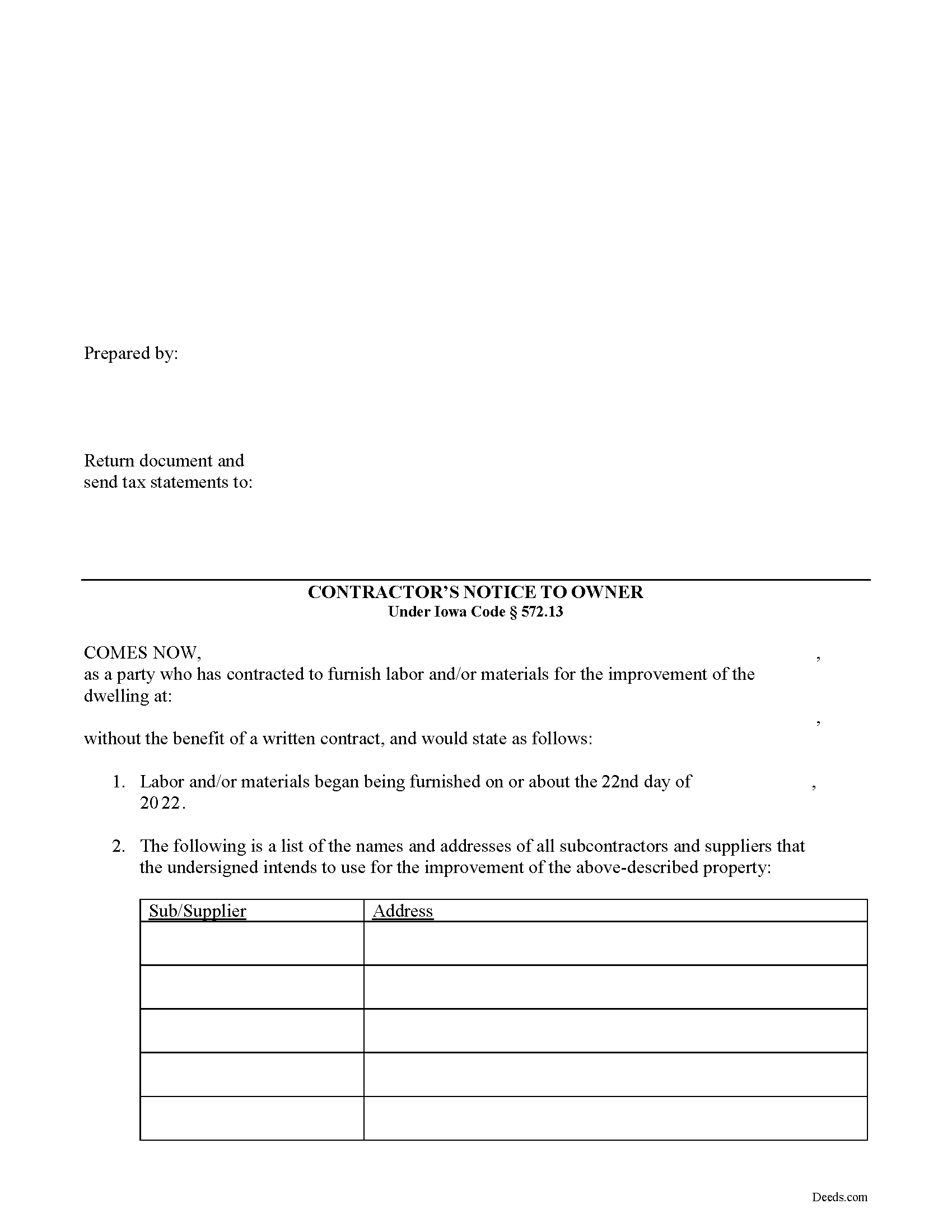

Mills County Contractor Notice to Owner Form

Mills County Contractor Notice to Owner Form

Fill in the blank Contractor Notice to Owner form formatted to comply with all Iowa recording and content requirements.

