Logan County Transfer on Death Revocation Form

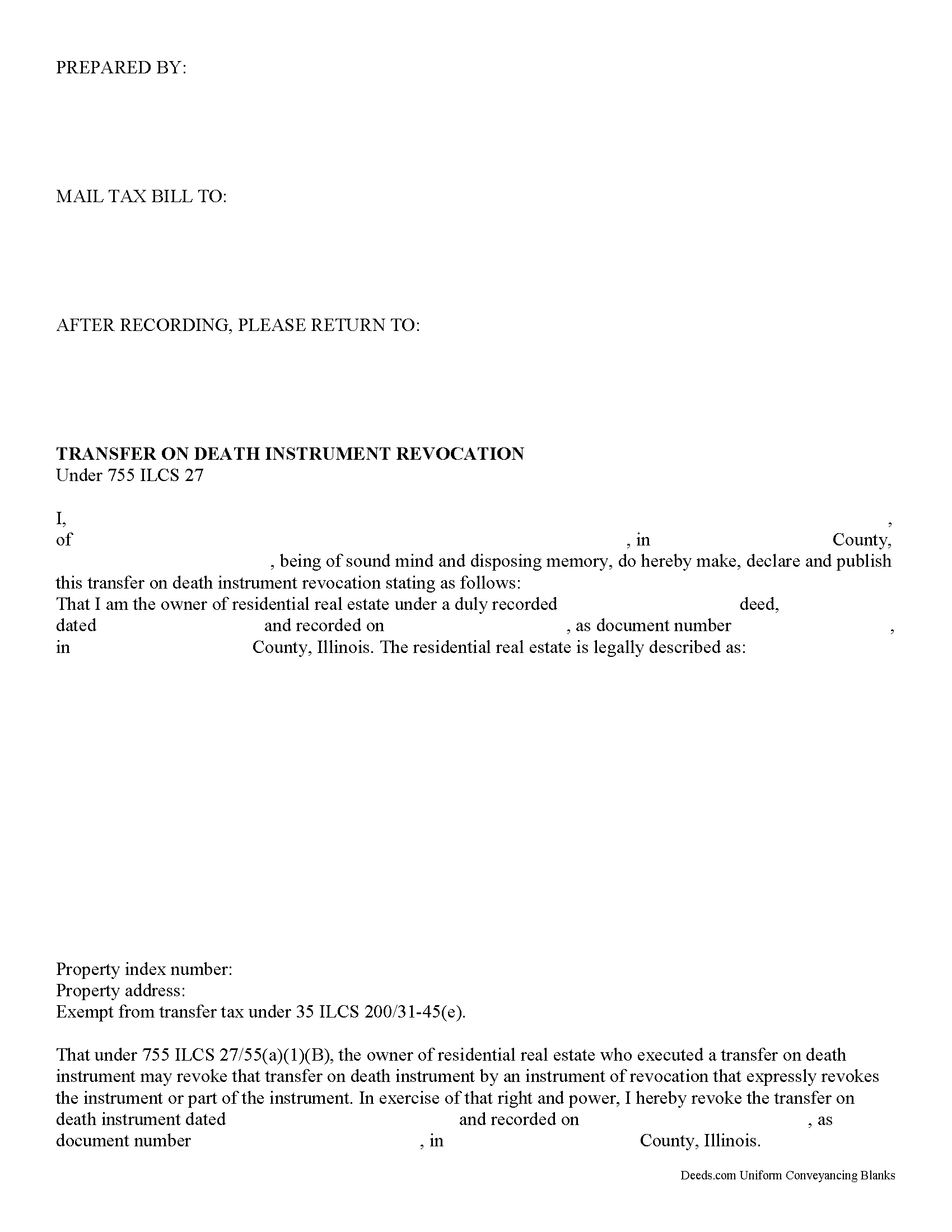

Logan County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

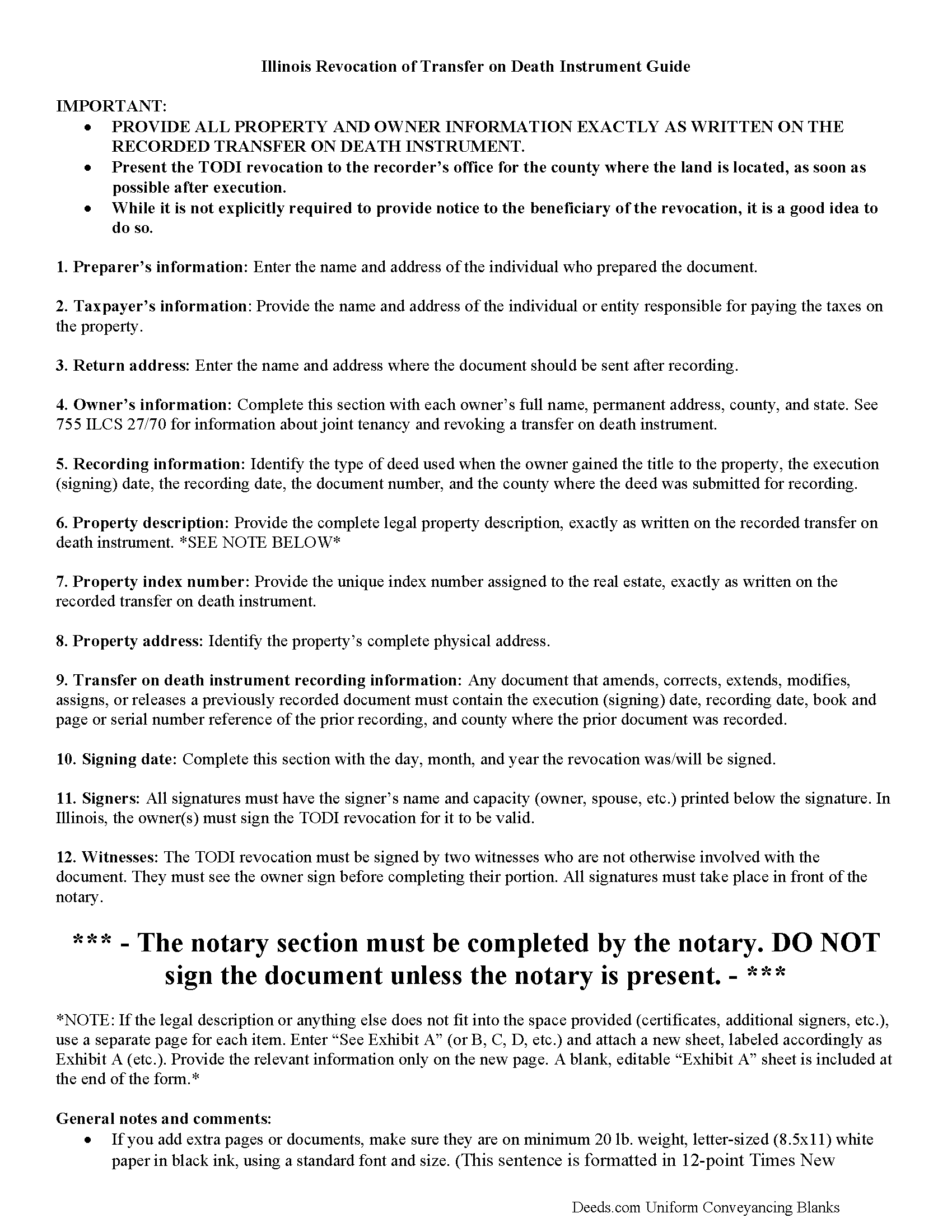

Logan County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

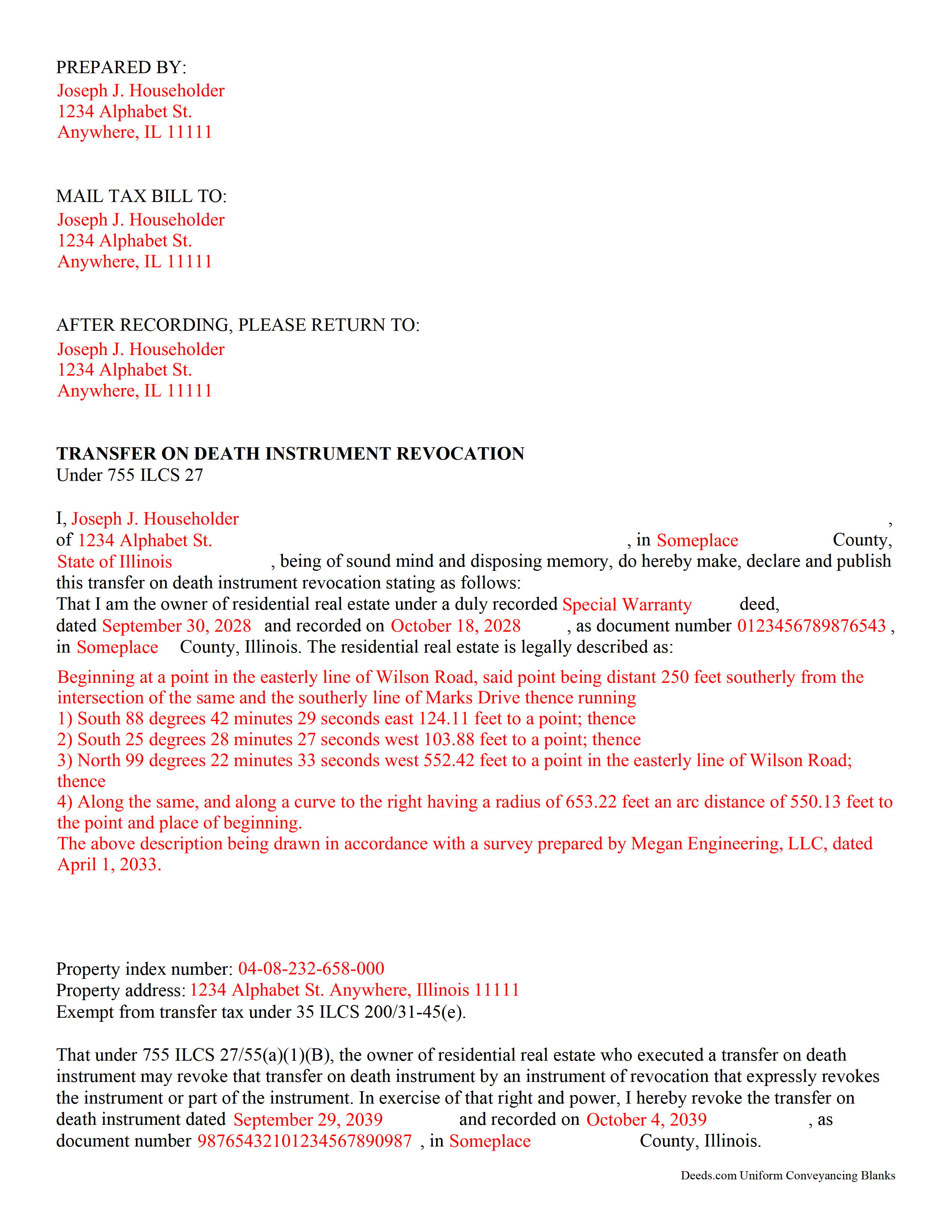

Logan County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Logan County documents included at no extra charge:

Where to Record Your Documents

Logan County Clerk and Recorder - Courthouse

Lincoln, Illinois 62656

Hours: 8:30 to 4:30 M-F

Phone: (217) 732–4148

Recording Tips for Logan County:

- Ensure all signatures are in blue or black ink

- Request a receipt showing your recording numbers

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Logan County

Properties in any of these areas use Logan County forms:

- Atlanta

- Beason

- Chestnut

- Cornland

- Elkhart

- Emden

- Hartsburg

- Lake Fork

- Latham

- Lawndale

- Lincoln

- Middletown

- Mount Pulaski

- New Holland

Hours, fees, requirements, and more for Logan County

How do I get my forms?

