Blackford County Mortgage Secured by Promissory Note Form

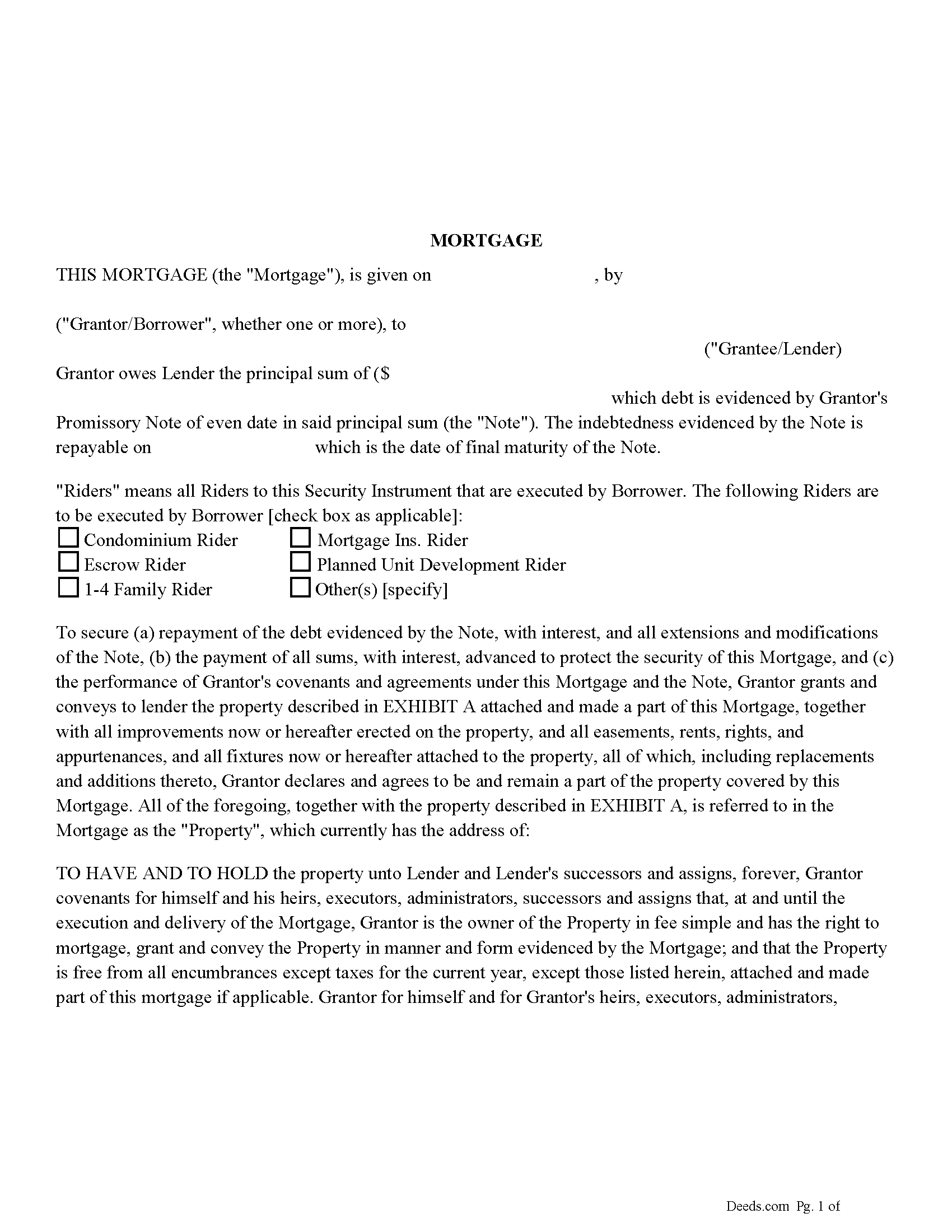

Blackford County