Morgan County Transfer on Death Deed Form

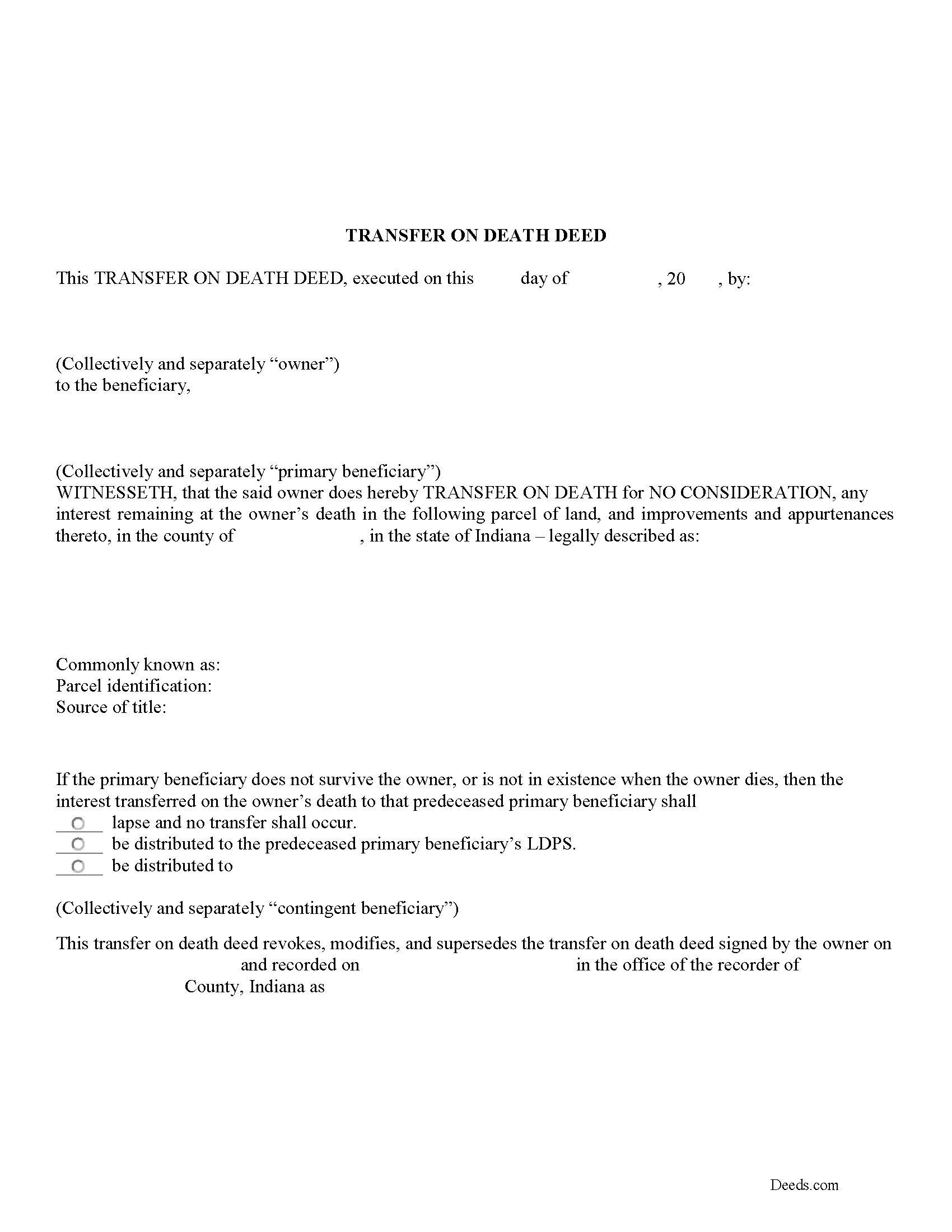

Morgan County Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all Indiana recording and content requirements.

