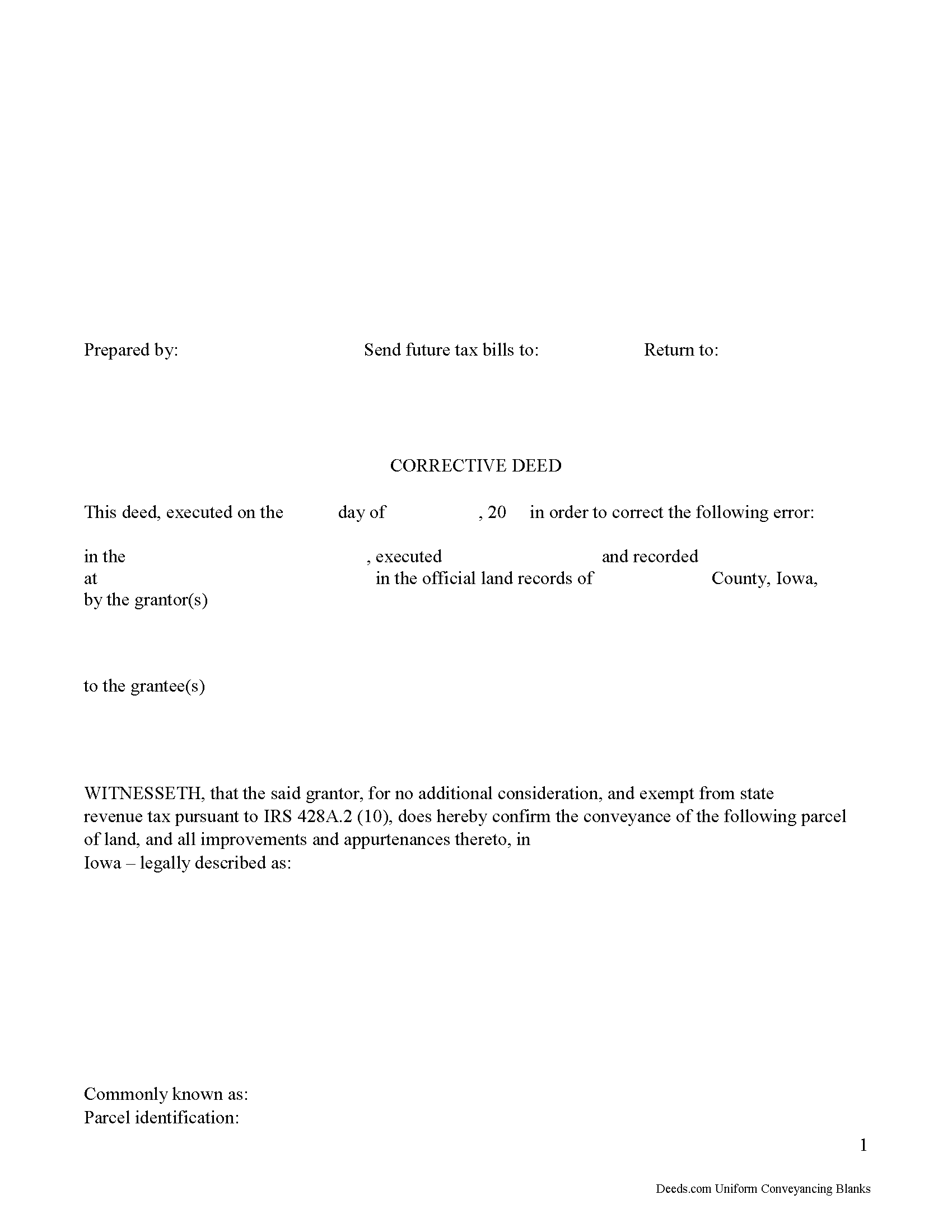

Jones County Correction Deed Form

Jones County Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

