Fayette County Court Officer Deed Form

Fayette County Court Officer Deed Form

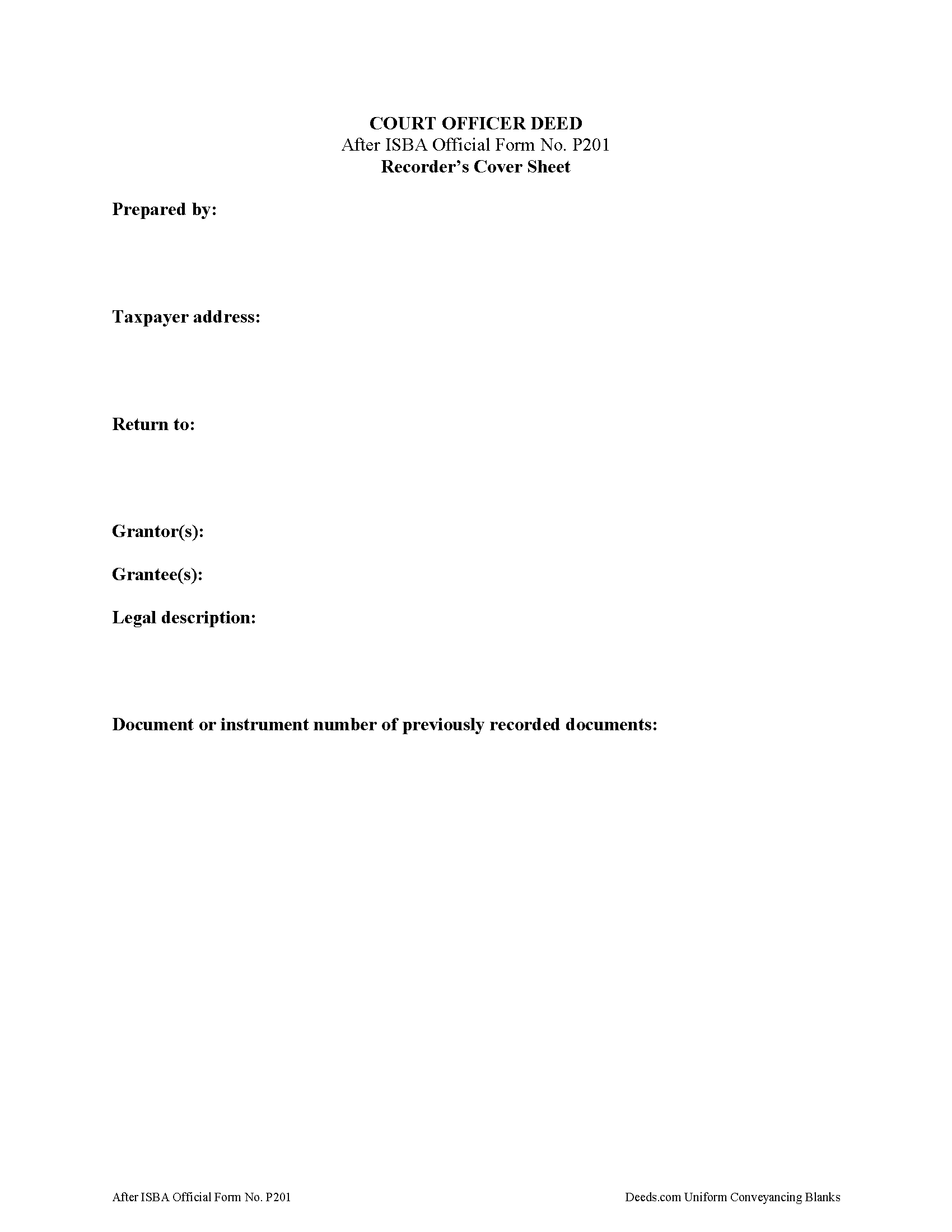

Fill in the blank form formatted to comply with all recording and content requirements.