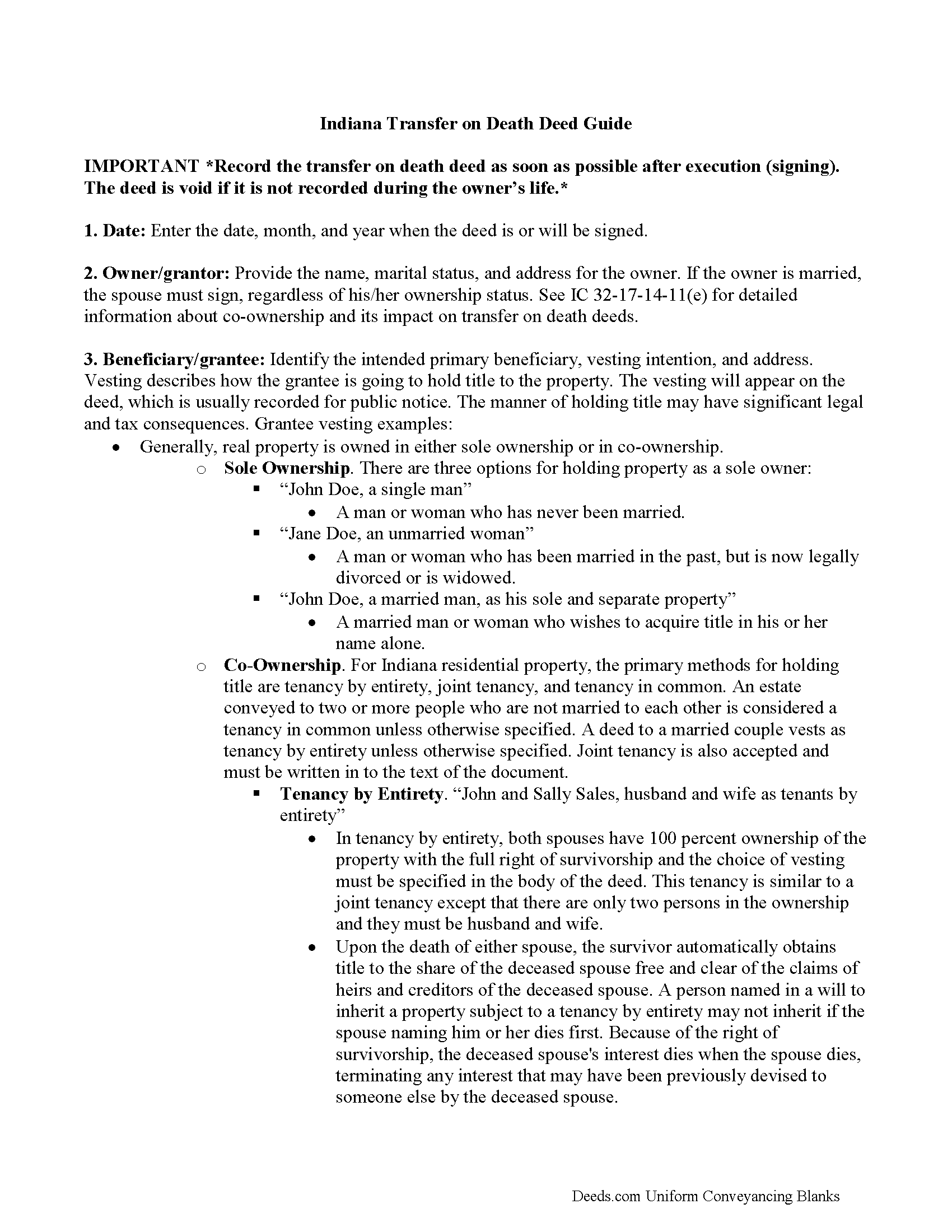

Morgan County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

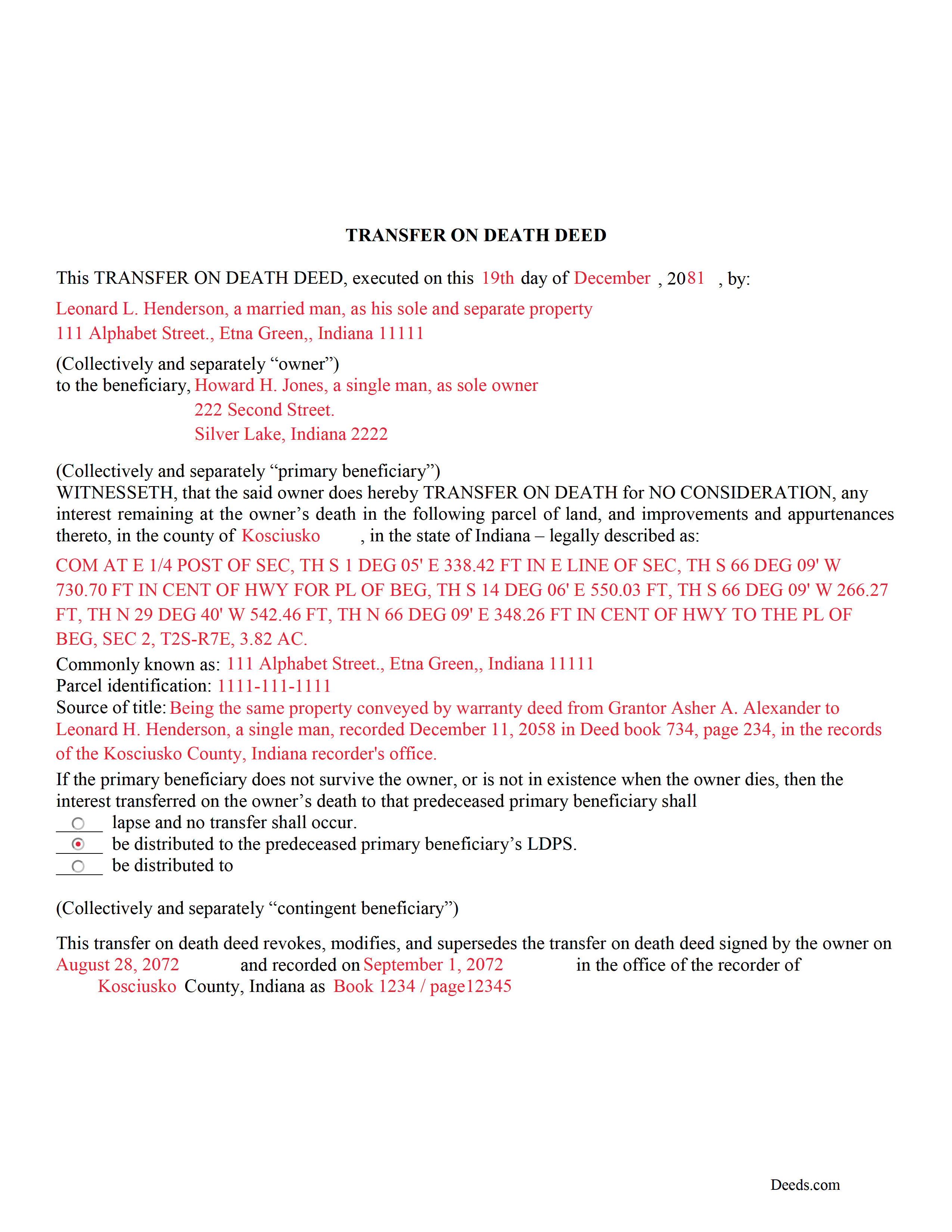

Morgan County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Morgan County documents included at no extra charge:

Where to Record Your Documents

Morgan County Recorder

Martinsville, Indiana 46151

Hours: 8:00 to 4:00 Monday through Friday

Phone: (765) 342-1077 or 1078

Recording Tips for Morgan County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Morgan County

Properties in any of these areas use Morgan County forms:

- Brooklyn

- Camby

- Eminence

- Martinsville

- Monrovia

- Mooresville

- Morgantown

- Paragon

Hours, fees, requirements, and more for Morgan County

How do I get my forms?

Forms are available for immediate download after payment. The Morgan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morgan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morgan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morgan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morgan County?

Recording fees in Morgan County vary. Contact the recorder's office at (765) 342-1077 or 1078 for current fees.

Questions answered? Let's get started!

Indiana outlines the rules for its transfer on death deed in I.C. 32-17-14 -- the "Transfer on Death Property Act."

Indiana transfer on death deeds transfer ownership rights of real property to a predetermined beneficiary after the owner's death. This enables Indiana residents to pass their real estate to their heirs outside of probate. The owners keep full control over the property during their lives -- the conveyance only occurs after the owners die -- so they may sell, rent or use the land as they wish. They may change the designated beneficiary or cancel the entire transfer by simply executing a revocation that redefines their wishes.

Note that this is only valid when it is executed (signed) and recorded WHILE THE OWNER IS STILL ALIVE. If not, the deed is void and the property passes through probate with the rest of the owner's estate.

These conveyances might also have an impact on taxes and eligibility for healthcare programs. Carefully review all aspects of estate planning when considering a transfer on death deed.

(Indiana Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Morgan County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Morgan County.

Our Promise

The documents you receive here will meet, or exceed, the Morgan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morgan County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Ebony L.

July 14th, 2022

