Marion County Statutory Short Form Power of Attorney for Property Form

Marion County Statutory Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

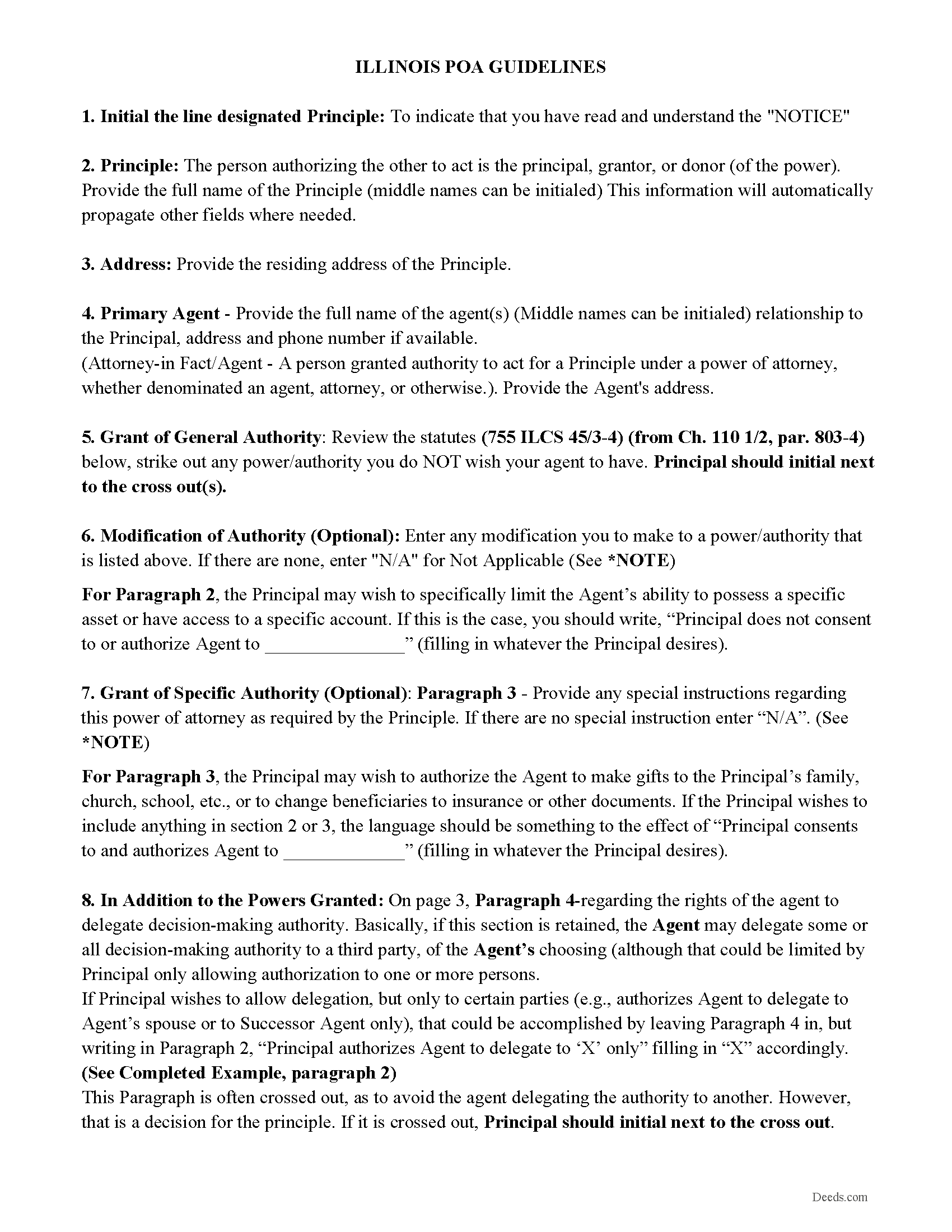

