Marion County Mortgage Secured by Promissory Note Form

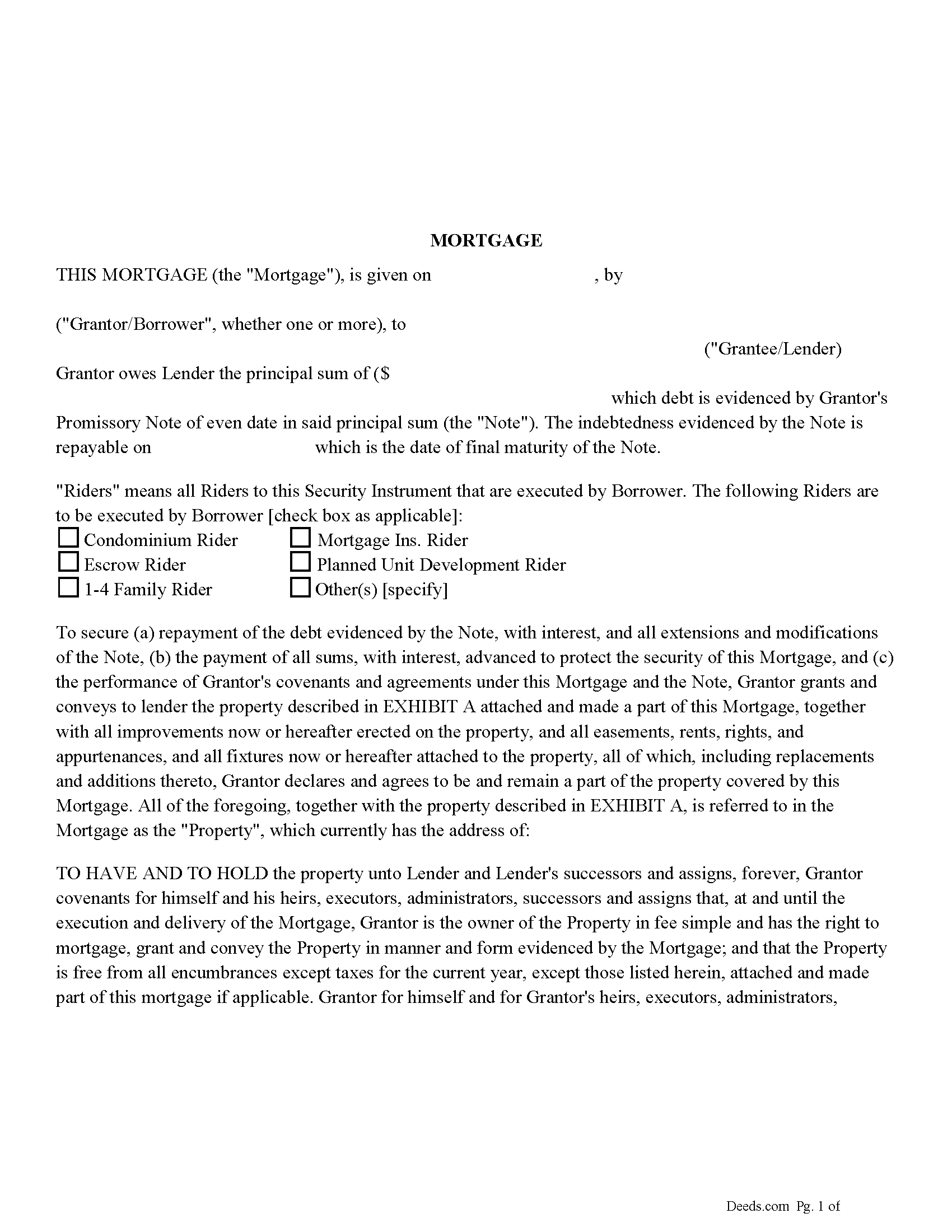

Marion County