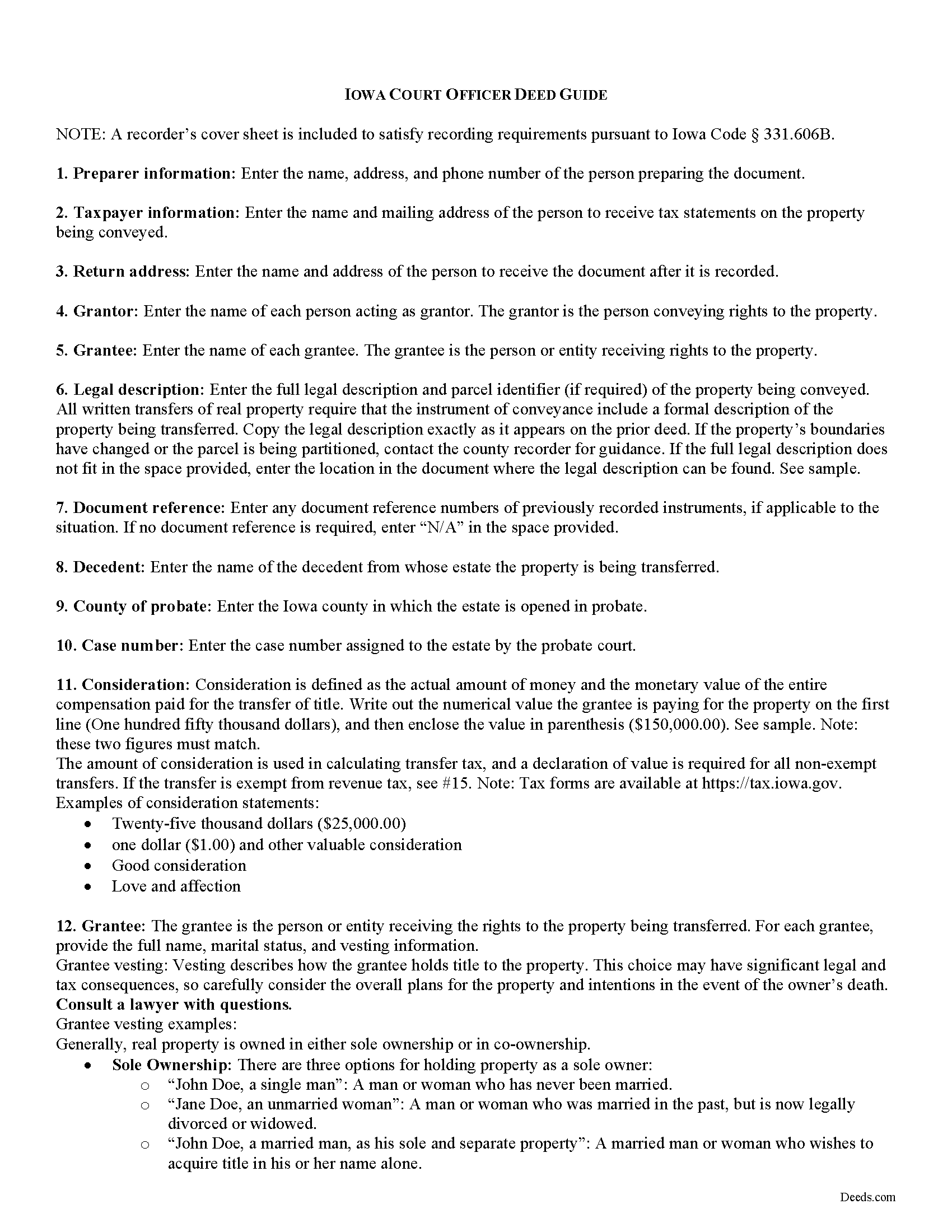

Fayette County Court Officer Deed Guide

Line by line guide explaining every blank on the form.

