Blaine County Special Power of Attorney for Real Property Form

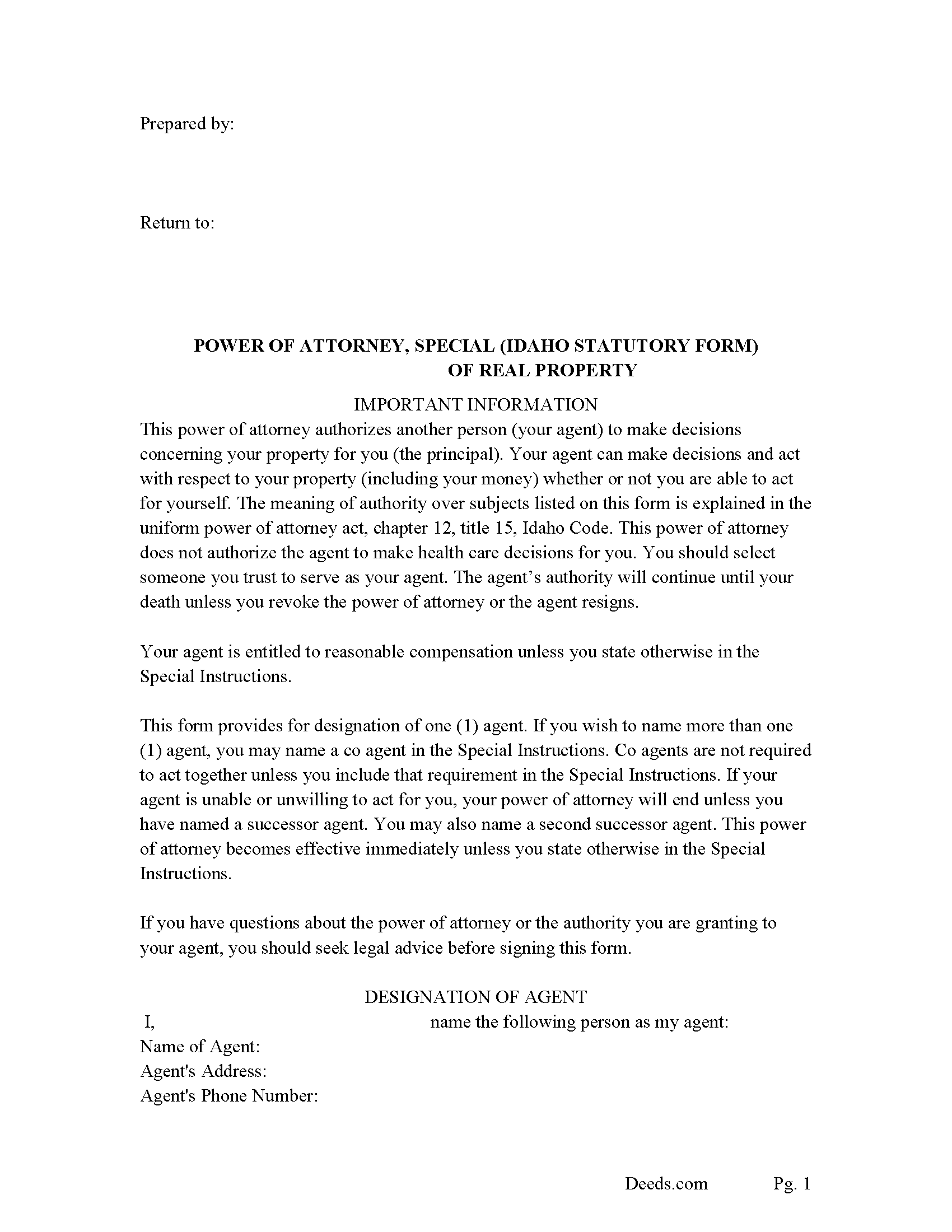

Blaine County Special Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

