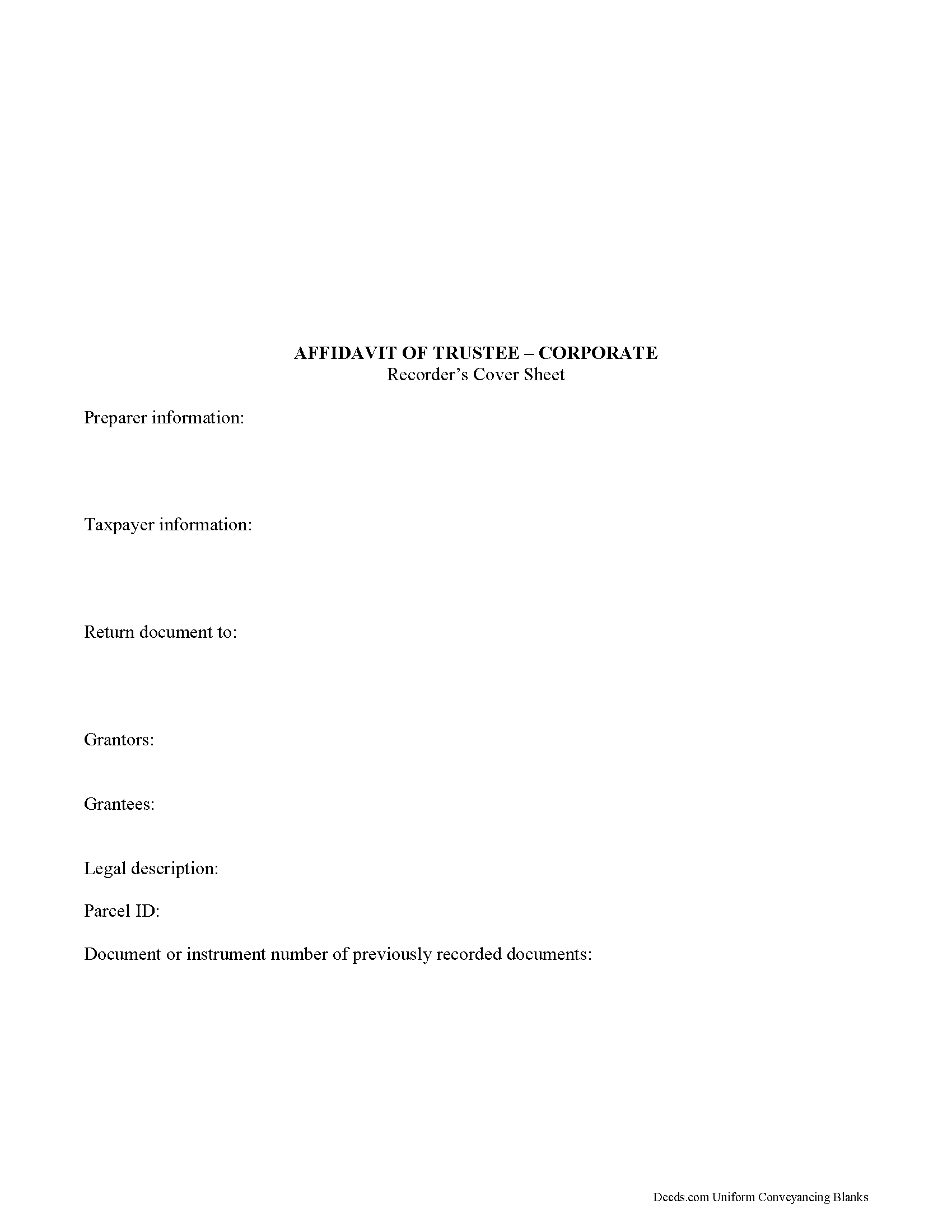

Union County Affidavit of Corporate Trustee Form

Union County Affidavit of Corporate Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

