Canyon County Trustee Deed Upon Sale Form

Canyon County Trustee Deed Upon Sale Form

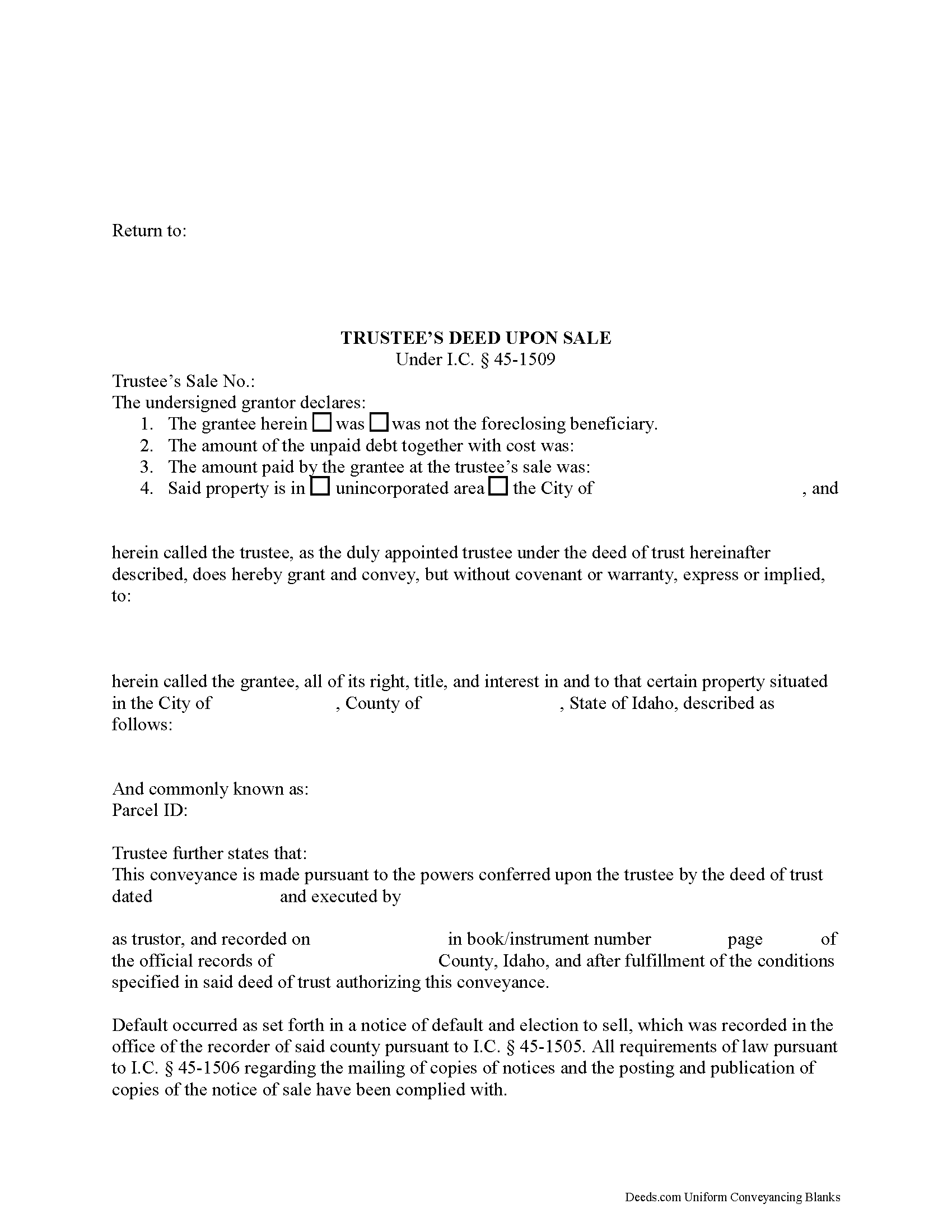

Fill in the blank form formatted to comply with all recording and content requirements.