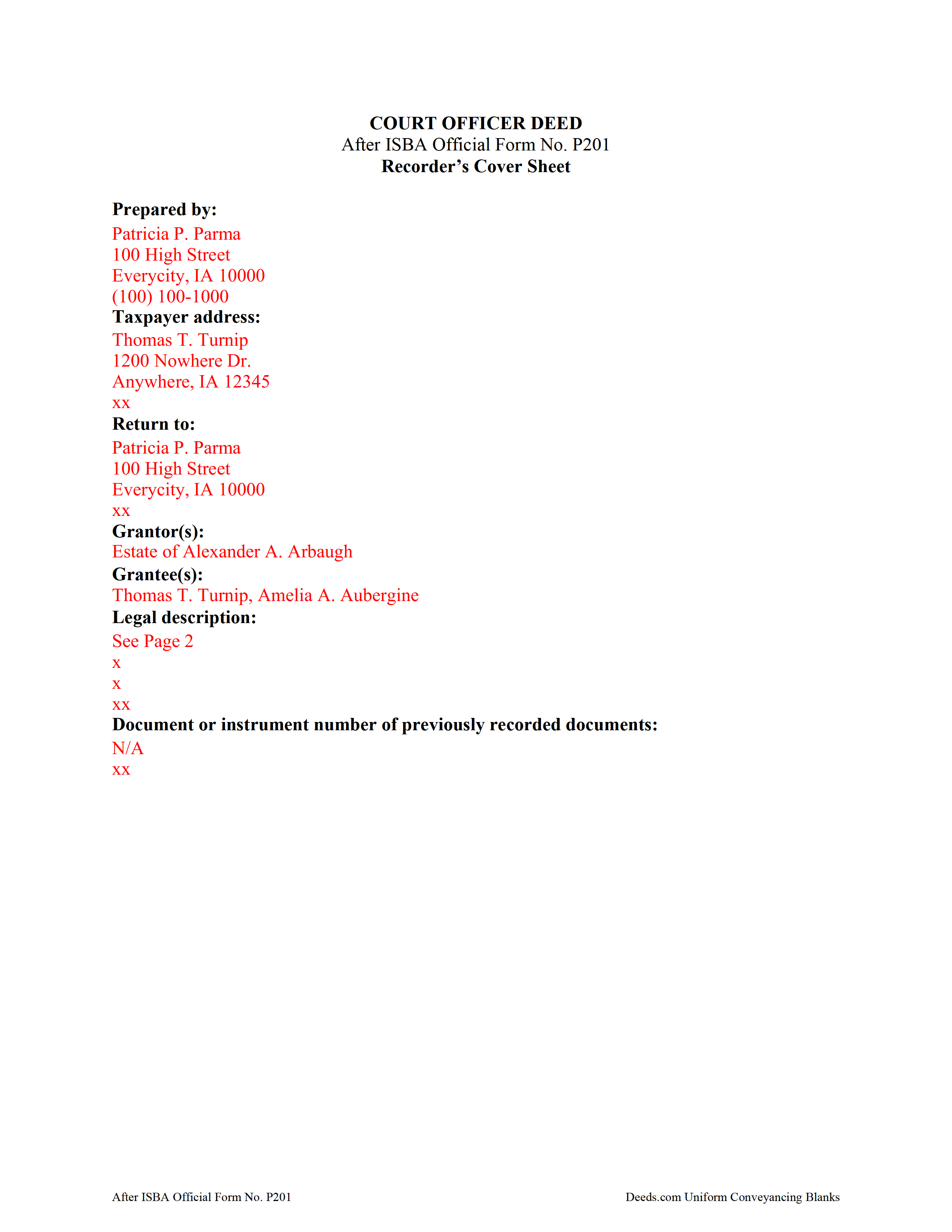

Fayette County Completed Example of the Court Officer Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Fayette County documents included at no extra charge:

Where to Record Your Documents

Fayette County Recorder

West Union, Iowa 52175

Hours: 8:00 to 4:00 Monday through Friday

Phone: (563) 422-3687

Recording Tips for Fayette County:

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Fayette County

Properties in any of these areas use Fayette County forms:

- Arlington

- Clermont

- Elgin

- Fayette

- Hawkeye

- Maynard

- Oelwein

- Oran

- Randalia

- Saint Lucas

- Wadena

- Waucoma

- West Union

- Westgate

Hours, fees, requirements, and more for Fayette County

How do I get my forms?

Forms are available for immediate download after payment. The Fayette County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fayette County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fayette County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fayette County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fayette County?