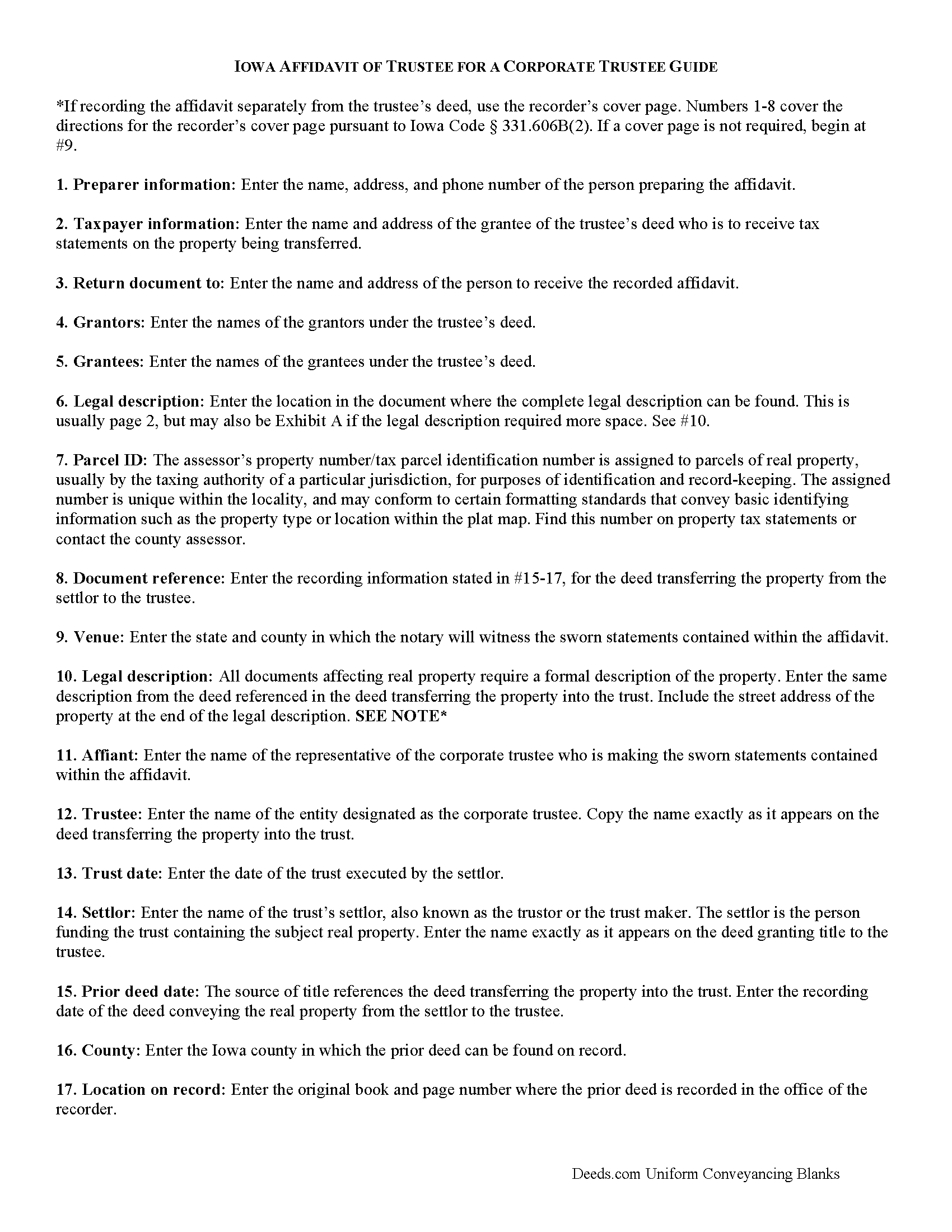

Union County Affidavit of Corporate Trustee Guide

Line by line guide explaining every blank on the form.

