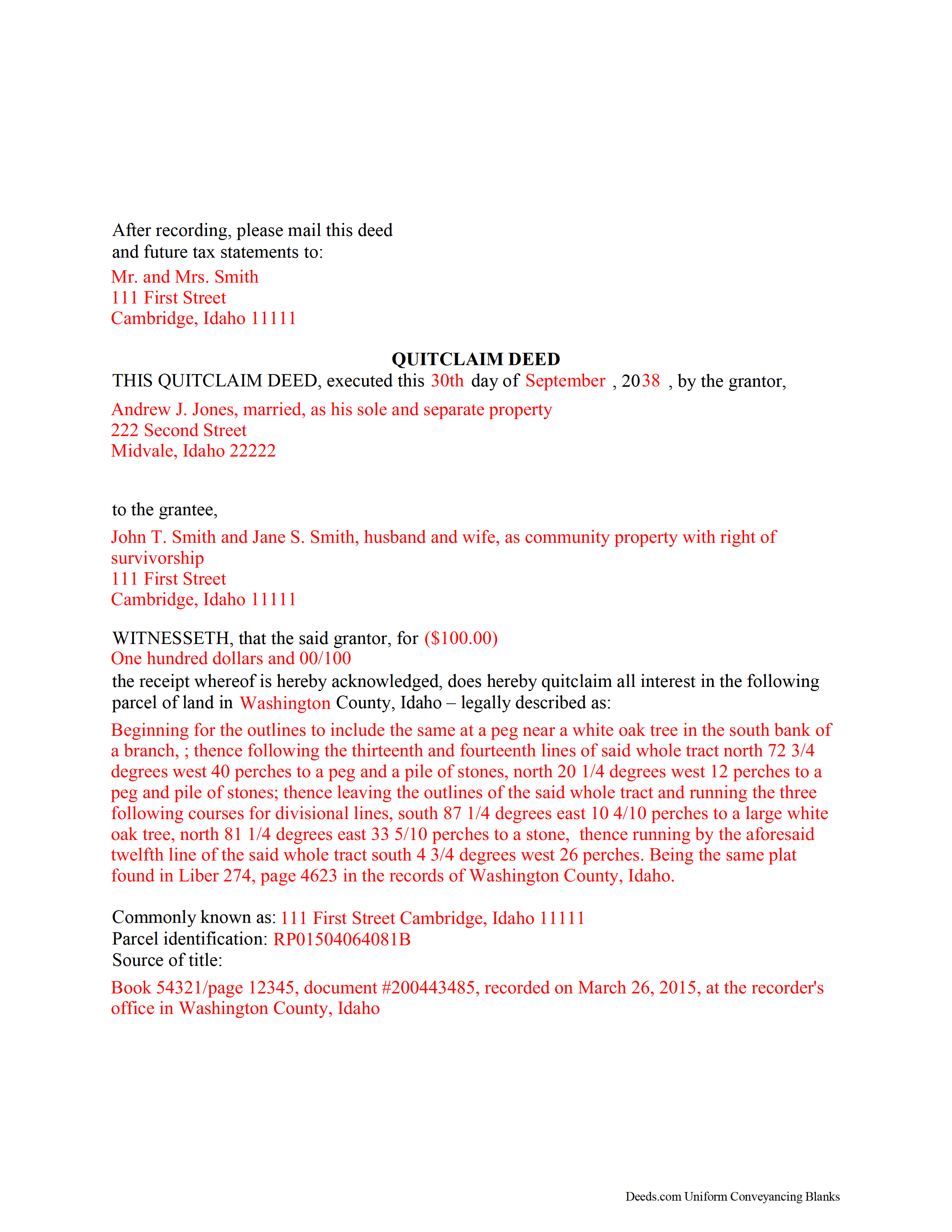

Elmore County Completed Example of the Quitclaim Deed Document

Example of a properly completed Idaho Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Elmore County documents included at no extra charge:

Where to Record Your Documents

Elmore County Recorder

Mountain Home, Idaho 83647

Hours: 9:00am to 5:00pm Monday-Friday

Phone: (208) 587-2130 Ext. 500

Recording Tips for Elmore County:

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Elmore County

Properties in any of these areas use Elmore County forms:

- Atlanta

- Glenns Ferry

- Hammett

- King Hill

- Mountain Home

- Mountain Home A F B

Hours, fees, requirements, and more for Elmore County

How do I get my forms?

Forms are available for immediate download after payment. The Elmore County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Elmore County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Elmore County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Elmore County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Elmore County?

Recording fees in Elmore County vary. Contact the recorder's office at (208) 587-2130 Ext. 500 for current fees.

