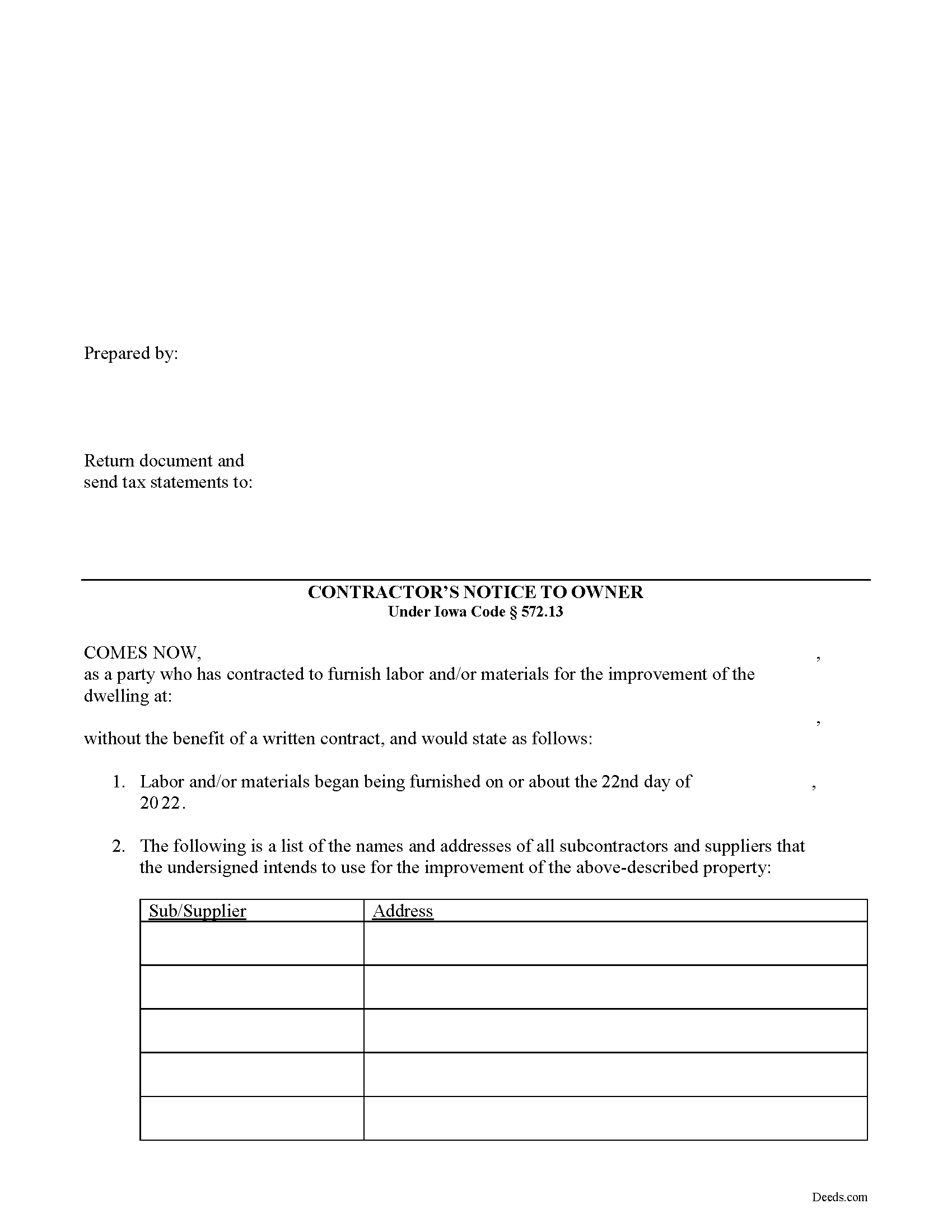

Jones County Contractor Notice to Owner Form

Jones County Contractor Notice to Owner Form

Fill in the blank Contractor Notice to Owner form formatted to comply with all Iowa recording and content requirements.