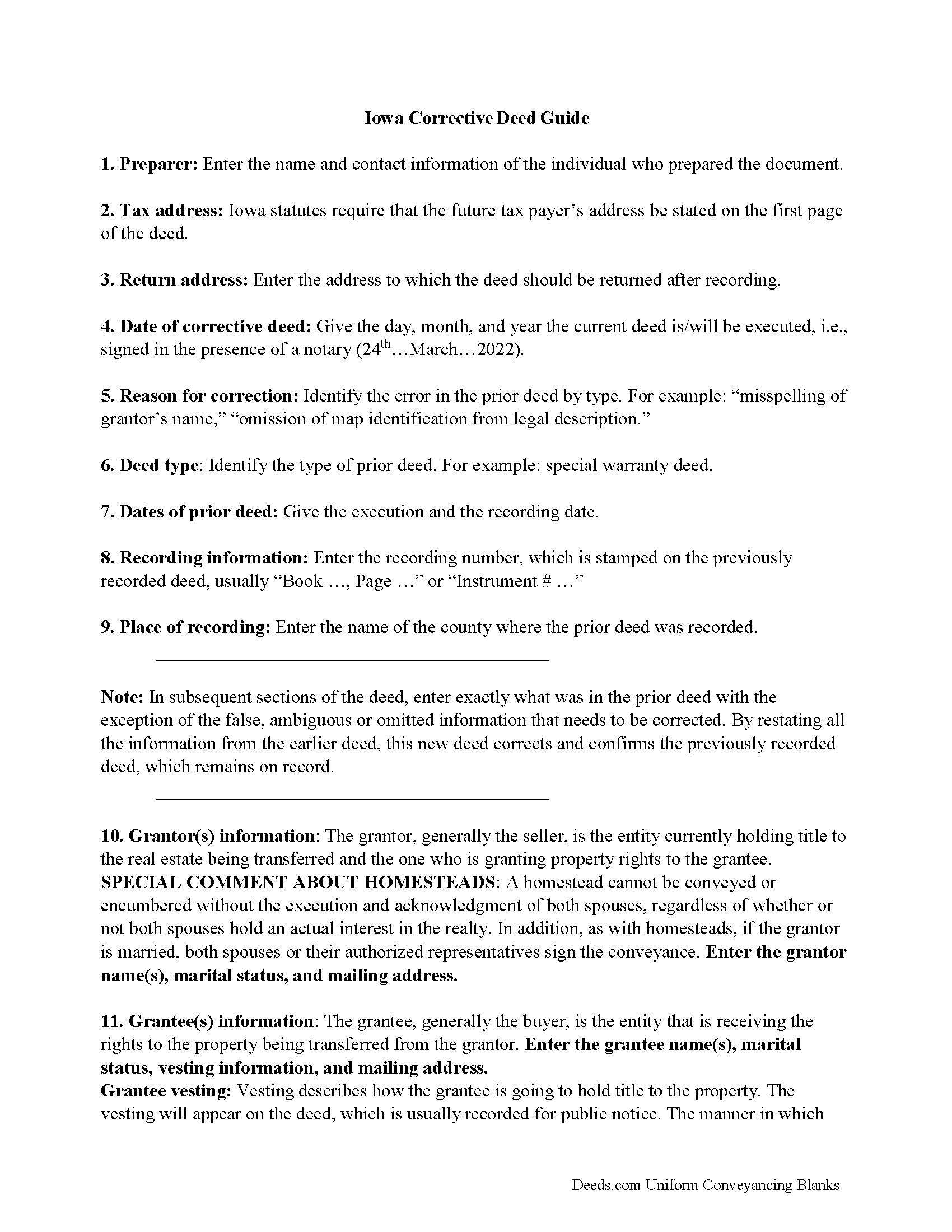

Jones County Corrective Deed Guide

Line by line guide explaining every blank on the form.

