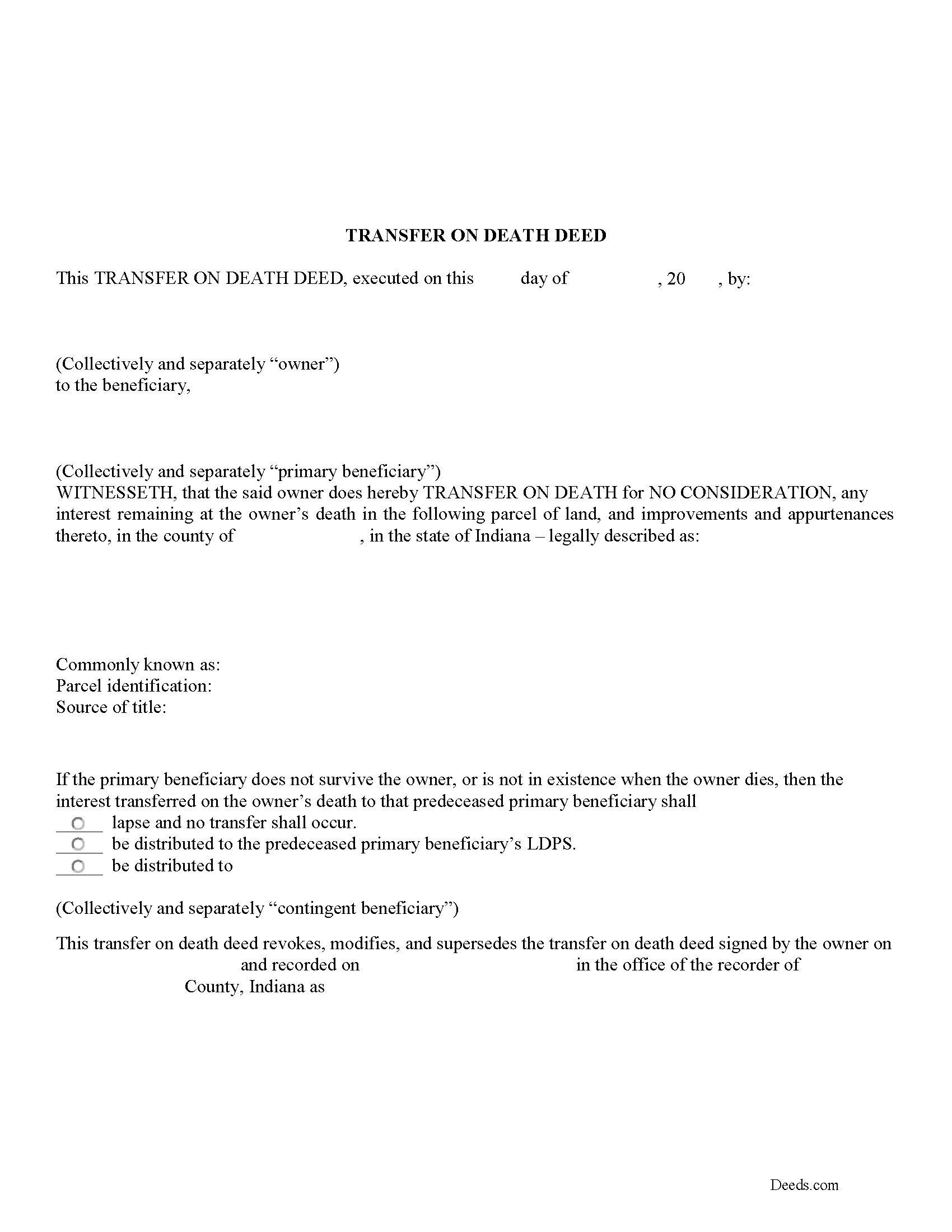

Johnson County Transfer on Death Deed Form

Johnson County Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all Indiana recording and content requirements.

