Jasper County Mechanics Lien Form

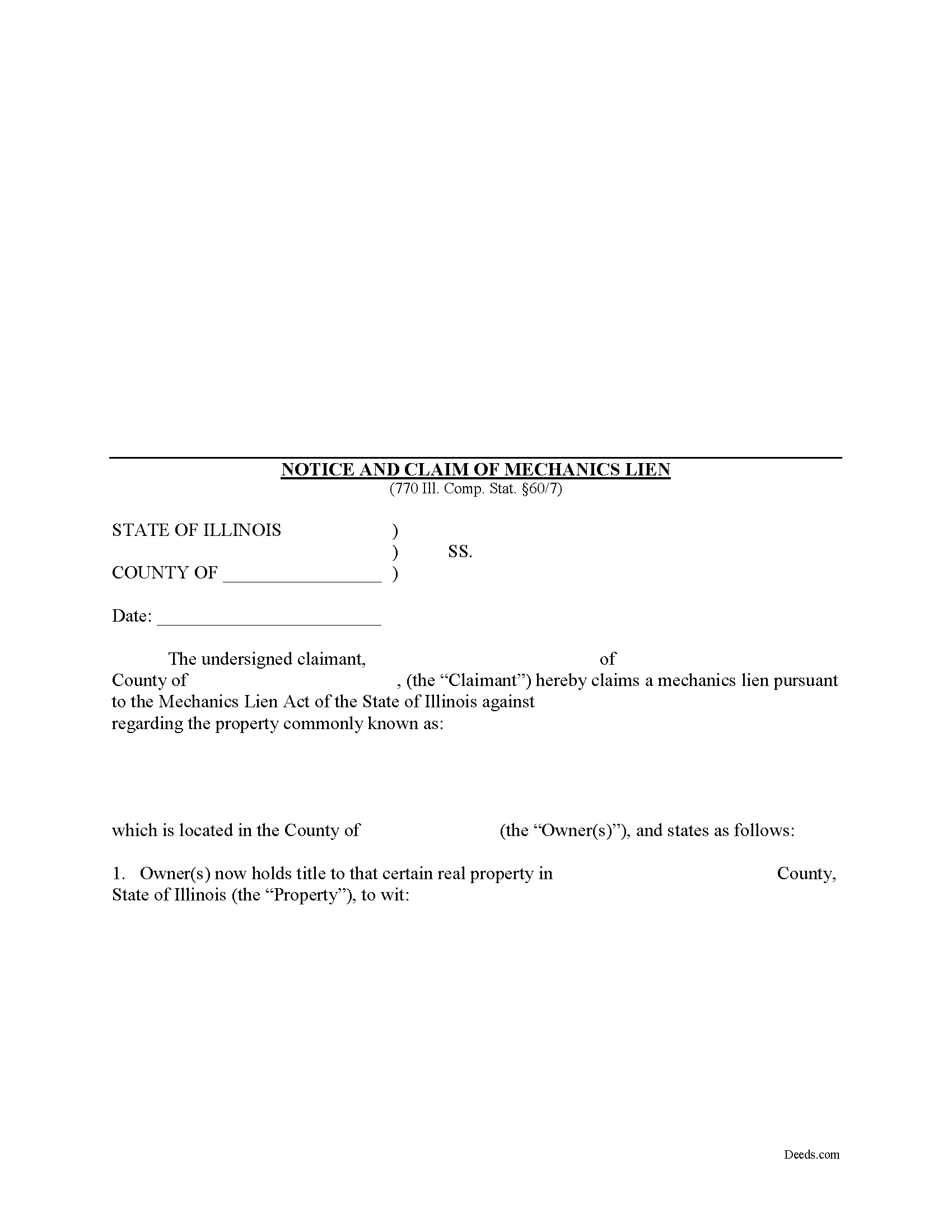

Jasper County Mechanics Lien Form

Fill in the blank Mechanics Lien form formatted to comply with all Illinois recording and content requirements.