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

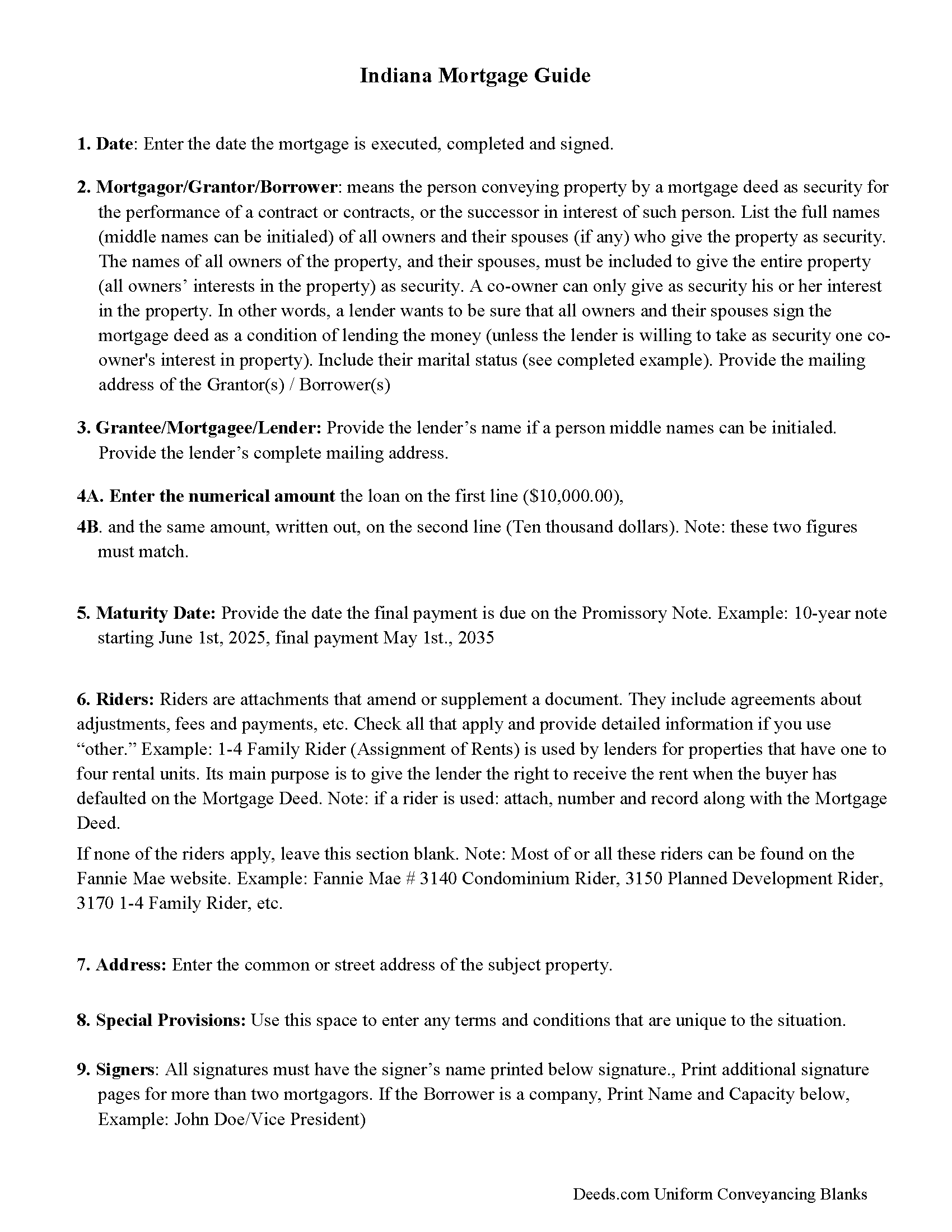

Marion County Mortgage Form Guidelines