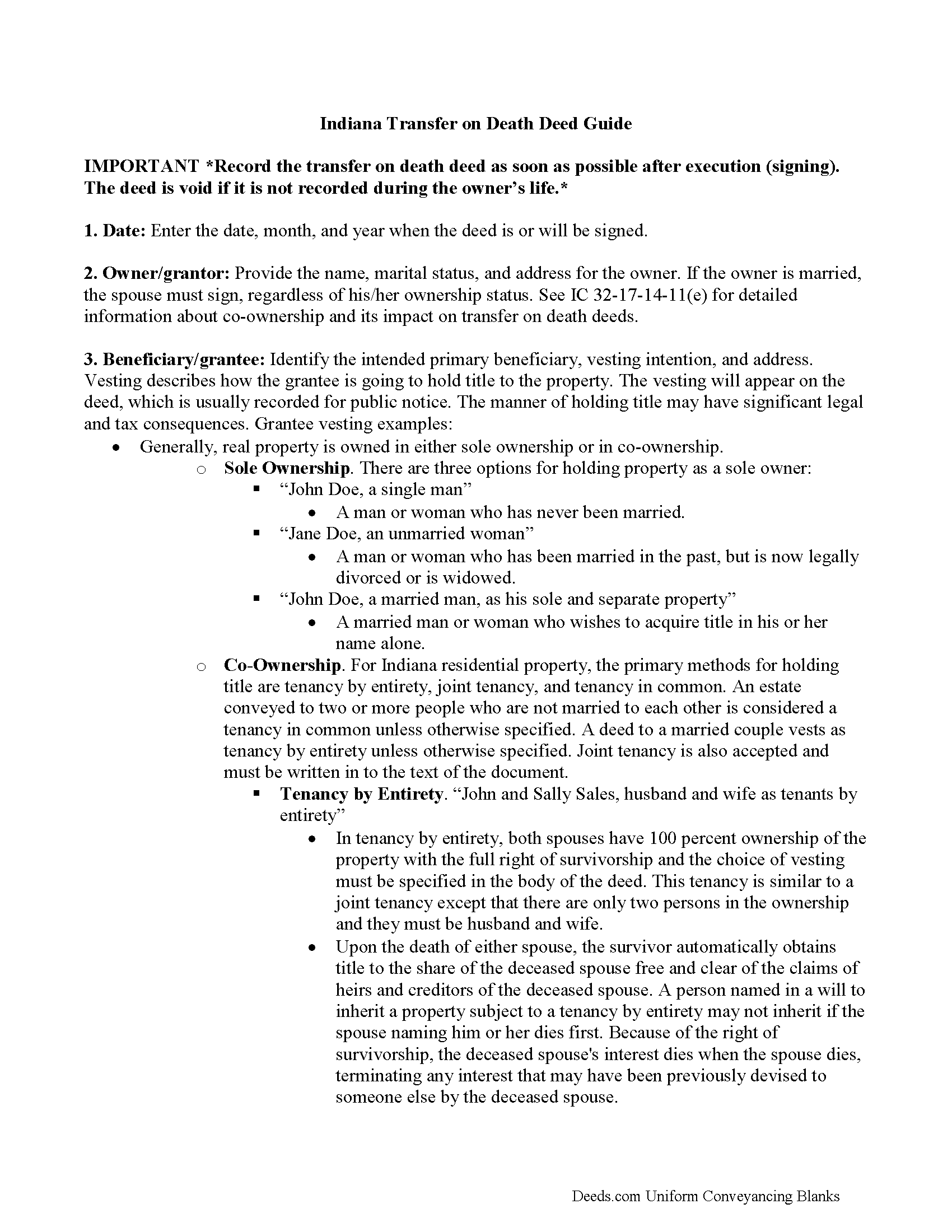

Johnson County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

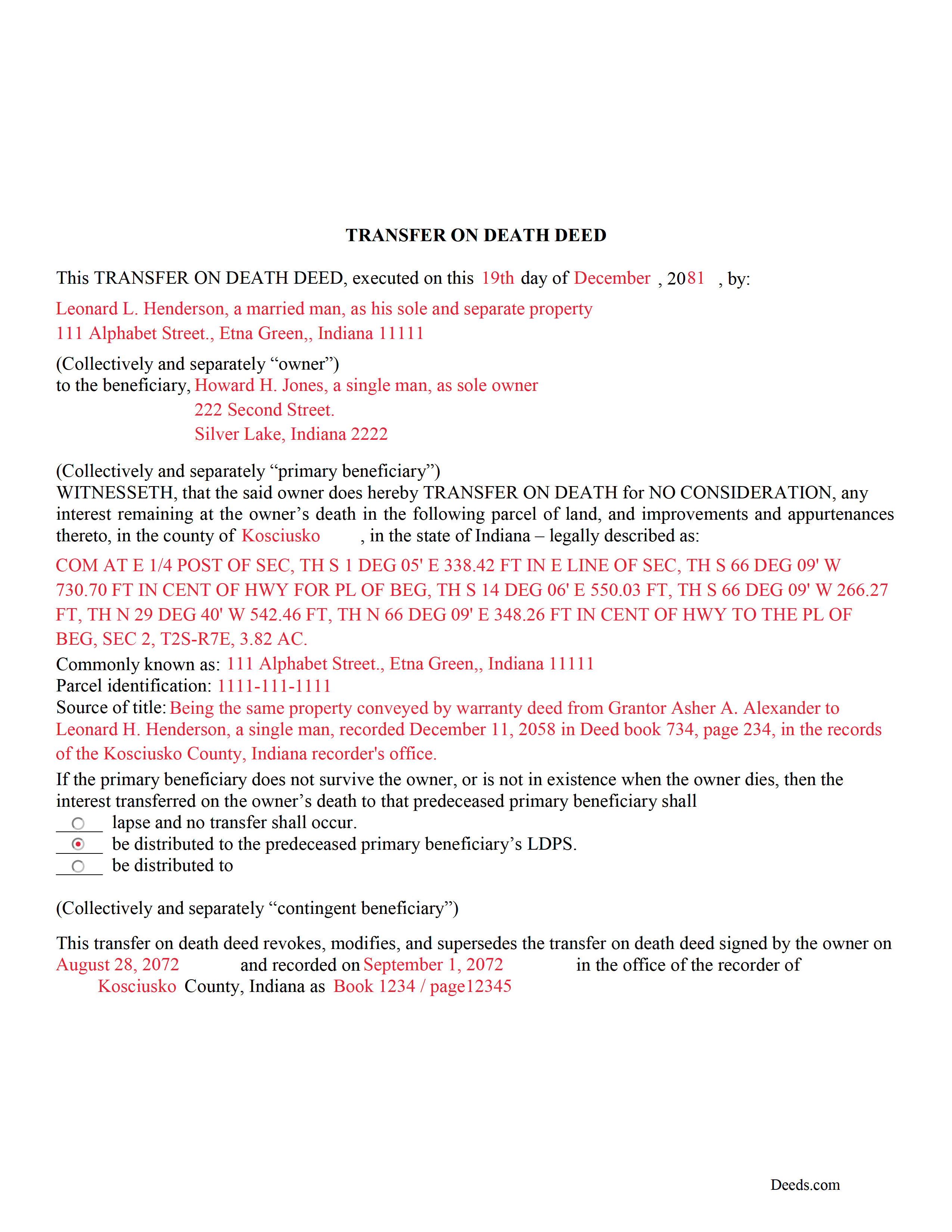

Johnson County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Recorder

Franklin, Indiana 46131

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (317) 346-4385

Recording Tips for Johnson County:

- Ensure all signatures are in blue or black ink

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Bargersville

- Edinburgh

- Franklin

- Greenwood

- Needham

- Nineveh

- Trafalgar

- Whiteland

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (317) 346-4385 for current fees.

Questions answered? Let's get started!

Indiana outlines the rules for its transfer on death deed in I.C. 32-17-14 -- the "Transfer on Death Property Act."

Indiana transfer on death deeds transfer ownership rights of real property to a predetermined beneficiary after the owner's death. This enables Indiana residents to pass their real estate to their heirs outside of probate. The owners keep full control over the property during their lives -- the conveyance only occurs after the owners die -- so they may sell, rent or use the land as they wish. They may change the designated beneficiary or cancel the entire transfer by simply executing a revocation that redefines their wishes.

Note that this is only valid when it is executed (signed) and recorded WHILE THE OWNER IS STILL ALIVE. If not, the deed is void and the property passes through probate with the rest of the owner's estate.

These conveyances might also have an impact on taxes and eligibility for healthcare programs. Carefully review all aspects of estate planning when considering a transfer on death deed.

(Indiana Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Prentis T.

September 9th, 2019

So far so good

Thank you for your feedback. We really appreciate it. Have a great day!

JIM H.

July 21st, 2022

