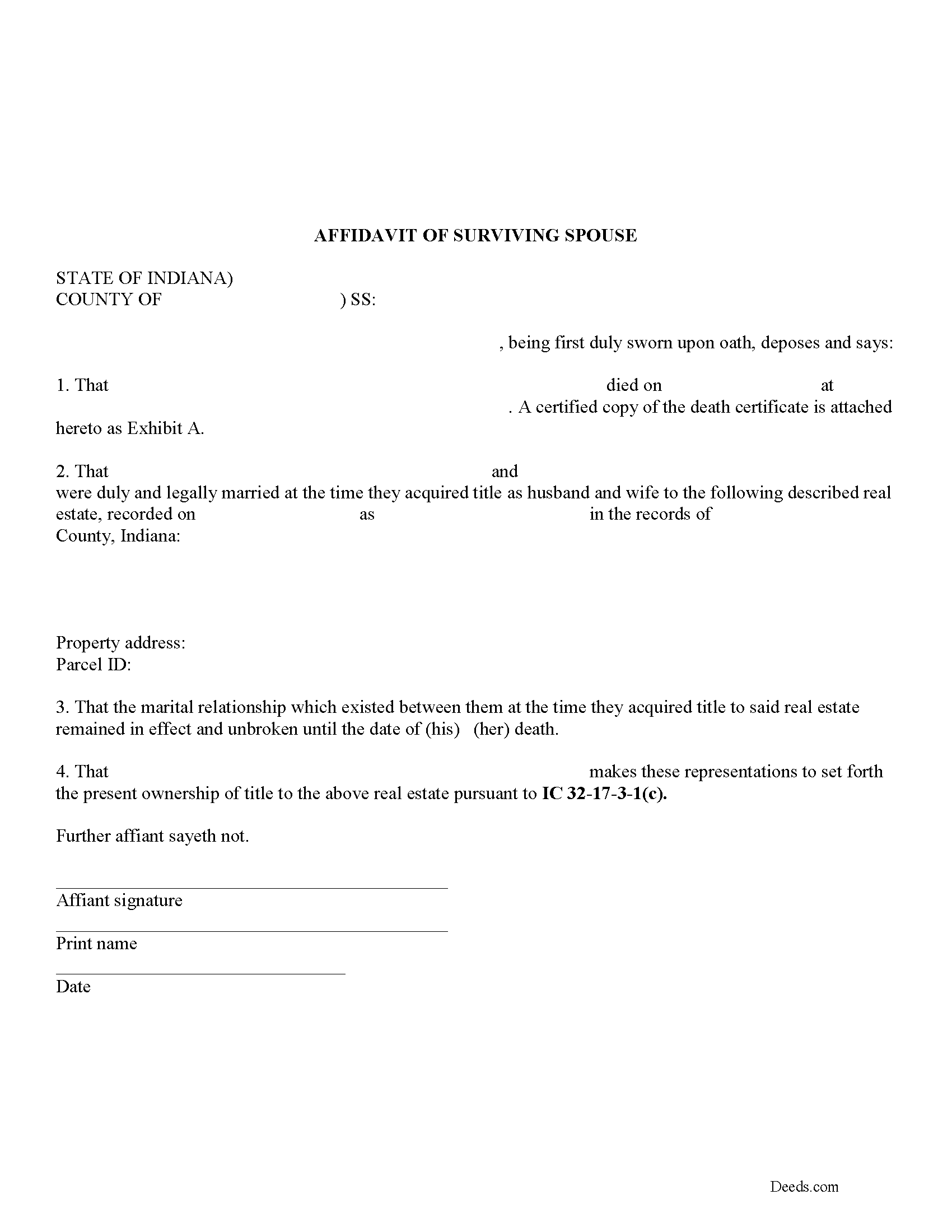

Posey County Affidavit of Surviving Spouse Form

Posey County Affidavit of Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

