Nez Perce County Substitution of Trustee - for Deed of Trust Form

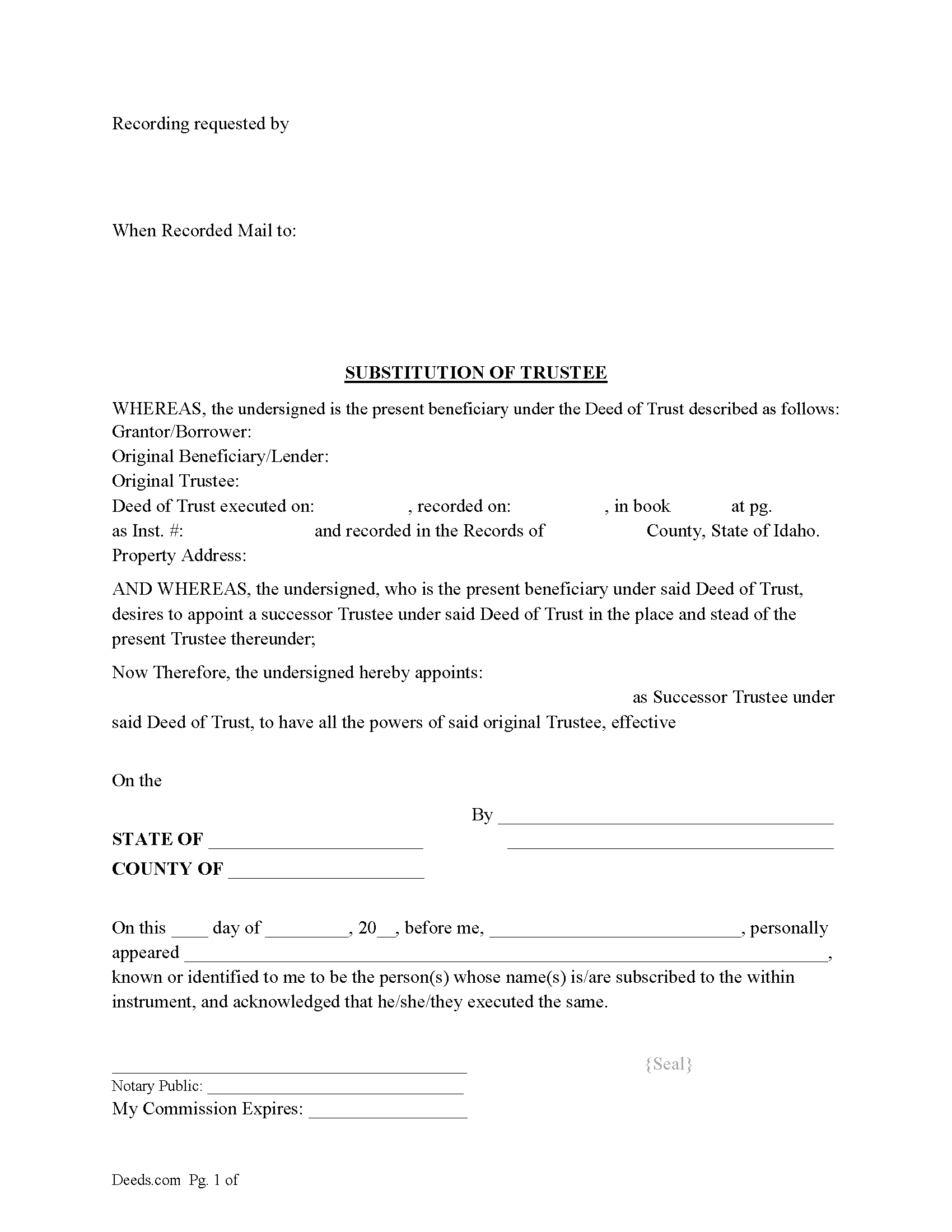

Nez Perce County Substitution of Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

