Howard County Quitclaim Deed Form (Iowa)

All Howard County specific forms and documents listed below are included in your immediate download package:

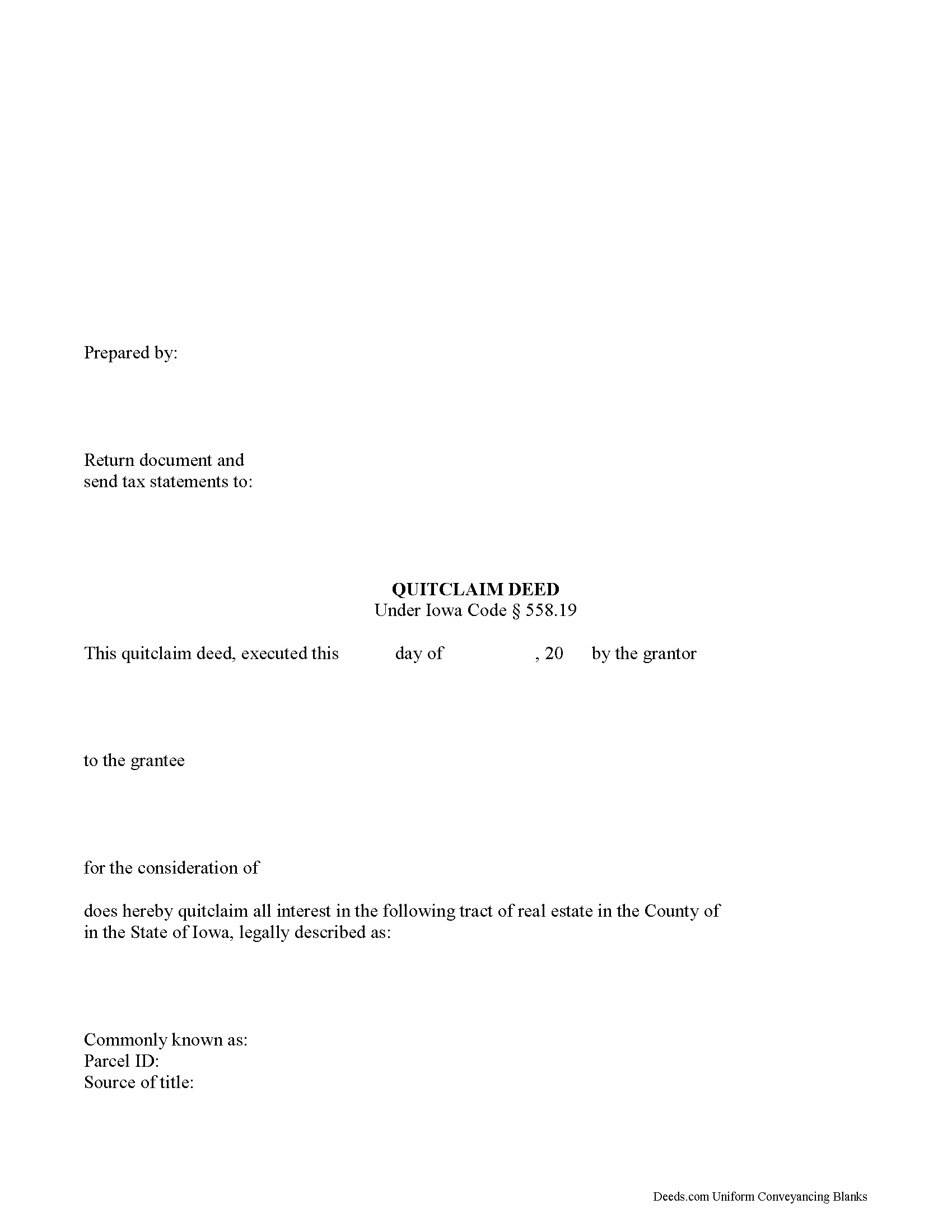

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Iowa recording and content requirements.