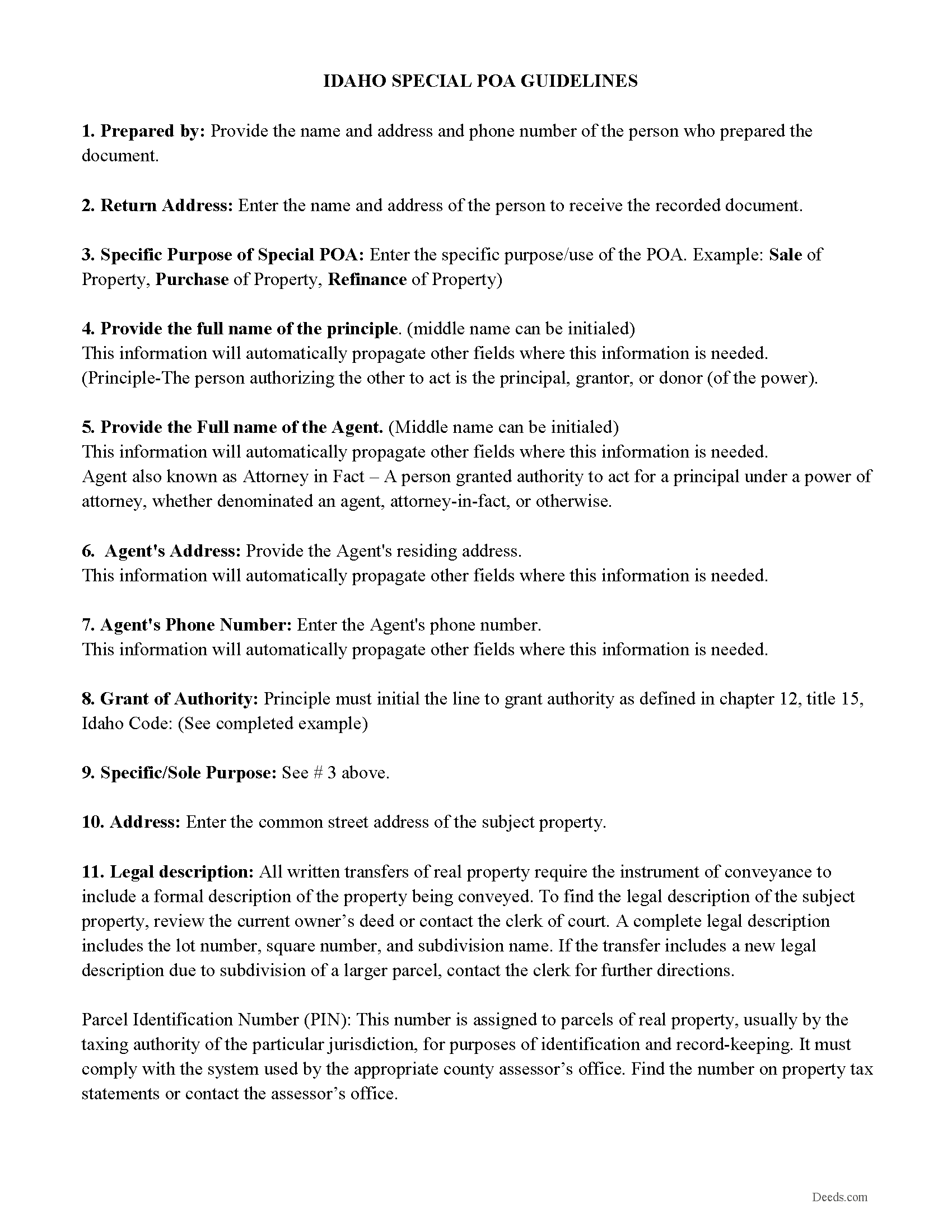

Blaine County Guidelines for the Special Power of Attorney

Line by line guide explaining every blank on the form.

