Marshall County Correction Deed Form

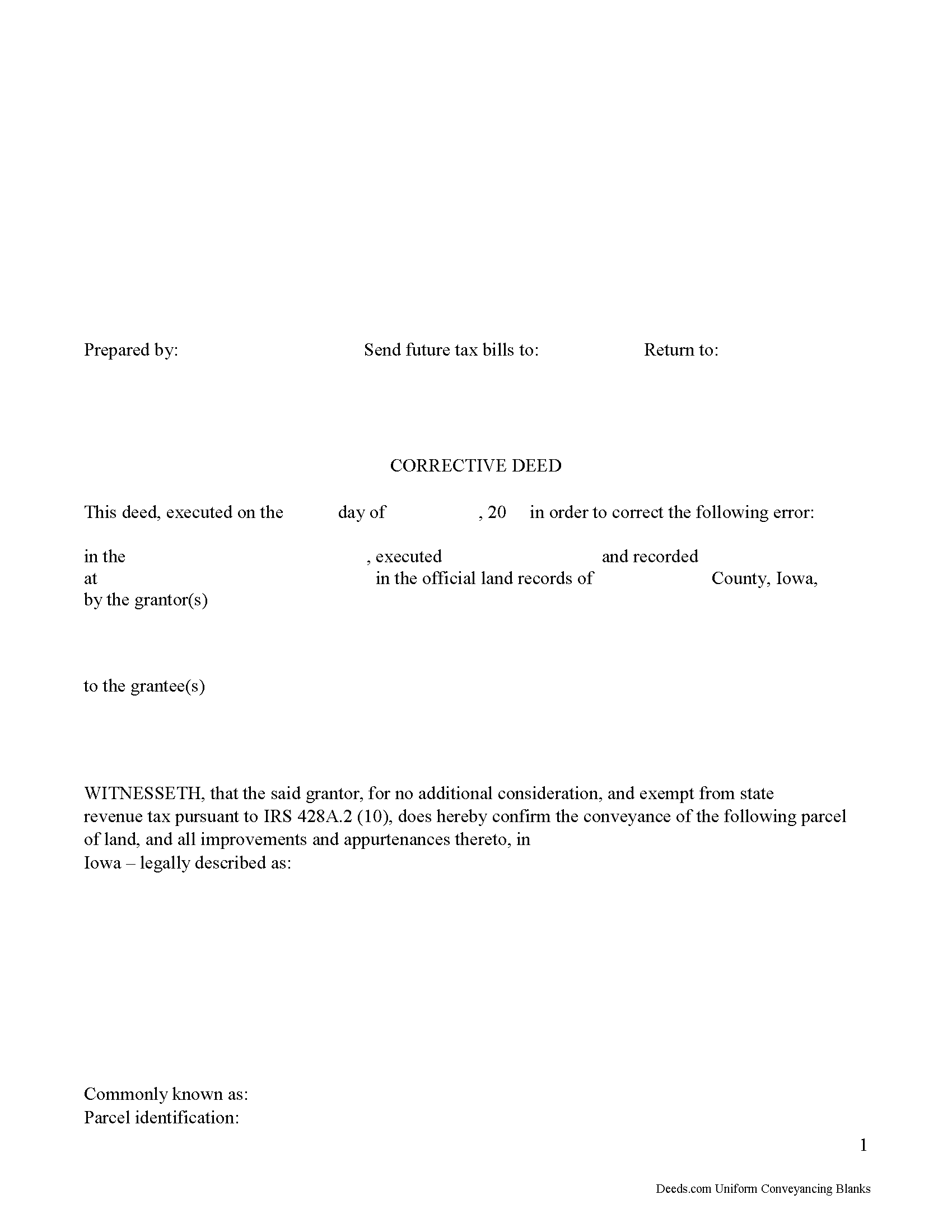

Marshall County Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

