Clinton County Statutory Short Form Power of Attorney for Property Form (Illinois)

All Clinton County specific forms and documents listed below are included in your immediate download package:

Statutory Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Clinton County compliant document last validated/updated 5/21/2025

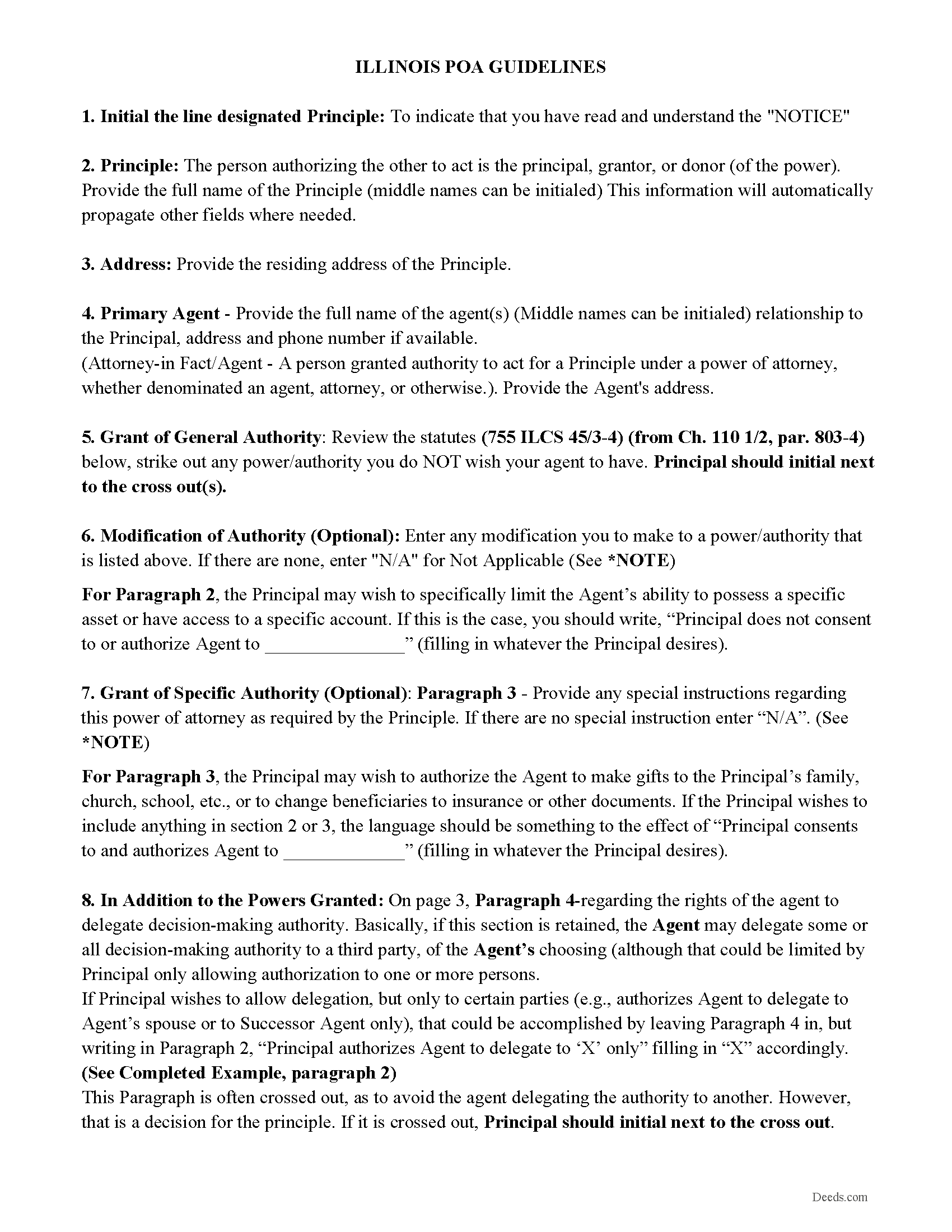

Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

Included Clinton County compliant document last validated/updated 6/24/2025

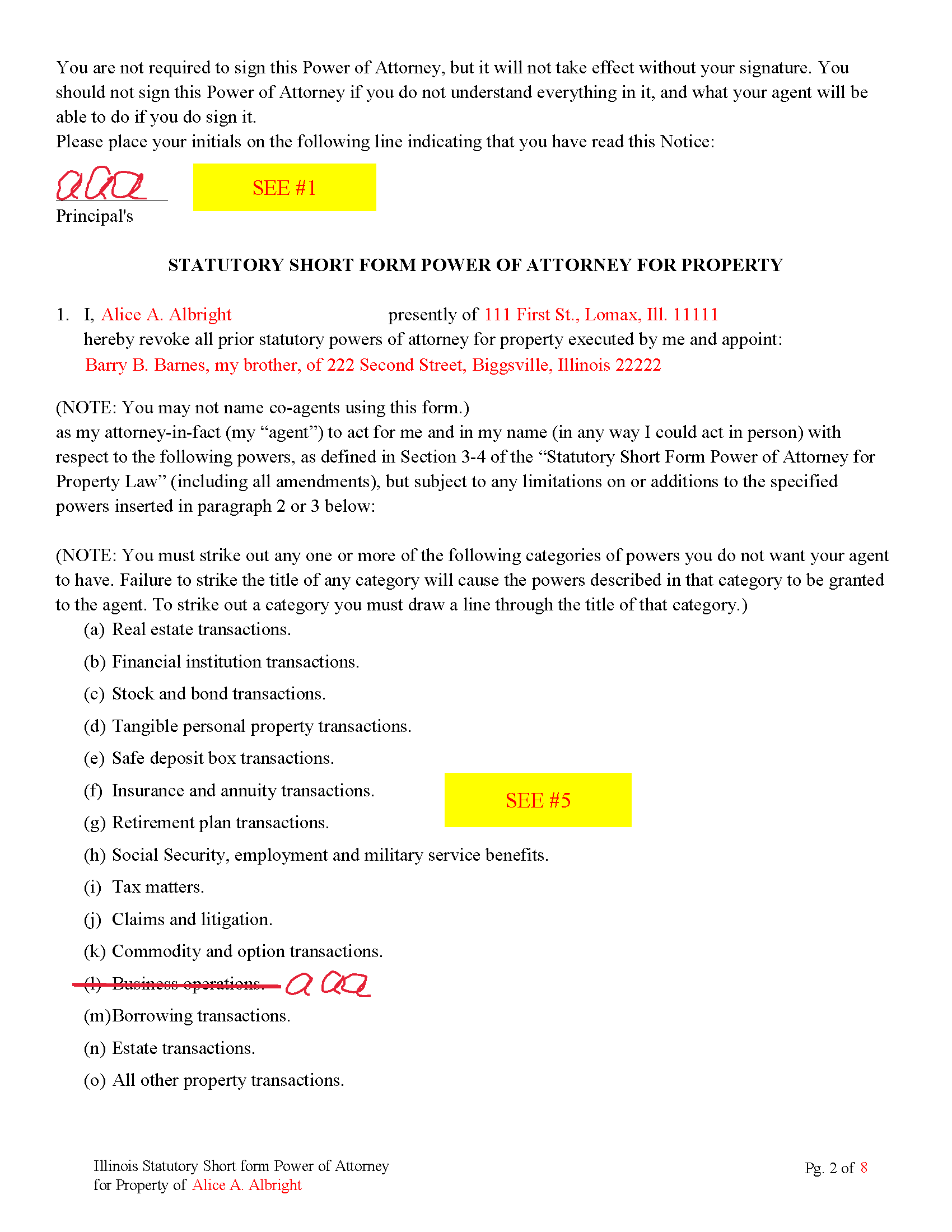

Completed Example of the Power of Attorney

Example of a properly completed form for reference.