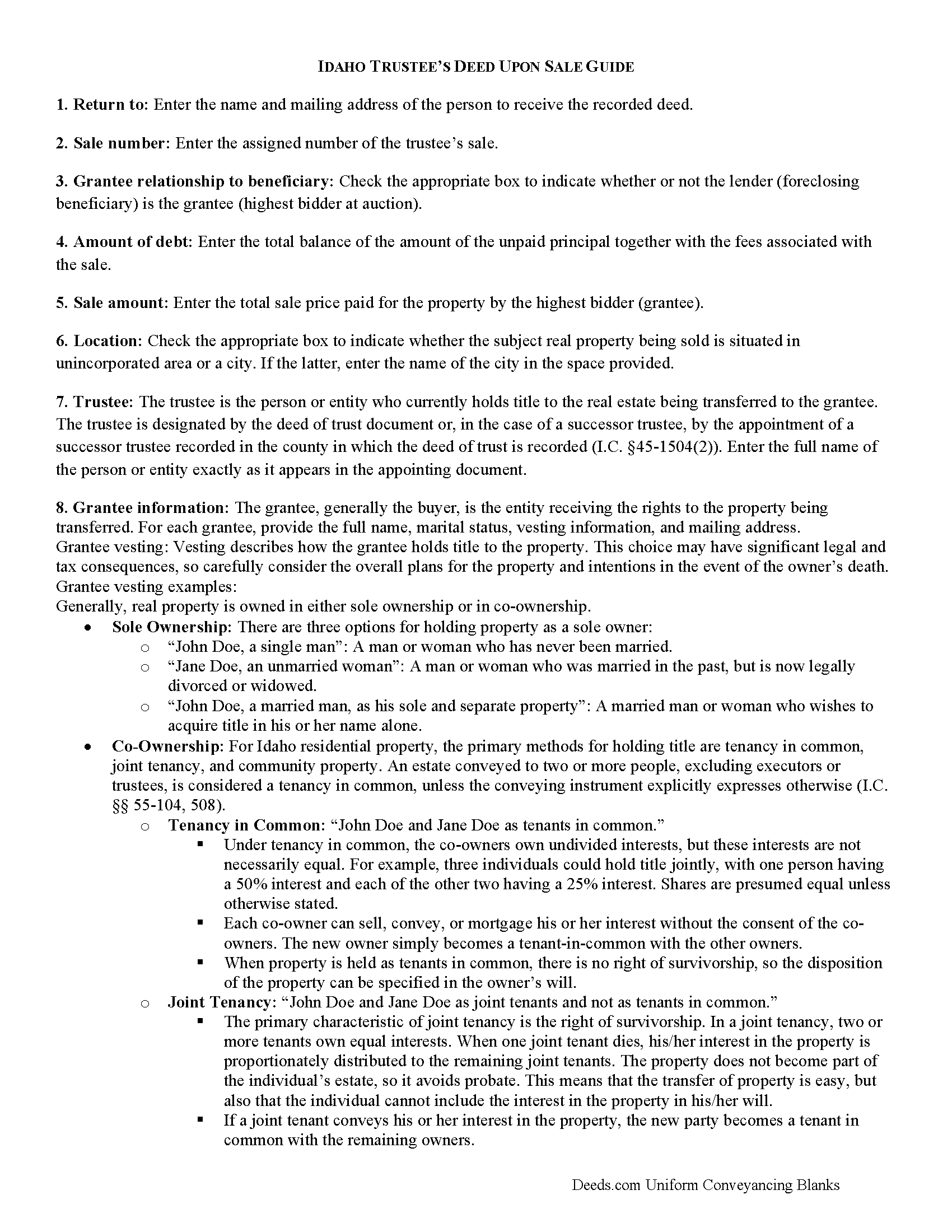

Canyon County Trustee Deed Upon Sale Guide

Line by line guide explaining every blank on the form.