Included Howard County compliant document last validated/updated 5/13/2025

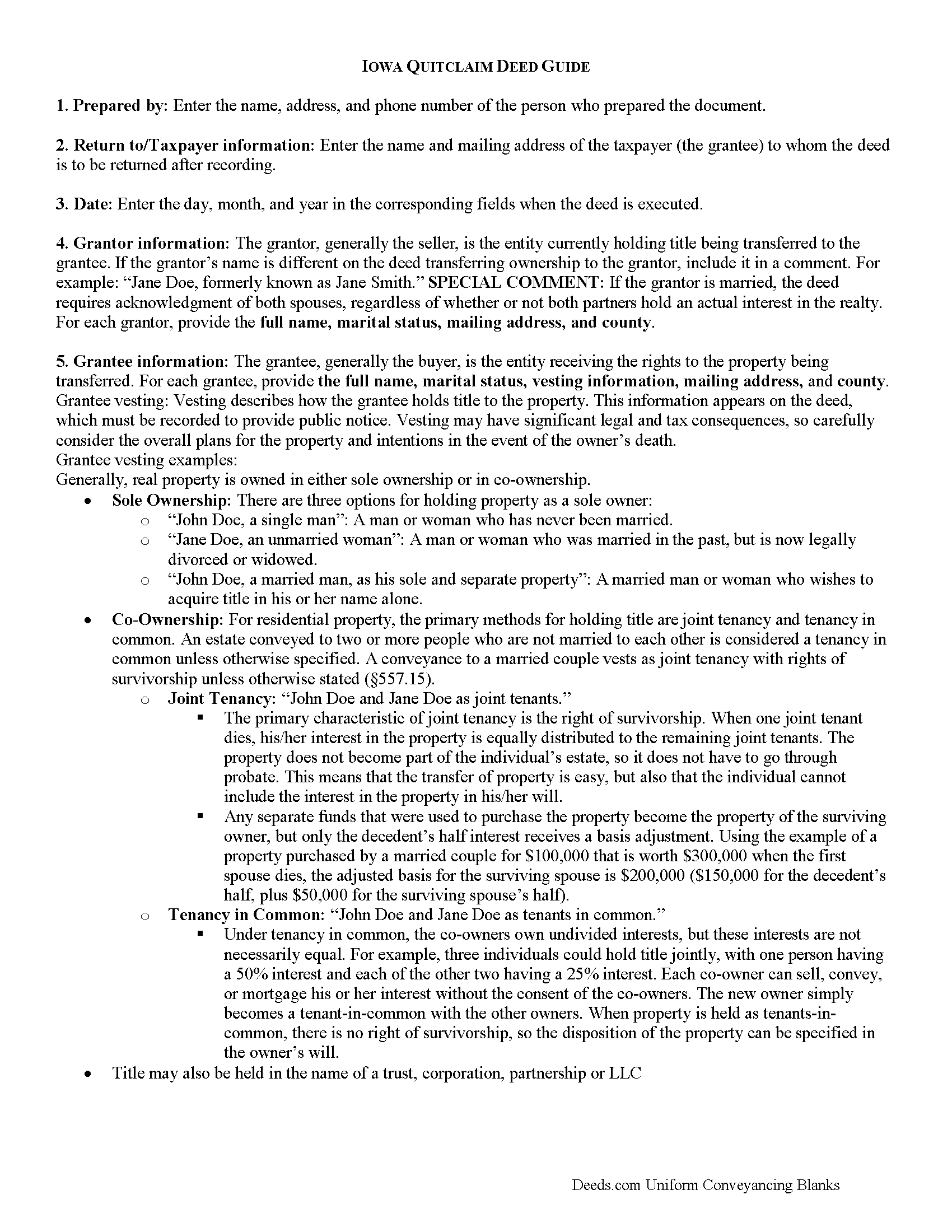

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Howard County compliant document last validated/updated 5/5/2025

