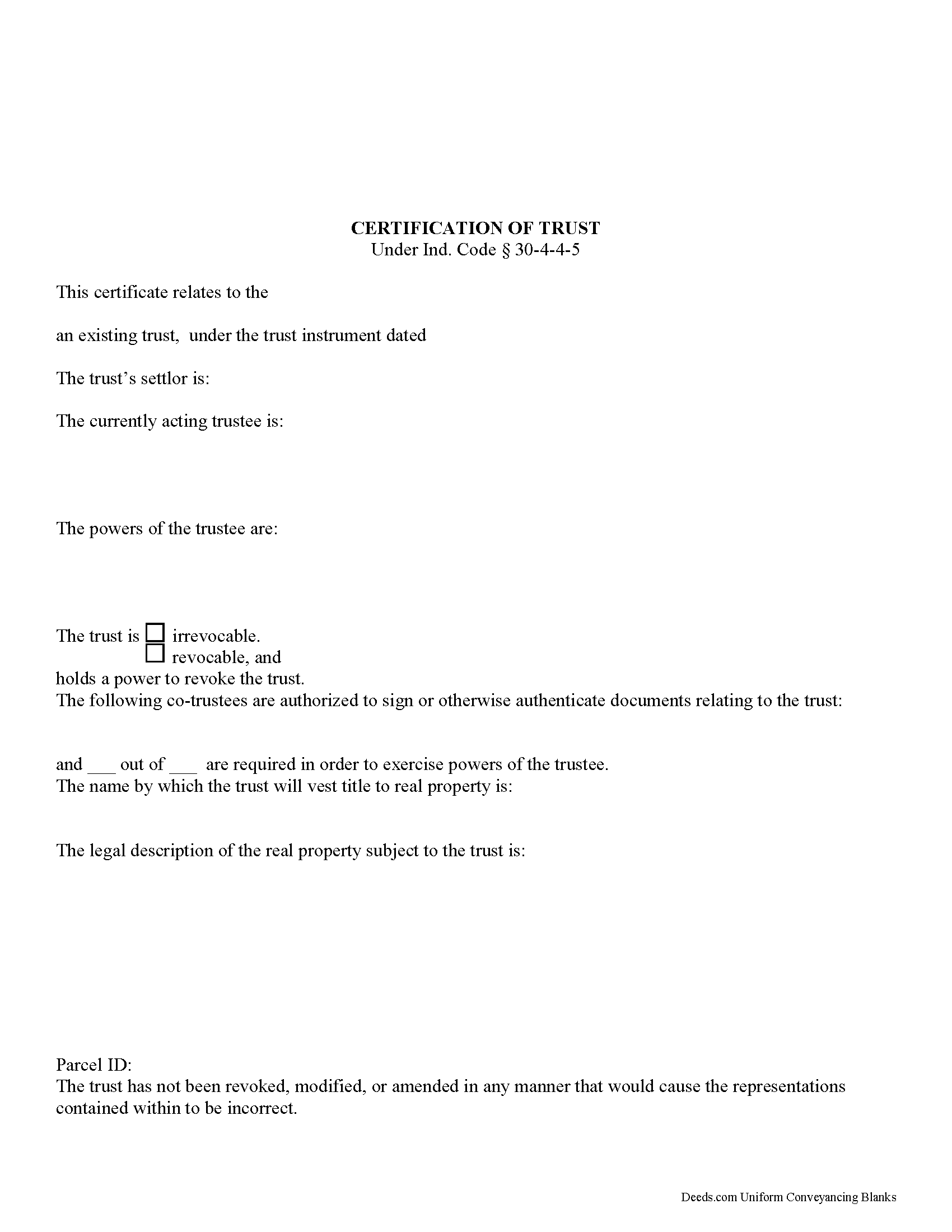

Johnson County Certificate of Trust Form

Johnson County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

