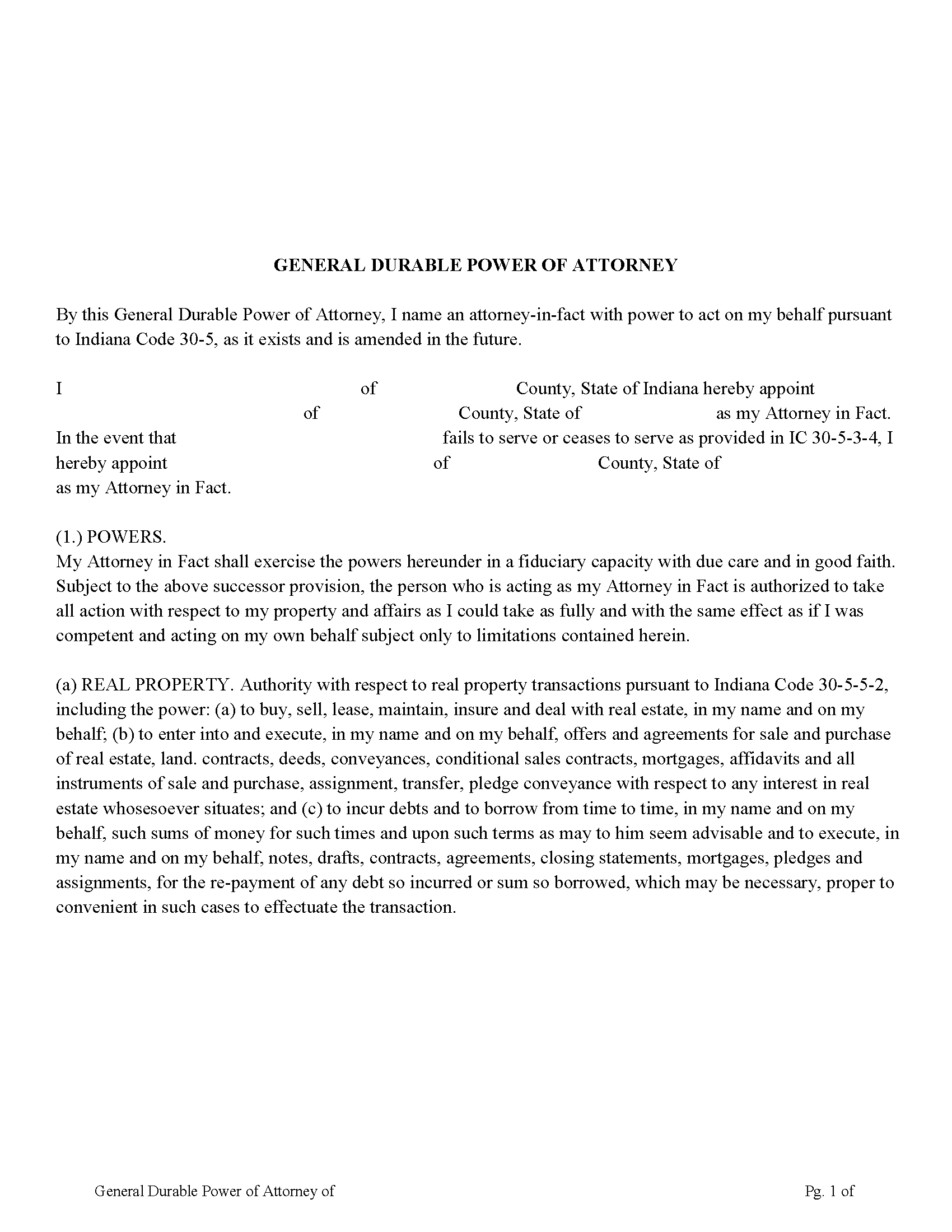

Newton County General Durable Power of Attorney Form

Newton County General Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