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

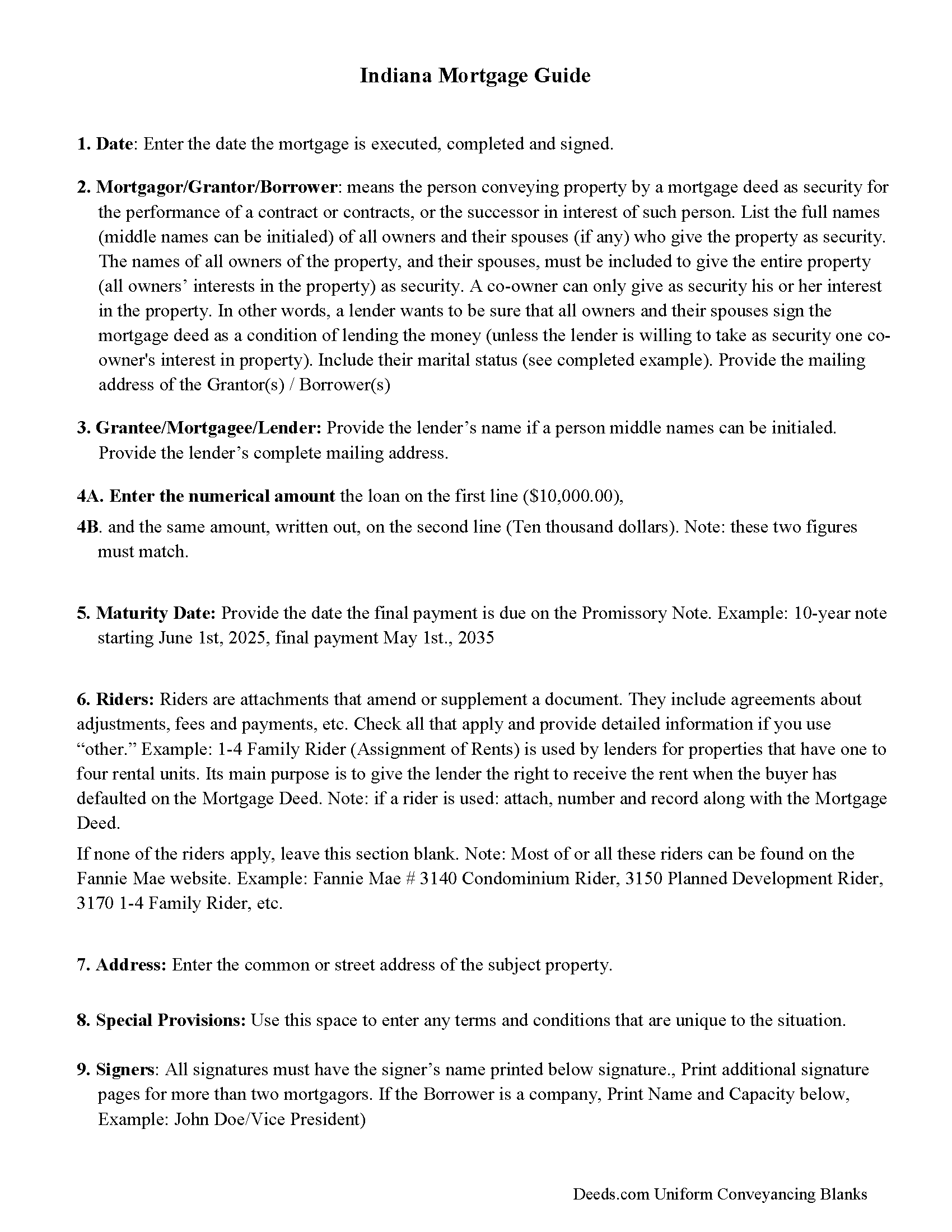

Blackford County Mortgage Form Guidelines

