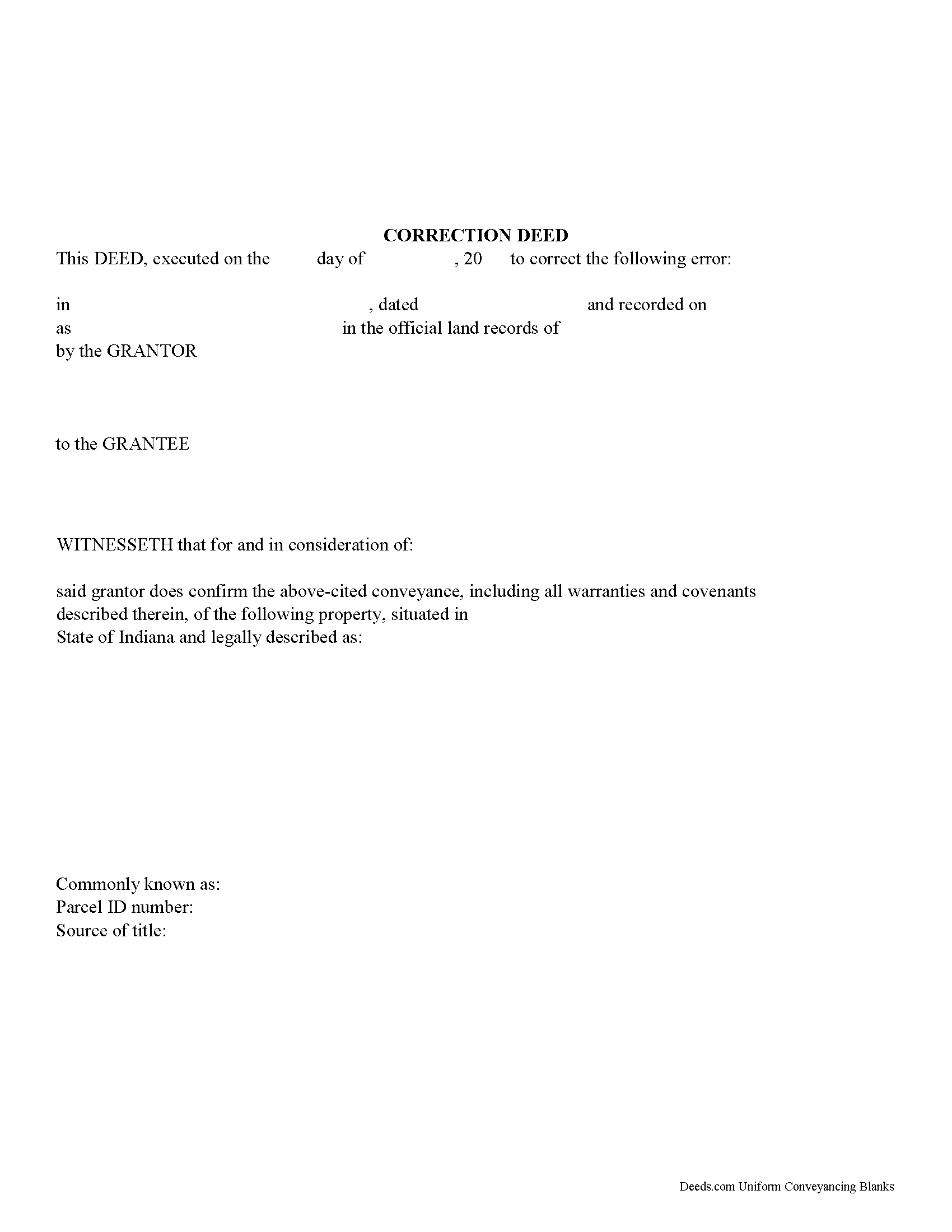

Johnson County Correction Deed Form

Johnson County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

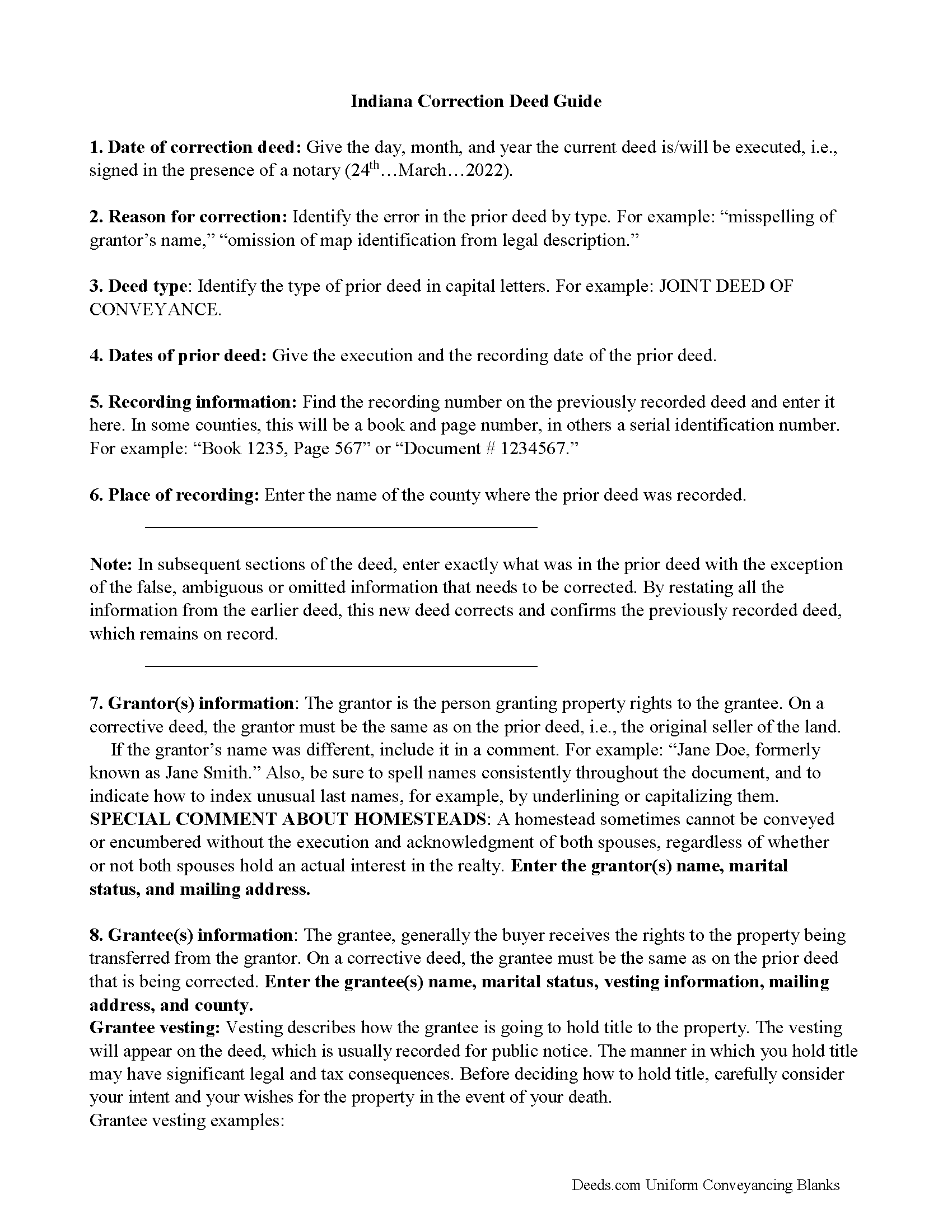

Johnson County Correction Deed Guide

Line by line guide explaining every blank on the form.