Line by line guide explaining every blank on the form

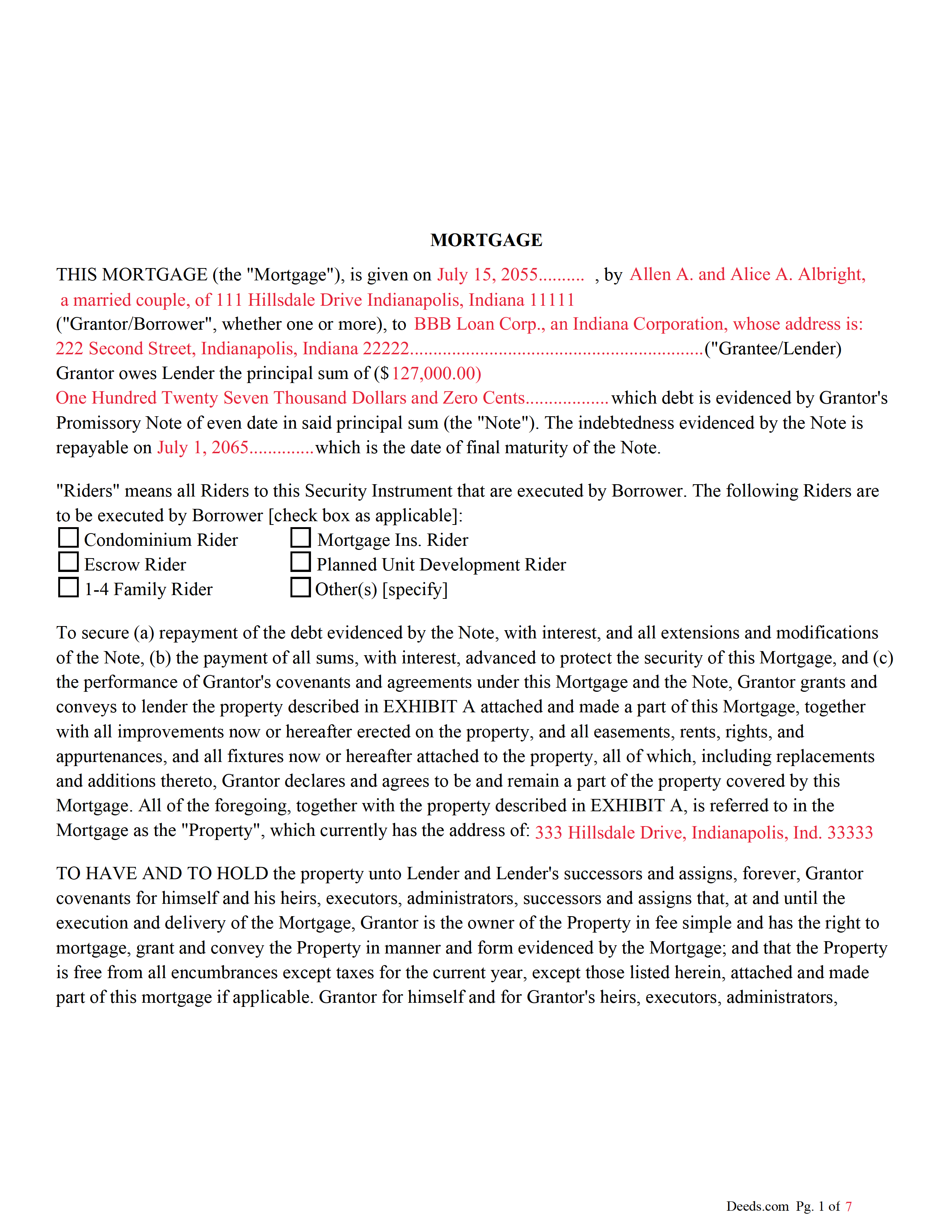

Marion County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