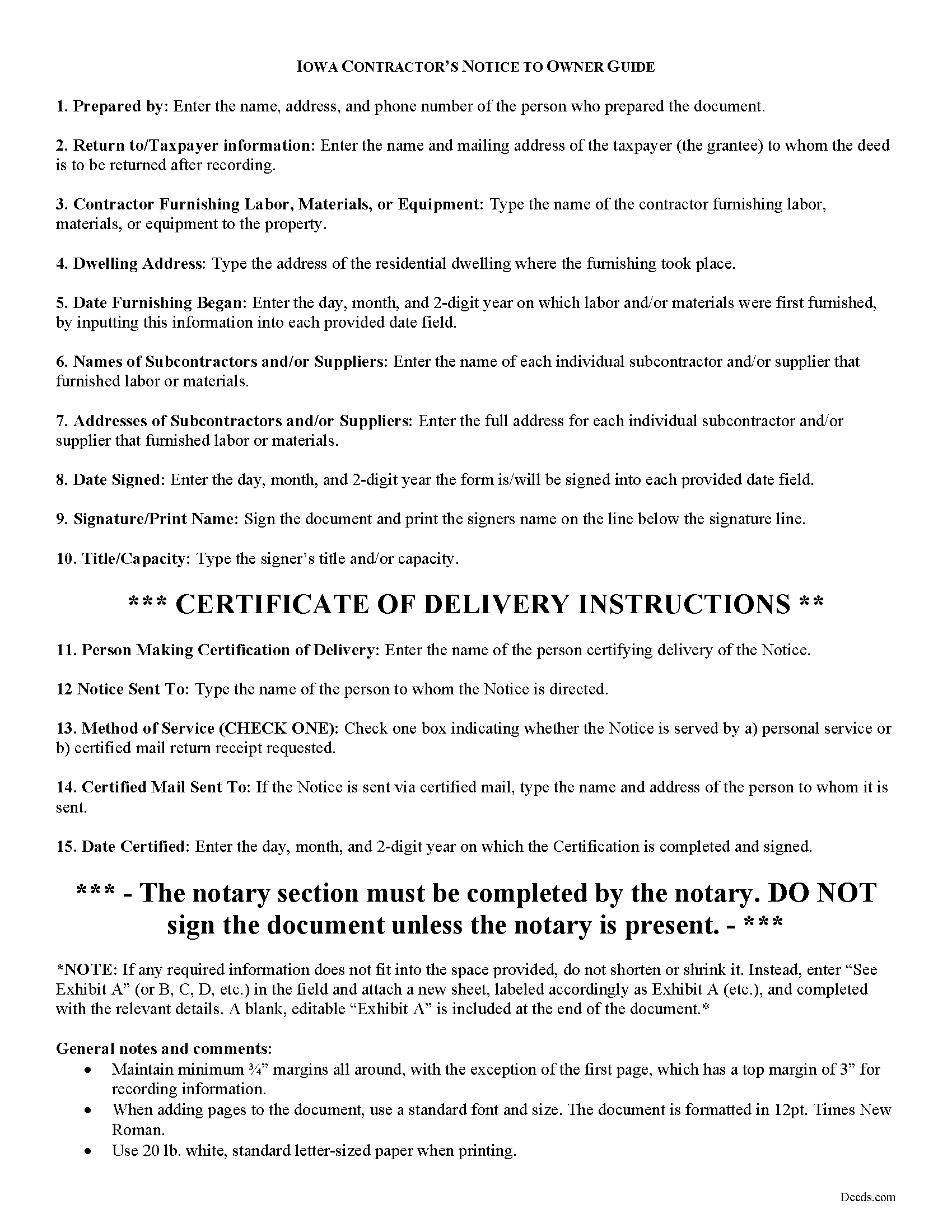

Mills County Contractor Notice to Owner Guide

Line by line guide explaining every blank on the form.