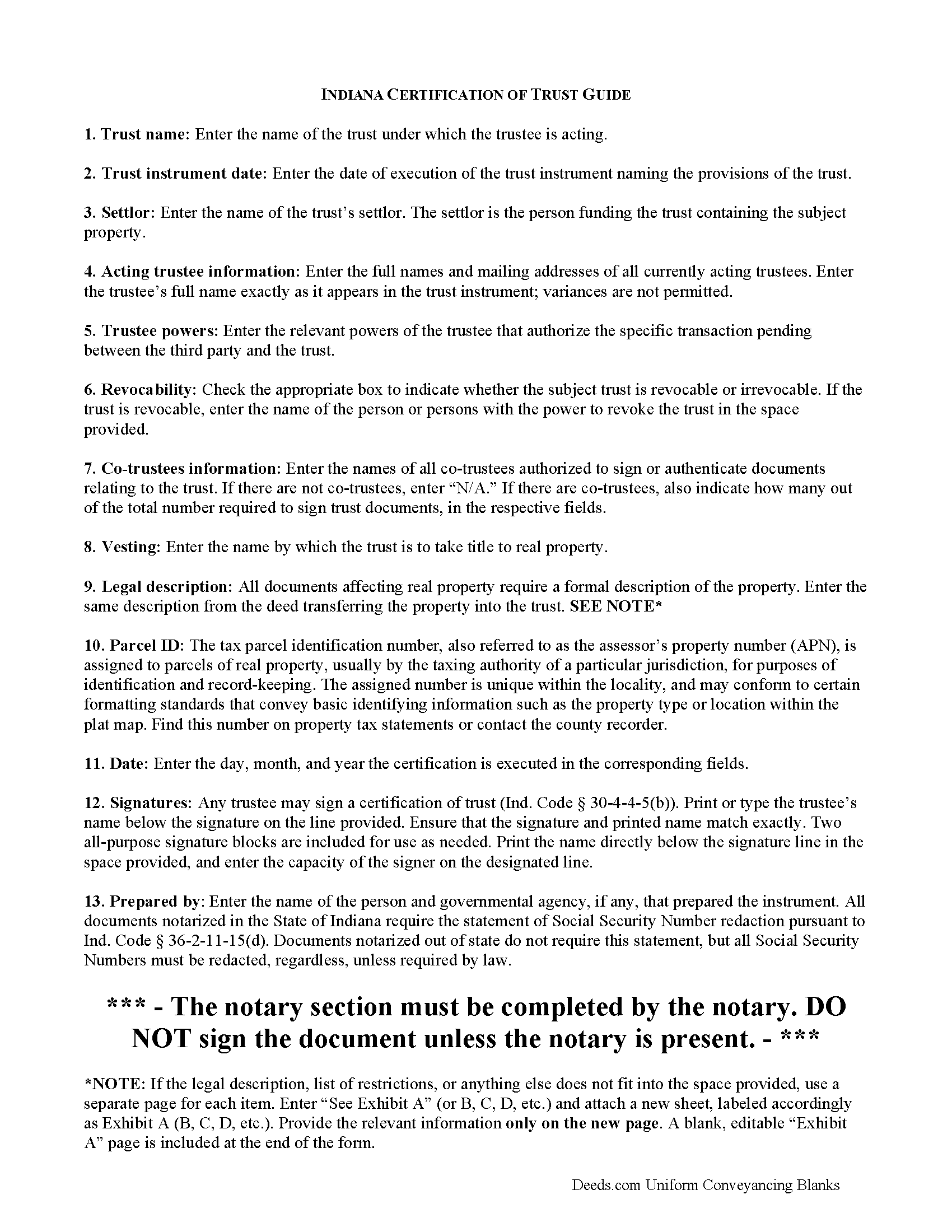

Johnson County Certificate of Trust Guide

Line by line guide explaining every blank on the form.