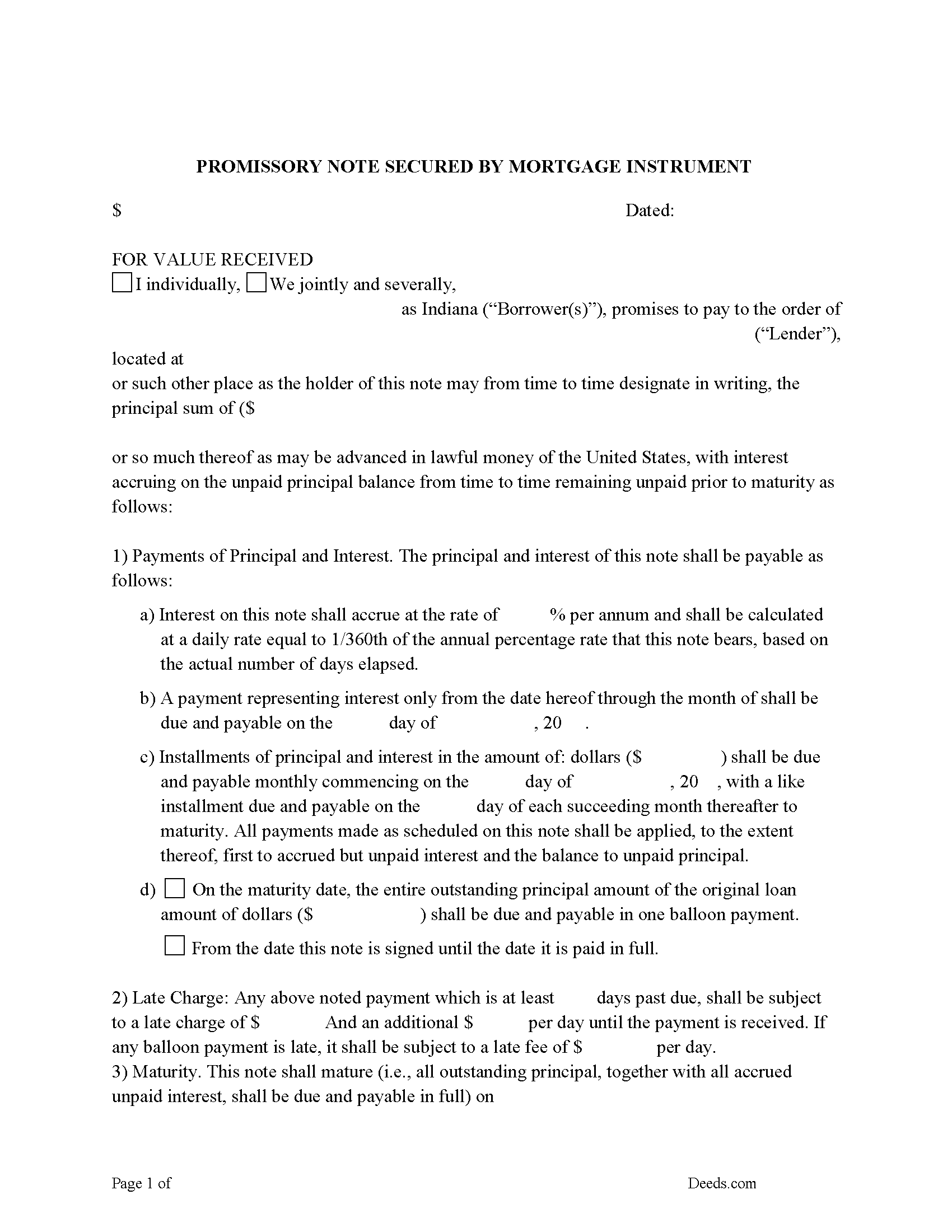

Marion County Promissory Note Form

Fill in the blank form.