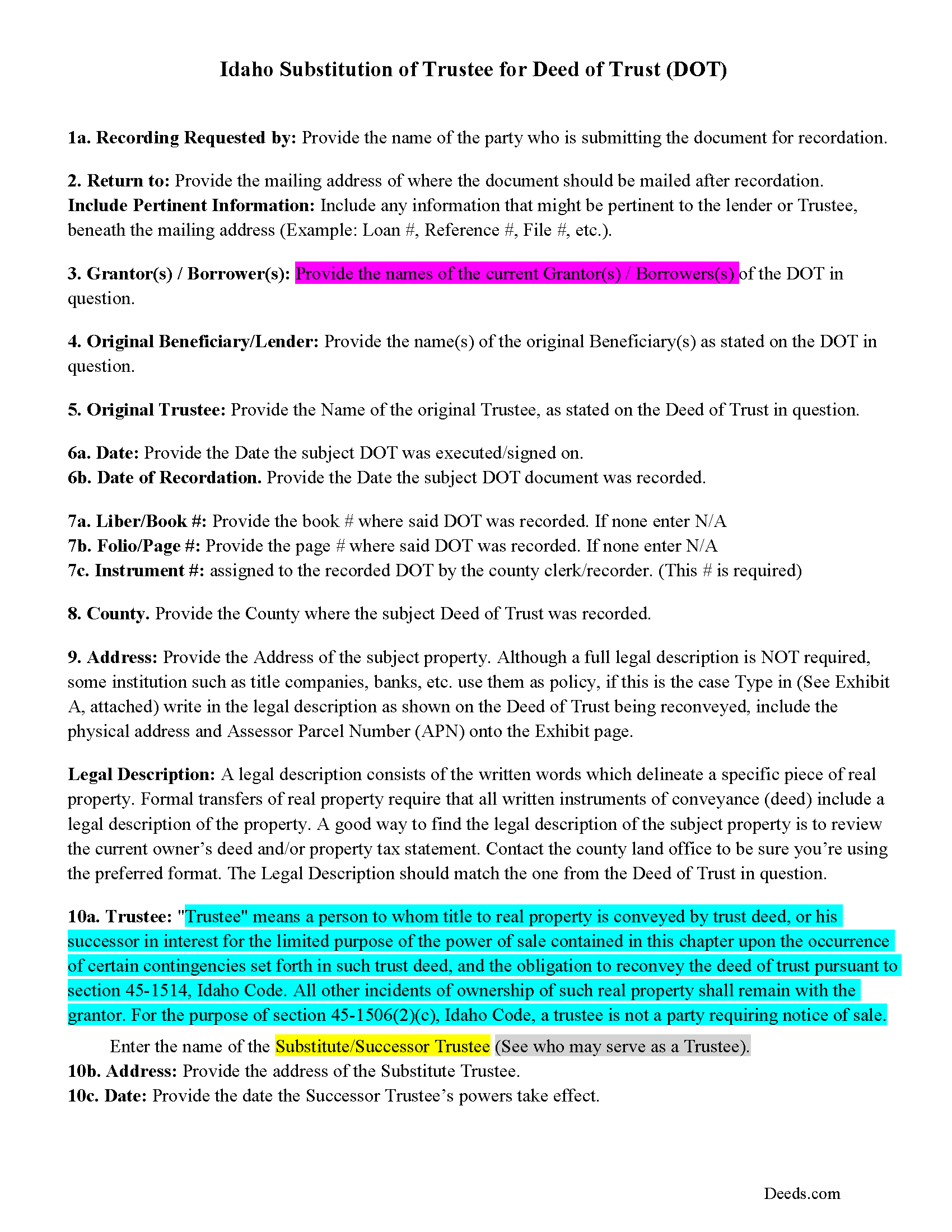

Nez Perce County Guidelines for Substitution of Trustee Form

Line by line guide explaining every blank on the form.