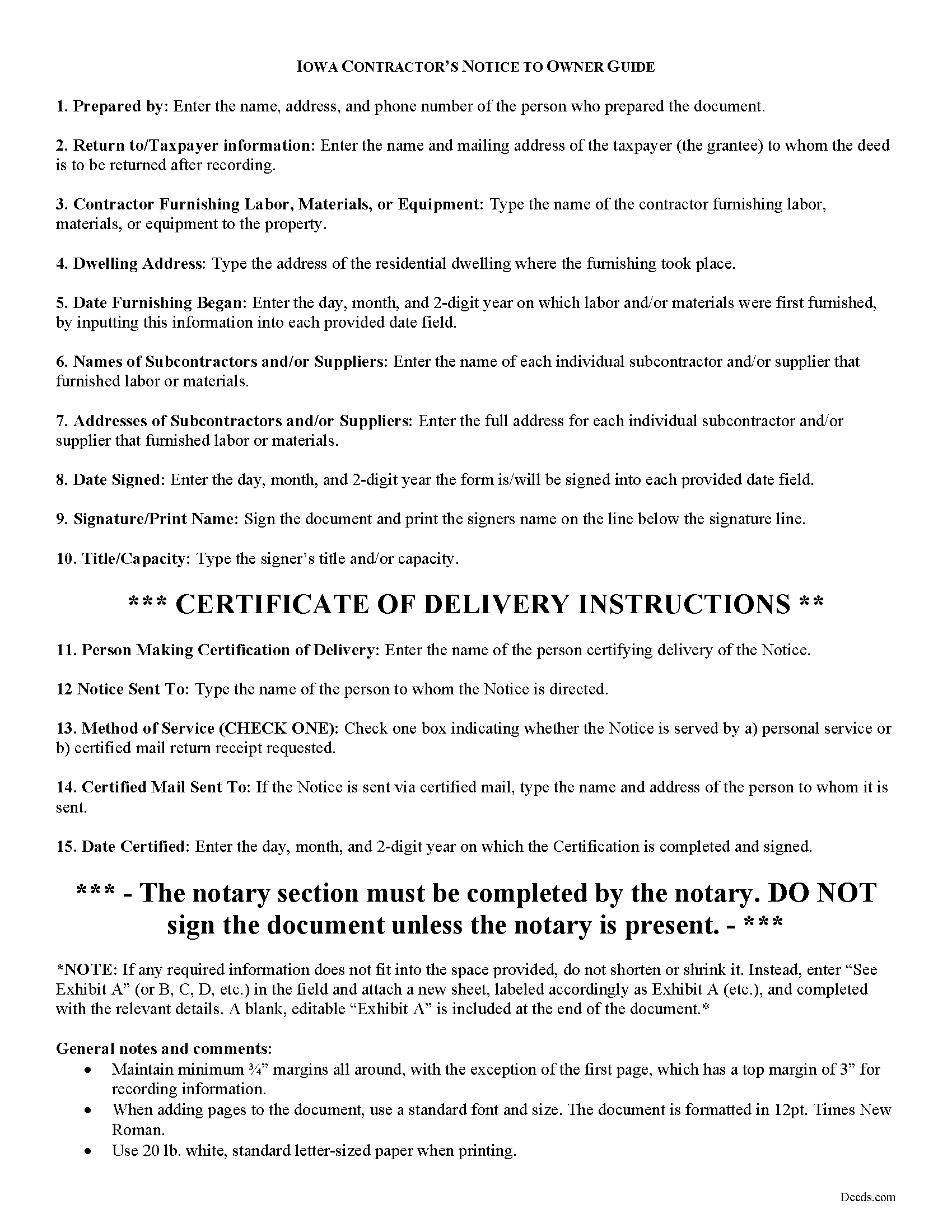

Jones County Contractor Notice to Owner Guide

Line by line guide explaining every blank on the form.

