Johnson County Transfer on Death Deed Revocation Form

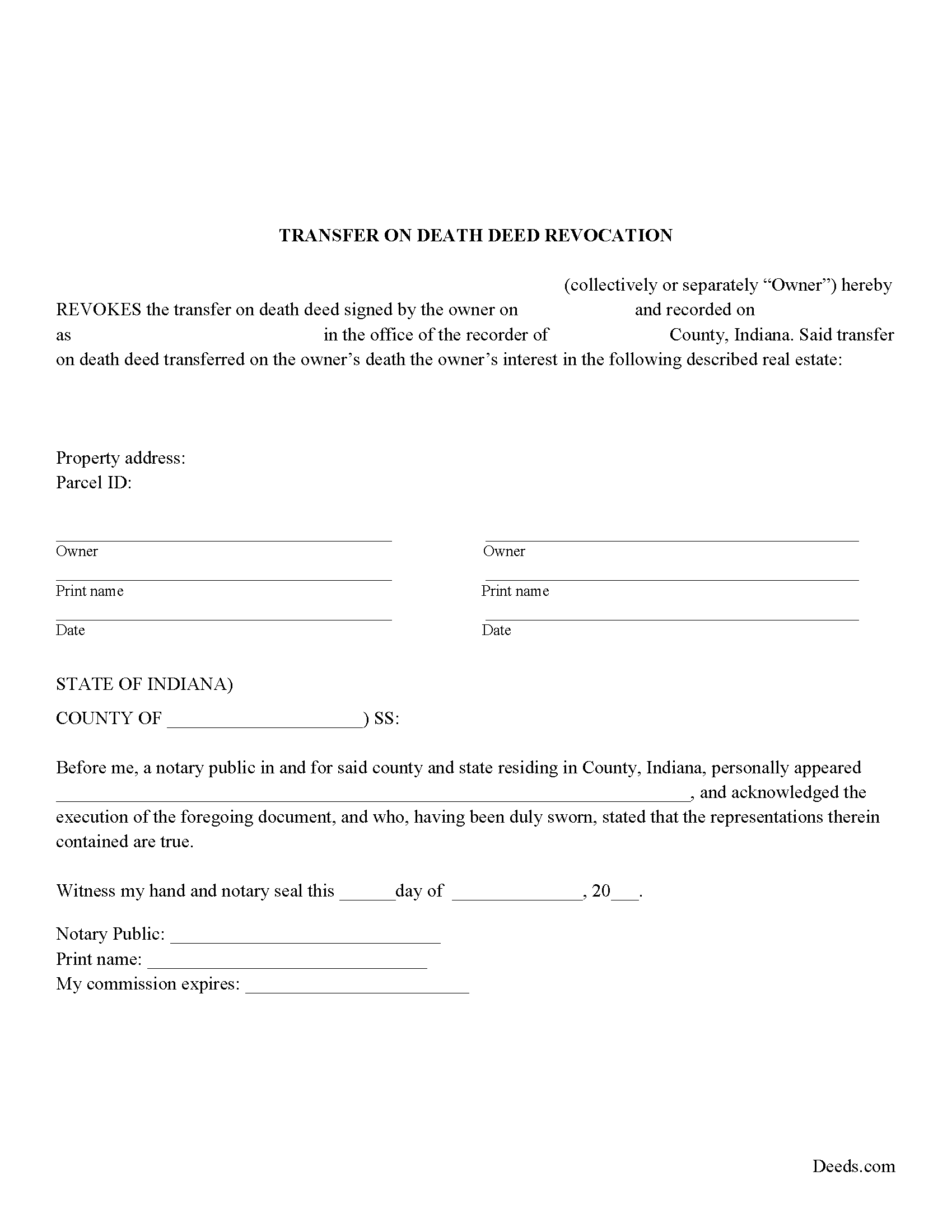

Johnson County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

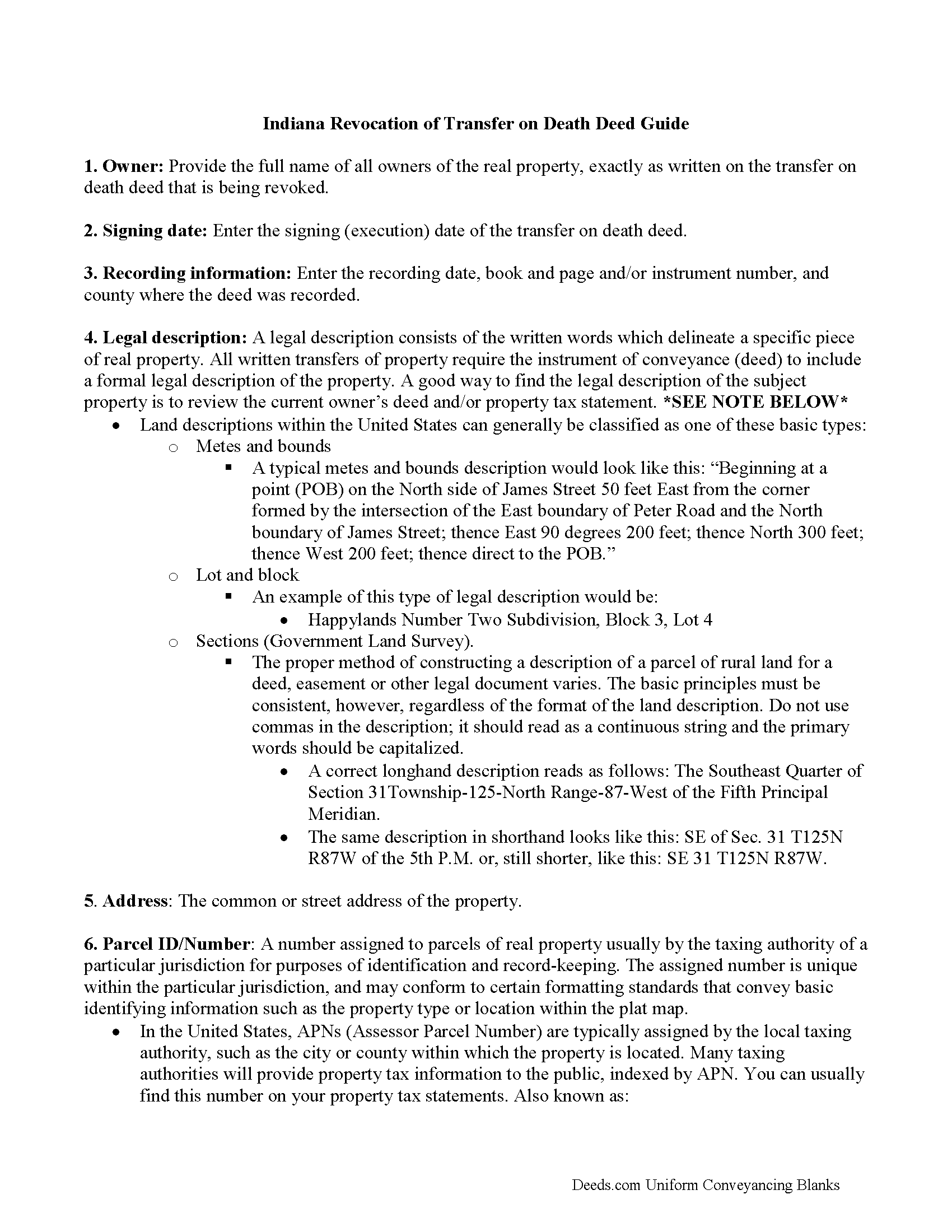

Johnson County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

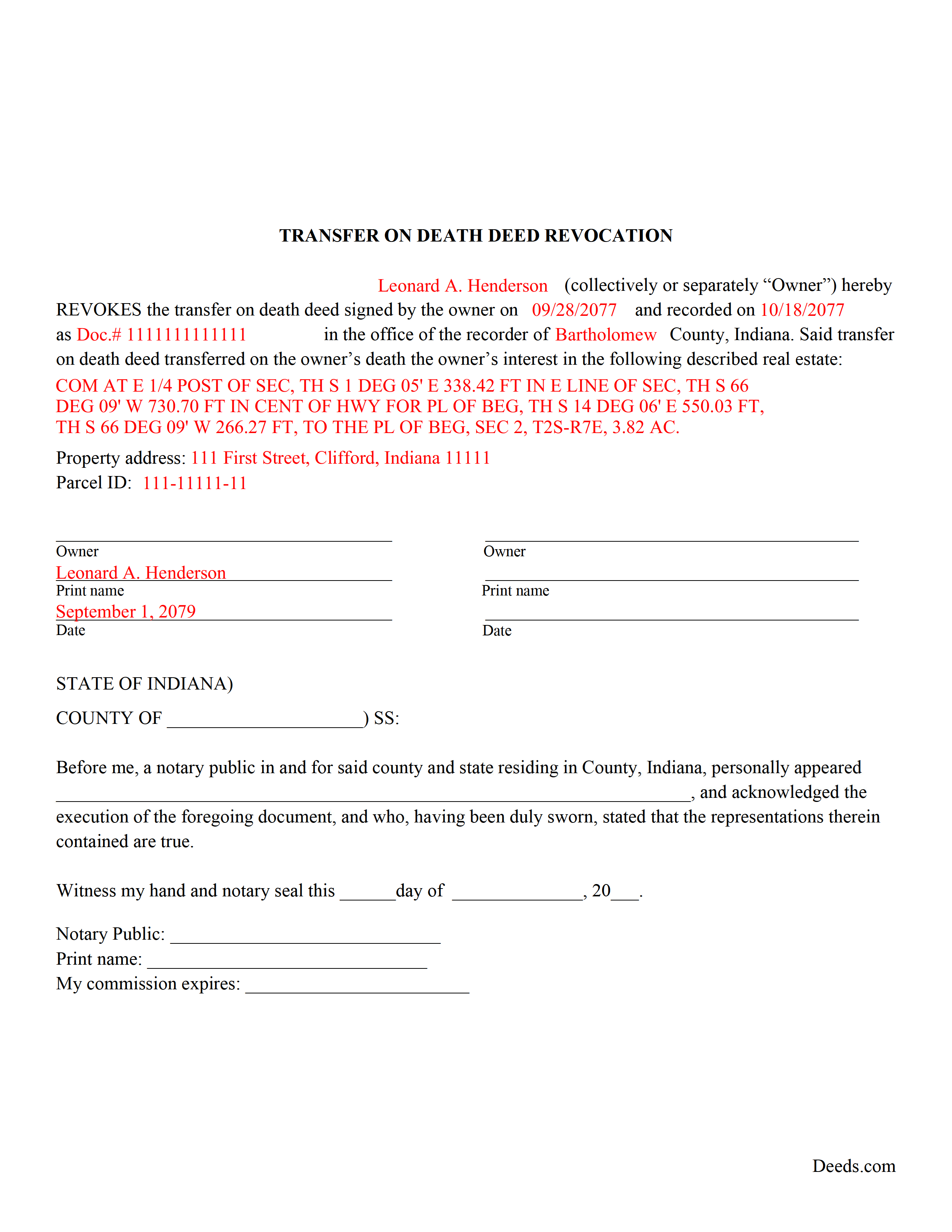

Johnson County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Recorder

Franklin, Indiana 46131

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (317) 346-4385

Recording Tips for Johnson County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Bargersville

- Edinburgh

- Franklin

- Greenwood

- Needham

- Nineveh

- Trafalgar

- Whiteland

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (317) 346-4385 for current fees.

Questions answered? Let's get started!

Use this form when the land owner wishes to completely cancel a previously recorded transfer on death deed. A revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

According to IC 32-17-14-16, there are two primary ways to revoke a transfer on death deed in Indiana:

If the real estate owner (grantor) decides to change the beneficiary or modify the way in which beneficiaries will hold title to the property when the owner dies, he/she simply completes and records a new transfer on death deed with the updated information.