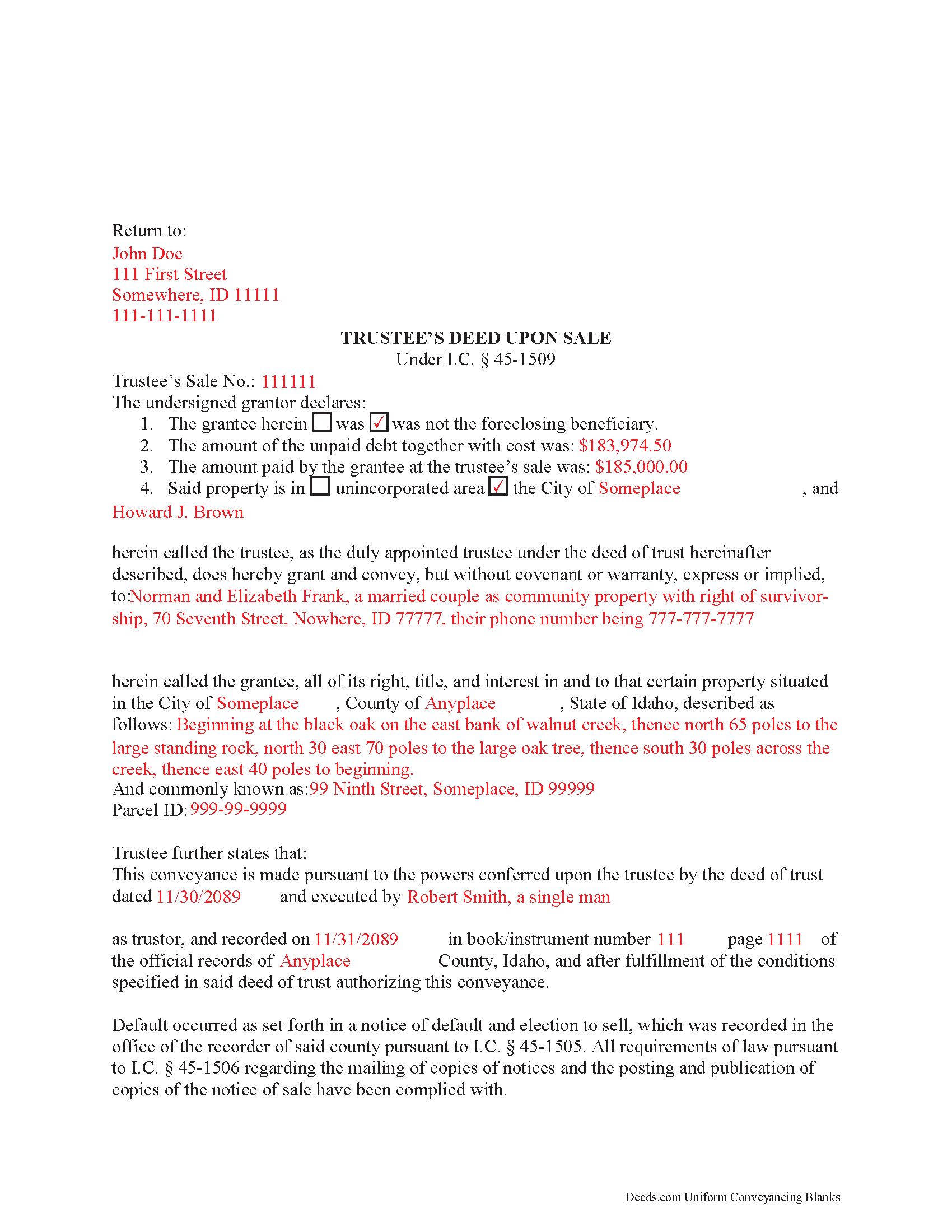

Canyon County Completed Example of the Trustee Deed upon Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Canyon County documents included at no extra charge:

Where to Record Your Documents

Canyon County Clerk-Recorder

Caldwell, Idaho 83605

Hours: 8:00am-5:00pm M-F

Phone: (208) 454-7555

Recording Tips for Canyon County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

Cities and Jurisdictions in Canyon County

Properties in any of these areas use Canyon County forms:

- Caldwell

- Greenleaf

- Huston

- Melba

- Middleton

- Nampa

- Notus

- Parma

- Wilder

Hours, fees, requirements, and more for Canyon County

How do I get my forms?