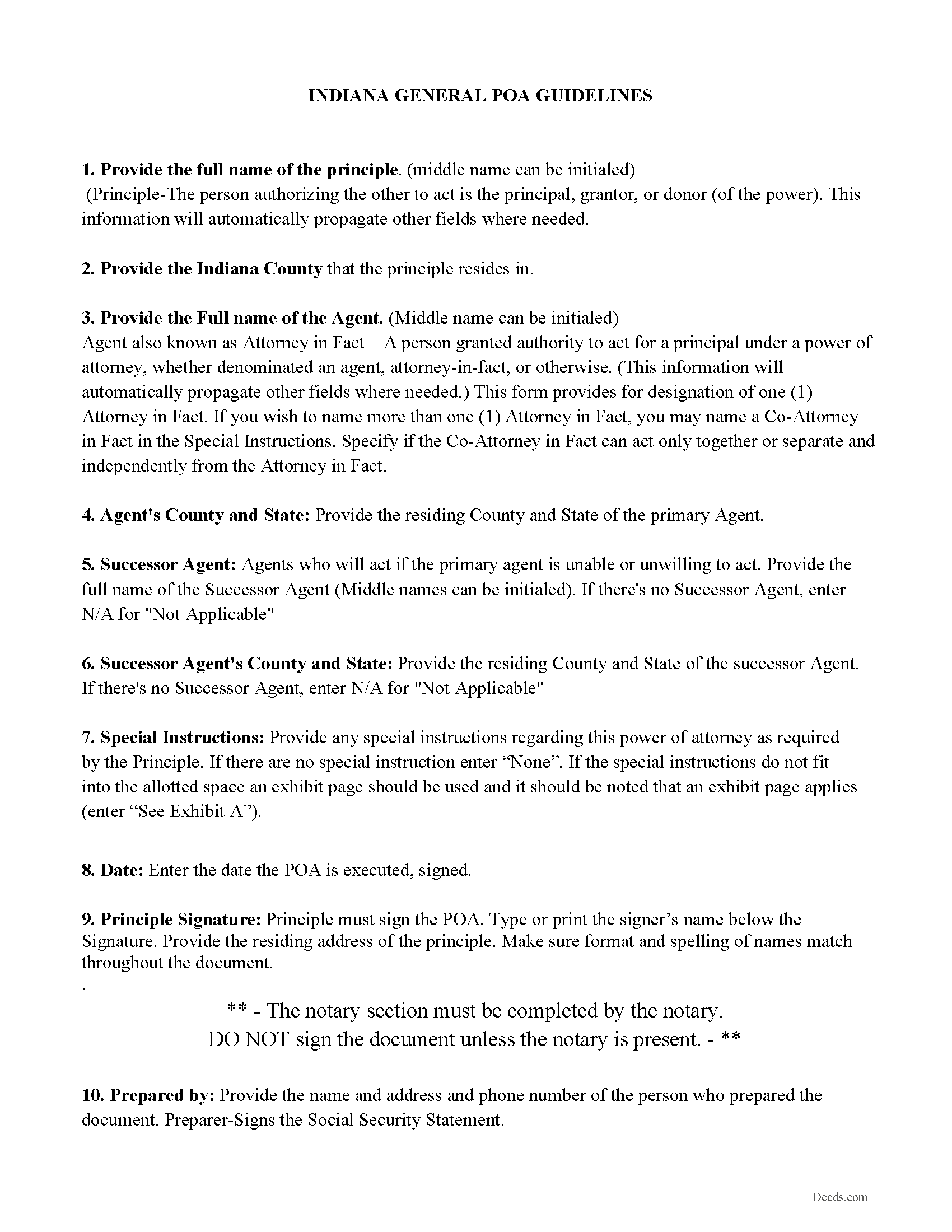

Newton County Power of Attorney Guidelines

Line by line guide explaining every blank on the form, includes Indiana POA Statutes

