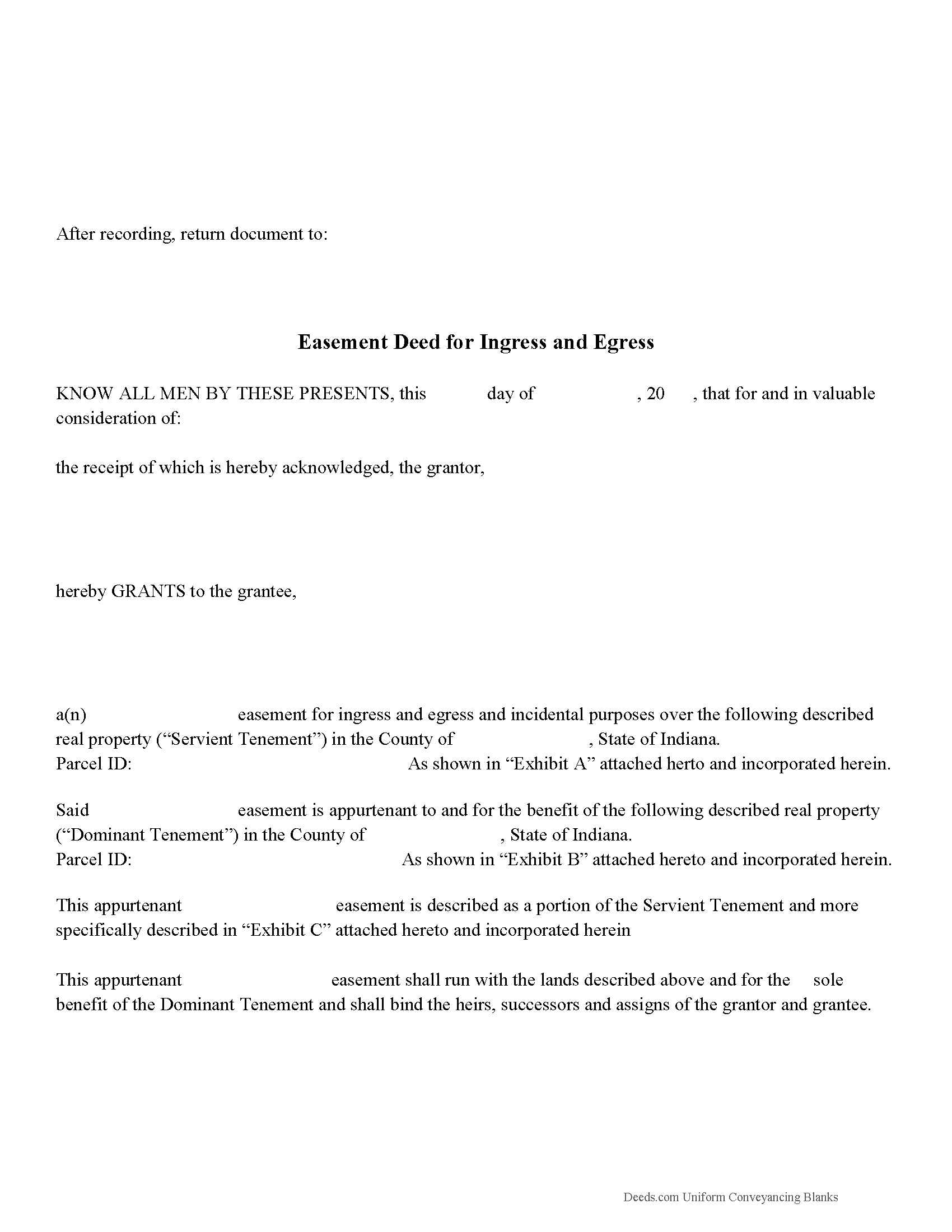

Lake County Easement Deed Form

Lake County Easement Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