Line by line guide explaining every blank on the form

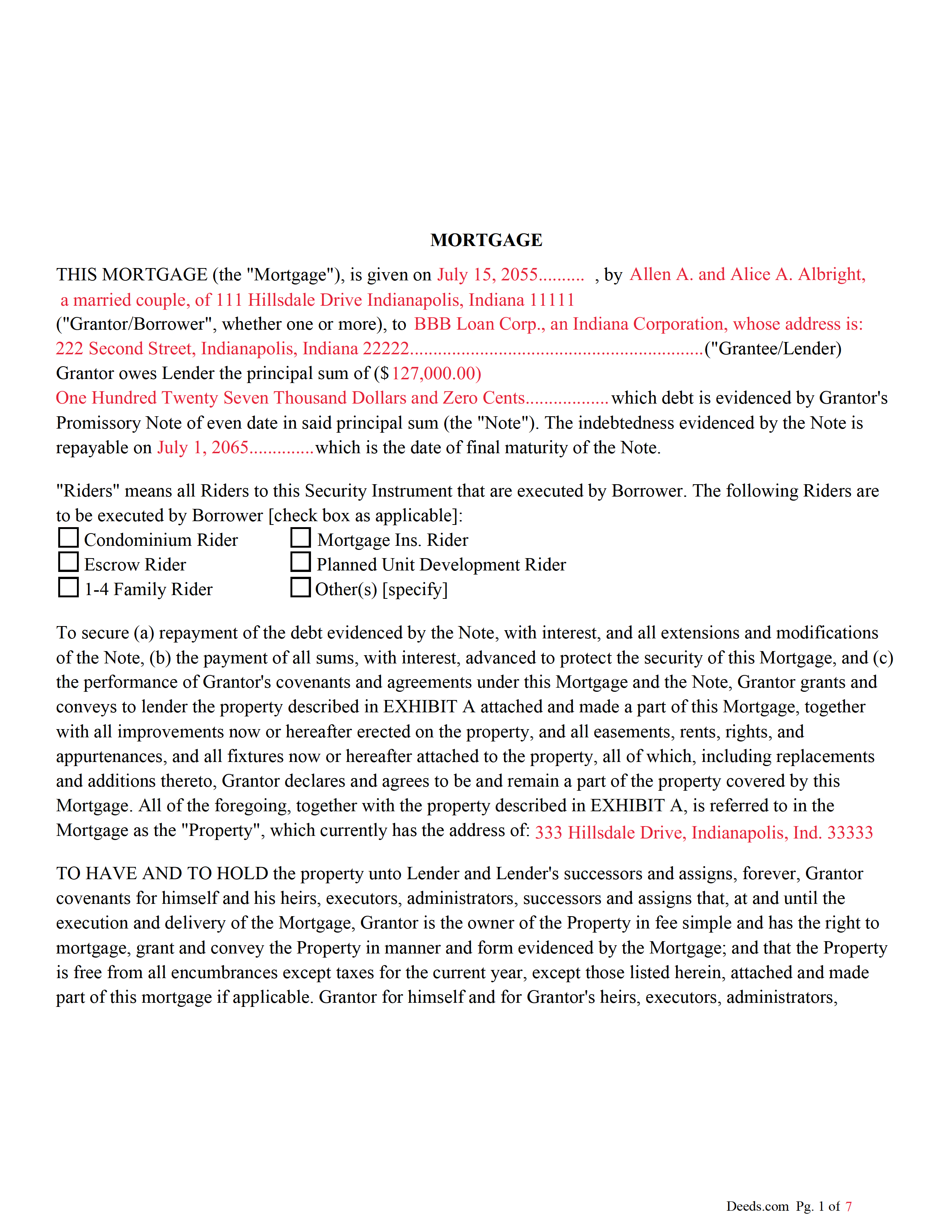

Blackford County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