Included Clinton County compliant document last validated/updated 7/1/2025

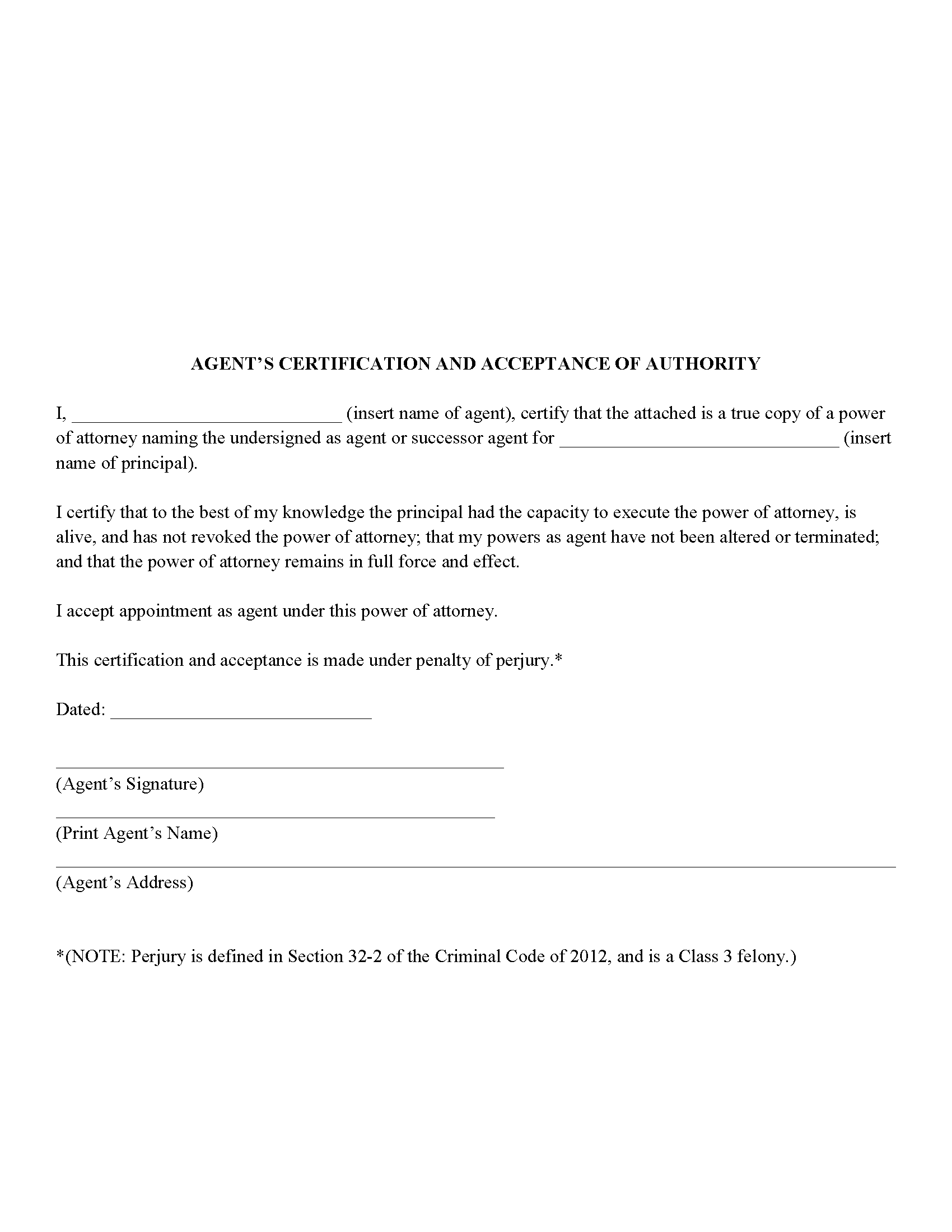

Agents Certification Form

Agent certifies he/she is authorized to act. Often required by third parties.