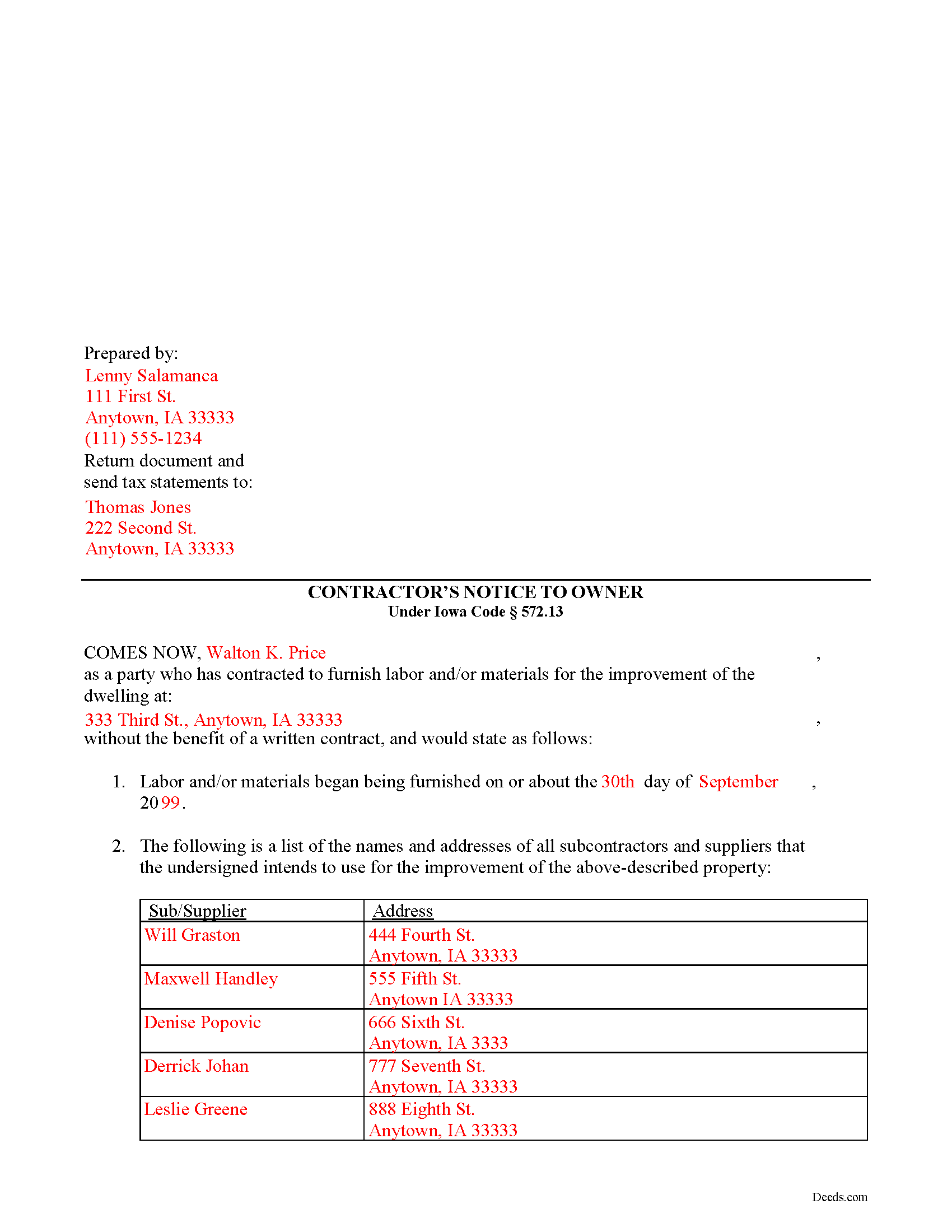

Jones County Completed Example of the Contractor Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Jones County documents included at no extra charge:

Where to Record Your Documents

Jones County Recorder

Anamosa, Iowa 52205

Hours: 8:00am to 4:30pm M-F / Recording until 4:00pm

Phone: (319) 462-2477

Recording Tips for Jones County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

- Make copies of your documents before recording - keep originals safe

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Jones County

Properties in any of these areas use Jones County forms:

- Anamosa

- Center Junction

- Langworthy

- Martelle

- Monticello

- Morley

- Olin

- Onslow

- Oxford Junction

- Wyoming

Hours, fees, requirements, and more for Jones County

How do I get my forms?

Forms are available for immediate download after payment. The Jones County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jones County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jones County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jones County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jones County?

Recording fees in Jones County vary. Contact the recorder's office at (319) 462-2477 for current fees.

Questions answered? Let's get started!