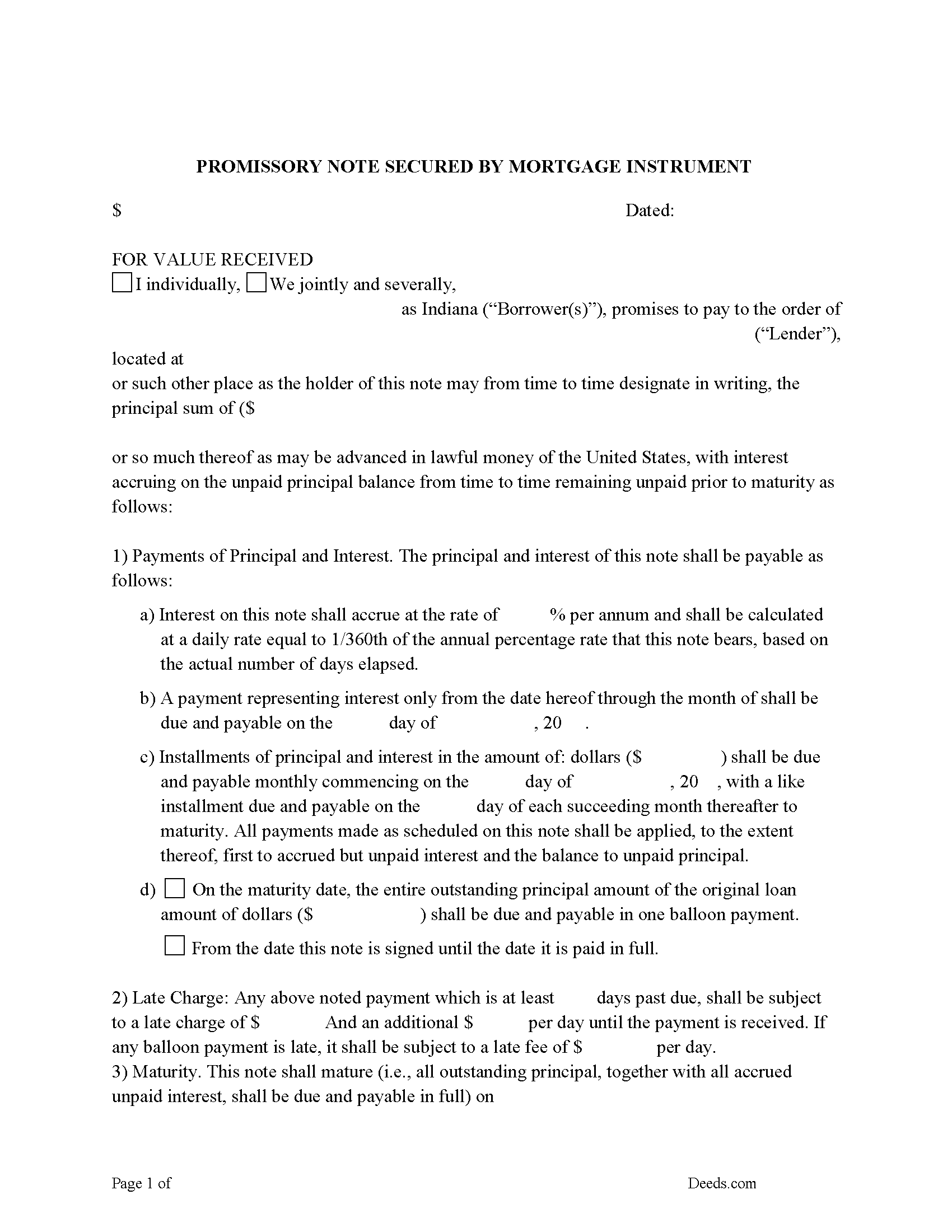

Blackford County Promissory Note Form

Fill in the blank form.