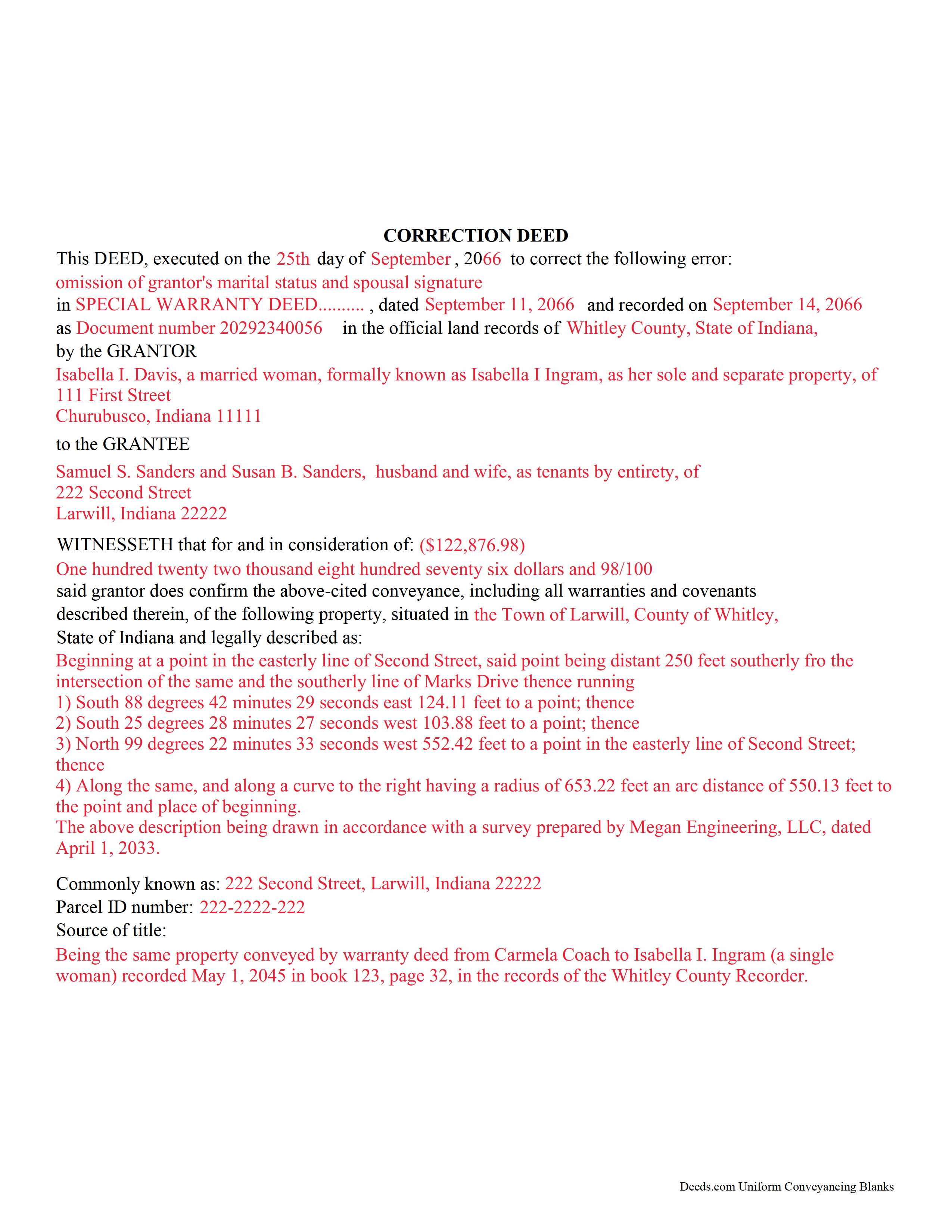

Johnson County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Recorder

Franklin, Indiana 46131

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (317) 346-4385

Recording Tips for Johnson County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Bargersville

- Edinburgh

- Franklin

- Greenwood

- Needham

- Nineveh

- Trafalgar

- Whiteland

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (317) 346-4385 for current fees.

Questions answered? Let's get started!

Use this form to correct an error in a fee simple, quitclaim, or joint deed of conveyance in Indiana, thus eliminating potential title flaws.

In Indiana, a previously recorded deed can be corrected by recording a second deed, called a correction or corrective deed. The sole purpose of such a document is to prevent potential title flaws, which may create problems when the current owner attempts to sell the property to a third party. The correction deed does not convey title but confirms the prior conveyance. For the most part it reiterates the prior deed verbatim, except for the corrected item.

The errors usually adjusted by a corrective deed are minor omissions or typographical mistakes, sometimes called scrivener's errors. Among those are misspelled names, omitted or wrong middle initial, a minor error in the property description, or an omitted execution date.

The corrective deed must state that its sole purpose is to correct a specific error, identified by type. For example: an error in the grantor's name, or an error in the grantor's marital status. The latter might also require an additional signature by the grantor's spouse in the acknowledgement section of the deed. The Indiana sales disclosure form is not required with a deed that does not transfer title, such as a correction deed.

(Indiana Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

kathy d.

March 20th, 2019

very easy make sense instructions. Thank you.

Thank you for your feedback Kathy. Have an amazing day!

Carnell G.

September 26th, 2020

The basic setup was fine but, I need to review the document in its entirety for accuracy which I have yet to do so. So far so good. The monthly fee is more than I need for right now.

Thank you!

Michael W.

February 8th, 2025

Wonderful service.

Thank you!

janice m.

November 9th, 2022

was great!

Thank you!

Jim W.

June 2nd, 2022