Forms are available for immediate download after payment. The Logan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Logan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Logan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Logan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Logan County?

Recording fees in Logan County vary. Contact the recorder's office at (217) 732–4148 for current fees.

Questions answered? Let's get started!

Revoking an Illinois transfer on death instrument is governed by 755 ILCS 27.

One of the many useful aspects of the Illinois transfer on death instrument (TODI) is the ability to revoke it with no penalty to the owner and no obligation to the beneficiary. If the owner, who already executed and recorded a TODI, decides, for any reason, to cancel the future transfer, completing, executing, and recording a revocation will negate the prior document and prevent the former beneficiary from gaining ownership of the residential real property covered by the TODI.

Complete, sign, and record this form to revoke a previously executed and recorded transfer on death instrument for residential real property in the state of Illinois.

Note that the requirements for executing a revocation are similar to those of the TODI. The owner must sign the revocation in the presence of two adult witnesses who are not otherwise involved with the transaction. Additionally, a notary public or other individual who is authorized by the courts to administer oaths must be present to certify the identities and signatures of the owner and the witnesses.

(Illinois Transfer on Death Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Logan County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Logan County.

Our Promise

The documents you receive here will meet, or exceed, the Logan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Logan County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Pamela S.

January 6th, 2021

Great experience! Instructions are very clear and thorough. The completeness of the instructions really inspired confidence. Within minutes of uploading my document, I received a message that it had been prepared and submitted to the county for recording. Makes it so simple! Well worth it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

jonnie F.

August 25th, 2020

Easiest and most efficient way to process your documents, this company is amazing. They help me meet the deadline on a critical inspection by processing my NOC in less then a day. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Edward B.

September 22nd, 2023

I was looking for a certain form I needed. Deeds.com had the necessary form and I was able to purchase it with little effort on my part. This was a good customer experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Herman B.

May 19th, 2022

Special Warranty Deed I can't seem to type all my info in the blank spaces. It won't allow me to type any more. Maybe you should consider either allowing typists to type more (leaving more space) or allowing more room to type more.

Thank you!

Joyce S.

June 28th, 2019

The site was very easy to understand and to download the required documents I need to prepare a release. Response of the documents ready for my use was very efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vickey W.

February 5th, 2021

Your company was great, you all walked me through every step of the process. With the pandemic and the inability to go into the DC Recorder of Deeds office. I look forward to working with you in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas M.

May 20th, 2021

Thomas hopefully these are the correct forms I need wish me luck

Thank you!

Deloris L.

August 25th, 2020

I downloaded documents easy. But haven't started work on them yet. Seems to be ok.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BROOKE W.

February 16th, 2021

Great fillable form! And the separate instruction sheet was detailed and very clear. I particularly appreciate you including a sample of a completed form. I've filled in real estate forms before but never this one, and there were some things I didn't know.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carla H.

May 29th, 2020

This is a very useful site for downloading legal forms - just be sure you're getting the form you need before buying. Unfortunately I selected the wrong form initially and had to buy a 2nd form to correct my error. I saw no way of communicating my error at that point - i.e., loss of one star.

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID G.

February 1st, 2021

Extremely helpful -- logically presented -- great documentation...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dana L.

January 29th, 2021

So far, so good! Love you guys!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eva S.

February 6th, 2024

I was able to download the forms and I needed and fill out quickly. There were examples to review if I needed any assistance. I would recommend this site to anyone.

We are delighted to have been of service. Thank you for the positive review!

Paul D.

July 24th, 2019

Easy to use! The forms were perfect and everything was explained well! Will use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert J.

August 11th, 2020

Ordered the quitclaim forms. Amazing value! Received everything I needed and then some. The forms were easy to use and understand with the help of the guide. The best part was that once completed I used deeds.com's e-recording service to submit the document for recording (our county offices are still closed). Outstanding!

Thank you for the kinds words Robert, glad we could help.