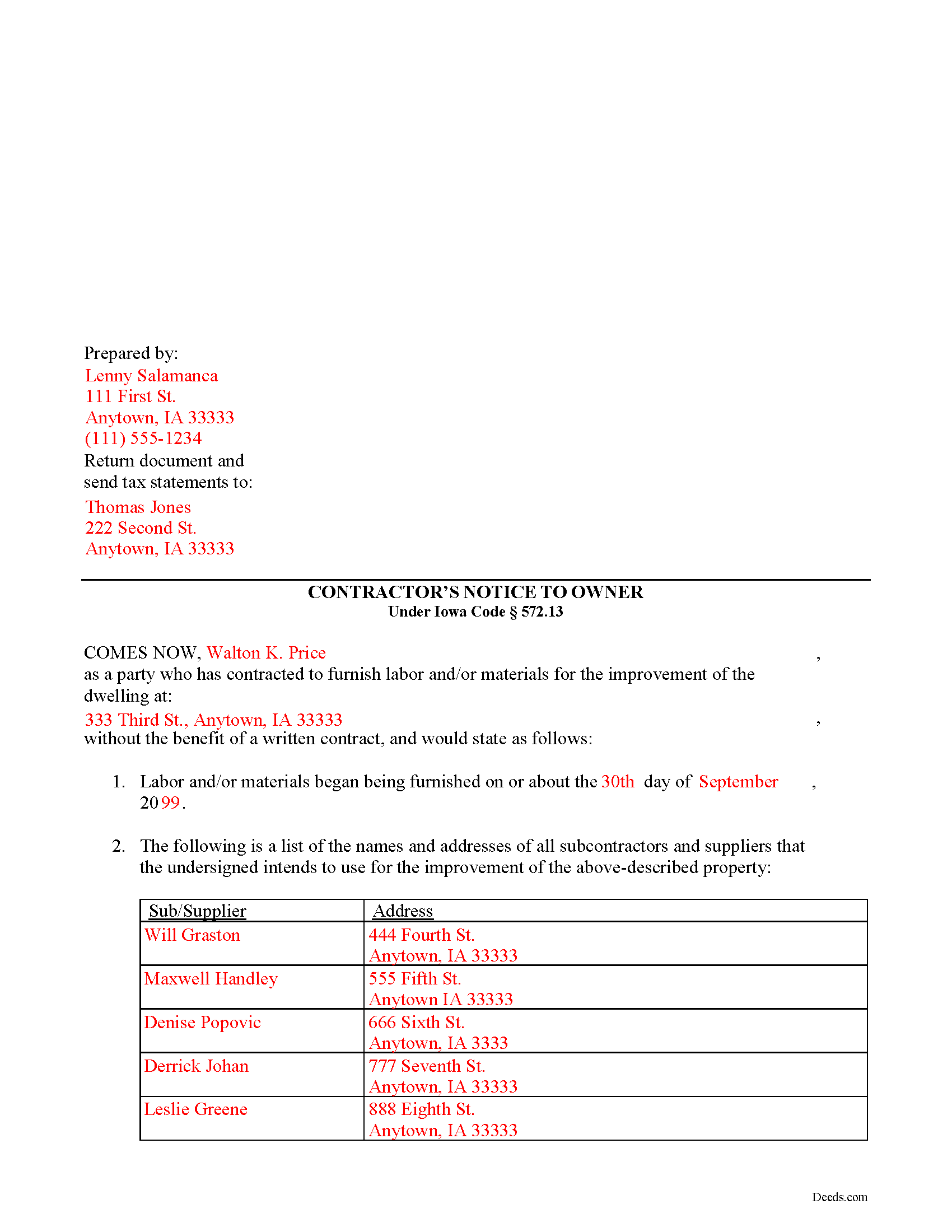

Mills County Completed Example of the Contractor Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Mills County documents included at no extra charge:

Where to Record Your Documents

Mills County Recorder

Glenwood, Iowa 51534

Hours: 8:00 to 4:30 M-F

Phone: (712) 527-9315

Recording Tips for Mills County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Mills County

Properties in any of these areas use Mills County forms:

- Emerson

- Glenwood

- Hastings

- Henderson

- Malvern

- Mineola

- Pacific Junction

- Silver City

Hours, fees, requirements, and more for Mills County

How do I get my forms?

Forms are available for immediate download after payment. The Mills County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mills County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mills County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mills County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mills County?