Included Clinton County compliant document last validated/updated 6/20/2025

The following Illinois and Clinton County supplemental forms are included as a courtesy with your order:

When using these Statutory Short Form Power of Attorney for Property forms, the subject real estate must be physically located in Clinton County. The executed documents should then be recorded in the following office:

Clinton County Clerk & Recorder

850 Fairfax St / PO Box 308, Carlyle, Illinois 62231

Hours: 8:00 to 4:30 Monday through Friday

Phone: (618) 594-6620

Local jurisdictions located in Clinton County include:

- Albers

- Aviston

- Bartelso

- Beckemeyer

- Breese

- Carlyle

- Germantown

- Hoffman

- Huey

- Keyesport

- New Baden

- New Memphis

- Trenton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Clinton County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Clinton County using our eRecording service.

Are these forms guaranteed to be recordable in Clinton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clinton County including margin requirements, content requirements, font and font size requirements.

Can the Statutory Short Form Power of Attorney for Property forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Clinton County that you need to transfer you would only need to order our forms once for all of your properties in Clinton County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Clinton County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Clinton County Statutory Short Form Power of Attorney for Property forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This short for power of attorney allows for a primary agent and successor agents (agents who will act if the primary agent can't or won't act)

Categories that your agent can or can NOT perform. Each governed by Illinois Statutes.

(a) Real estate transactions.

(b) Financial institution transactions.

(c) Stock and bond transactions.

(d) Tangible personal property transactions.

(e) Safe deposit box transactions.

(f) Insurance and annuity transactions.

(g) Retirement plan transactions.

(h) Social Security, employment and military service benefits.

(i) Tax matters.

(j) Claims and litigation.

(k) Commodity and option transactions.

(l) Business operations.

(m) Borrowing transactions.

(n) Estate transactions.

(o) All other property transactions. (755 ILCS 45/3-4)

This is a recordable document, if you allow your agent to transfer real property, Title Companies and/or other third parties will usually require the power of attorney to be recorded before a transfer of real property can take place if it has not been done so previously. This power of attorney includes an addendum page to list real property.

(Illinois Statutory POA Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Clinton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clinton County Statutory Short Form Power of Attorney for Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Jack B.

May 2nd, 2020

The service was fast, but I didn't learn about the results until I logged in. I would have liked to get email when the report was finished.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey M.

December 1st, 2021

Great service. It had all the forms I needed.

Thank you!

Hanne R.

November 17th, 2020

excellent

Thank you!

Gwen N.

September 16th, 2021

Easy to use

Thank you!

Melisa H.

August 17th, 2020

Quick turnaround and superior customer service from my reviewer. Above and beyond my expectations and took the time to look into the lengthy list of other counties I have to confirm you are able to e-record for me. I appreciate all the time and effort taken to help me.

Thank you for your feedback. We really appreciate it. Have a great day!

rita t.

November 4th, 2019

Thanks for asking, everything was fine. Forms worked as expected, no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Curtise L.

September 15th, 2021

Excellent experience. Quickly responded and was able to get us exactly what we needed!

Thank you!

CINDY P.

July 30th, 2019

Such any easy process! Thank you!

Thank you Cindy, we appreciate your feedback.

Kendall B.

September 24th, 2019

Good

Thank you!

Jeanne A.

October 22nd, 2019

great forms, nice that they are fillable pdfs, easy to use, no issues. thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynnellen S.

May 9th, 2019

My rating is not a 5. Although it had good instructions, it would NOT print the whole document no matter how many times I inputted the names. I ended up writing it in to complete.

I also recommend putting it on one page. I had to pay an additional fees per page and if I had to notarize it, why did I have to find 2 witnesses as well.

I deserve a discount for the time I spent repeatedly putting the same data. I was trying to save money since Im on social security only. It didnt. Get it to work correctly

Thank you for your feedback Lynnellen. Sorry to hear of your struggle with our document. We've gone ahead and refunded your payment. Hope you have a wonderful day.

Kay G.

April 1st, 2019

Found just the form I was looking for. It was an easy download process. Now just have to complete the forms!

Thank you for your feedback Kay, we really appreciate it.