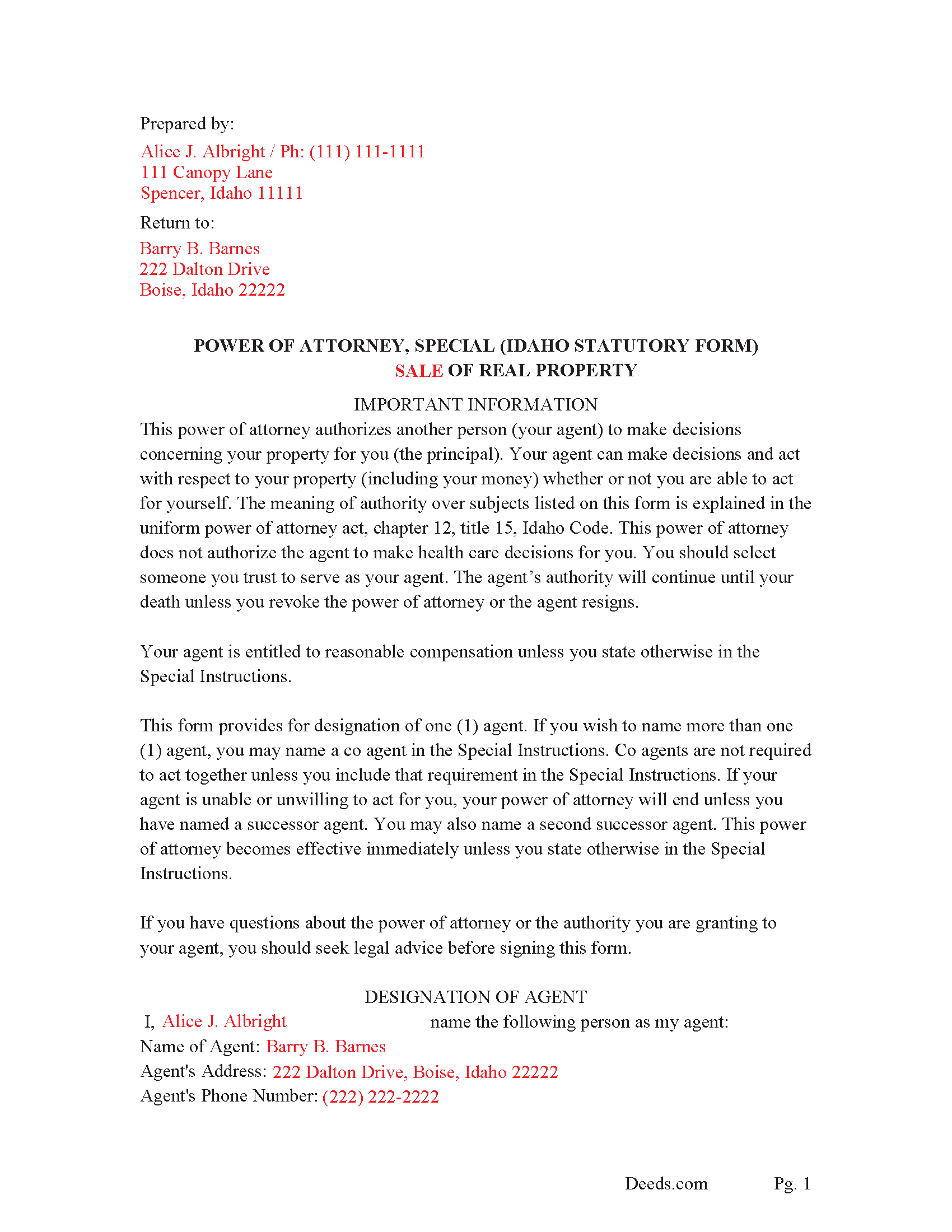

Blaine County Completed Example of the Special POA

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Blaine County documents included at no extra charge:

Where to Record Your Documents

Blaine County Recorder / Clerk

Hailey, Idaho 83333

Hours: 8:00 to 12:30 & 1:30 to 6:00 Mon-Thu; Fri until 5:00

Phone: (208) 788-5505

Recording Tips for Blaine County:

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Blaine County

Properties in any of these areas use Blaine County forms:

- Bellevue

- Carey

- Hailey

- Ketchum

- Picabo

- Sun Valley

Hours, fees, requirements, and more for Blaine County

How do I get my forms?