Forms are available for immediate download after payment. The Canyon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Canyon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Canyon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Canyon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Canyon County?

Recording fees in Canyon County vary. Contact the recorder's office at (208) 454-7555 for current fees.

Questions answered? Let's get started!

The Idaho Trustee's Deed Upon Sale is codified at I.C. 45-1509.

A trustee uses a trustee's deed upon sale to convey real property sold at a trustee's sale following foreclosure under a deed of trust. A deed of trust is a security instrument that, along with a promissory note, sets out the terms for repaying a loan used to purchase real property. Some states use deeds of trust in the place of mortgages.

The three parties involved in a deed of trust are the lender, the borrower (the grantor under the deed of trust), and the trustee. The trustee is generally a title insurance agent who holds legal title to the real property until the borrower has fulfilled the obligation of the deed of trust. The borrower holds equitable title.

If the borrower defaults on the terms of the deed of trust, the trustee, under the direction of the lender, may act on the power of sale clause in the deed, and initiate non-judicial foreclosure proceedings on the property. Statutory requirements, including the mailing of notices of default and sale, must be met before a trustee's sale is held at public auction. See I.C. Title 45 for more information.

The trustee's deed names the trustee as the grantor and conveys title to the highest bidder at the sale. In addition to describing the real property being conveyed, the deed recites basic information from the deed of trust, including the date of the instrument, the grantor's name, and a reference to where the deed can be found on record. The trustee's deed also includes references to facts about the default and the trustee's sale itself, and is recorded in the county in which the subject property is situated (I.C. 45-1509).

The foreclosure process is complicated, and each situation is unique. Contact an attorney for legal guidance.

Important: Your property must be located in Canyon County to use these forms. Documents should be recorded at the office below.

This Trustee Deed Upon Sale meets all recording requirements specific to Canyon County.

Our Promise

The documents you receive here will meet, or exceed, the Canyon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Canyon County Trustee Deed Upon Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Robert B.

January 4th, 2021

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen D.

April 17th, 2020

I recommend you add a box "Add another document or package." The way it is now confused me, so I uploaded the same document two more times, thinking the upload failed the first two times.

Thank you for your feedback Stephen.

Janalee T.

April 17th, 2020

Fast, easy. quickly accepted by county recorder.

Thank you!

Christine G.

April 23rd, 2021

. Easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Sylvia S.

May 24th, 2025

Thank you for making my life easier!!

Thank you for your feedback. We really appreciate it. Have a great day!

davidjrhall e.

March 13th, 2023

So far its been good. The David Jr Hall Estate Trust is a Business Blind Trust and we are looking forward to working with your platform and seeing how far we can go.

Thank you!

Edwin M.

July 2nd, 2021

Good marks from me. Keep up the good work !

Thank you!

Nancy D.

July 30th, 2019

Program works well. Saves a lot of time trying to find out what you need to do.

Thank you!

Marilyn S.

August 20th, 2022

I was pleased with the service and product.

Thank you!

Maxine P.

August 24th, 2020

This is so amazing and I truly thank you for what I needed for my documents. This is a great company and will take care of what you needs.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly H.

December 17th, 2021

Exceptional Service all Year~ I wish Deeds.com A Happy Holidays & A Happy New Year.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hal M.

September 23rd, 2022

Very good, and easy and fast to use.

Thank you!

Jimmy P.

November 7th, 2021

Works well. Very satisfied.

Thank you!

LeiLoni L.

June 18th, 2025

This site was easy to use.

Thank you for your positive words! We’re thrilled to hear about your experience.

Donna P.

September 20th, 2020

Your documents were very helpful. I went ahead and filled in all the info for the Release of Lien document. It was easy to do with your example. I had all the necessary info such as plot numbers, etc. for the property and everything fit nicely onto the document. It has been notorized and mailed. My grandparents' Victorian home has new owners who love it and has paid it off. Yeah!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!