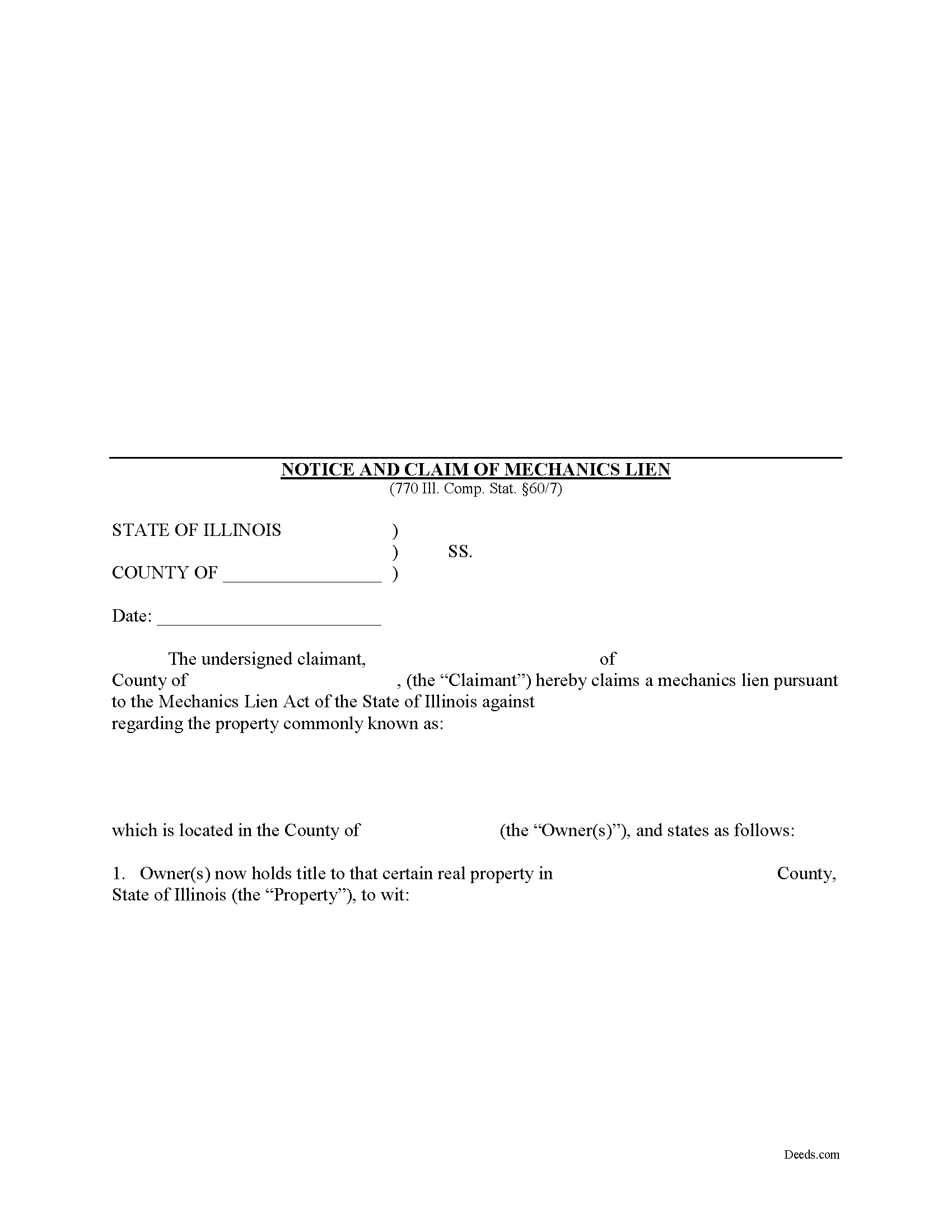

Mason County Mechanics Lien Form

Mason County Mechanics Lien Form

Fill in the blank Mechanics Lien form formatted to comply with all Illinois recording and content requirements.