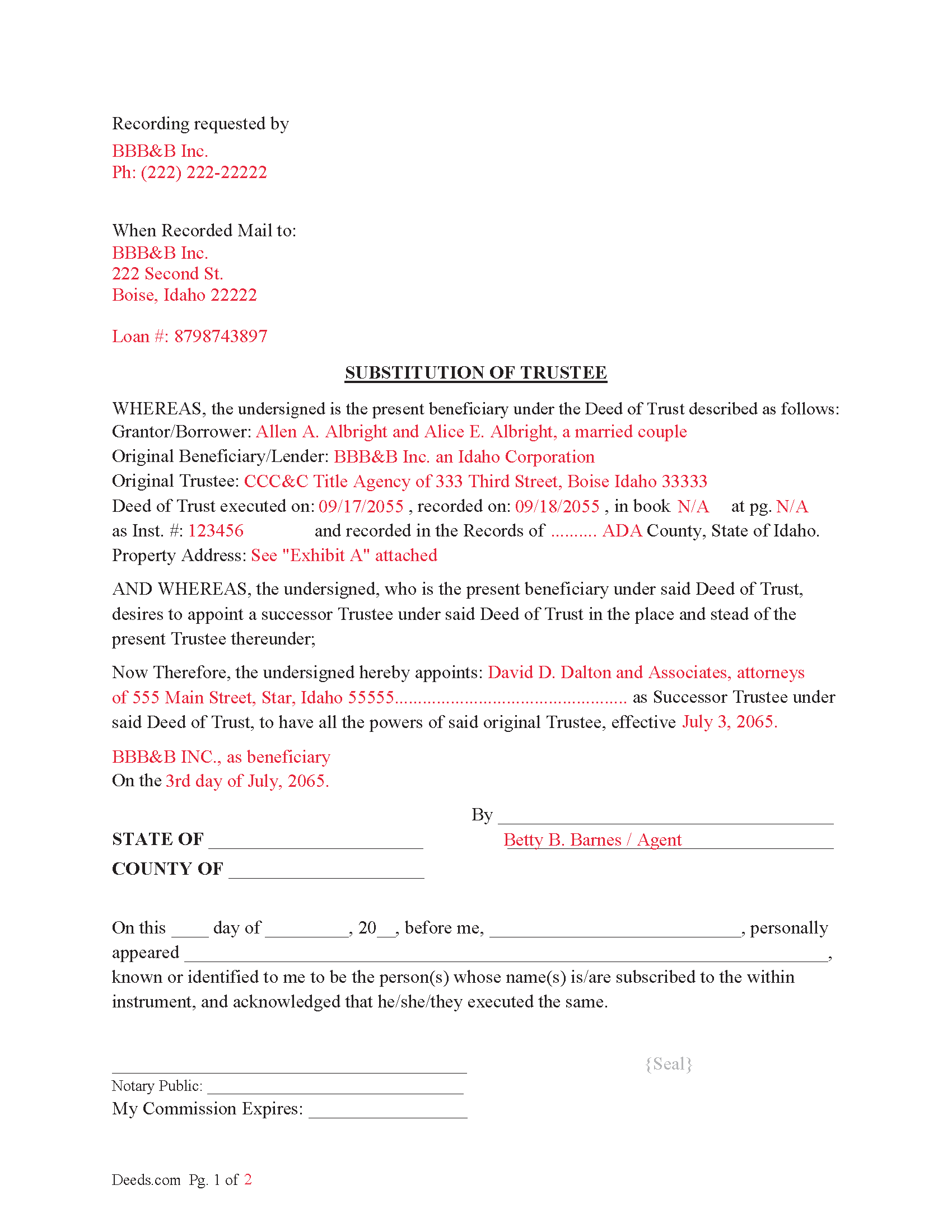

Nez Perce County Completed Example of the Substitution of Trustee Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Nez Perce County documents included at no extra charge:

Where to Record Your Documents

Nez Perce County Clerk-Auditor-Recorder

Lewiston, Idaho 83501

Hours: 8:00 to 5:00 M-F

Phone: (208) 799-3020

Recording Tips for Nez Perce County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

Cities and Jurisdictions in Nez Perce County

Properties in any of these areas use Nez Perce County forms:

- Culdesac

- Lapwai

- Lewiston

- Peck

Hours, fees, requirements, and more for Nez Perce County

How do I get my forms?