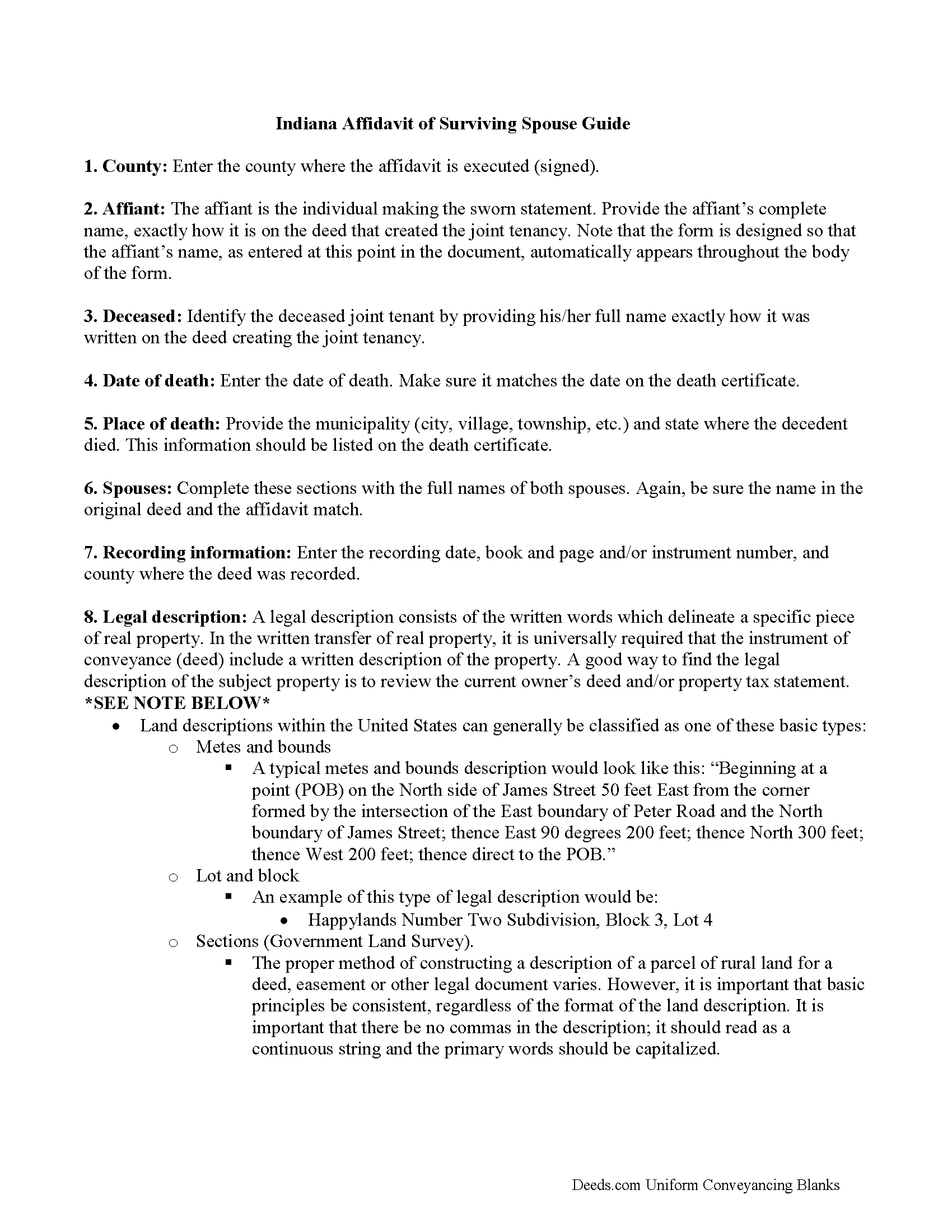

Posey County Affidavit of Surviving Spouse Guide

Line by line guide explaining every blank on the form.