Recording fees in Mills County vary. Contact the recorder's office at (712) 527-9315 for current fees.

Questions answered? Let's get started!

Liability of an Owner to the Original Contractor in Iowa

An owner of a building, land, or improvement upon which a subcontractor's mechanic's lien may be filed, is not required to pay the original contractor any compensation for work done or material furnished for the building, land, or improvement until the expiration of ninety (90) days after the completion of the building or improvement. I.C. 572.13(1). However, payment may be due sooner if the original contractor furnishes the owner with one of the following: a) receipts and waivers for any claims for mechanics' liens, signed by all persons who furnished material or performed labor for the building, land, or improvement; or b) good and sufficient bond to be approved by the owner, on the condition that the owner will be relieved from liability for any loss which the owner may sustain by reason of the filing of mechanics' liens by subcontractors. I.C. 572.13(1).

An original contractor entering into a contract for an owner-occupied dwelling and who has contracted or will contract with a subcontractor to provide labor or furnish material for the dwelling must include the following notice in any written contract with the owner and shall provide the owner with a copy of the written contract:

"Persons or companies furnishing labor or materials for the improvement of real property may enforce a lien upon the improved property if they are not paid for their contributions, even if the parties have no direct contractual relationship with the owner."

I.C. 572.13(2).

If there is no written contract between the original contractor and the dwelling owner, the original contractor must, within ten (10) days of commencement of work on the dwelling, provide a written notice to the dwelling owner stating the name and address of all subcontractors that the contractor intends to use for the construction and, that the subcontractors or suppliers may have lien rights in the event they are not paid for their labor or material used on this site. Id. The notice must be updated as additional subcontractors and suppliers are used from the names disclosed on any earlier notices. Id.

This notice is essential as any original contractor who fails to provide notice is not entitled to lien rights. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to a dwelling owner or anything else with regard to mechanic's liens.

Important: Your property must be located in Mills County to use these forms. Documents should be recorded at the office below.

This Contractor Notice to Owner meets all recording requirements specific to Mills County.

Our Promise

The documents you receive here will meet, or exceed, the Mills County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mills County Contractor Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Vicki L.

July 4th, 2020

Quick results with accurate information and thorough information.

Thank you!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Eric L.

June 28th, 2021

Great service, but still needs some knowledge to complete. Also missing Michigan right to farm paragraph.

Thank you!

Rhonda E.

March 10th, 2021

Quick, easy, well-priced, and I have the forms that I need. PDFS download easily and are fillable! Thank you, Deeds.com!

Thank you!

JAMES E.

November 22nd, 2020

Easy to use and excellent software.

Thank you!

Virginia M.

August 26th, 2020

This was the easiest web page ive ever navigated .Found just what i needed fast !

Thank you!

James E.

December 1st, 2020

Forms were available for immediate download. Examples were helpful in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda R.

April 30th, 2019

I was happy to have my payment cancelled when no information was found. And I was given a link to contact the deed office directly.

Thank you!

sean m.

April 28th, 2021

Wow everything I need in one place... what a concept. thanks Deeds.com for the deeds, the guides and the transfer certificate all included for a great price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn S.

January 7th, 2021

I was fine. But I don't like surveys.

Thank you!

Elizabeth H.

December 17th, 2020

You had just what I was looking for. It was explained well and easy to find. Will recommend you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ALFRED B.

September 4th, 2020

The product was just what I needed. Not being the sharpest computer user I stumbled a little but after reading more carefully I navigated the process and I am very satisfied with my experience. deeds certainly saved me a lot of time.

Thank you!

Byron M.

September 18th, 2023

Prompt service... provide thorough explanation of what is needed to complete the recording.

Thank you for your feedback. We really appreciate it. Have a great day!

michael k.

February 24th, 2023

fast and easy to fill out forms.

Thank you!

Susanne N.

February 25th, 2021

It's hard having to change names on an account when someone dies. I called and was helped by a rep named Lilah. She was most helpful and comforting. Thank you again Lilah.

Thank you for taking the time to leave such kind words Susanne, we appreciate you.