Questions answered? Let's get started!

The State of Idaho does not have a statutory form for quitclaim deeds. Instead, the requirements are spread out in different parts of the statutes. Idaho Code 55-505 (2012) defines a conveyance as a transfer in writing. I. C. 55-601 expands on this definition by explaining that a conveyance of real estate must be in writing, signed by the grantor or authorized agent, and also include the grantee's name and complete mailing address. To be accepted for recordation, I. C. 31-2410 notes the need for the name of the individual requesting the instrument's recording, while I. C. 31-2413 lists the items the recorder must present in a reception book. In addition to the information above, a valid quit claim deed must contain a title clearly representing the character of the document and a legal description of the property. Additionally, I. C. 55-612 relates the covenants associated with the word "grant." Because quitclaim deeds contain no warranties, this word should not appear in the text of the conveyance. I. C. 55-818 mentions additional requirements, including the execution date (when the quitclaim deed was signed) and a description of the interest or interests in the property created by executing the deed. I. C. 55-1007 explains that if the conveyance relates to a parcel of land classified as a homestead, the spouse of the grantor, if any, must sign the deed as well. Finally, I. C. 73-121 states that all documents submitted for recording in Idaho must be in English or be accompanied by a certified translation.

Recording:

When submitting quitclaim deeds for recordation in Idaho, follow the sizing requirements set by I. C. 31-3205, which sets the limits to legal-sized pages (8" x 14"). Standard letter size is also acceptable (8" x 11"). I. C. 55-808 states that the instrument must be recorded in the county where the land affected by the transfer is situated.

Idaho follows a "race-notice" recording statute as codified in I. C. 55-811: from the time a conveyance of real property is accepted for recording by the county officer responsible for maintaining land records, the public is served with constructive notice about the change in ownership. I. C. 55-809 asserts that an "instrument is deemed to be recorded when, being duly acknowledged, or proved and certified, it is deposited in the recorder's office with the proper officer for record." Despite the fact that I. C. 55-815 validates unrecorded transfers between parties, I. C. 55-812 discusses that a deed must be recorded or the transfer of title is void against a future bona fide purchaser (buyer for value, usually money.) In other words, even though quit claim deeds contain no warranties of title for the grantee, recording the document as soon as possible after execution enters the transaction into the public record, preserves the property rights conveyed in the deed, and protects the interests of all parties.

Important: Your property must be located in Elmore County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Elmore County.

Our Promise

The documents you receive here will meet, or exceed, the Elmore County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Elmore County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

ROBERT P.

August 26th, 2022

Got what I needed

Thank you!

Daniel Z.

September 13th, 2022

All is well that ends well and this form service seemed to work quite smoothly, even though my printer gives me fits at times, having to hand feed the blank paper.

Thank you for your feedback. We really appreciate it. Have a great day!

GARY S.

August 27th, 2020

sweet & easy

Thank you!

George S.

June 24th, 2020

Very good, very expensive. I hope that this is what my lawyer needed for us to finish our wills. George

Thank you!

Jana C H.

July 29th, 2019

Form was the one I needed and the instructions along with a sample form was all I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George R.

July 28th, 2020

One of the most satisfactory and easy to use websites I have come across. Being able to record documents in the court records without having to pay an atty $500 per hour and accomplish the recording in about 24 hours instead of days and even weeks i s invaluable. Worked perfectly.

Thank you!

Wendy S.

December 19th, 2019

Very easy and affordable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin M.

November 22nd, 2019

Thank you for your services...Attny office quoted a very large fee for the "TOD DEED" process, so this is very helpful that I am able to take care of this myself. If I would have researched your link sooner, I could have saved my Dad a lot of money for the "SURVIVORSHIP DEED". Thanks again & have a wonderful day:)

Thank you for your feedback. We really appreciate it. Have a great day!

Mary S.

January 25th, 2019

I am so excited to find this site. Thank you

Thank you Mary. We appreciate your enthusiasm, have a great day!

Cynthia S.

January 19th, 2019

Good find, provides guide to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sohaib R.

April 4th, 2022

Digital anything can be extremely convenient and quick, and my experience with Deeds.com has been exactly that. Very worth their fee. (I used them to record real property records/deeds in Texas).

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marion Paul W.

January 31st, 2019

Quick service .Easy download.I ordered Quit Claim and should have ordered warranty deed. I will make it work

Thank you!

Patricia M.

August 19th, 2019

Very easy site to navigate and very helpful information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelly D.

March 13th, 2020

Excellent

Thank you!

Roy T.

April 3rd, 2020

Thank you for an easy to use system. I was able to find all the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!