Liability of an Owner to the Original Contractor in Iowa

An owner of a building, land, or improvement upon which a subcontractor's mechanic's lien may be filed, is not required to pay the original contractor any compensation for work done or material furnished for the building, land, or improvement until the expiration of ninety (90) days after the completion of the building or improvement. I.C. 572.13(1). However, payment may be due sooner if the original contractor furnishes the owner with one of the following: a) receipts and waivers for any claims for mechanics' liens, signed by all persons who furnished material or performed labor for the building, land, or improvement; or b) good and sufficient bond to be approved by the owner, on the condition that the owner will be relieved from liability for any loss which the owner may sustain by reason of the filing of mechanics' liens by subcontractors. I.C. 572.13(1).

An original contractor entering into a contract for an owner-occupied dwelling and who has contracted or will contract with a subcontractor to provide labor or furnish material for the dwelling must include the following notice in any written contract with the owner and shall provide the owner with a copy of the written contract:

"Persons or companies furnishing labor or materials for the improvement of real property may enforce a lien upon the improved property if they are not paid for their contributions, even if the parties have no direct contractual relationship with the owner."

I.C. 572.13(2).

If there is no written contract between the original contractor and the dwelling owner, the original contractor must, within ten (10) days of commencement of work on the dwelling, provide a written notice to the dwelling owner stating the name and address of all subcontractors that the contractor intends to use for the construction and, that the subcontractors or suppliers may have lien rights in the event they are not paid for their labor or material used on this site. Id. The notice must be updated as additional subcontractors and suppliers are used from the names disclosed on any earlier notices. Id.

This notice is essential as any original contractor who fails to provide notice is not entitled to lien rights. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to a dwelling owner or anything else with regard to mechanic's liens.

Important: Your property must be located in Jones County to use these forms. Documents should be recorded at the office below.

This Contractor Notice to Owner meets all recording requirements specific to Jones County.

Our Promise

The documents you receive here will meet, or exceed, the Jones County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jones County Contractor Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Woody P.

August 28th, 2021

I was informed that a quit Claim Deed that I had submitted, did not meet county requirements. I ordered the correct form and was surprised that the form included instructions and a sample "completed" form for me to follow. I found it al very helpful. Thank you !!!

Thank you!

Vera O.

February 25th, 2022

I love how quick and easy everything was. I'll definitely be using deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lowell R.

July 29th, 2020

Awesome. Quick informative and very easy. I made a mistake the first time, emailed you and was able to get it fixed quickly and got it done.

Thank you for your feedback. We really appreciate it. Have a great day!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LEON S.

November 16th, 2019

recorded deed space to small for corrective deed requirement

Thank you for your feedback. We really appreciate it. Have a great day!

Hamed T.

January 12th, 2022

Easy Process! Realy recommend them for E-Recording!

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID F.

September 16th, 2021

excellent experience with this product. Well worth the cost to save time running down forms

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie L.

April 3rd, 2019

Great documents! with complete instructions and the CTC as well. I work with a lot of recordings and transfers, this is a great comprehensive set..

Thank you!

Christine K.

February 12th, 2021

While I was initially disappointed I could not go to the local County to file my paperwork due to Covid-19, I was thrilled to work with Deeds.com. Their staff was INCREDIBLY FAST, super knowledgeable and the whole process happened from my computer in minutes. Very positive experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

laura s.

February 2nd, 2023

thanks for providing my with exactly what I needed, almost instantly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy N.

September 21st, 2020

Extremely easy and fast recording of real estate records. I was impressed that it was less than 6 hours from the time I uploaded the document to Deeds.com to receiving confirmation that it was recorded by the county clerk. I would highly recommend this service to save you time and quickly get documents recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

David M.

May 21st, 2020

Extremely easy to use. The sample completed document was very helpful. I really appreciated not having to spend a few hundred dollars for a lawyer to generate a document that I can produce myself for a small fraction of the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth L.

November 5th, 2019

Used this site and the forms a few times now and always a good experience. It's so nice to be able to download these forms to my computer and work on them there. So many others want you to do everything online, pain in my opinion. Thank you Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

Edwart D.

November 30th, 2021

I tend to not pay attention to the details and then blame other people. Thankfully Deeds.com has my back when I make silly mistakes.

Thank you!

Michael B.

November 13th, 2019

It was a breeze to utilize.

Thank you!