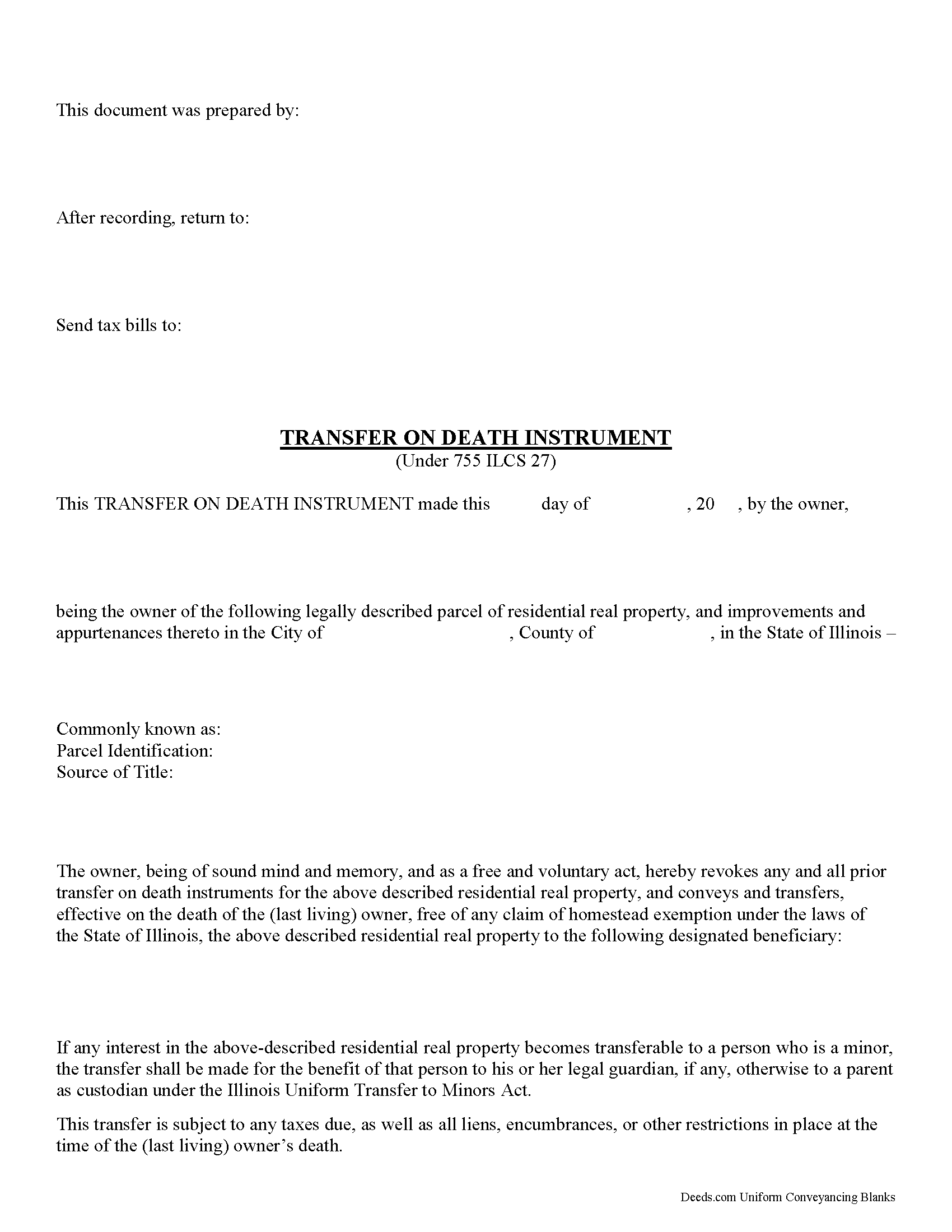

Mason County Transfer on Death Instrument Form

Mason County Transfer on Death Instrument

Fill in the blank form formatted to comply with all recording and content requirements.