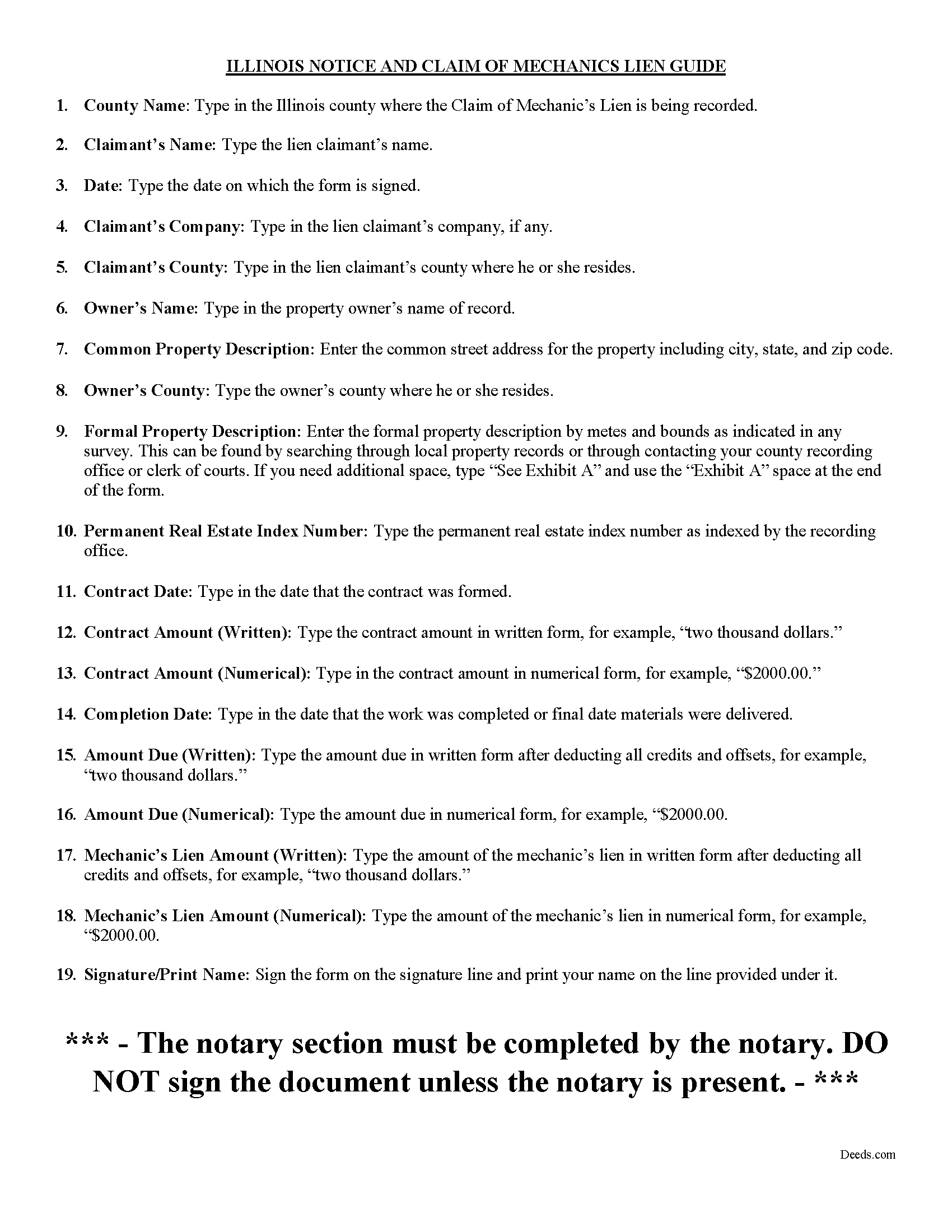

Jasper County Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

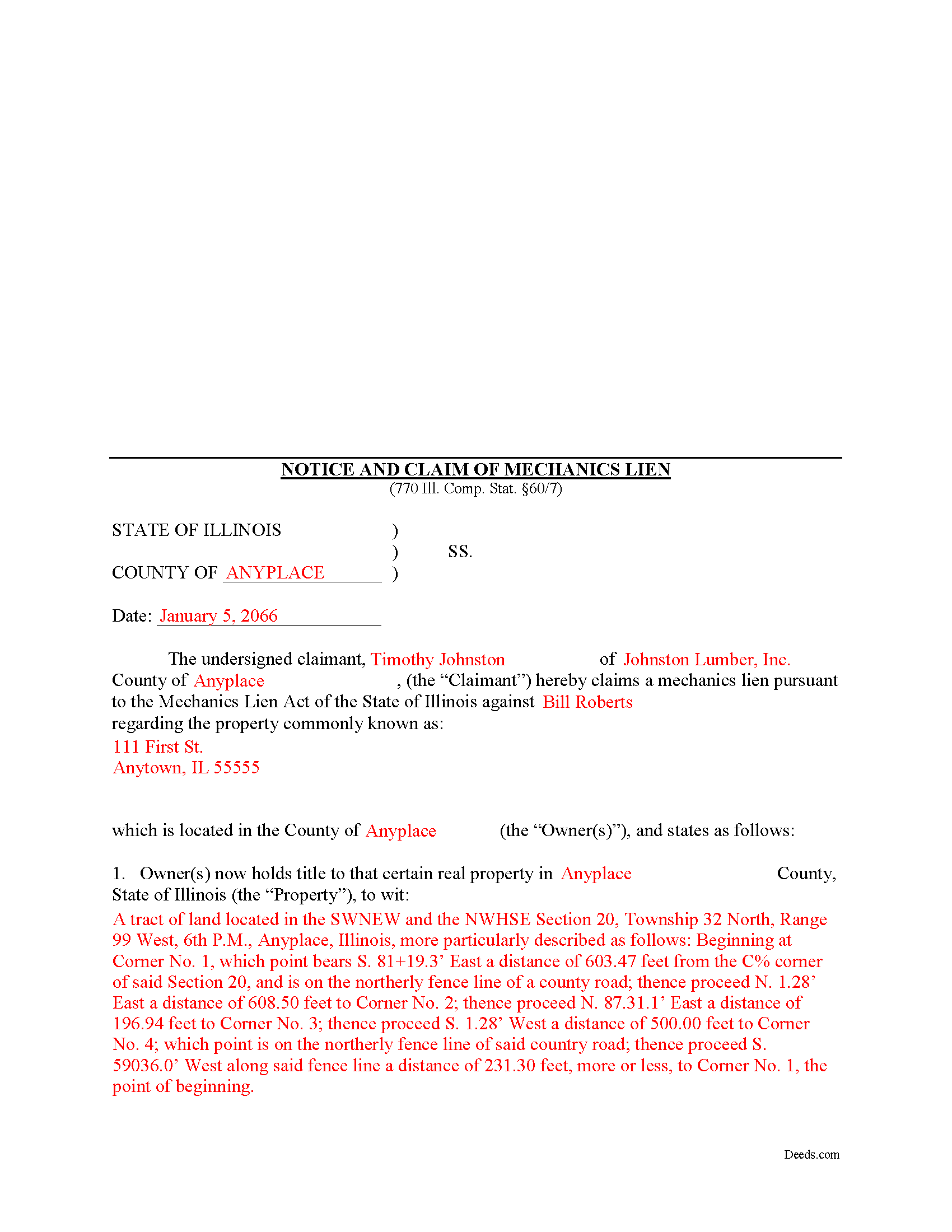

Jasper County Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Jasper County documents included at no extra charge:

Where to Record Your Documents

Jasper County Clerk/Recorder

Newton, Illinois 62448

Hours: 8:00 to 4:00 M-F

Phone: (618) 783-3124

Recording Tips for Jasper County:

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Jasper County

Properties in any of these areas use Jasper County forms:

- Hidalgo

- Newton

- Sainte Marie

- West Liberty

- Wheeler

- Willow Hill

- Yale

Hours, fees, requirements, and more for Jasper County

How do I get my forms?

Forms are available for immediate download after payment. The Jasper County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jasper County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jasper County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jasper County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jasper County?

Recording fees in Jasper County vary. Contact the recorder's office at (618) 783-3124 for current fees.

Questions answered? Let's get started!

Mechanic's liens are available in Illinois pursuant to the Mechanic's Lien Act compiled under 770 ILCS 60 for contractors, subcontractors, material or equipment suppliers, architects, and other design professionals.

A lien is a type of property interest, like a mortgage, in which the lienor retains a claim against the property if it is later sold. The lienor can also force a sale through foreclosure. Illinois only authorizes mechanic's liens on private projects, not those associated with public (government) entities.

When you provide labor or materials on a contract job and the client never pays the invoice, filing a mechanic's lien is the next step in recovering the amount due. NOTE: Subcontractors must individually file 60-day (owner-occupied residential projects only) and 90-day notices to access their lien rights.