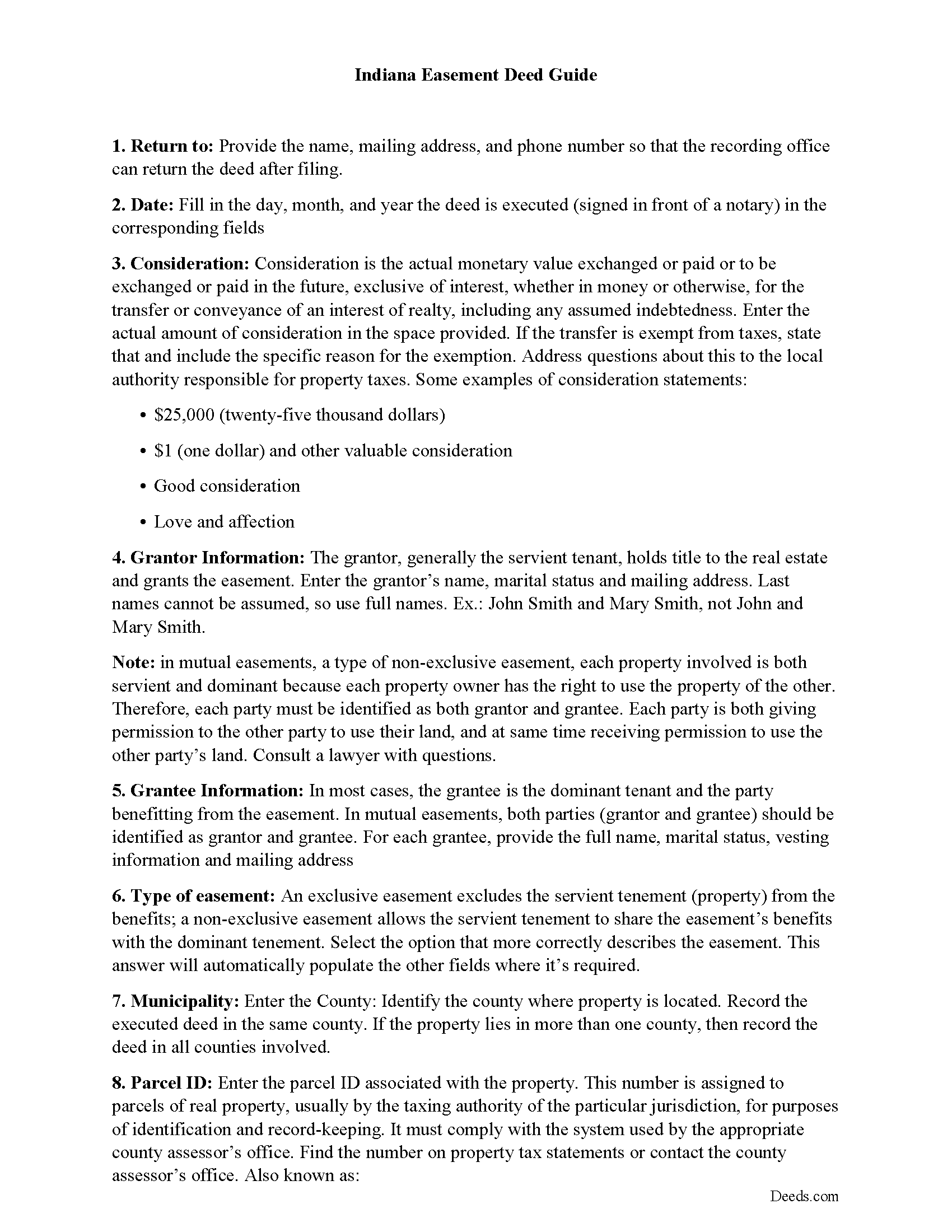

Lake County Easement Deed Guide

Line by line guide explaining every blank on the form.