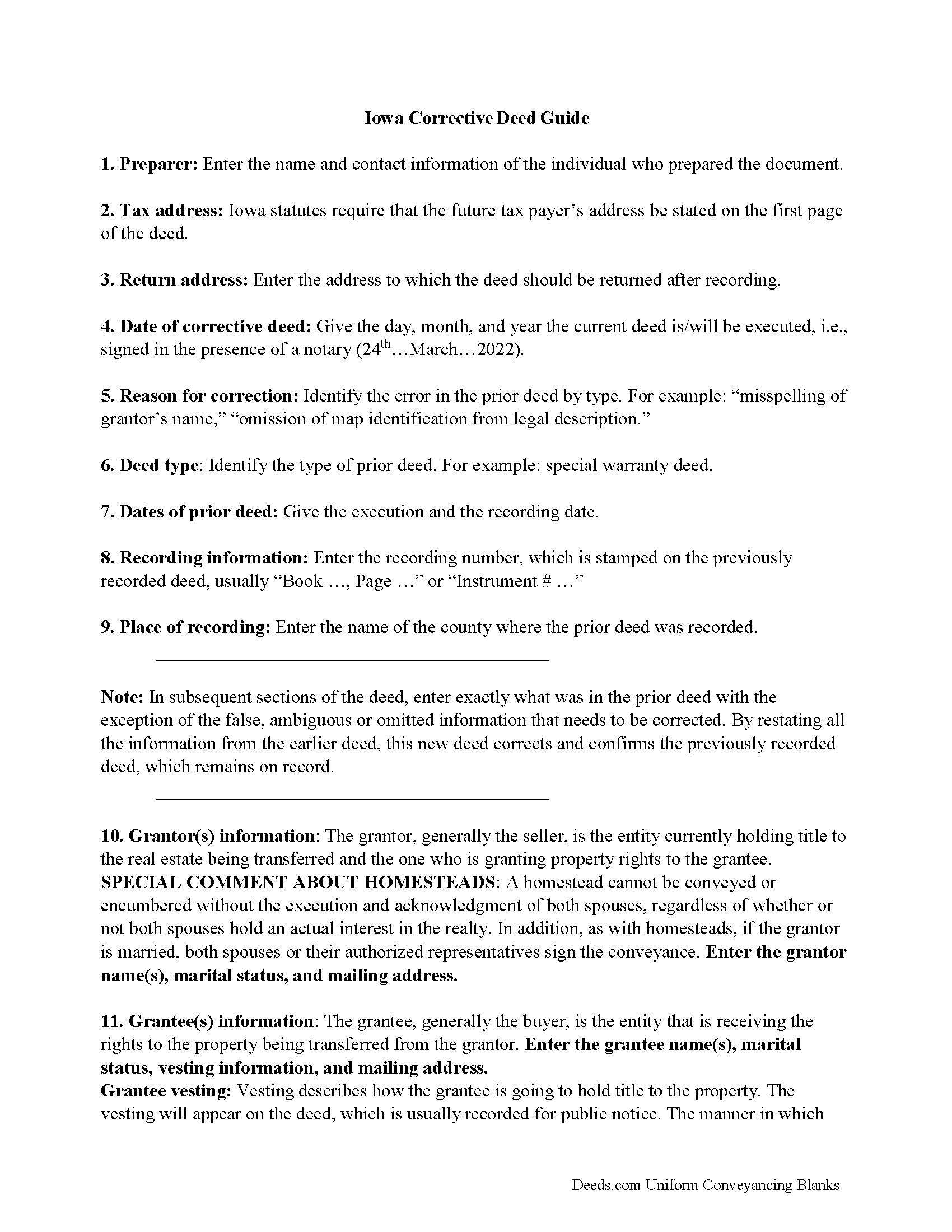

Marshall County Corrective Deed Guide

Line by line guide explaining every blank on the form.