Mechanic's liens demand strict deadlines and missing the filing date by even one day can cost you your right to a lien. In Illinois, the time to file a lien arises within four months from the last date you or any of your employees furnished labor or delivered materials to the jobsite. The four-month period applies to your right against all third parties and subsequent owners. You have two years to file suit against the original owner to foreclose on a mechanic's lien. 770 ILCS 60/9.

The claim for lien must state the parties to the contract and its terms, identify the general contractor and all upper tier subcontractors, include a description of the work completed or materials delivered, state a legal description of the owner's property, and state the total amount due and unpaid as of the date the notice is recorded. The lien amount includes the invoice amount owed minus all credits and offsets. A lienor may not include extras such as attorney's fees or lost profits, but may charge interest measured by the legal rate in Illinois. 770 ILCS 60/1(a).

Before recording the lien, sign it in the presence of a notary public who then notarizes it with his or her seal. The lien should be recorded at the recording office for the county where the property is situated. For residential projects, you must serve the owner with a copy of the recorded lien within ten days' time.

The deadlines for filing a lien are set in stone, and failure to file on time will cost you your right to a lien. Additionally, putting in improper amounts or exaggerating the claim will invalidate the lien. If you lose your lien rights, the only remedy is to sue the property owner under contract law.

Each case is unique. Contact an attorney with specific questions regarding filing a claim or any other issues related to mechanic's liens in Illinois.

Important: Your property must be located in Jasper County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien meets all recording requirements specific to Jasper County.

Our Promise

The documents you receive here will meet, or exceed, the Jasper County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jasper County Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Irwin C.

August 25th, 2023

For starters, enrolling was as easy as could be. Then, it only took minutes before my entry was formatted and filed. Finally, when I asked a question, I got an answer within a few minutes. Couldn't be happier with service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janna C.

January 11th, 2023

Great site! I found everything I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maureen F.

January 27th, 2021

Forms were delivered quickly and were easily filled out. State specific!

Thank you!

Jesse S.

January 2nd, 2020

I am excited for your service. I'm counting on this working-and calling to see if I can e-file with the County of dealing with, and if so, your service will have saved me more years of stress, worrying about how to correct a deed that was titled incorrectly.

Thank you!

Michael M.

January 11th, 2019

I downloaded the gift deed and I can not type my info onto it what am I doing wrong. Please advise

Sounds like you may be trying to complete the form in your browser. The document needs to be downloaded and saved to you computer, then opened in Adobe.

Robert T.

September 23rd, 2019

Very quick thank you.

Thank you!

Leslie C.

September 13th, 2023

I recently purchased online DIY legal forms, and I must say I was thoroughly impressed. The documents provided were accurate, comprehensive, and precisely what I needed. The accompanying guide was clear, instructive, and really bridged the gap for someone like me who isn't well-versed in legal jargon. What stood out the most, however, was the inclusion of the example. It served as a practical reference and made the entire process so much more approachable. Being able to see a filled-out sample made all the difference. Overall, this product has been invaluable in helping me navigate legal processes on my own.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy C.

February 17th, 2022

Very easy to use, guides are also nice to have. thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Amy L B.

March 12th, 2025

easy to download forms and help is there if you need it!

Thank you, Amy! We appreciate your kind words and are glad you found the forms easy to download. Our team is always here if you ever need assistance. Thanks for choosing us!

shelley m.

March 5th, 2019

I thought the service was good

Thank you Shelley. Have a fantastic day!

Debbra .S C.

June 1st, 2023

Very easy and nice website to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Kristina R.

March 27th, 2020

Fast and friendly service. I will use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John v.

April 7th, 2020

Process is well laid out, clear and concise. Check out is easy. Recommendations: * Assign names to the downloadable files that are meaningful, such as: WARRANTY DEED instead of the useless and cryptic 1420490866F11417.pdf. * Provide a ONE BUTTON DOWNLOAD for all forms ordered. It's aggravating to have to click on each of the 20 documents and download them individually.

Thank you for your feedback. We really appreciate it. Have a great day!

Lorraine F.

October 9th, 2024

I followed the instructions to download the form for my Mac, typed in the legal description of the real property but the space provided for it would not expand so I just typed the form into Word as a document. While I appreciate having the form to work with it would have been a breeze if it worked properly.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Joyce D.

October 29th, 2021

Great service. Fast and efficient.

Thank you!