Forms are available for immediate download after payment. The Nez Perce County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Nez Perce County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Nez Perce County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Nez Perce County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Nez Perce County?

Recording fees in Nez Perce County vary. Contact the recorder's office at (208) 799-3020 for current fees.

Questions answered? Let's get started!

This form is issued by the current beneficiary/lender to replace an existing trustee with a successor trustee in a Deed of Trust. This is commonly performed when the current trustee resigns, can't or won't act on a foreclosure, reconveyance, etc.

45-1504. TRUSTEE OF TRUST DEED --- WHO MAY SERVE --- SUCCESSORS.

(1) The trustee of a trust deed under this act shall be:

(a) Any member of the Idaho state bar;

(b) Any bank or savings and loan association authorized to do business under the laws of Idaho or the United States;

(c) An authorized trust institution having a charter under chapter 32, title 26, Idaho Code, or any corporation authorized to conduct a trust business under the laws of the United States; or

(d) A licensed title insurance agent or title insurance company authorized to transact business under the laws of the state of Idaho.

(2) The trustee may resign at its own election or be replaced by the beneficiary. The trustee shall give prompt written notice of its resignation to the beneficiary. The resignation of the trustee shall become effective upon the recording of the notice of resignation in each county in which the deed of trust is recorded. If a trustee is not appointed in the deed of trust, or upon the resignation, incapacity, disability, absence, or death of the trustee, or the election of the beneficiary to replace the trustee, the beneficiary shall appoint a trustee or a successor trustee. Upon recording the appointment of a successor trustee in each county in which the deed of trust is recorded, the successor trustee shall be vested with all powers of an original trustee. (2) The trustee may resign at its own election or be replaced by the beneficiary. The trustee shall give prompt written notice of its resignation to the beneficiary. The resignation of the trustee shall become effective upon the recording of the notice of resignation in each county in which the deed of trust is recorded. If a trustee is not appointed in the deed of trust, or upon the resignation, incapacity, disability, absence, or death of the trustee, or the election of the beneficiary to replace the trustee, the beneficiary shall appoint a trustee or a successor trustee. Upon recording the appointment of a successor trustee in each county in which the deed of trust is recorded, the successor trustee shall be vested with all powers of an original trustee.

For use in Idaho only.

Important: Your property must be located in Nez Perce County to use these forms. Documents should be recorded at the office below.

This Substitution of Trustee - for Deed of Trust meets all recording requirements specific to Nez Perce County.

Our Promise

The documents you receive here will meet, or exceed, the Nez Perce County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Nez Perce County Substitution of Trustee - for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura D.

February 4th, 2023

Great forms - I got several property deeds and really appreciated that they came with the required state forms (for NY). the sample completed form is also really helpful. Attorney wanted hundreds- with this form it is the same amount of work but I can file myself for the cost of lunch!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Claude F.

February 8th, 2021

quick and easy to use, thank you

Thank you!

Judy A D.

March 26th, 2022

It was quick and easy.

Thank you!

JOHNNY M.

September 28th, 2019

The information provided is quite thorough.I recommend this Site to anyone, in need of Material for Quit Claim Deeds.

Thank you!

Katherine A R.

March 8th, 2023

It's very easy to navigate through the website to find the service that you want. Great program.

Thank you!

Sherilyn L.

February 14th, 2020

Easy to use & cost is great Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald B.

April 5th, 2021

Thank you so much for the helpful service and quick action! If needed, I will definitely choose Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald P.

August 18th, 2020

Very easy to use... awaiting info

Thank you for your feedback. We really appreciate it. Have a great day!

Shane J.

December 5th, 2024

I use deeds.com for all of my document filing needs. The amount of time and money saved on making trips to the auditor's office is well worth the nominal fee that is charged. I highly recommend deeds.com!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Karen B.

August 1st, 2025

Great forms! No issues at all at the recorder office. Will be back for sure if needed.

Wonderful to hear Karen. Thanks for taking the time to share your experience. Have a great day!

Patricia S.

August 3rd, 2022

The forms was easy to use and the guides was helpful

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

August 14th, 2021

The forms were easy to download and fill.

Thank you!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!