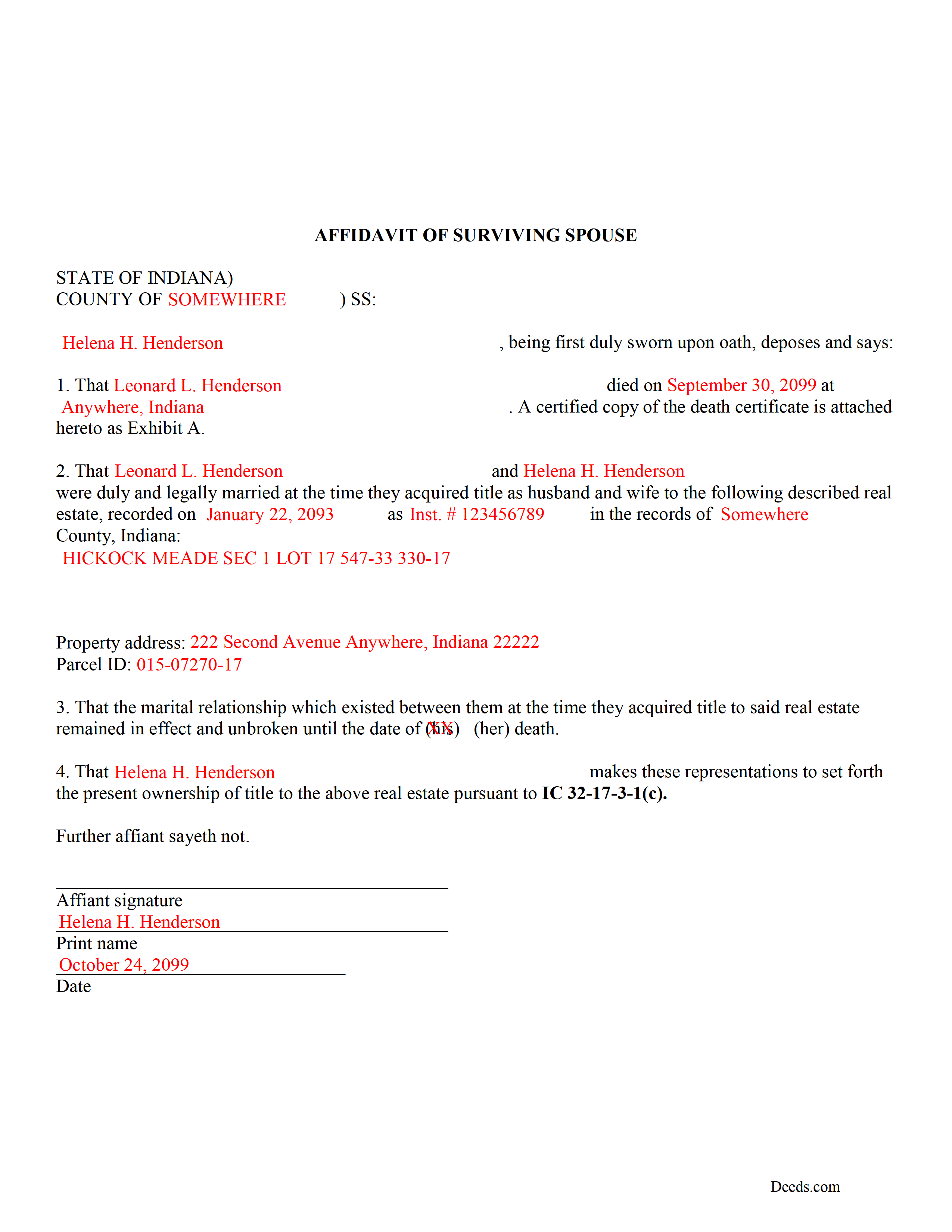

Posey County Completed Example of the Affidavit of Surviving Spouse Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Posey County documents included at no extra charge:

Where to Record Your Documents

Posey County Recorder

Mt. Vernon, Indiana 47620

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 838-1314

Recording Tips for Posey County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Posey County

Properties in any of these areas use Posey County forms:

- Cynthiana

- Griffin

- Mount Vernon

- New Harmony

- Poseyville

- Wadesville

Hours, fees, requirements, and more for Posey County

How do I get my forms?

Forms are available for immediate download after payment. The Posey County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Posey County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Posey County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Posey County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Posey County?

Recording fees in Posey County vary. Contact the recorder's office at (812) 838-1314 for current fees.

Questions answered? Let's get started!

Married couples in Indiana may hold title to real estate as tenants by the entireties. This means that when one spouse dies, the other gains full ownership of the property by function of law, and without the need for probate. Use this instrument to formalize the acceptance of ownership rights conveyed when a spouse dies. Complete and sign the affidavit and submit it, along with a certified copy of the decedent's death certificate, to the recorder for the county where the real estate is located.

In order to gain full ownership, the husband or wife submits a completed affidavit of surviving spouse, along with an official copy of the death certificate of the deceased spouse, to the recorder for the county where the land is located.

This does not, however, remove the deceased's name from the deed. To accomplish that, the survivor must execute and record a new deed from the married couple to the remaining spouse only. After completing this final step, the public record and current deed will contain the most up-to-date information.

(Indiana Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)

Important: Your property must be located in Posey County to use these forms. Documents should be recorded at the office below.

This Affidavit of Surviving Spouse meets all recording requirements specific to Posey County.

Our Promise

The documents you receive here will meet, or exceed, the Posey County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Posey County Affidavit of Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles G.

August 14th, 2022

Easy to request. Fast response

Thank you!

joab k.

May 20th, 2021

Usable mediocre average stuff. functional but not extraordinary but the price and service is quite good

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn C.

April 6th, 2020

My document got recorded right away. Thank you! Will use again in the future when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deb D.

January 31st, 2019

Excellent website - easy to use, and found exactly the form I needed right away. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Roy K.

February 15th, 2019

Just what we were looking for. Very easy to fill out. Thanks

Thank you Roy. We appreciate your feedback.

Laurentina F.

December 10th, 2020

Great and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

lisa c.

January 21st, 2020

I didn't like your website. It was complicated for an elderly person to use.

Sorry to hear that we failed you Lisa. We do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

DON O.

December 16th, 2020

needs to be more user friendly

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy N.

September 21st, 2020

Extremely easy and fast recording of real estate records. I was impressed that it was less than 6 hours from the time I uploaded the document to Deeds.com to receiving confirmation that it was recorded by the county clerk. I would highly recommend this service to save you time and quickly get documents recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

DOUGLAS H.

December 16th, 2020

Just as promised My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen O.

June 2nd, 2021

I often think I am smarter than I am. Thankfully there are people that know what they are doing so I can focus on my business and the big picture without worrying about the little things.

Thank you!

Clarence F.

January 25th, 2022

very easy to use !!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David C.

July 21st, 2021

I was very impressed. Your program makes it very user friendly which is a must for most of the public . I have recommended this site to various clients for estate planning documents with simple estates.

Thank you!