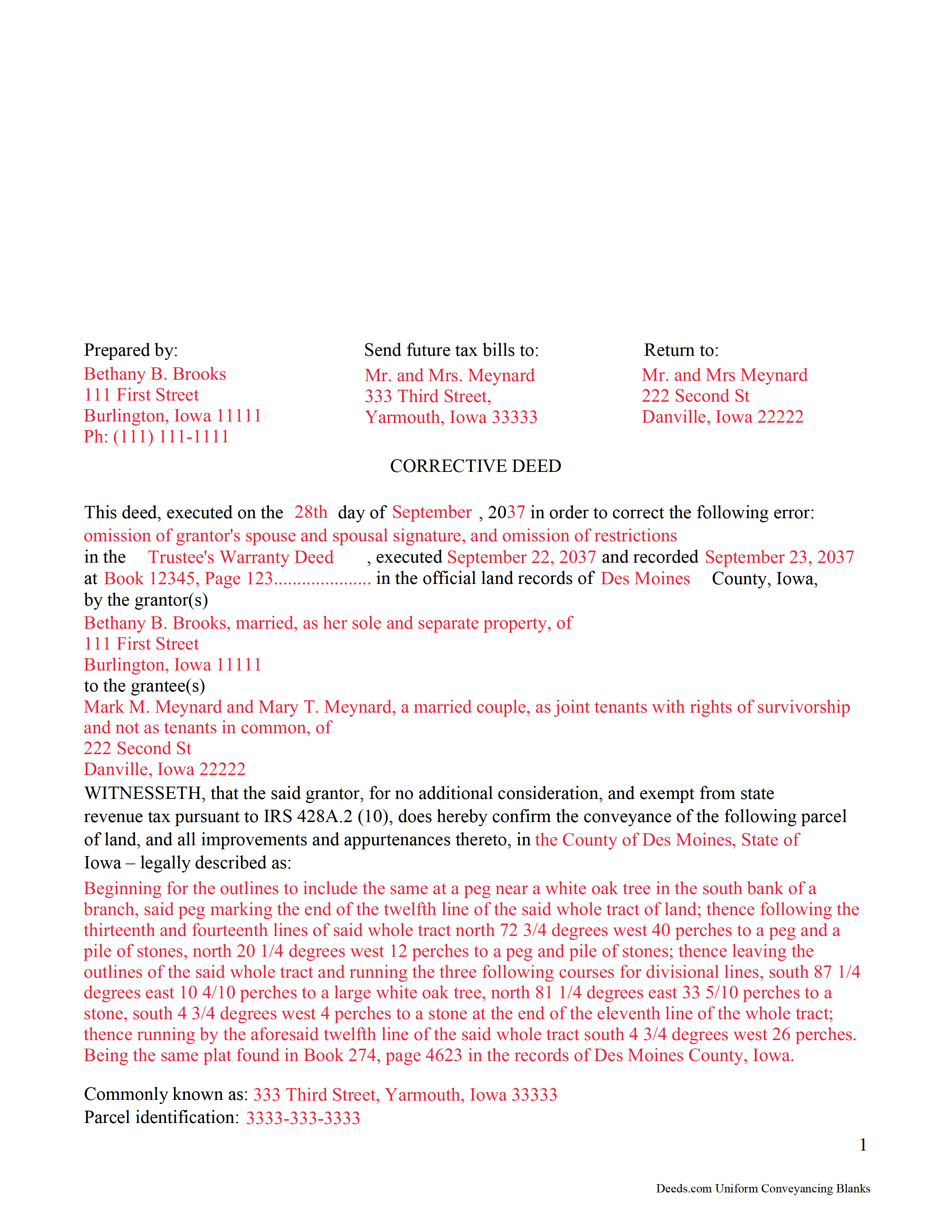

Marshall County Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Recorder

Marshalltown, Iowa 50158

Hours: 8:00 a.m. - 4:30 p.m. Monday - Friday

Phone: (641) 754-6355

Recording Tips for Marshall County:

- Bring your driver's license or state-issued photo ID

- Request a receipt showing your recording numbers

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Albion

- Clemons

- Ferguson

- Gilman

- Haverhill

- Laurel

- Le Grand

- Liscomb

- Marshalltown

- Melbourne

- Rhodes

- Saint Anthony

- State Center

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (641) 754-6355 for current fees.

Questions answered? Let's get started!

In Iowa, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title and, except for the corrected item, reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, which remains on record and receives a cross-reference to the corrective instrument.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing the vesting information or the legal description of the property, may require a new deed of conveyance instead of a correction deed.

Correction deeds are exempt from state revenue tax pursuant to IRS 428A.2 (10) that exempts "deeds which, without additional consideration, confirm, correct, modify, or supplement a deed previously recorded." The exemption needs to be identified on the deed itself, or the declaration of value form must be submitted with the deed.

(Iowa Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

DAVID K.

April 6th, 2019

Already gave a review Great site and help

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth L.

November 5th, 2019

Used this site and the forms a few times now and always a good experience. It's so nice to be able to download these forms to my computer and work on them there. So many others want you to do everything online, pain in my opinion. Thank you Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

David T.

September 6th, 2022

This is a great service and terrific value. The form package provided (blank form, example form & set of instructions) was clear and easy to follow. Being able to complete the forms using the computer to insert the needed information saved countless hours. My completed form was accepted by the Clerk & Recorder office without any issue. Well worth the investment

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Doreen A.

February 13th, 2024

Easy to navigate Efficient Service

Your kind words warm our hearts. Thank you for sharing your experience!

NANETTE G.

March 6th, 2021

I was so Happy to find a website that had deeds for property, reasonable price, helpful directions for diy flling out the deed info, no surprise hidden fees at checkout...what a relief. Saved hundreds because I can do it myself! Great service here!!

Thank you for your feedback. We really appreciate it. Have a great day!

Johnnie W.

June 26th, 2023

Five stars for quick retrieval/no hassle of forms. Will review them again once I have completed the forms and they have been accepted.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

November 5th, 2019

Site was easy to understand and use. Service was prompt. Good job Montgomery County!

Thank you!

Christian M.

June 11th, 2019

Easy to find the necessary documents needed

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael T.

January 29th, 2021

Very easy to find what I was looking for and the cost was reasonable. The documents saved me a lot of time and were easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Allan A.

June 5th, 2020

Excellent service, communication and done in a timely fashion. Worth the cost for the convenience and safety

Thank you!

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Gloria R.

September 12th, 2023

The website was easy.

Thank you!

Eva L.

June 19th, 2020

So far so good! I haven't had an opportunity to populate the forms but they seem to be very easy to do. The sample deed serves very well. Ordering the forms were very easy, I was impressed with the ease of doing so.

Thank you!

Conrad R.

January 28th, 2023

Easy to obtain form, easy to use. Came with instrucions and references to state statutes. Very Helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!