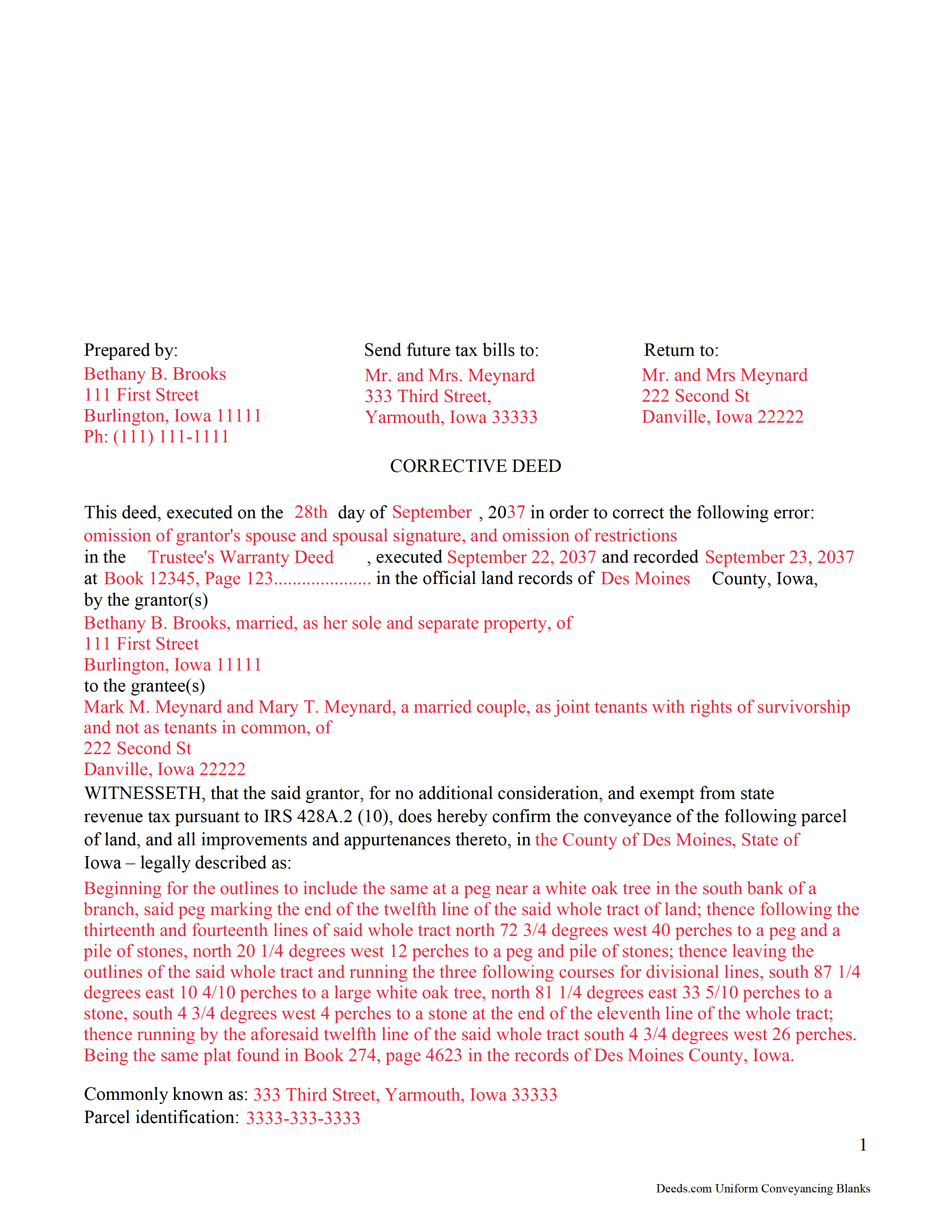

Jones County Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Jones County documents included at no extra charge:

Where to Record Your Documents

Jones County Recorder

Anamosa, Iowa 52205

Hours: 8:00am to 4:30pm M-F / Recording until 4:00pm

Phone: (319) 462-2477

Recording Tips for Jones County:

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Jones County

Properties in any of these areas use Jones County forms:

- Anamosa

- Center Junction

- Langworthy

- Martelle

- Monticello

- Morley

- Olin

- Onslow

- Oxford Junction

- Wyoming

Hours, fees, requirements, and more for Jones County

How do I get my forms?

Forms are available for immediate download after payment. The Jones County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jones County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jones County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jones County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jones County?

Recording fees in Jones County vary. Contact the recorder's office at (319) 462-2477 for current fees.

Questions answered? Let's get started!

In Iowa, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title and, except for the corrected item, reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, which remains on record and receives a cross-reference to the corrective instrument.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing the vesting information or the legal description of the property, may require a new deed of conveyance instead of a correction deed.

Correction deeds are exempt from state revenue tax pursuant to IRS 428A.2 (10) that exempts "deeds which, without additional consideration, confirm, correct, modify, or supplement a deed previously recorded." The exemption needs to be identified on the deed itself, or the declaration of value form must be submitted with the deed.

(Iowa Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Jones County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Jones County.

Our Promise

The documents you receive here will meet, or exceed, the Jones County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jones County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

SHARON R.

September 12th, 2019

Excellent Service! Please note that form Realty Transfer Tax Statement of Value does not print completely. Part of the pages are cut off. Otherwise, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark W.

December 19th, 2022

Great form and easy to complete. Sending a sample and instructions was very helpful. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe S.

July 6th, 2020

Easy to use, reasonable price and excellent customer service! I would not hesitate to use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

November 20th, 2020

Fantastic service. I purchased the form one day, had it filled out, notarized and e-filed the next day. The following day I received the recorded document back. It was really overnight service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

YU LI K.

December 27th, 2023

Very easy to find the document I need and easy to download

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert C.

March 31st, 2019

I hope I have the right form. My deed should be for a mfg home.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

January 18th, 2019

Liked the fact that the forms were fill in the blank. Good to have the option of re-doing them if needed, and I needed ;)

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce B.

July 25th, 2019

Very easy to purchase and download.

Thank you!

AJ H.

April 30th, 2019

What a wonderful service to offer! Very impressed, and grateful for the forms and instructions!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April L.

March 21st, 2020

It was easy and I will use it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine S.

July 11th, 2022

This was easy!!

Thank you!

Francis L.

February 8th, 2023

You have duplicate documents in your listing of documents. please clean up.

Thank you!

Michael S.

May 13th, 2023

I'll give you a review. YOur deeds are way, way, TOO EXPENSIVE Michael Spinks, Attorney

Thank you for your feedback. We're sorry to hear that you're dissatisfied with our pricing.

We take pride in the quality of our products, and our prices reflect the costs involved in sourcing, producing, and ensuring the high standards we've set. It's a balancing act between affordability and maintaining these standards.

We're aware that everyone has a budget to consider, and we're constantly working on optimizing our pricing. However, we won't compromise the quality of our products for the sake of cutting costs. We believe in fair value, and we hope our customers do too.

John B.

November 15th, 2023

Fantastic service, easy to use, and supported the entire way through every process. Excellent service!

We are motivated by your feedback to continue delivering excellence. Thank you!