Recording fees in Fayette County vary. Contact the recorder's office at (563) 422-3687 for current fees.

Questions answered? Let's get started!

When a property owner dies in Iowa, title to his or her real property passes by means of the decedent's will, or, in the absence of a will, via the laws of intestate succession established in the probate code, codified at chapter 633 of the Iowa Code.

Probate is the court procedure through which a decedent's will is proved and his or her estate is settled. The probate process takes place in the county in which the decedent was domiciled at the time of his or her death.

Pursuant to designation in the decedent's will or priority to administer the decedent's estate, as established by Iowa Code 633.227, the court appoints a personal representative (PR) who will oversee the estate's administration. The PR is either called an executor, when named by a decedent's will, or an administrator, in the absence of a will or lack of designation in a will. Regardless, the fiduciary duties of the personal representative remain the same, including marshalling the decedent's assets, paying debts and valid claims on the estate, and distributing the remainder of the estate to beneficiaries.

Title to real property that does not transfer outside of the probate process by means of a survivorship interest or trust must pass by means of a deed. Depending on the situation, a PR may be directed by the terms of a will to sell real property, or might need to consolidate the estate by selling property. The PR will need to petition the court for an order of sale if a power of sale is not set forth in a will. In Iowa, PRs use a court officer deed to transfer property from a decedent's estate to a distributee or purchaser.

A court officer's deed must meet all state and local standards, and might also require additional supporting documentation. The completed deed is executed and signed by the PR of the decedent's estate and recorded in the office of the recorder of land records in the county where the subject real property is situated. Iowa requires additional documentation when recording land records, including a Ground Water Hazard Statement (GWHS) and a Declaration of Value (DOV), unless a revenue tax exemption is claimed on the face of the conveyancing document.

As always, consult a lawyer with any questions regarding estate administration and court officer deeds in Iowa.

(Iowa Court Officer Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Fayette County to use these forms. Documents should be recorded at the office below.

This Court Officer Deed meets all recording requirements specific to Fayette County.

Our Promise

The documents you receive here will meet, or exceed, the Fayette County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fayette County Court Officer Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Kellie Z.

December 4th, 2020

Wow! So much simpler & faster than I had expected. I had thought it would take weeks to get filed & took days- yea! Super easy & speedy!

Thank you!

Marilyn J.

July 18th, 2020

Just what I needed!

Thank you!

VICTOR S.

November 16th, 2019

Wow! Nice and easy!

Thank you!

Maria M.

August 30th, 2021

EASY, PAINLESS, LOVED THE USER FRIENDLY INSTRUCTIONS

Thank you for your feedback. We really appreciate it. Have a great day!

Mary D.

January 21st, 2022

Gift Deed is exactly what was required. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen B.

May 9th, 2020

They have been fabulous not only for getting me the Title and Property info I needed quickly, but also for determining which Deed (of many) that I actually needed. They are an outstanding resource for any real estate investor, property owner, Realtor, or attorney.

Thank you for your feedback. We really appreciate it. Have a great day!

RUTH A.

October 25th, 2024

I am so very thankful for the service that you provide for the public, thank you very much.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Amber H.

January 31st, 2019

after typing in the information, the printing is not in alignment - looks disorganized on the page and hard to read

Thank you for your feedback. We will flag the document for review.

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen M.

September 23rd, 2021

I'm not too bright. Ordered one thing when I wanted something else. Deeds staff fixed it for me.

Glad we could help.

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norman K.

March 2nd, 2021

It wasn't really what I needed I read and read and read and read and I thought I was to do with for filing for probate or probate executor but instead it was for the property if you are executor and but it wasn't very clear on that so it didn't work for me so I was kind of wasted money

Sorry to hear that Norman. We've gone ahead and canceled your order and payment.

Nancy H.

December 31st, 2018

Site was excellent and saved a trip to the County office to pick up forms.

Thank you Nancy. Glad we could help. Have a great day!

Suhila C.

August 23rd, 2020

This site is awesome. It has everything I need to purchase and sell (transfer deed ownership) land and property. I cannot wait to get our new land and building for business. Thanks, Suhila

We appreciate your business and value your feedback. Thank you. Have a wonderful day!