Lee County Statutory Short Form Power of Attorney for Property Form

Lee County Statutory Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

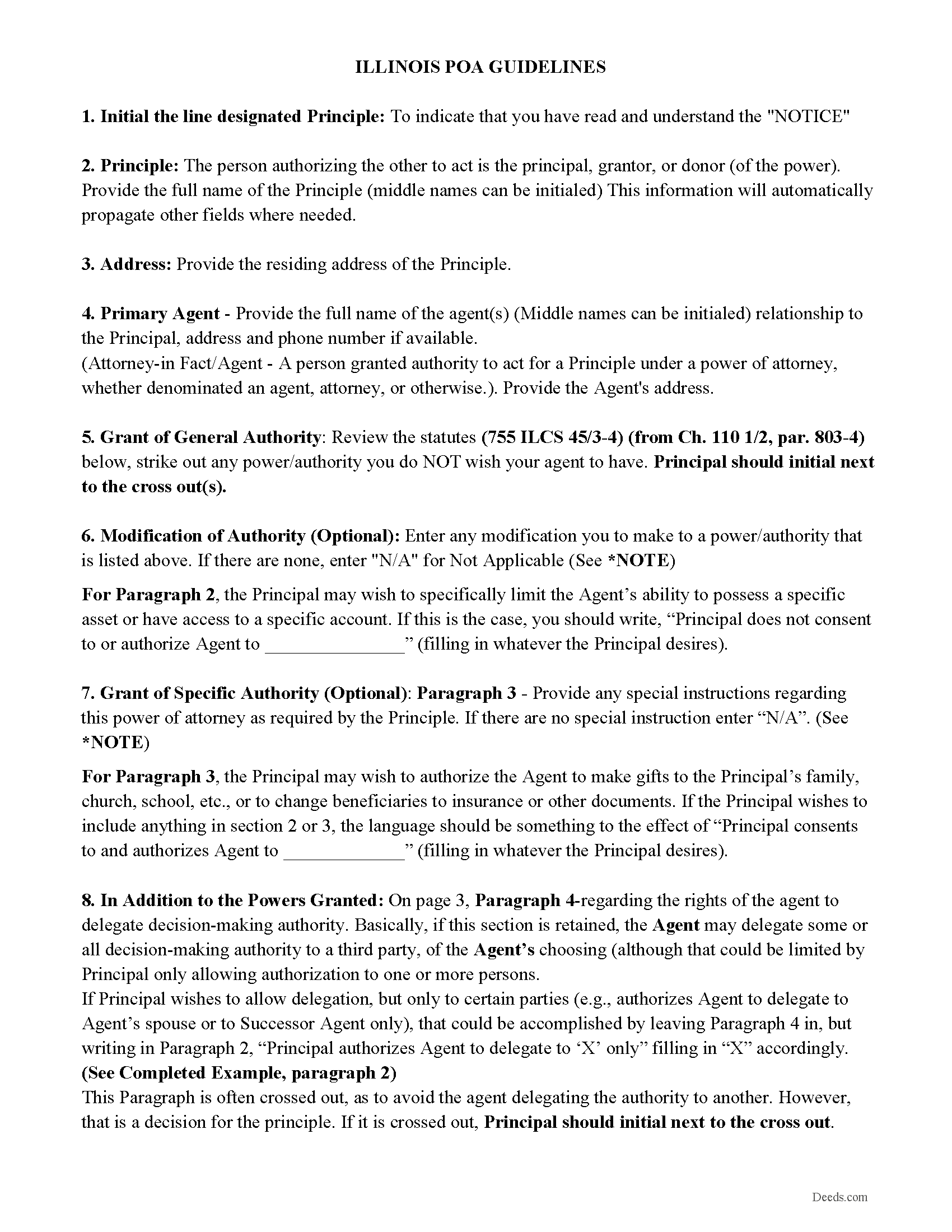