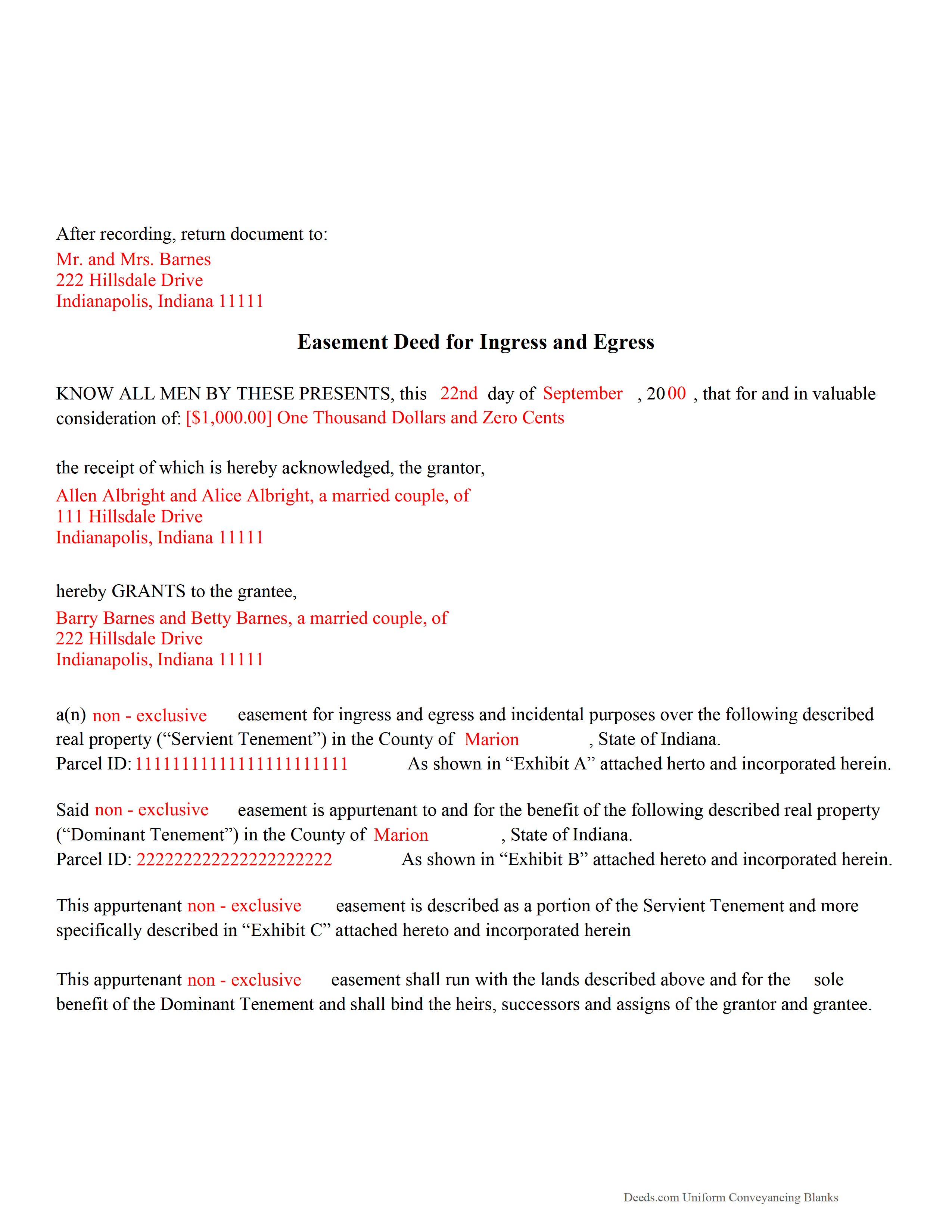

Lake County Completed Example of the Easement Deed Document

Example of a properly completed form for reference.