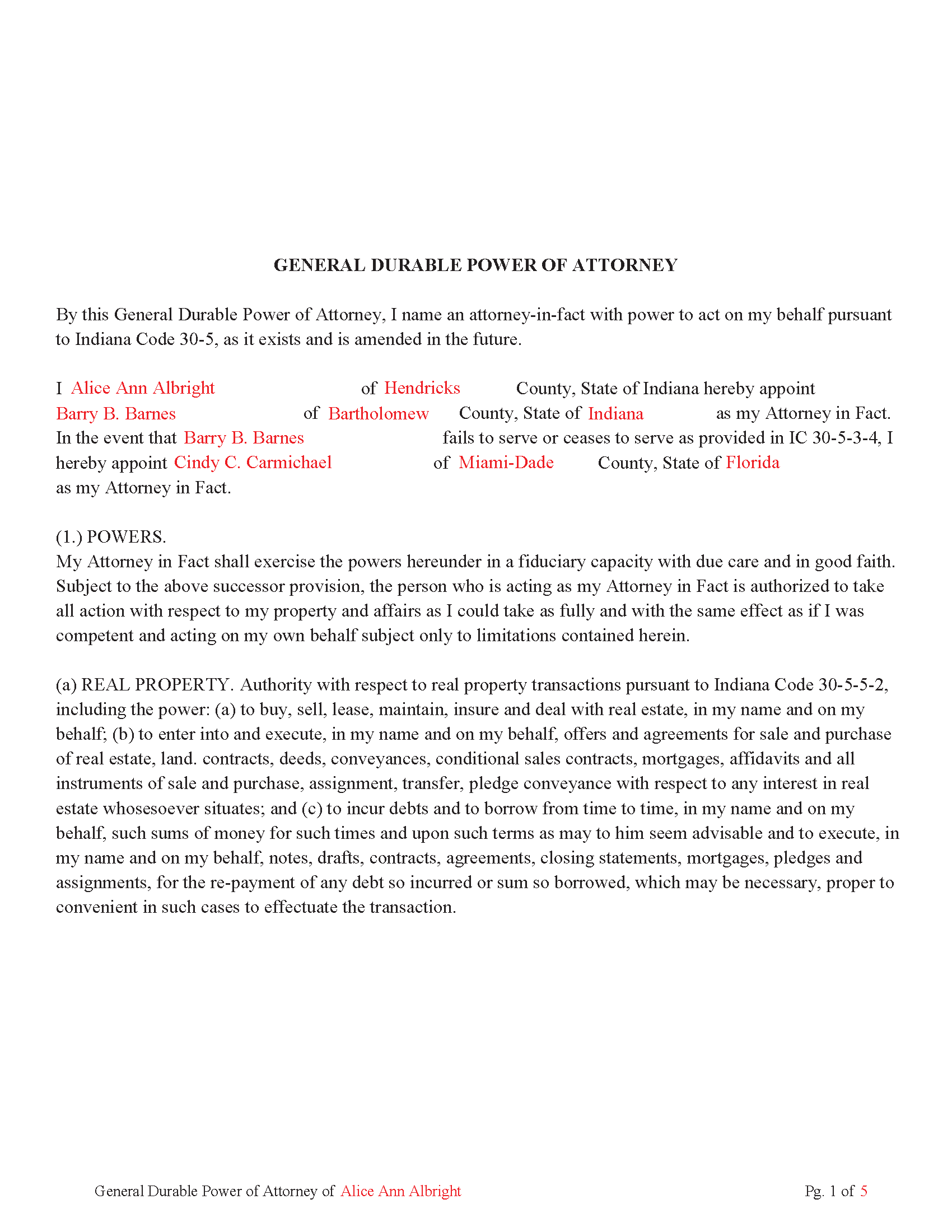

Newton County Completed Example of the Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Newton County documents included at no extra charge:

Where to Record Your Documents

Newton County Recorder

Kentland, Indiana 47951

Hours: 8:00 to 4:00 Monday through Friday

Phone: (888) 663-9866 x 1401 or (219) 474-6081

Recording Tips for Newton County:

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Newton County

Properties in any of these areas use Newton County forms:

- Brook

- Goodland

- Kentland

- Lake Village

- Morocco

- Mount Ayr

- Roselawn

- Sumava Resorts

- Thayer

Hours, fees, requirements, and more for Newton County

How do I get my forms?

Forms are available for immediate download after payment. The Newton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Newton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Newton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Newton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Newton County?

Recording fees in Newton County vary. Contact the recorder's office at (888) 663-9866 x 1401 or (219) 474-6081 for current fees.

Questions answered? Let's get started!

(5) Five Page General Durable Power of Attorney, following Indiana Code and subjects listed below.

By this General Durable Power of Attorney, you name an attorney-in-fact with power to act on your behalf pursuant to Indiana Code 30-5, as it exists and is amended in the future.

(a) REAL PROPERTY. Authority with respect to real property transactions pursuant to Indiana Code 30-5-5-2

(b) TANGIBLE PERSONAL PROPERTY. Authority with respect to tangible personal property transactions pursuant to Indiana Code 30-5-5-3

(c) BOND, SHARE AND COMMODITY. Authority with respect to bond, share. and commodity transactions pursuant to Indiana Code 30-5-5-4,

(d) BANKING. Authority with respect to banking transactions pursuant to Indiana Code 30-5-5-5, including but not limited to the authority:

(e) BUSINESS. Authority with respect to business operating transactions pursuant to Indiana Code 30-5-5-6, including the power:

(f) INSURANCE. Authority with respect to insurance transactions pursuant to

Indiana Code 30-5-5-7.