Forms are available for immediate download after payment. The Blaine County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Blaine County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Blaine County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Blaine County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Blaine County?

Recording fees in Blaine County vary. Contact the recorder's office at (208) 788-5505 for current fees.

Questions answered? Let's get started!

This form is used by a principle to empower an agent to act in his/her name and stead. Its sole purpose is to either purchase, sell or refinance a specific property. Unless stated otherwise, this power of attorney is durable and stays active in the case of the principal's disability.

"Principal" means an individual who grants authority to an agent in a power of attorney. 15-12-102 (9)

"Agent" means a person granted authority to act for a principal under a power of attorney, whether denominated an agent, attorney-in-fact, or otherwise. The term includes an original agent, coagent, successor agent or a person to which an agent's authority is delegated. 15-12-102 (1)

For use in Idaho only.

Important: Your property must be located in Blaine County to use these forms. Documents should be recorded at the office below.

This Special Power of Attorney for Real Property meets all recording requirements specific to Blaine County.

Our Promise

The documents you receive here will meet, or exceed, the Blaine County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Blaine County Special Power of Attorney for Real Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Marilyn G.

June 21st, 2020

Easy to follow instructions

Thank you for your feedback. We really appreciate it. Have a great day!

BARBARA T.

July 16th, 2019

Love this site! So easy to use and very economical

Thank you!

Meredith B.

January 5th, 2021

Clean and easy process. Super attentive and helpful.

Thank you!

TEDDY Y.

January 29th, 2022

this experience was made possible with the ease of using your service thank you

Thank you!

Diane C.

December 5th, 2019

Hey, great job! Love these forms. They make the process really easy.

Great to hear Diane, have a fantastic day!

John F.

January 28th, 2021

The document I purchased was perfect for what I needed done. Very easy to obtain the document. Website very easy to navigate. Would use again and would recommend to anyone who needs the documents.

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

October 4th, 2022

Fast turn-around, very efficient!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig P.

August 19th, 2019

Good

Thank you!

JESSICA B.

June 25th, 2020

easy to move through the site and create an account.

Thank you!

STANLEY K.

February 3rd, 2022

I AM DELIGHTED TO BE PARTY TO DEEDS.COM. THE PROCESS IS DOWN-TO-EARTH AND VERY USER FRIENDLY. I MUST SAY THAT JUST THE SAVINGS IN TRAVEL TIME AND MONEY IS IN ITSELF VERY REFRESHING. THIS ON LINE PROCESS IS SO CONVENIENT FOR MY OVERALL EFFORT AND OF COURSE FOR OUR CLIENTS AS WELL. I GOT BACKED UP IN RECORDING WHEN THE VIRUS BEGAN RAGING AND PERSONAL VISITS TO LAND RECORDS BECAME A THING OF THE PAST.I FOUND THE SITE WITH A SUGGESTION FROM DC LAND RECORDS' ASSISTANT BY PHONE. I ONLY WISH I'D KNOWN ABOUT THIS AWESOME SERVICE BEFORE 2020. HATS OFF TO DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas H.

April 15th, 2023

I had an initial problem of downloading the form. After contacting the website, I got an answer very quickly, and they fixed the problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Regina G.

May 18th, 2022

Very good customer service. Would recommend them highly.

Thank you!

Shane J.

April 21st, 2020

Easy to use and quickly filed documents!

Thank you!

Susan K.

February 16th, 2019

Very helpful; information included on the form explanations about Colorado laws in regards to beneficiary deeds helped us understand the issues involved.

Thank you for your feedback. We really appreciate it. Have a great day!

Lawrence R.

February 4th, 2020

Forms do not allow enough space for fields and cutoff. Need to expand the fields to allow for more writing. I ended up re-typing to be able to include full property description. Would be nice if available in Word format rather than only PDF format.

Thank you for your feedback. We really appreciate it. Have a great day!