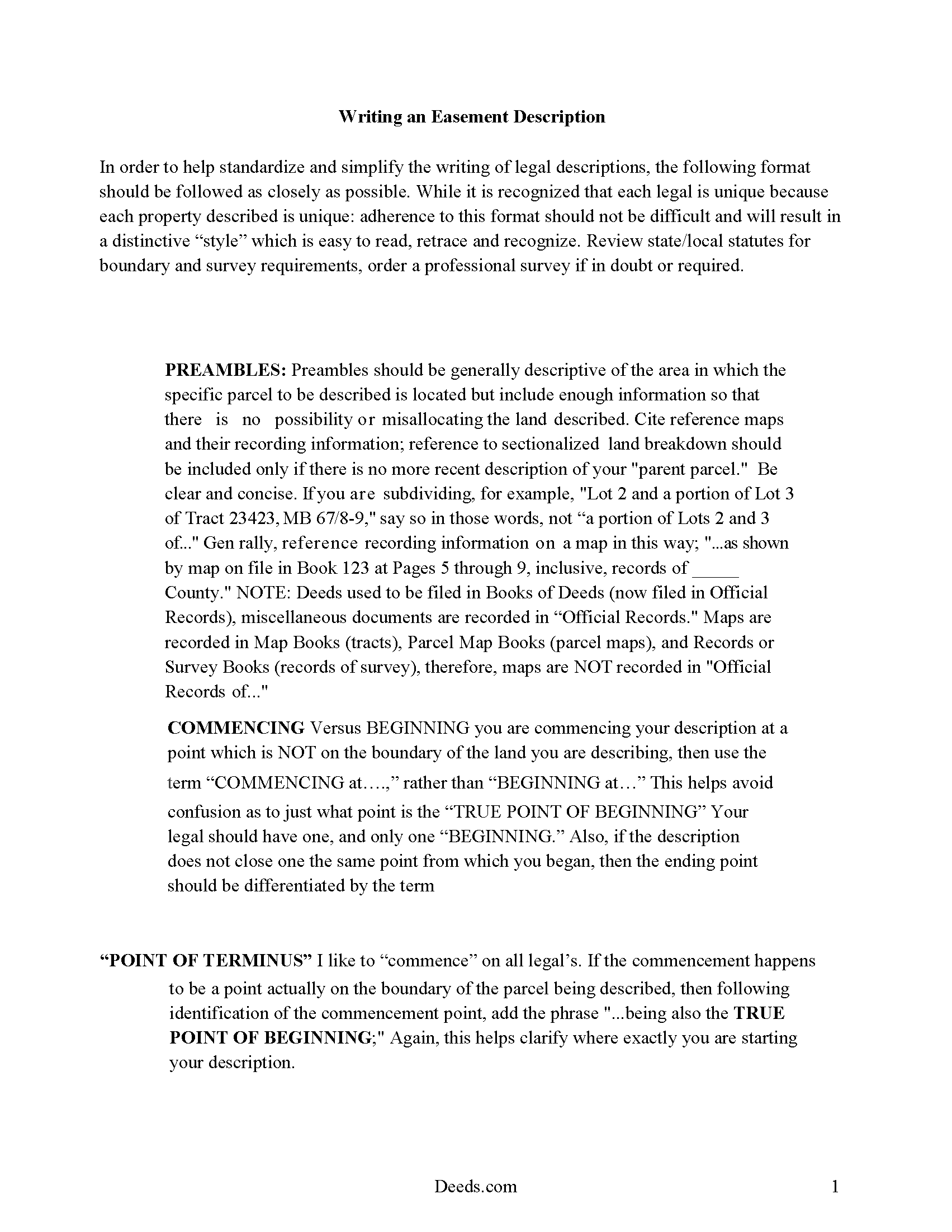

Lake County Easement Deed Description

A Description of the Easement will be required. This will show how to write an acceptable description for a Right of Way Easement, which gives access, to and from - point A to point B.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Lake County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Crown Point, Indiana 46307

Hours: 8:30am - 4:30pm M-F

Phone: 219-755-3730

Recording Tips for Lake County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Lake County

Properties in any of these areas use Lake County forms:

- Cedar Lake

- Crown Point

- Dyer

- East Chicago

- Gary

- Griffith

- Hammond

- Highland

- Hobart

- Lake Station

- Leroy

- Lowell

- Merrillville

- Munster

- Saint John

- Schererville

- Schneider

- Shelby

- Whiting

Hours, fees, requirements, and more for Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lake County?

Recording fees in Lake County vary. Contact the recorder's office at 219-755-3730 for current fees.

Questions answered? Let's get started!