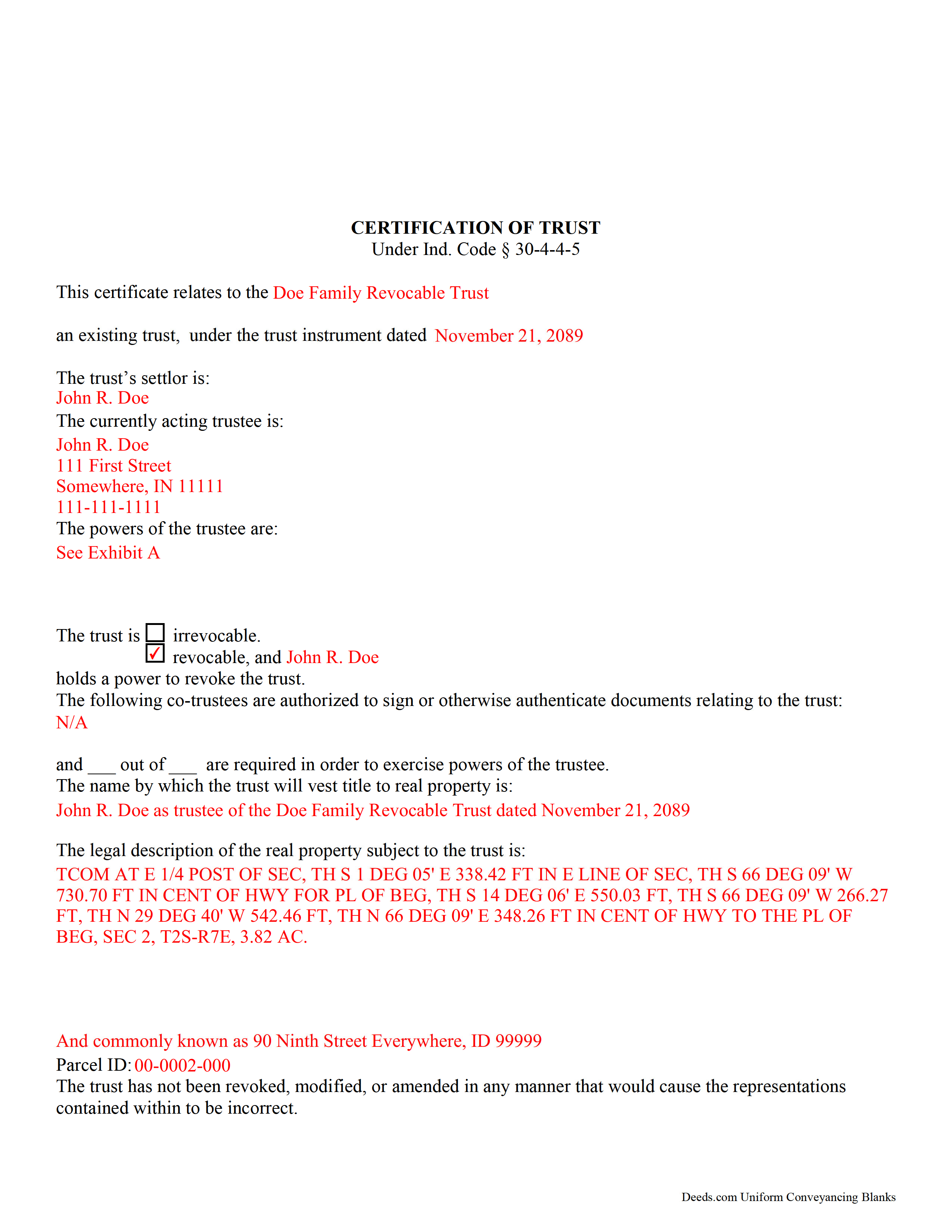

Johnson County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Recorder

Franklin, Indiana 46131

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (317) 346-4385

Recording Tips for Johnson County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Bargersville

- Edinburgh

- Franklin

- Greenwood

- Needham

- Nineveh

- Trafalgar

- Whiteland

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (317) 346-4385 for current fees.

Questions answered? Let's get started!

Codified at Indiana Code 30-4-4-5, a certification of trust is a document presented by a trustee as evidence of the trustee's authority to act on behalf of a trust.

Lending institutions or other third parties might request a certification of trust before they enter into any transactions with a trustee. Since trust instruments are not recorded, the identities of those with a beneficial interest in the trust remain private. The certification presents only the essential information needed while maintaining confidentiality of personal information a trustee or trust maker may not wish to disclose.

The certification verifies the existence of the trust under which the trustee is named. The document provides basic information, such as the name and date of the trust; the type of trust and who, if any, retains a power to revoke the trust; the identity of the trust's settlor; and the identities of all acting trustees. If a trust has co-trustees, the certification states how many co-trustees are required to sign off on documents relating to the trust, as well as their identities. In addition, the certification provides the name by which the trust is to hold assets.

As with other documents relating to real property, the certification should include a legal description of the subject real estate. The document may be executed and signed by any acting trustee and acknowledged before a notary public. Certifications can be recorded in the county or counties in which the real property is situated.

Finally, the powers of the trustee relevant to the transaction at hand are laid out. A recipient of a certification may request additional excerpts from the trust instrument, such as those which designate the trustee and lay out the trustee's powers to act in the pending transaction, but the recipient can reliably act on the information contained in the certification alone as if it were fact.

Requesting excerpts from a trust instrument opens the requester to certain liability under Ind. Code 30-4-4-5(h).

Trust law is complicated, and each situation is unique. Consult a lawyer for guidance.

(Indiana Certificate of Trust Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Pansie H.

August 23rd, 2019

Quick and Easy

Thank you!

Debra D.

January 2nd, 2019

Really good forms, easy to understand and use. The guide was a must have, made the process very simple.

Thank you!

GERALD P.

September 19th, 2019

Product is as advertised. Most beneficial is including detailed instructions and examples. Most other options did not include instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Kari G.

July 15th, 2021

The service was prompt and attentive to my questions. I would've just appreciated a heads up that I also needed to contact the county directly (and provide contact info) to receive a certified copy of the document (Notice of Commencement) in order to submit the certified copy to the Building Department. This was an extra step that I haven't had to complete before using another eRecording service. Even if this extra step is a result of the county's system. I would still have expected a head's up (since there wasn't any info regarding this on the county's site for eRecording).

Thank you for your feedback. We really appreciate it. Have a great day!

STEPHEN C.

January 22nd, 2020

Excellent service. Easy to use. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa M.

June 24th, 2020

Excellent service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer M.

April 3rd, 2024

Consistent and quick. This site saves me so much time away from my desk. It's a great resource for my small business!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Djala C.

November 18th, 2019

my experience was excellent.

Thank you!

George W.

April 2nd, 2020

The process was easy and the forms were a very complete package. FAST AND EASY DOWNLOAD

Thank you George.

Mark E.

March 12th, 2019

Thank you for your Swift response. Have docs I was looking for!

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah P.

September 13th, 2022

Very helpful! Easy and clear guidance. Good examples on sample forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas M.

September 21st, 2020

EXCELLENT resource for ALL state documents! The forms come with explanations and examples. A real Deal!!!

Thank you!

Frank T.

February 3rd, 2020

Great service, fast easy to use, accurate forms for our project. Thank you. FTM

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer K.

March 4th, 2021

User friendly!

Thank you!

Angela S.

April 29th, 2021

Very easy process and efficient. Made my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!