Excellent service Always find the documents in minutes. Supporting docs is a super plus!

Thank you!

Joan L. W.

June 9th, 2021

Excellent Service

Thank you!

Tamara H.

May 11th, 2023

Absolutely awesome! Quick, easy and efficient. I will definitely be using again!

Thank you Tamara. We really appreciate you taking the time to leave your comments. Have an amazing day!

Pamela G.

November 18th, 2020

I have an apple phone. I could not fill in the form to pay because apple phones do not have a dash that can be used when the field requires a phone number with a dash. I had to borrow an android phone in which the telephone keypad had a dash that could be used. It was easy to pay using an android phone but impossible to pay using an apple phone. Remove the requirement for dashes to allow apple phones to use this service.

Thank you!

Maday G.

July 31st, 2020

The service was easy and fast. Definitely much better than the regular process directly at the County's office.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CINDY P.

July 30th, 2019

Such any easy process! Thank you!

Thank you Cindy, we appreciate your feedback.

Cecil S.

January 3rd, 2023

EXCELLENT SERVICE DONE WELL AND QUICKLY

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

heather i.

December 5th, 2022

I don't pay very close attention to what I'm doing all the time which leads to mistakes. Deeds.com was helpful in correcting my error and getting me on my way.

Thank you!

Marcia G.

June 24th, 2020

I am so happy with this service. I can not tell you. In about 30 minutes my records were recorded. Excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhobe M.

May 8th, 2023

Very user friendly site. I was able to get the information I needed fast.

Thank you!

Brenda B.

January 6th, 2019

Excellent transaction.

Thank you Brenda.

Lydia E.

December 16th, 2021

Very intuitive to use and comprehensive enough for the most complex of cases.

Thank you!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!