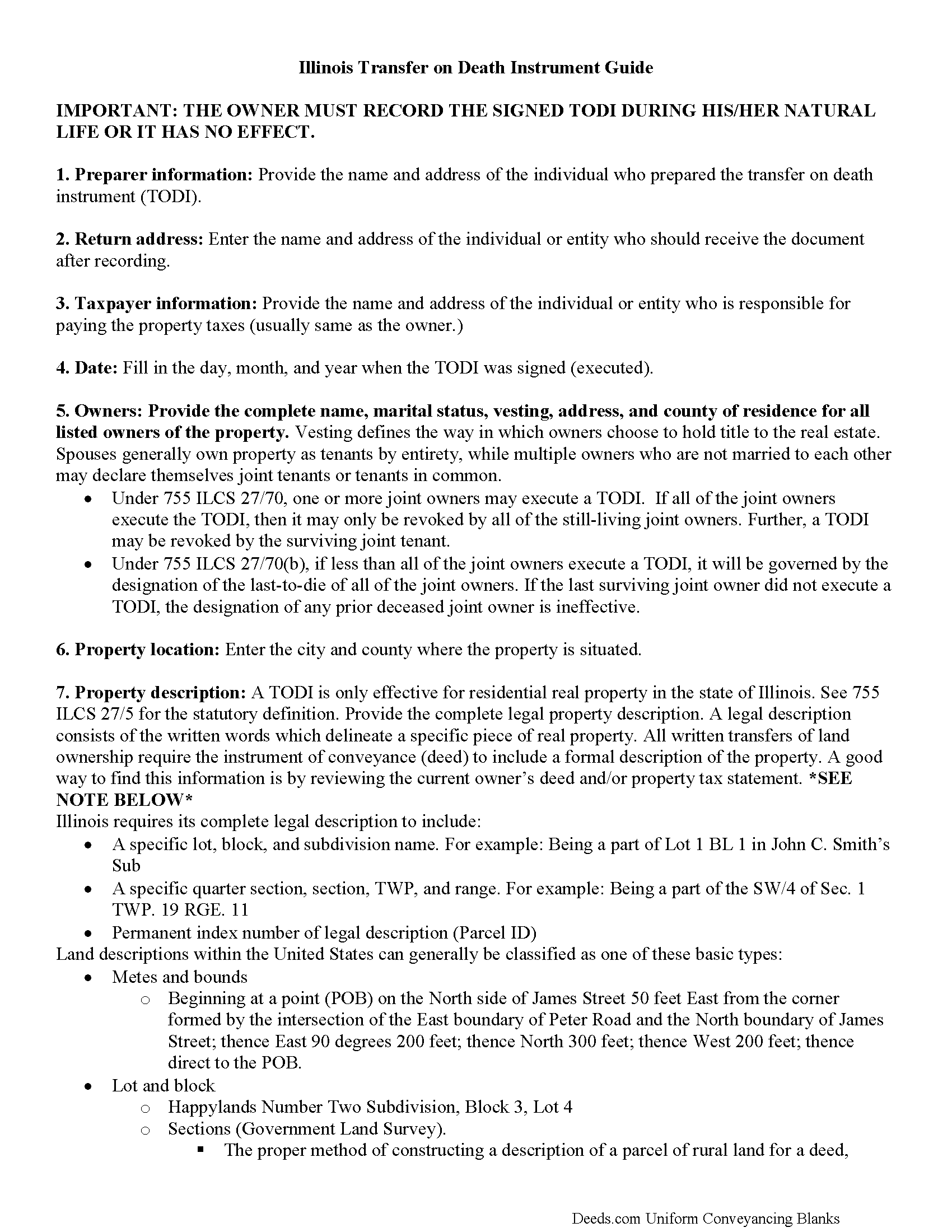

Mason County Transfer on Death Instrument Guide

Line by line guide explaining every blank on the form.