Lee County Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

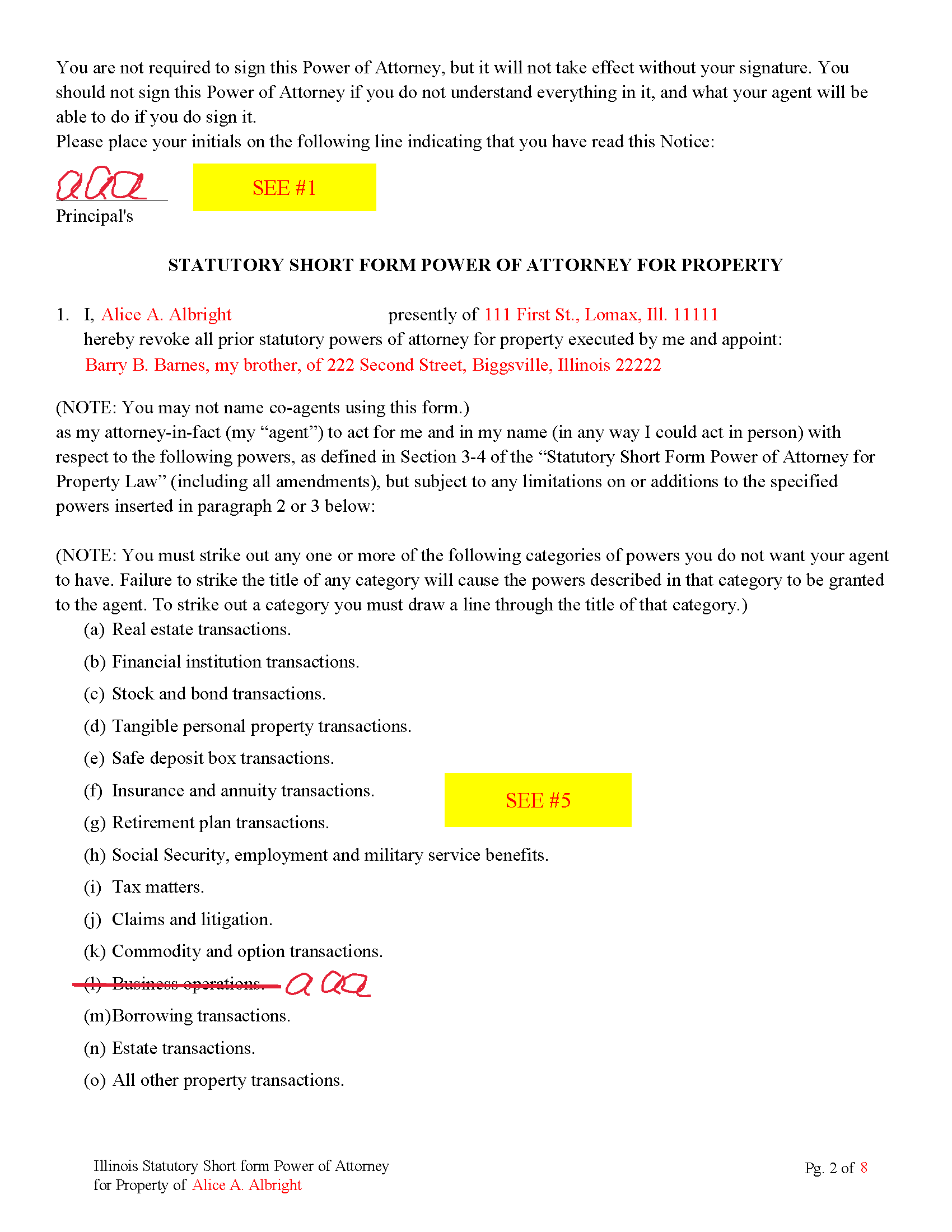

Lee County Completed Example of the Power of Attorney

Example of a properly completed form for reference.