Very pleased with deeds.com. I highly recommend them to anyone, from clueless beginners like myself to the more advanced. Thank you for simplifying this process.

Thank you for your feedback. We really appreciate it. Have a great day!

Arthur L.

October 31st, 2020

The directions were clear, I typed the deed out and it was successfully recorded and mailed back to me in less than a week.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheilah C.

November 24th, 2020

So far very good. I will know more when I complete the forms and submit them.

Thank you!

Gwen R.

January 23rd, 2019

Happy with the forms no complaints at all.

Thank you Gwen!

Michelle R.

December 23rd, 2022

Fairly easy to use. Need to be able to find platts easy.

Thank you!

Melissa S.

March 24th, 2024

Simple & easy to navigate. At time of writing this, guide & example of purchased deed is included. Plus lots of extra information to help secure your property. Would recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet B.

July 28th, 2020

Review: Very user friendly and that is very important to me. Quick, easy and clear instructions. I would highly recommend deeds.com for your online filing services.

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon B.

August 11th, 2022

My questions were answered promptly. I was not able to locate the deed I was searching for because my county has not uploaded the documents to be accessed through this system. I am sure I could have found what I was looking for had the information been available through the system. Thank you for your assistance.

Thank you!

Cindy A.

January 14th, 2019

Easy to understand and use. However, need to add line for phone number for preparer - Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Jerry B.

May 14th, 2023

Easy to use and fully comprehensive.

Thank you for your feedback Jerry, we appreciate you.

Lori W.

December 2nd, 2020

Great resource! Nice to have these forms and information available. No problems at the recorder, in fact it was the recorder that referred me to deeds.com they like their forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Joel N.

September 7th, 2019

Was helpful

Thank you for your feedback. We really appreciate it. Have a great day!

JAMES D.

November 5th, 2022

Fast and easy. Sample completed form & guidelines very useful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lavonia L.

October 7th, 2024

Found exactly what I was looking for and it helped tremendously.

Thank you for your feedback. We really appreciate it. Have a great day!

John V.

June 17th, 2020

getting the proper forms was easy--filling them out, not so much

Thank you!