Marion County Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

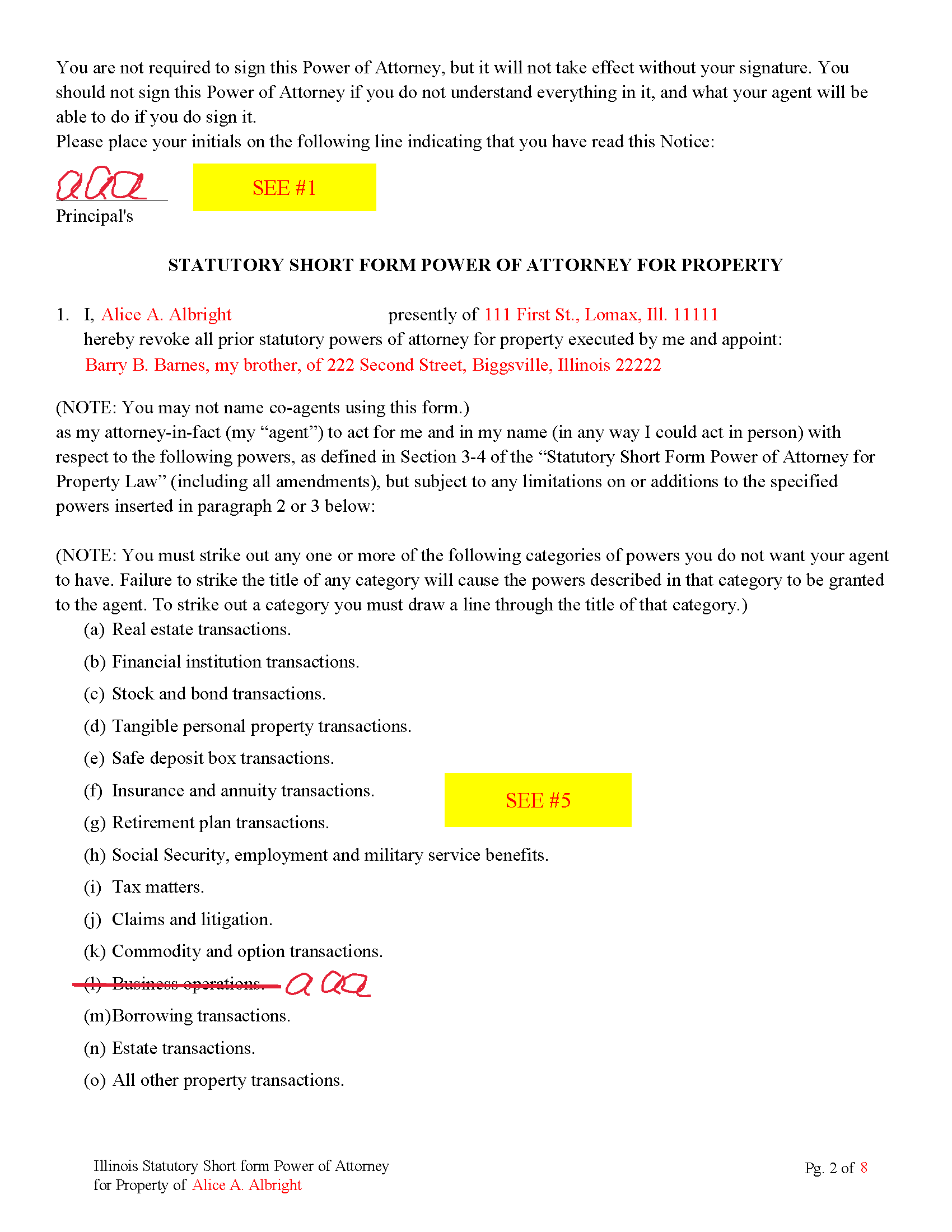

Marion County Completed Example of the Power of Attorney

Example of a properly completed form for reference.