Easements in Indiana are commonly created by prescription, in gross, in appurtenant, or by necessity. An easement is a non-possessory and non-ownership right of one person to use the real property of another person for a specific purpose. The easement deed is the instrument in writing that creates the right. Additional easements, such as solar easements and conservation easements, can also be obtained in Indiana. A solar easement can be obtained for the purpose of exposure of a solar energy devise or passive solar energy system to the direct rays of the sun (32-23-4-2). A conservation easement is a non-possessory interest of a holder of real property that imposes limitations or affirmative obligations for purposes as outlined in 32-23-5-2 of the Indiana Revised Code. Conservation and solar easements are subject to the same conveyance and recording requirements as other easements in this state.

An easement created after June 30, 1989 must cross reference the original recorded plat. If the real property from which the easement is being created is not platted, the easement must cross reference the most recent deed of record for that property in the recorder's office (32-23-2-5).

Just as with any other real property instrument in Indiana, an easement deed should be dated and signed, sealed, and acknowledged by the grantor. If an acknowledgement is not present on the deed, it can be proved before one of the officers listed in 32-21-2-3. Easement deeds can be acknowledged in the county where the deed is to be recorded, in another county in Indiana, or in another state, or as according to statute. If acknowledged in another county or state, the easement deed must be certified by the clerk of the circuit court in the county where the officer resides and must also be attested by the seal of that court (32-21-2-4). If acknowledgements are taken before an officer having an official seal and are attested by the officer's official seal, it will be sufficient without a certificate. If the certificate of acknowledgment is required, it should be written on the easement deed or attached to it and recorded with it (32-21-2-29). Unless the certificate of acknowledgement is recorded with the easement deed, the deed may not be received or read in evidence (32-21-2-11).

Easement deeds will not be valid or effectual against any person other than the grantor, the grantor's heirs and devisees, and those with notice of the conveyance unless the easement deed is recorded within the time and manner provided by Indiana Statutes (32-21-3-3). An easement deed will take priority according to the time of its filing. Easement deeds in Indiana should be recorded with the county recorder in the county where the property is located.

(Indiana Easement Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Lake County to use these forms. Documents should be recorded at the office below.

This Easement Deed meets all recording requirements specific to Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Easement Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Michelle G.

April 26th, 2021

EXCEPTIONAL CUSTOMER SERIVCE!!! THANK YOU!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Rohini L.

January 31st, 2024

This is the first time I am filling out a legal form downloaded from a website. Throughly impressed with the detailed explanation along with sample forms to help a novice like me to fill out the actual form. I will remember to go to your site if I need in the future and have already recommended your site to others. Thanks for an excellent job.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Edward S.

June 10th, 2020

I was able to e-record 3 document with ease. The Middlesex registry of deeds is closed due to COVID-19 and this was my only option. Even if it was open, this is much faster and saves me time and money on parking ..etc. Great services.

Thank you!

David D.

September 20th, 2022

Two thumbs up!

Thank you!

Larry L.

January 20th, 2022

I am completely satisfied. It was easy to find the correct form and download it. The instructions were very clear.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen K.

April 1st, 2023

this 5-star rating is well-deserved.

Thank you!

Solomon L.

October 10th, 2024

Great communication, this was my first e-recording.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Frank B.

March 16th, 2023

Great website, super easy to use, user friendly to navigate. Will definitely use for future needs, and will definitely refer to other customers. F. Betancourt Texas

Thank you!

John N.

July 19th, 2020

Very easy to navigate.

Thank you!

jack b.

December 21st, 2018

good form, reasonable fee

Thank you Jack. We really appreciate you taking the time to leave your feedback. Have a great day!

Gary A.

March 15th, 2019

I believe this is the way to go without the need of a lawyer. Fast downloads, very informative, Now the work starts

Thank you Gary.

LeRoy E.

June 20th, 2022

So thankful I found this. I was feeling stressed out and reluctant about doing this on my own.

Thank you!

AARON D.

July 26th, 2024

Forms were great ! Cancelled my lawyer's appointment & utilized your forms.

We are grateful for your feedback and looking forward to serving you again. Thank you!

ronald d.

February 19th, 2021

I found that the website was laid out well and referenced documents were professionally created.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!