If the land owner wishes to completely cancel a previously recorded transfer on death deed, a revocation may be a better idea. A properly executed revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

(Indiana Transfer on Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

steven L.

April 8th, 2020

download was fast and easy. if no problems with county recorder i will give 5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John G.

July 25th, 2022

I was actually quite pleased with the ease of use of this site. I really, really liked the step by step instructions and examples of the finished product !!

Thank you!

Shabaz W.

June 5th, 2020

Very convenient

Thank you!

Bobbi W.

February 16th, 2019

Site was super easy to use. After frustrating search for the item I needed I found it here!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok. Thankyou!!!

Thank you!

Anna P.

April 15th, 2021

Deeds.com was a life saver! I was able to have a document recorded the very same day of my request. Thank you for taking care of this! Top notch service.

Thank you!

Reida S.

September 29th, 2020

Have used two times. Smooth transaction both times. Fast, simple and easy to use system. Would use them again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary B.

December 1st, 2021

Great job, Deeds.com! I'm a retired lawyer, and I'm liking what I see. Well done.

Thank you!

DOUGLAS H.

December 16th, 2020

Just as promised My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott M.

August 21st, 2024

Complete Package don't spend good money for a title co. to do this

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine D.

August 22nd, 2022

Once I found your site it was very easy to understand, order and copy the forms. It is very helpful that you included an example of a completed form. Thank you. This form helps hundreds of seniors avoid lawyers, probate and the fear of losing their homes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry T.

July 28th, 2020

Ordered a 'Gift Deed' form The 'Example' form was most helpful. The actual form was very detailed, and seemed to 'cover all the bases'

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen B.

January 13th, 2020

Completed although having the sample really helped. Now to file.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott H.

April 14th, 2021

Very helpful

Thank you!

Nikie U.

September 10th, 2021

This was my first time using this service and it worked smoothly and efficiently and I will definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!