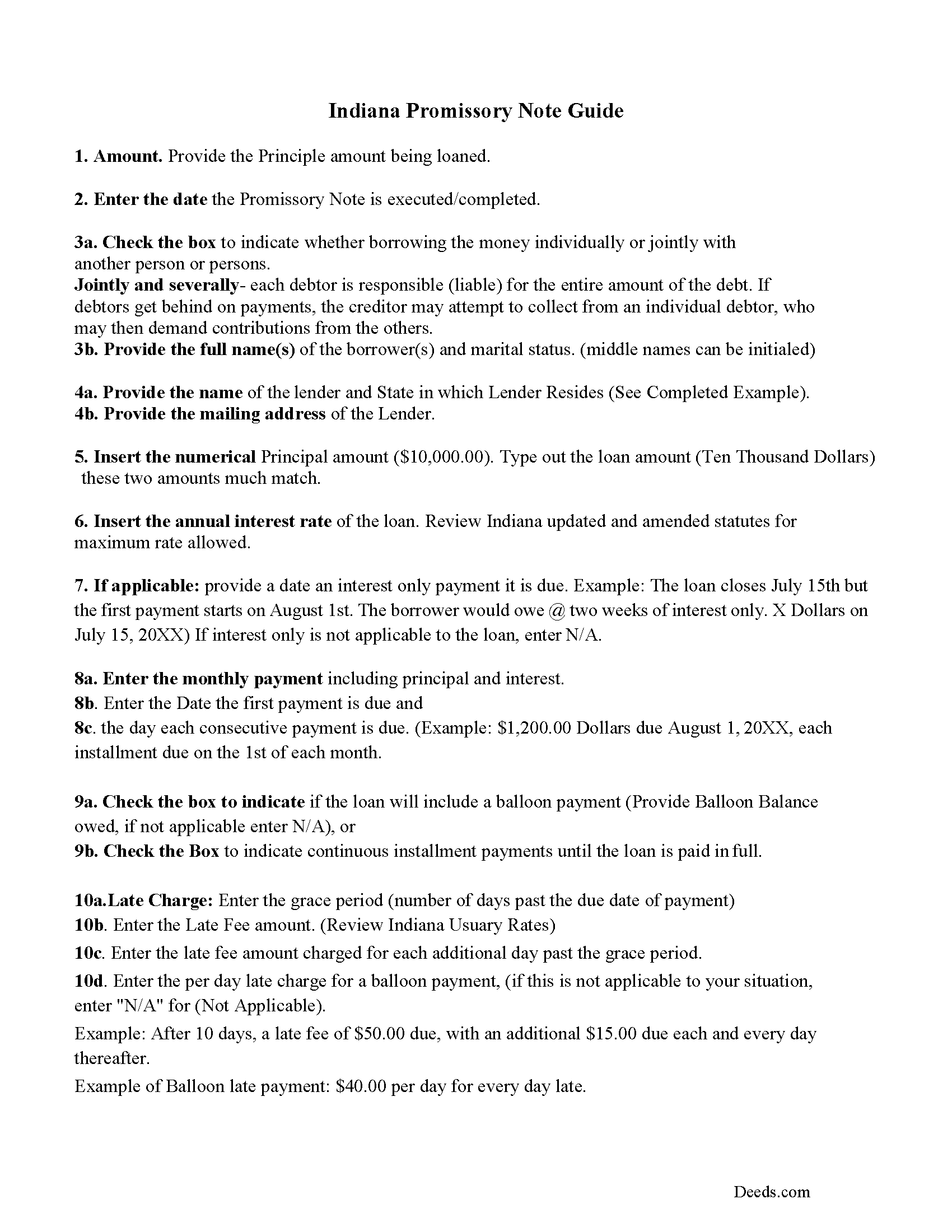

Marion County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

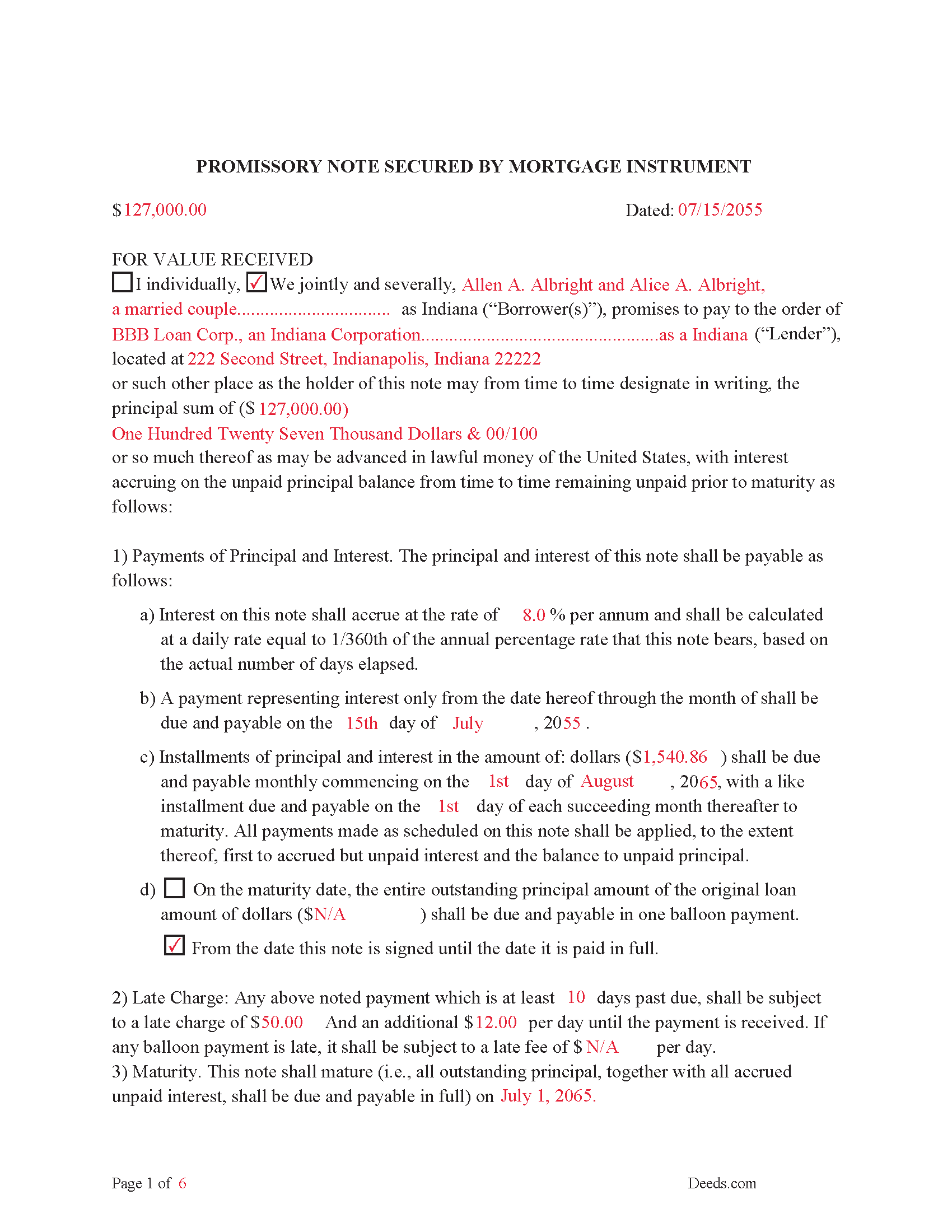

Marion County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

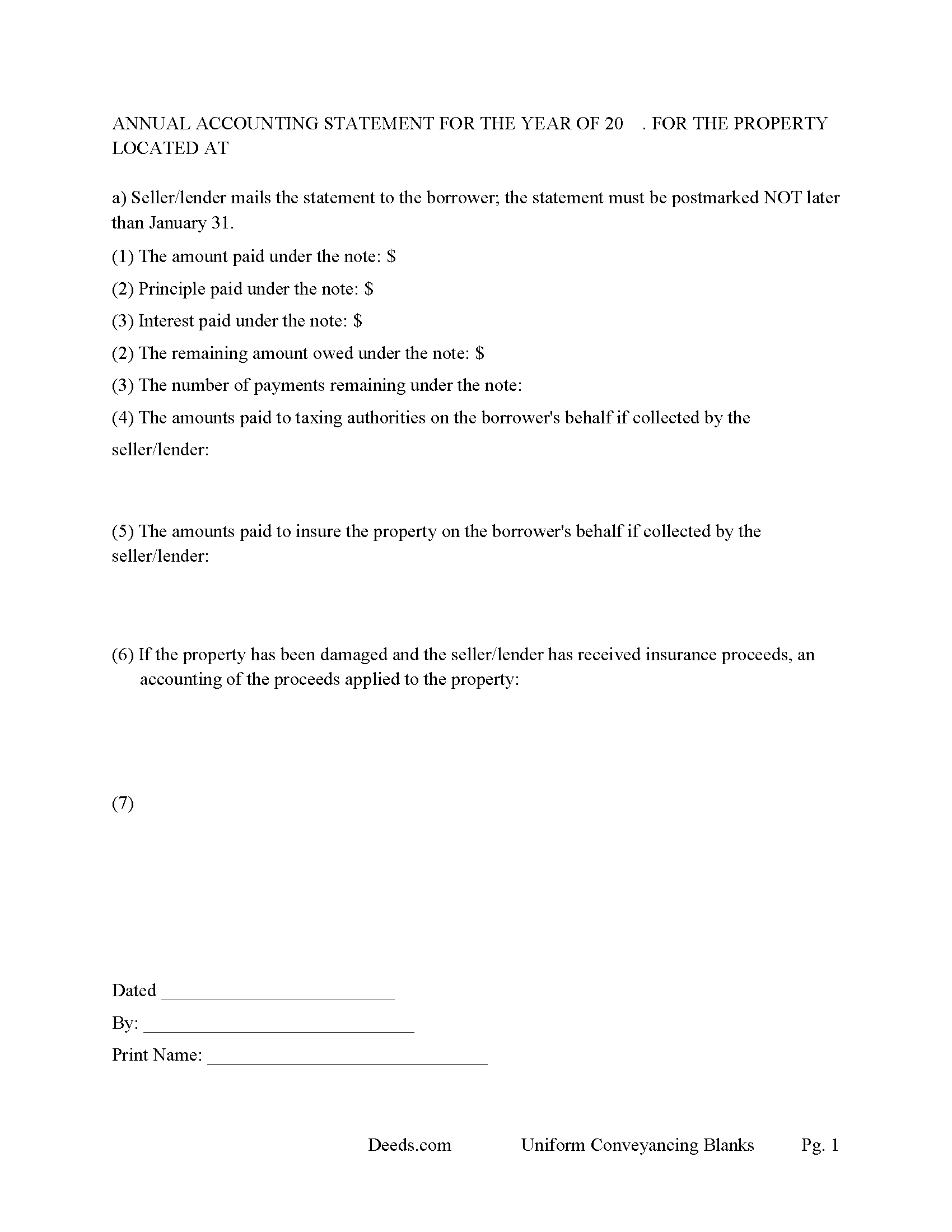

Marion County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion County Recorder

Indianapolis, Indiana 46204

Hours: 8:00 to 4:30 Monday through Friday / Recording Cut-Off 4:15

Phone: (317) 327-4020

Recording Tips for Marion County:

- Ensure all signatures are in blue or black ink

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Beech Grove

- Indianapolis

- Speedway

- West Newton

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (317) 327-4020 for current fees.

Questions answered? Let's get started!