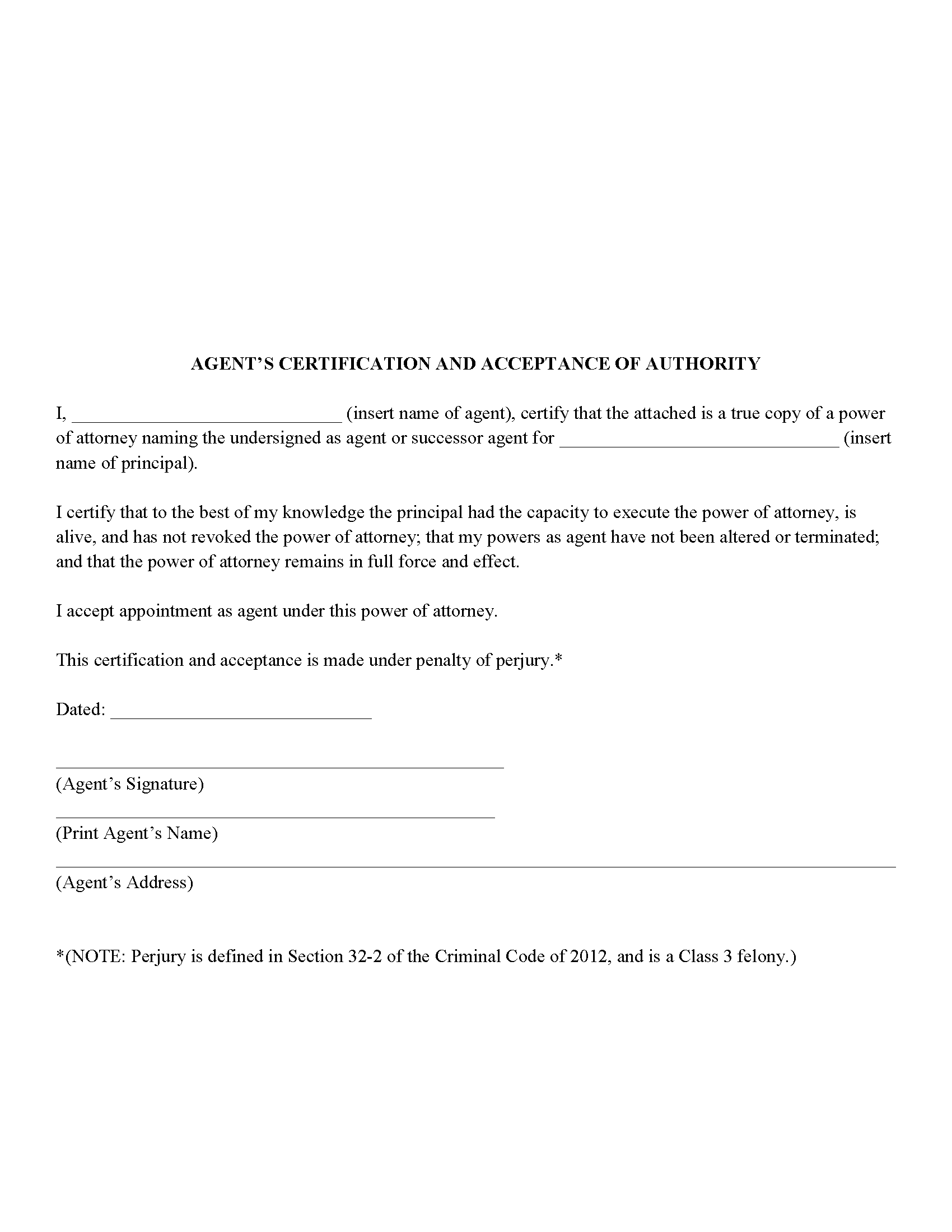

Marion County Agents Certification Form

Agent certifies he/she is authorized to act. Often required by third parties.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion County Clerk/Recorder

Salem, Illinois 62881

Hours: 8:00 to 4:00 M-F

Phone: (618) 548-3400

Recording Tips for Marion County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Alma

- Centralia

- Iuka

- Kell

- Kinmundy

- Odin

- Patoka

- Salem

- Sandoval

- Vernon

- Walnut Hill

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (618) 548-3400 for current fees.