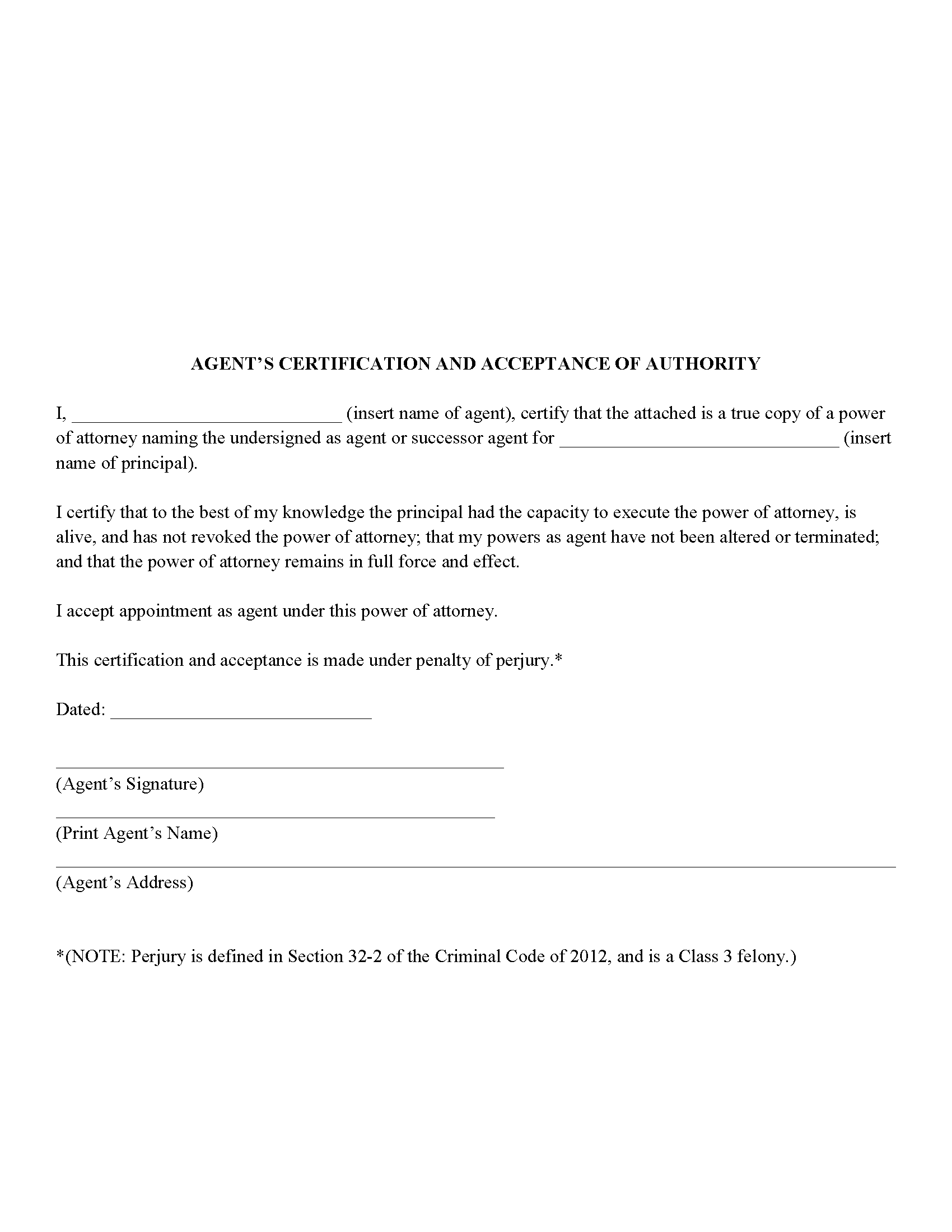

Lee County Agents Certification Form

Agent certifies he/she is authorized to act. Often required by third parties.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Lee County documents included at no extra charge:

Where to Record Your Documents

Lee County Clerk/Recorder

Dixon, Illinois 61021

Hours: 8:00 to 4:30 Monday through Friday

Phone: (815) 288-3309

Recording Tips for Lee County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Lee County

Properties in any of these areas use Lee County forms:

- Amboy

- Ashton

- Compton

- Dixon

- Eldena

- Franklin Grove

- Harmon

- Lee

- Lee Center

- Nachusa

- Paw Paw

- Steward

- Sublette

- West Brooklyn

Hours, fees, requirements, and more for Lee County

How do I get my forms?