Indiana Mortgage -- IC 32-29; IC 36-2-7-10

Requires:

1. From parties (Grantor).

2. To parties (Grantees).

3. Legal description.

4. Amount.

5. Signatures with names typed or printed below or next to each name.

6. Signatures acknowledged or notarized.

7. Prepared by statement.

8. Social Security redaction statement.

IC 32-29-1-2 Construction of mortgage

Sec. 2. A mortgage may not be construed to imply a covenant for the payment of the sum intended to be secured by the mortgage so as to enable the mortgagee or the mortgagee's assignees or representatives to maintain an action for the recovery of this sum. If an express covenant is not contained in the mortgage for the payment and a bond or other separate instrument to secure the payment has not been given, the remedy of the mortgagee is confined to the real property described in the mortgage.

IC 32-29-1-5 Form; mortgage

Sec. 5. A mortgage of land that is:

(1) worded in substance as "A.B. mortgages and warrants to C.D." (here describe the premises) "to secure the repayment of" (here recite the sum for which the mortgage is granted, or the notes or other evidences of debt, or a description of the debt sought to be secured, and the date of the repayment); and

(2) dated and signed, sealed, and acknowledged by the grantor;

is a good and sufficient mortgage to the grantee and the grantee's heirs, assigns, executors, and administrators, with warranty from the grantor (as defined in IC 32-17-1-1) and the grantor's legal representatives of perfect title in the grantor and against all previous encumbrances. However, if in the mortgage form the words "and warrant" are omitted, the mortgage is good but without warranty.

This Mortgage States: Grantor for himself and for Grantor's heirs, executors, administrators,

successors and assigns forever, warrants and agrees to defend the title to the Property to and for Lender and Lender's successors and assigns forever, against all claims and demands, except those listed herein, attached and made part of this mortgage if applicable.

Uses include residential property, condominiums, rental property, small commercial, vacant land and planned unit developments.

(Indiana Mortgage Package includes form, guidelines, and completed example)

For use in Indiana only.

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured by Promissory Note meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Sheron W.

May 23rd, 2022

I've used Deeds.com for a few years. The service is good, and orders are completed fast. I will continue using them and I recommend them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Grace O.

November 4th, 2020

I was happy to find a way to file my title without having to send original. Although I found it hard to naigste, my daughter came to my rescue and we were successful. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura H.

January 12th, 2023

Process was easy. The instructions for TOD and a sample completed form was very helpful. E-recording of deed saved a trip to the county building and well worth the very reasonable charge.

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia C.

February 4th, 2022

I had a nice surprise seeing how fast the process was to download in a safe manner the documents. The example and guide to fill the original document are very valuable to facilitate the filling in. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

Veronica T.

September 14th, 2021

Great Service! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Janet R.

October 21st, 2019

The site was easy to navigate...all the information needed to fill in the forms was included, which was very helpful and a pleasant surprise...form completed in short order...made taking care of business quick and easy...Thanks for the thoughtful and excellent help, I will share the link with others and I will use the site again...Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sinh L.

January 13th, 2020

Deeds.com did such a wonderful job that I had to leave a positive review. I did a deed retrieval and ran across some hiccups. Deeds.com was able to help me get my deed and even went beyond to help me have a more in depth understanding of it's title history. They responded quickly to all my messages. Great customer service. Definitely recommend! Thank you Deeds.com and thank you KVH.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ieva r.

March 14th, 2019

Excellent! I was worried because I saw some negative reviews online but I really needed an e-recording company and they completed everything perfectly. I will most definitely recommend them and use them again in the future. All the staff was super nice and very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!

Scott G.

June 4th, 2024

Frankly, if our tax dollars were being used to run government "services" correctly, we wouldn't need Deeds.com Since the sun will burn out before government is run correctly, Deeds.com provides an important, efficient, time-saving service that, all things considered, offers big savings over time-and-soul-draining struggles with government agencies.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Maria C.

June 3rd, 2022

Amazing service truly great to work with your team on a difficult filing!

Thank you!

E. Louise S. M.

April 5th, 2019

Your site is simple, easy to use, and an outstanding service.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael P.

June 17th, 2020

excellent and timely service.

Thank you!