ALL I CAN SAY IS WOW. I AM SO GLAD THAT SOMEONE THOUGHT OF THIS OPROCESS FOR NON-TITLE COMPANIES, SMALL COMPANIES, ETC. I REALLY APPRECIATED THE SERVICE WHEN I RECORDED MY FIRST SET OF DOCS HERE. THEY WERE A MESS AND I HAD A LOT OF QUESTIONS. AGAIN THANK YOU!

Thank you for your feedback. We really appreciate it. Have a great day!

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Lynnellen S.

May 9th, 2019

My rating is not a 5. Although it had good instructions, it would NOT print the whole document no matter how many times I inputted the names. I ended up writing it in to complete. I also recommend putting it on one page. I had to pay an additional fees per page and if I had to notarize it, why did I have to find 2 witnesses as well. I deserve a discount for the time I spent repeatedly putting the same data. I was trying to save money since Im on social security only. It didnt. Get it to work correctly

Thank you for your feedback Lynnellen. Sorry to hear of your struggle with our document. We've gone ahead and refunded your payment. Hope you have a wonderful day.

Jennifer K.

February 12th, 2022

Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles S.

July 7th, 2021

Quick and easy. Highly recommend. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Sherry P.

November 24th, 2020

It would be helpful to have a frequently asked questions section. That would make it easier to know I have the correct form. Sherry

Thank you for your feedback. We really appreciate it. Have a great day!

Jay W.

February 7th, 2019

your service is more than I expected easy to navigate, great info, easy to understand. other other sites every time you go to next page there is something to buy to get the info you want. Jay

Thank you!

Steven W.

April 11th, 2021

Seems to be just what I needed and easy to use.

Thank you!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!

James W.

June 10th, 2019

It turned out that I was able to search for what I needed on the local county website, which is what your site suggested be tried. I was impressed with your honesty and practical instructions for searches your site gave. I'm pretty sure I'll be back.

Thank you for your feedback James. Glad to hear we were able to steer you in the right direction.

Donna R.

February 10th, 2021

Great service. Just started using Deeds.com yesterday. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!