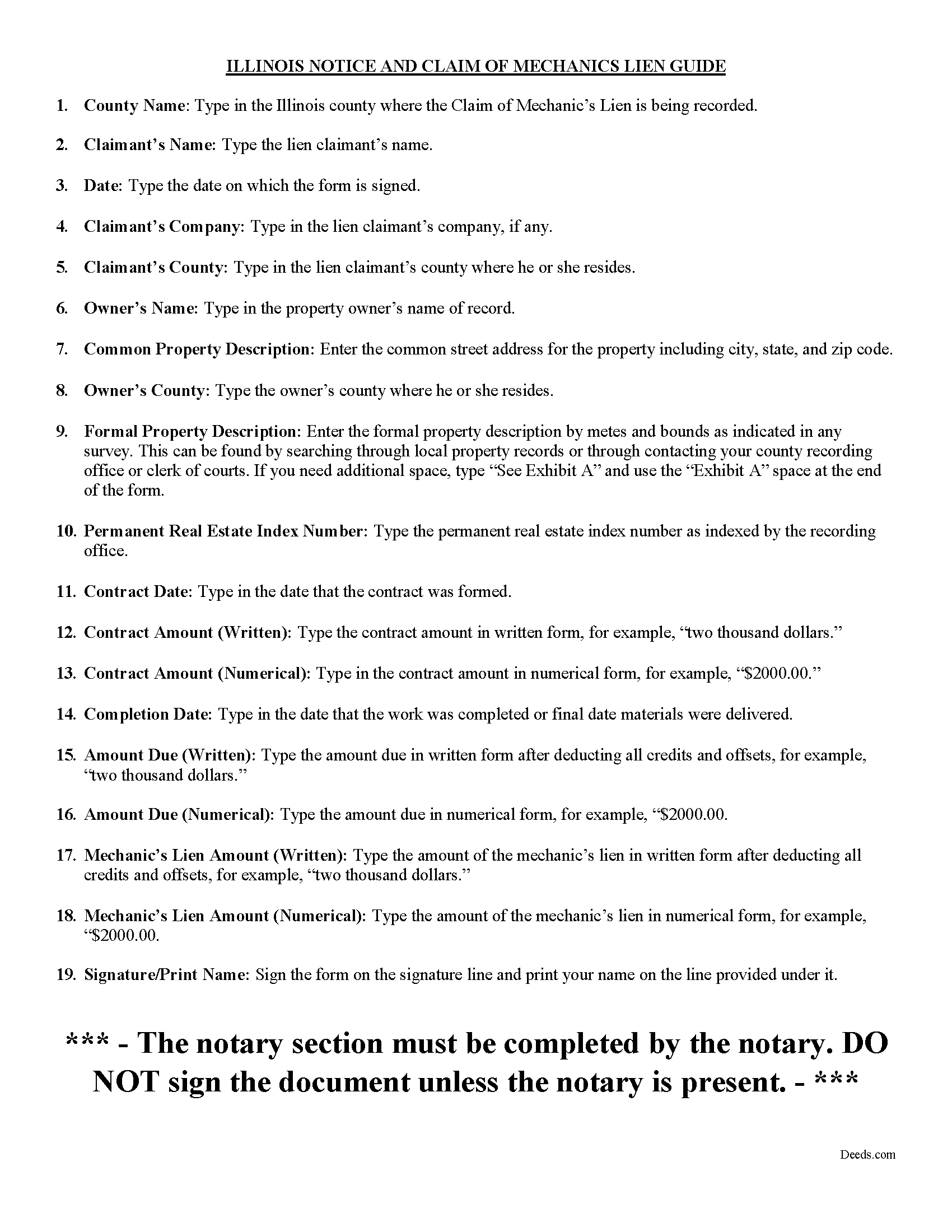

Mason County Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

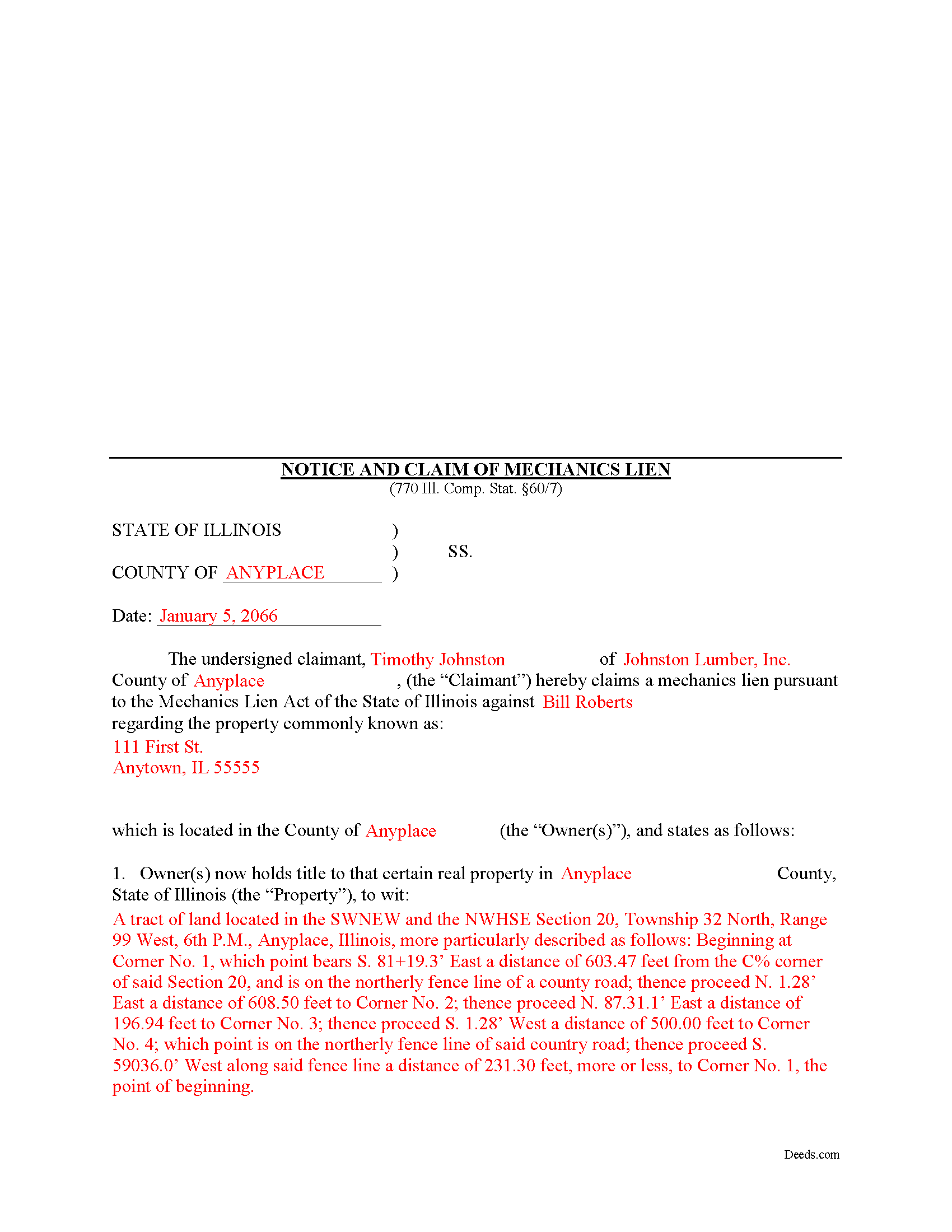

Mason County Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Mason County documents included at no extra charge:

Where to Record Your Documents

Mason County Clerk & Recorder

Havana, Illinois 62644-0077

Hours: 8:00 to 4:00 Monday through Friday

Phone: (309) 543-6661

Recording Tips for Mason County:

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Mason County

Properties in any of these areas use Mason County forms:

- Bath

- Easton

- Forest City

- Havana

- Kilbourne

- Manito

- Mason City

- San Jose

- Topeka

Hours, fees, requirements, and more for Mason County

How do I get my forms?

Forms are available for immediate download after payment. The Mason County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mason County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mason County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mason County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mason County?

Recording fees in Mason County vary. Contact the recorder's office at (309) 543-6661 for current fees.

Questions answered? Let's get started!

Mechanic's liens are available in Illinois pursuant to the Mechanic's Lien Act compiled under 770 ILCS 60 for contractors, subcontractors, material or equipment suppliers, architects, and other design professionals.

A lien is a type of property interest, like a mortgage, in which the lienor retains a claim against the property if it is later sold. The lienor can also force a sale through foreclosure. Illinois only authorizes mechanic's liens on private projects, not those associated with public (government) entities.

When you provide labor or materials on a contract job and the client never pays the invoice, filing a mechanic's lien is the next step in recovering the amount due. NOTE: Subcontractors must individually file 60-day (owner-occupied residential projects only) and 90-day notices to access their lien rights.

Mechanic's liens demand strict deadlines and missing the filing date by even one day can cost you your right to a lien. In Illinois, the time to file a lien arises within four months from the last date you or any of your employees furnished labor or delivered materials to the jobsite. The four-month period applies to your right against all third parties and subsequent owners. You have two years to file suit against the original owner to foreclose on a mechanic's lien. 770 ILCS 60/9.