(g) BENEFICIARY. Authority with respect to beneficiary transactions pursuant to

Indiana Code 30-5-5-8.

(h) GIFTS. In the event I become permanently mentally incapacitated, to make gifts of my property and to have general authority with respect to gift transactions as provided in IC 30-5-5- 9

(i) FIDUCIARY. Authority with respect to fiduciary transactions pursuant to Indiana Code 30-5-5-10

(j) CLAIMS AND LITIGATION. Authority with respect to claims and litigation pursuant to

Indiana Code 30-5-5-11.

(k) FAMILY MAINTENANCE. Authority with respect to family maintenance pursuant to

Indiana Code 30-5-5-12.

(l) MILITARY SERVICE. Authority with respect to benefits from military service pursuant to

Indiana Code 30-5-5-13.

(m) RECORDS, REPORTS AND STATEMENTS. Authority with respect to records, reports and statements pursuant to Indiana Code 30-5-5-14, including, but not limited to, the power to execute on my behalf any

(n) ESTATE TRANSACTIONS. Authority with respect to estate transaction pursuant to

Indiana Code 30-5-5-15.

(o) DELEGATING AUTHORITY. Authority with respect in delegating authority in writing to one (1) or more persons as to any or all powers given to the attorney-in-fact by this General Durable Power of Attorney document, pursuant to Indiana Code 30-5-5-18.

(p) TAX MATTERS. Authority: (a) to prepare, execute and file on your behalf.

(q) SOCIAL SECURITY ADMINISTRATION. Authority to act as your representative and attorney-in-fact for all matters involving the Social Security Administration and benefits from the administration.

(r) ALL OTHER MATTERS. Authority with respect to all other possible matters and affairs affecting property owned by you pursuant to Indiana Code 30-5-5-19.

(Indiana General Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Newton County to use these forms. Documents should be recorded at the office below.

This General Durable Power of Attorney meets all recording requirements specific to Newton County.

Our Promise

The documents you receive here will meet, or exceed, the Newton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Newton County General Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Allen M.

June 18th, 2022

Fast,quick and easy to work with. Not confusing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cessaly D H.

December 27th, 2022

Excellent service bc you create your own account and have immediate access to documents!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laurie F.

February 24th, 2019

I am so glad I found Deeds.com. You had exactly what I needed and made it easy to download. I have bookmarked you in the event of further inquiry. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jany F.

November 8th, 2021

Great and quick service.

Thank you!

Joshua P.

July 27th, 2022

Easy fill in the blanks form. Just FYI make sure you have a copy of whatever deed you are changing and the tax records. You will want the language to be identical.

Thank you for your feedback. We really appreciate it. Have a great day!

Francine H.

April 18th, 2023

Somewhat confusing, but I'm really not sure what I need. I have not complete4d the document.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Delsina T.

October 9th, 2020

So helpful. Thank you so much for making this a smooth process.

Thank you!

Laura L.

July 22nd, 2023

The website looks good and probably like it is easy to use, but I needed a deed in lieu and couldn't fine one.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott P.

March 15th, 2021

The site was easy to use and find what I needed. The purchase and download were very easy.

Thank you!

Dee W.

December 11th, 2019

Easy process! Submit payment, fill out forms using the document guide provided, and print!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet P.

July 30th, 2021

Extremely easy to use. The guide and sample were a great source of reference.

Thank you for your feedback. We really appreciate it. Have a great day!

Kelly S.

May 19th, 2020

Fast, easy, responsive.

Thank you!

Desiree R.

August 19th, 2024

very easy to use

We are delighted to have been of service. Thank you for the positive review!

Alex Q.

July 26th, 2023

The best people to work with! Thank you for all you do. We send documents from all states to Deeds.com to record for us. They are professional, keep us updated and always notify us if there is an issue with one of our documents prior to sending to recording and that saves us money and time! Thank you!!

Thanks for the kind words Alex. We appreciate you!

Jamie F.

February 13th, 2019

I purchased he Alabama Correction Warranty Deed Form to correct a mistake in the legal description. However, this form says it must be signed by all who previously signed the deed. One of these people is now deceased. Can I use this form? How would it be different? I would give you 5 stars but wish this issue had been addressed. Thanks.

Thank you for your feedback. From the product description: All parties who signed the prior deed must sign the correction deed in the presence of a notary.