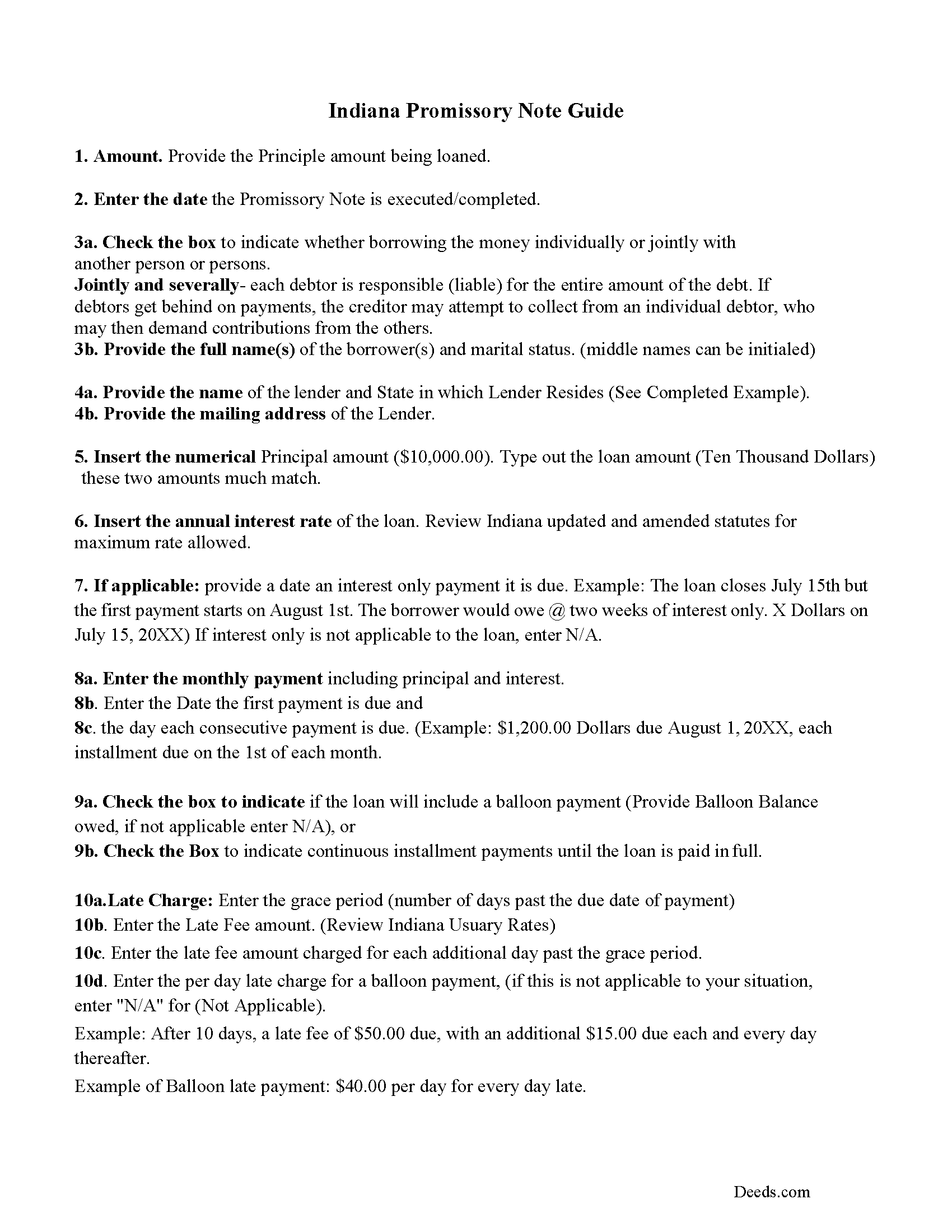

Blackford County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

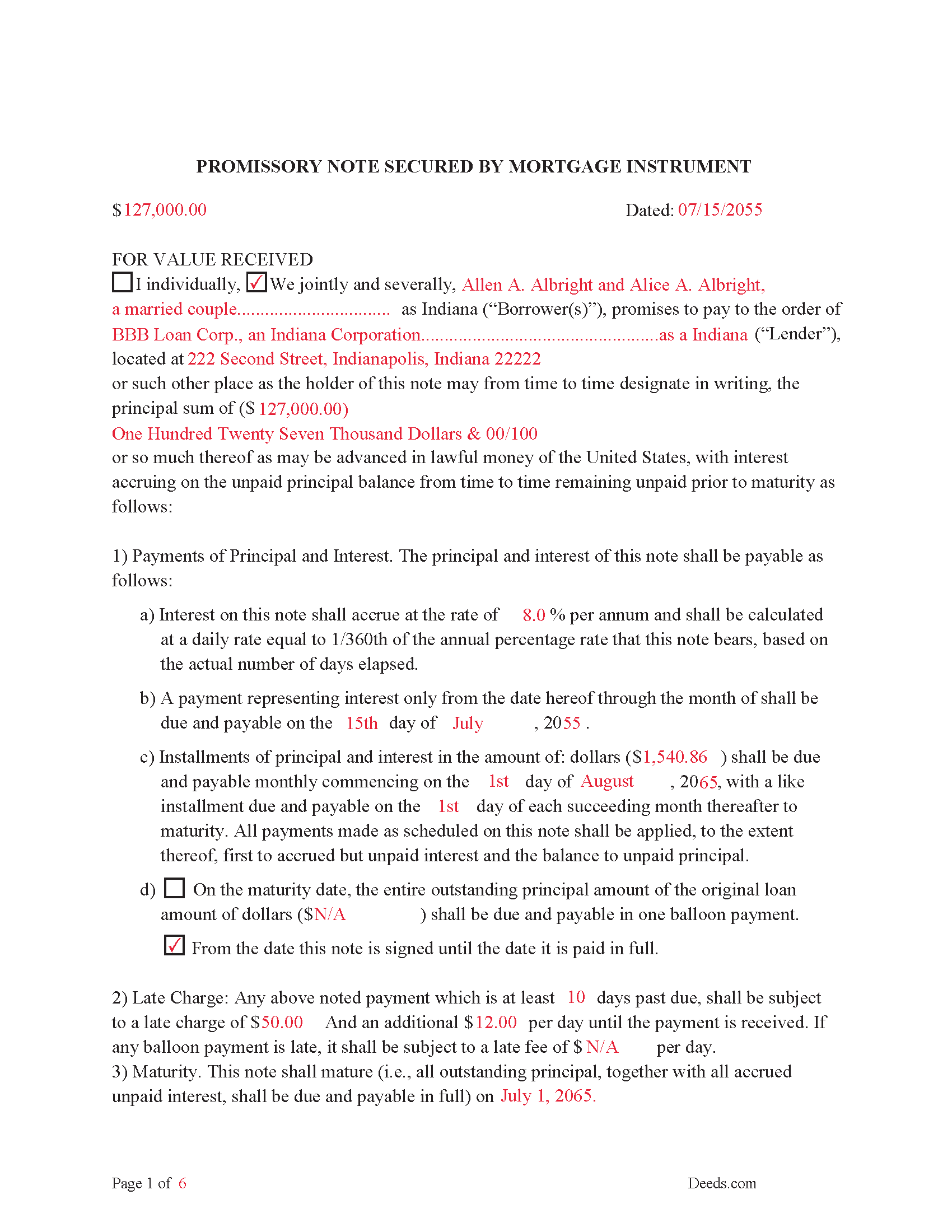

Blackford County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

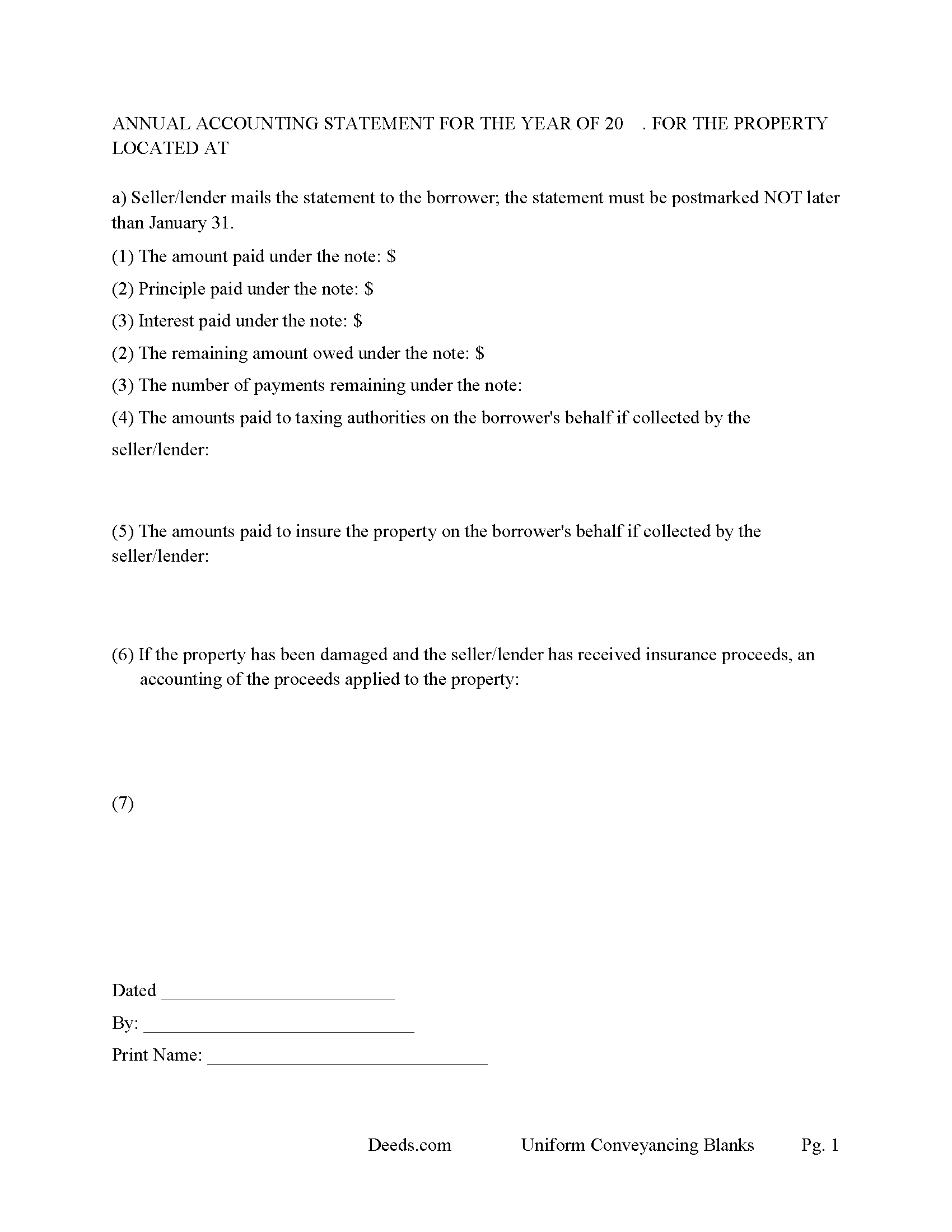

Blackford County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Blackford County documents included at no extra charge:

Where to Record Your Documents

Blackford County Recorder

Hartford City, Indiana 47348

Hours: 8:00am to 4:00pm M-F

Phone: (765) 348-2207

Recording Tips for Blackford County:

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Blackford County

Properties in any of these areas use Blackford County forms:

- Hartford City

- Montpelier

Hours, fees, requirements, and more for Blackford County

How do I get my forms?

Forms are available for immediate download after payment. The Blackford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Blackford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Blackford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Blackford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Blackford County?

Recording fees in Blackford County vary. Contact the recorder's office at (765) 348-2207 for current fees.

Questions answered? Let's get started!

Indiana Mortgage -- IC 32-29; IC 36-2-7-10

Requires:

1. From parties (Grantor).

2. To parties (Grantees).

3. Legal description.

4. Amount.

5. Signatures with names typed or printed below or next to each name.

6. Signatures acknowledged or notarized.

7. Prepared by statement.

8. Social Security redaction statement.

IC 32-29-1-2 Construction of mortgage

Sec. 2. A mortgage may not be construed to imply a covenant for the payment of the sum intended to be secured by the mortgage so as to enable the mortgagee or the mortgagee's assignees or representatives to maintain an action for the recovery of this sum. If an express covenant is not contained in the mortgage for the payment and a bond or other separate instrument to secure the payment has not been given, the remedy of the mortgagee is confined to the real property described in the mortgage.