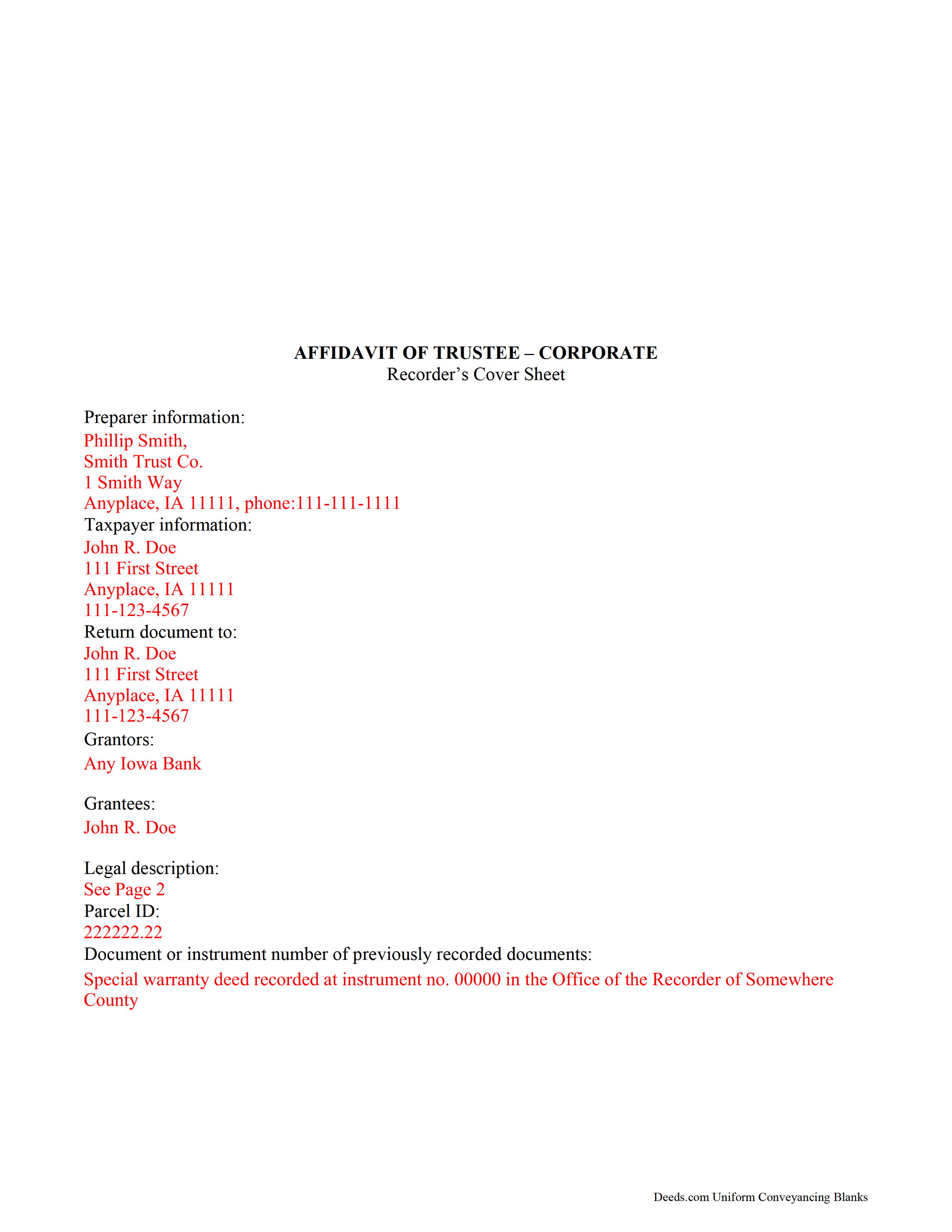

Union County Completed Example of the Affidavit of Corporate Trustee Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Union County documents included at no extra charge:

Where to Record Your Documents

Union County Recorder's Office

Creston, Iowa 50801

Hours: 8:30am to 4:30pm M-F

Phone: (641) 782-1725

Recording Tips for Union County:

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Union County

Properties in any of these areas use Union County forms:

- Afton

- Arispe

- Creston

- Cromwell

- Lorimor

- Shannon City

- Thayer

Hours, fees, requirements, and more for Union County

How do I get my forms?

Forms are available for immediate download after payment. The Union County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Union County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Union County?

Recording fees in Union County vary. Contact the recorder's office at (641) 782-1725 for current fees.

Questions answered? Let's get started!

Under Iowa Code 614.14, the affidavit of corporate trustee is used in conjunction with a trustee's deed executed by a corporate trustee. The affidavit is a sworn statement confirming the title held by the corporate trustee is free and clear of adverse claims. It is recorded and presented to the purchaser along with the trustee's deed.

(Iowa Affidavit of Corporate Trustee Package includes form, guidelines, and completed example) Consult a lawyer with questions about corporate trustee's deeds and affidavits.

Important: Your property must be located in Union County to use these forms. Documents should be recorded at the office below.

This Affidavit of Corporate Trustee meets all recording requirements specific to Union County.

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Affidavit of Corporate Trustee form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

barbara s.

May 2nd, 2020

you provided the service requested for a reasonable fee

Thank you!

Patricia W.

October 1st, 2020

The technology and service was excellent. The content was too limited. I was seeking to find out about 61b deeds on the property and that was not provided.

We appreciate your feedback Patricia.

Jo G.

November 8th, 2021

The form was easy enough to purchase but I ended up not needing it. No fault of Deeds.com, but it was of no value to me.

Thank you for your feedback. We really appreciate it. Have a great day!

Sera E.

January 25th, 2022

East, fast, reliable. Great service!

Thank you!

Emery N.

May 16th, 2019

Thank you for your service,,you have a very good site,,easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Richard R.

November 14th, 2019

Very straightforward, and fair-enough pricing.

Thank you!

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Cathy W.

December 18th, 2021

Easy to use and fee is reasonable.

Thank you!

Cheryl W.

August 10th, 2019

Have yet to use. Appears over whelming, we will see.

Thank you for your feedback. We really appreciate it. Have a great day!

Kay C.

December 22nd, 2021

Thank you for your patience and help with filing the documents needed. You were helpful, prompt, courteous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

william w.

January 23rd, 2019

Simple, straight forward, and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen L.

October 8th, 2021

My card was charged twice in error, I contacted deeds.com and within minutes, the error was corrected! Fast service, thank you deed.com

Thank you!

Richard T.

February 8th, 2020

Easy forms for DIYers

Thank you!

William U.

December 1st, 2020

Prompt service, reasonable price.

Thank you!

Maribel I.

September 15th, 2022

It would be helpful to be able to edit verbiage on the form. I was preparing a Deed of Distribution; therefore, there was no consideration paid. I had to type the language into a Word document instead.

Thank you for your feedback. We really appreciate it. Have a great day!