The claim for lien must state the parties to the contract and its terms, identify the general contractor and all upper tier subcontractors, include a description of the work completed or materials delivered, state a legal description of the owner's property, and state the total amount due and unpaid as of the date the notice is recorded. The lien amount includes the invoice amount owed minus all credits and offsets. A lienor may not include extras such as attorney's fees or lost profits, but may charge interest measured by the legal rate in Illinois. 770 ILCS 60/1(a).

Before recording the lien, sign it in the presence of a notary public who then notarizes it with his or her seal. The lien should be recorded at the recording office for the county where the property is situated. For residential projects, you must serve the owner with a copy of the recorded lien within ten days' time.

The deadlines for filing a lien are set in stone, and failure to file on time will cost you your right to a lien. Additionally, putting in improper amounts or exaggerating the claim will invalidate the lien. If you lose your lien rights, the only remedy is to sue the property owner under contract law.

Each case is unique. Contact an attorney with specific questions regarding filing a claim or any other issues related to mechanic's liens in Illinois.

Important: Your property must be located in Mason County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien meets all recording requirements specific to Mason County.

Our Promise

The documents you receive here will meet, or exceed, the Mason County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mason County Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Cheryl B.

August 26th, 2022

I did this on a desktop using a scanned .pdf file. Simple, straight-forward, excellent instructions, easy, fast, and well documented for each step. From account creation to proof of recording: 4 hours... from the comfort of my home. I would highly recommend this service to anyone, including - and maybe especially - those who are looking for fast recording who aren't well versed in computers and on-line processes. Well done in all ways.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Irma D.

June 14th, 2021

Very impressed with the Service in Miami-Dade County. THank you

Thank you!

Kahn B.

May 2nd, 2019

The Quitclaim deed seems pretty simple However I wonder if I can fll out the paper as easily as it looks I appreciate very much the sample and the direction for filling out the deed. Now I am in the process of gathering document to fill out the deed and I think only when after everything done, I may have a clear idea how good the Quitclaim Deed is. I hope I can follow instruction and will successfully done the paperwork. Thank you very much.

Thank you for your feedback. We really appreciate it. Have a great day!

Rhonda L.

May 27th, 2020

This was one of the most simple but efficient process. Walked me thru every step. Total process was less than 2 weeks.

Thank you!

Charles S.

February 14th, 2025

very happy with guidance and responses - thank you - not finished yet but confident

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

iris e.

April 11th, 2024

Easy to use website. customer service messages you back super quickly. They also double check your work and if anything is missing they message me right away. Price is reasonable. I highly recommend their services. 5 Star hands Down!!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Edward S.

June 10th, 2020

I was able to e-record 3 document with ease. The Middlesex registry of deeds is closed due to COVID-19 and this was my only option. Even if it was open, this is much faster and saves me time and money on parking ..etc. Great services.

Thank you!

Shawn B.

November 17th, 2021

Deeds.com support is very quick and responsive. Would use again and recommend to others in need of e-recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne H.

July 25th, 2024

After some initial general confusion -- (we sold a small piece of land privately and therefore do not typically prepare such documentation (!)) -- we were able to purchase and download all forms from Deeds.com and understand how to complete it/them. The help is all there, we just needed to read and study it - the "Example" helped alot. We were able to complete the Document per your online form(s) and then take it to be signed/notarized - and take the completed paper document to the Registry -- and it is now all registered and we are All Set. Took the morning (only). THANK YOU. A wonderful tool!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

rita t.

November 4th, 2019

Thanks for asking, everything was fine. Forms worked as expected, no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert R.

September 1st, 2019

Just joined. Recommended by a strong source. Looking forward to doing business.

Thank you!

Pamela R.

April 8th, 2022

Thank you for this excellent website. Obtaining appropriate forms was very easy. Thank you!

Thank you!

lee s.

March 21st, 2019

Over all quality of document was good. The issue I had was where it states claimant did not have a contract with the owner or their agent. I did have a contract with their agent, and there was no option for both. So had improvise.

Thank you for your feedback. We really appreciate it. Have a great day!

DOYCE F.

September 25th, 2019

Very helpful.Thank you

Thank you!

Bernadette G.

February 4th, 2019

I LOVE that very concise directions and a sample completed deed were included. They were incredibly helpful. I did like the quick response to questions and the refund of my purchase when they were unable to find a deed I needed. I wasn't sure if I could trust this site, but my deed transfer went through without a hitch with the paperwork that was provided/purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!