IC 32-29-1-5 Form; mortgage

Sec. 5. A mortgage of land that is:

(1) worded in substance as "A.B. mortgages and warrants to C.D." (here describe the premises) "to secure the repayment of" (here recite the sum for which the mortgage is granted, or the notes or other evidences of debt, or a description of the debt sought to be secured, and the date of the repayment); and

(2) dated and signed, sealed, and acknowledged by the grantor;

is a good and sufficient mortgage to the grantee and the grantee's heirs, assigns, executors, and administrators, with warranty from the grantor (as defined in IC 32-17-1-1) and the grantor's legal representatives of perfect title in the grantor and against all previous encumbrances. However, if in the mortgage form the words "and warrant" are omitted, the mortgage is good but without warranty.

This Mortgage States: Grantor for himself and for Grantor's heirs, executors, administrators,

successors and assigns forever, warrants and agrees to defend the title to the Property to and for Lender and Lender's successors and assigns forever, against all claims and demands, except those listed herein, attached and made part of this mortgage if applicable.

Uses include residential property, condominiums, rental property, small commercial, vacant land and planned unit developments.

(Indiana Mortgage Package includes form, guidelines, and completed example)

For use in Indiana only.

Important: Your property must be located in Blackford County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured by Promissory Note meets all recording requirements specific to Blackford County.

Our Promise

The documents you receive here will meet, or exceed, the Blackford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Blackford County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4584 Reviews )

Michael B.

November 17th, 2020

I'm very pleased with the service provided by Deeds.com. After a format issue caused my scanner, it was a very smooth and speedy process. Highly recommended.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joni Y.

November 25th, 2019

Deeds.com is a very up to date & easy instruction website. I recommend this site to all who are looking for forms dealing with deeds. Thank you for making life easy in this aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April L.

November 13th, 2019

The warranty deed forms I received worked fine.

Thank you!

Diana L.

June 19th, 2020

Easy to use but need to go through the courthouse to do what I need to do.

Thank you!

Kathryn M.

May 1st, 2019

Never know an online service was available for recording county documents. It was so easy and simple and FAST! Within a matter of a couple hours it's done. I would definitely recommend Deeds.com to anyone.

Thank you Kathryn, we really appreciate that.

Janice W.

January 25th, 2019

Great instructions, samples, ease in getting the form I needed, filling it out as a PDF, and having it ready for a Notary's signature. I was hesitant a first, but glad I paid the fee - now it is done!

Great to hear Janice! Thanks, have a great day!

Brian O.

June 27th, 2020

It's an instant download. I was very pleased that it included instructions and any necessary additional forms. Much easier than spending 3 hours on a county assessor's website searching for every single form. A good deal and I don't know how Deeds.com keeps up with thousands of counties. The fillable .pdf capability is a great enhancement.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura S.

April 21st, 2025

Easy to utilize database and instructions!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Susan S.

November 26th, 2021

What a delight to find this Website. Professionally done and easy to work with.

Thank you for your feedback. We really appreciate it. Have a great day!

Cecilia G.

July 24th, 2023

This site is so easy to use. It is so convenient to have access to forms for all states. I’d recommend this site to anyone who needs to create any real estate documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark E.

March 12th, 2019

Thank you for your Swift response. Have docs I was looking for!

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory N.

September 10th, 2020

Good information guiding through filling out the product. Would like form to be more flexible in terms of spacing, but otherwise excellent.

Thank you for your feedback. We really appreciate it. Have a great day!

Travis S.

February 25th, 2020

Glad this existed.

Thank you!

Anna C.

February 9th, 2021

It was more detailed than the forms on other website, plus cheaper. I do not have date it was recorded in 2000 but did have date of warranty deed. Will that be ok with Recorder? Also did not want to date it today till I know when and where the Recorders office is located.

Thank you for your feedback. We really appreciate it. Have a great day!