Questions answered? Let's get started!

This short for power of attorney allows for a primary agent and successor agents (agents who will act if the primary agent can't or won't act)

Categories that your agent can or can NOT perform. Each governed by Illinois Statutes.

(a) Real estate transactions.

(b) Financial institution transactions.

(c) Stock and bond transactions.

(d) Tangible personal property transactions.

(e) Safe deposit box transactions.

(f) Insurance and annuity transactions.

(g) Retirement plan transactions.

(h) Social Security, employment and military service benefits.

(i) Tax matters.

(j) Claims and litigation.

(k) Commodity and option transactions.

(l) Business operations.

(m) Borrowing transactions.

(n) Estate transactions.

(o) All other property transactions. (755 ILCS 45/3-4)

This is a recordable document, if you allow your agent to transfer real property, Title Companies and/or other third parties will usually require the power of attorney to be recorded before a transfer of real property can take place if it has not been done so previously. This power of attorney includes an addendum page to list real property.

(Illinois Statutory POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Statutory Short Form Power of Attorney for Property meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Statutory Short Form Power of Attorney for Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Nanette G.

March 4th, 2020

The Website was easy to use. I live in Houston Texas and mother recently passed away in California and I need affidavit of joint tenant forms. I was provided all the forms necessary to complete the documents. I had been a legal secretary in California about 20 years ago and just need the current forms and received them all very quickly.

Thank you!

patricia l.

February 16th, 2019

found this site very easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

daniel b.

April 15th, 2019

nice & easy, site needs to have notification as to security of credit card info. who and how?

Thank you for your feedback. We really appreciate it. Have a great day!

Leroy B.

February 7th, 2020

I have a Timeshare in Florida and started looking to sell it. Just finally downloaded this site, it looks fairly simple. I will start getting more serious soon. Looking forward to working with Deeds.com.

Thank you!

Linda W.

January 22nd, 2021

Fast service. From the time I sent my Quit Claim Deed to deeds.com, and six hours later my deed was recorded. It was painless, great convenience.

Thank you!

Sally P.

June 22nd, 2023

I cannot thank the staff at Deeds.com enough for all of their assistance and their quick and their most pleasant responses. They were extremely quick and efficient to help me to file my documents. Thanks for everything and I will definitely be referring folks to your site.

Our team is deeply committed to providing efficient, reliable assistance and it's always rewarding to know we've made a difference for our customers. Your kind words about our quick and pleasant responses are much appreciated and will certainly serve as an extra boost of motivation for our team.

We also sincerely appreciate your intention to refer others to our site. Your trust and confidence in our service means a lot to us, and we're grateful to have you as part of the Deeds.com community.

James B.

May 6th, 2019

All required forms readily available at fair price. Easy to create account. Immediately acquired documents upon order.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

james B.

May 10th, 2021

Downloaded quickly and saved to hard drive easily. I then opened in Adobe Acrobat Reader DC then was able to enter and save data in appropriate blanks. Yes, worth $22.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marci C.

November 6th, 2024

Excellent Service! Quick and easy! Will definitely be using again!

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Mike H.

February 11th, 2021

Great

Thank you!

Anthony C.

September 20th, 2019

I am filing a Personal Representative Deed. Haven't used the forms yet but the package sent is comprehensive and appears easy to follow. A bit help to someone who has never done this.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joan E S.

June 10th, 2022

appreciate the ease of finding a group of forms without the need for a lawyer--the time and expense--for a basic transfer of joint tenancy following a death.

Thank you!

GLENN C.

January 22nd, 2020

Your response was very thorough

Thank you for your feedback. We really appreciate it. Have a great day!

Beaugwynn Wigley S.

October 26th, 2021

Thanks so much for all your help! That was painless.

Thank you!

Maria M.

September 27th, 2023

The requested documents I needed were provided and also complete instructions on how to fill them out. I definitely will you this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!