Forms are available for immediate download after payment. The Lee County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lee County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lee County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lee County?

Recording fees in Lee County vary. Contact the recorder's office at (815) 288-3309 for current fees.

Questions answered? Let's get started!

This short for power of attorney allows for a primary agent and successor agents (agents who will act if the primary agent can't or won't act)

Categories that your agent can or can NOT perform. Each governed by Illinois Statutes.

(a) Real estate transactions.

(b) Financial institution transactions.

(c) Stock and bond transactions.

(d) Tangible personal property transactions.

(e) Safe deposit box transactions.

(f) Insurance and annuity transactions.

(g) Retirement plan transactions.

(h) Social Security, employment and military service benefits.

(i) Tax matters.

(j) Claims and litigation.

(k) Commodity and option transactions.

(l) Business operations.

(m) Borrowing transactions.

(n) Estate transactions.

(o) All other property transactions. (755 ILCS 45/3-4)

This is a recordable document, if you allow your agent to transfer real property, Title Companies and/or other third parties will usually require the power of attorney to be recorded before a transfer of real property can take place if it has not been done so previously. This power of attorney includes an addendum page to list real property.

(Illinois Statutory POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Lee County to use these forms. Documents should be recorded at the office below.

This Statutory Short Form Power of Attorney for Property meets all recording requirements specific to Lee County.

Our Promise

The documents you receive here will meet, or exceed, the Lee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lee County Statutory Short Form Power of Attorney for Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Teresa M.

July 22nd, 2020

Very easy and quick. Report gave me the info I needed to know. Will use again if I need to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Hoang N.

June 18th, 2020

Thank you for helping. Deeds online service is so good. I would refer to my friends or whoever if they need this services. once again you guy is doing great work

Thank you!

Evelyn B.

June 23rd, 2023

Wow! Deeds.com provided proficient eRecording with great response time and great service... and it was super easy, super fast, and very reasonably priced. What more could you possibly want?! Highly recommended!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura R.

August 13th, 2022

Afficavit worked kind of pricey

Thank you for your feedback. We really appreciate it. Have a great day!

Clinton M.

January 8th, 2020

Very informative. I submitted my form.The county accepted it. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Lorrie P.

January 8th, 2021

What a wonderful and easy task using deeds.com. I searched on line for the proper procedure to file a quit claim deed. It looked to confusing to do mysellf until I found deeds.com. With their instructions, I was able to fill out all the proper forms and file with the court in two days. Saved me at least a thousand dollars if I had an attorney do the same. Thank you. I will definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan E.

May 4th, 2023

Great customer service. I was surprised by the attention to detail that went into reviewing my documents and value provided by deeds.com. Definitely recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph K.

June 12th, 2020

Your responsiveness is outstanding. I appreciate the guidance and consistent support. Thank you.

Thank you!

Miguel R.

August 18th, 2019

Easy to create an account! Awesome!

Thank you!

James R.

September 1st, 2021

Useful and quick.

Thank you!

Robert K.

July 9th, 2022

This document was exactly what I needed and with the corresponding sample I was easily able to complete it. This saved me a lot of money by not having to hire an attorney to fill out a form. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Brian Z.

May 2nd, 2019

Great site with the forms I needed

Thanks Brian, we appreciate your feedback.

Elango R.

November 9th, 2020

It was so easy to use the site and got recording done in a day. Very happy with experience.

Thank you!

R Rodney H.

January 29th, 2019

Excellent service--I got just the information I needed quickly and reasonably priced. I am glad to know of this service for future needs, as an individual, in this sector. Cheers, RRH

We appreciate your business and value your feedback. Thank you. Have a wonderful day!