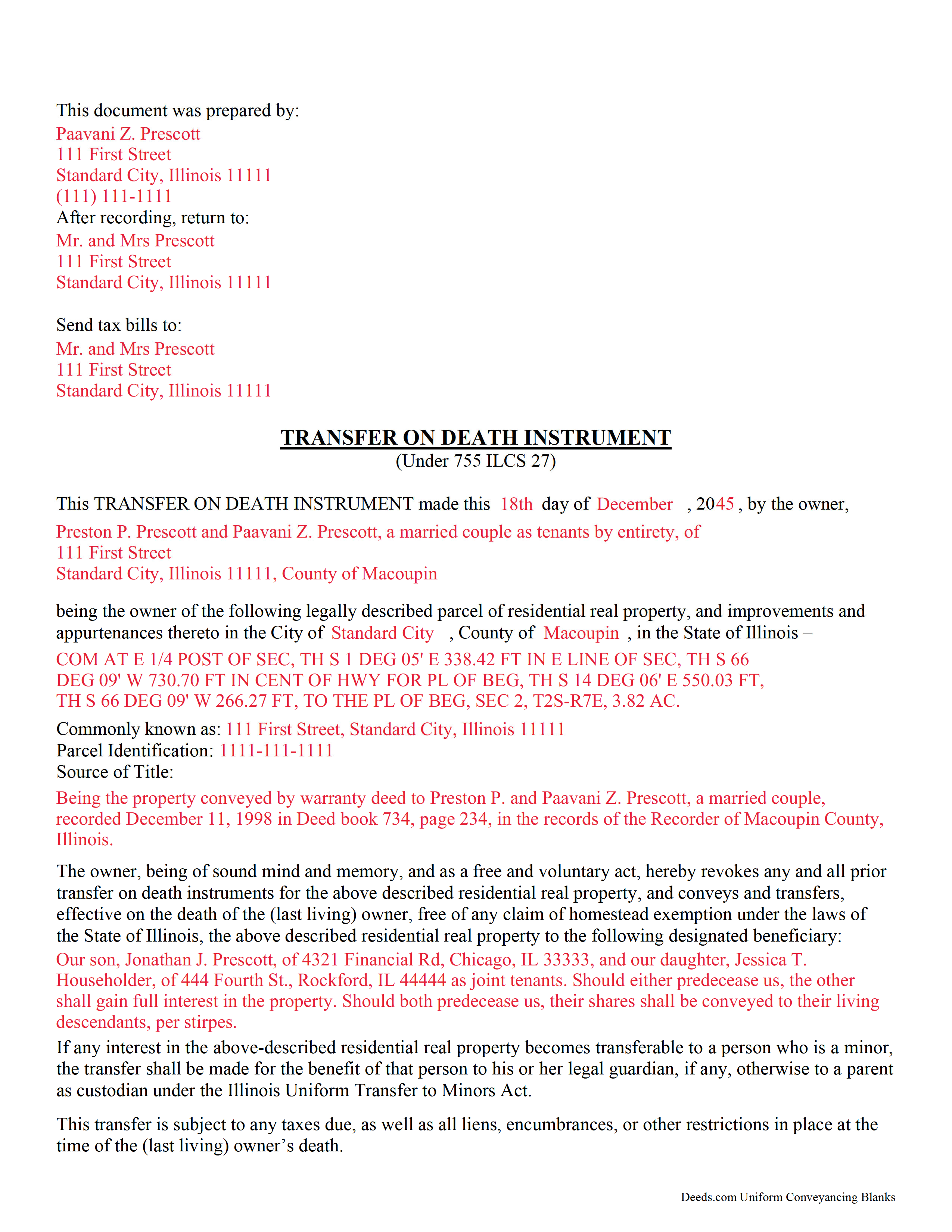

Mason County Completed Example of the Transfer on Death Instrument Document

Example of a properly completed Illinois Transfer on Death Instrument document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Mason County documents included at no extra charge:

Where to Record Your Documents

Mason County Clerk & Recorder

Havana, Illinois 62644-0077

Hours: 8:00 to 4:00 Monday through Friday

Phone: (309) 543-6661

Recording Tips for Mason County:

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Mason County

Properties in any of these areas use Mason County forms:

- Bath

- Easton

- Forest City

- Havana

- Kilbourne

- Manito

- Mason City

- San Jose

- Topeka

Hours, fees, requirements, and more for Mason County

How do I get my forms?

Forms are available for immediate download after payment. The Mason County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mason County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mason County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mason County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mason County?

Recording fees in Mason County vary. Contact the recorder's office at (309) 543-6661 for current fees.

Questions answered? Let's get started!

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)

Important: Your property must be located in Mason County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Instrument meets all recording requirements specific to Mason County.

Our Promise

The documents you receive here will meet, or exceed, the Mason County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mason County Transfer on Death Instrument form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Kathy H.

August 25th, 2024

Very accommodating and self explanatory.

It was a pleasure serving you. Thank you for the positive feedback!

Joyce B.

July 25th, 2019

Very easy to purchase and download.

Thank you!

Gloria R.

September 12th, 2023

The website was easy.

Thank you!

Patsy H.

January 10th, 2022

I had trouble at first printing out the forms but once I figured out what to do, all went well. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah O.

June 3rd, 2019

Response time was fantastic. I had no idea it would be so quick. I would definitely use again. They send you a message if they need additional information, etc. I would rate them a 10+ on a 1-10 scale

Thank you for your feedback. We really appreciate it. Have a great day!

Willard V.

May 11th, 2025

While it's nice to get all the forms and info in one package for a reasonable cost, the fixed format of the form does not allow for a lengthy meet and bounds property description for real property. Also, the Cover Sheet has big fillable sections with no instructions about what's supposed to go there. I tried the "Contact Us" link, but all it does is spin saying it's trying verify the security of my connection. Looks like I;m going to have to create my own deed in MS Word instead of just filling in the blacks of the PDF file that I downloaded. Bummer!

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Nancy B.

July 22nd, 2021

Very user-friendly. Looks like everything I needed in one place. Great job.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SHEDDRICK H.

June 17th, 2023

I got exactly what I paid for. No fraudulent transaction on my card. I like that. This is an excellent service. Straight and to the point help. That e-recording process looks like a winner. When I get my forms filled out I might use that.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Corinna N.

October 20th, 2024

The website made it easy to find and print out the documents I needed. The whole process was straightforward and user-friendly. Highly recommend!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Daniel L.

September 25th, 2023

so far appears to meet my needs!

Thank you for your feedback. We really appreciate it. Have a great day!

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT L.

April 1st, 2019

I got a blank, a sample and detailed instructions, I'm happy. If the recorder's office had a form as they like to see, with your name as they like to see, and the property name as they like to see, no one would ever pay a lawyer for this but a little time to look up the exact names and this package you're all set. I recommend this because, while it isn't difficult, making a mistake could be very bad so getting the details right for a particular county is well worth the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Boyd B.

June 16th, 2025

I had an issue because of what I was doing, thanks to these guys. I received an email and lickety-split done no more problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John M.

November 18th, 2021

Just finished downloading all of the forms; so far so good

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra H.

April 1st, 2020

I did not receive the information in a timely fashion as stated on the website. I would not recommend this service.

Thank you for your feedback Sandra. In reviewing your order I see that it did take our staff 11 minutes to respond to your order. That is significantly longer than the 10 minute average listed on our website. Even in these unprecedented times of quarantines and staff shortages our failure is unacceptable. We have fully refunded your account and we do hope that you found something more suitable to your needs elsewhere.