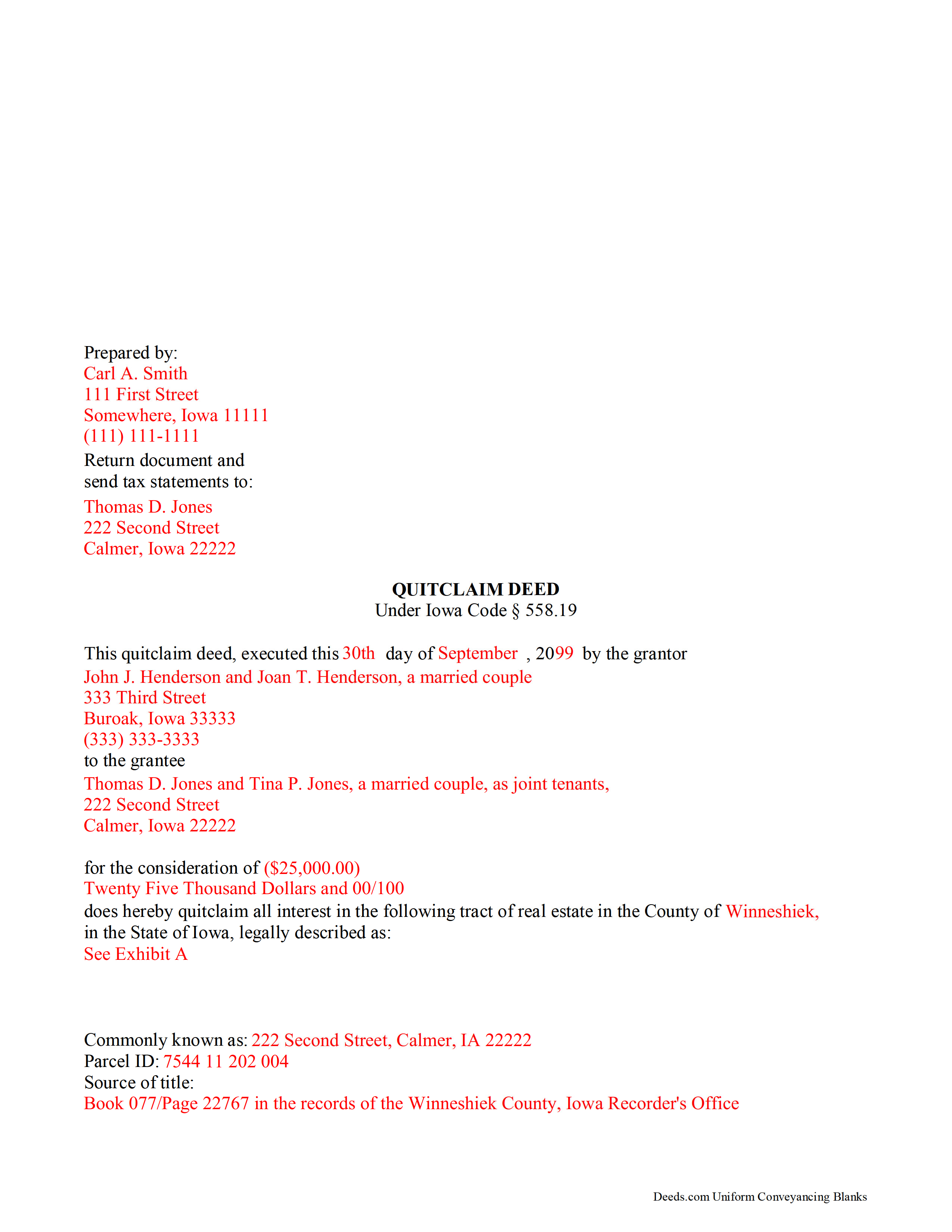

Completed Example of the Quitclaim Deed Document

Example of a properly completed Iowa Quitclaim Deed document for reference.

Included Howard County compliant document last validated/updated 3/18/2025

The following Iowa and Howard County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Howard County. The executed documents should then be recorded in the following office:

Howard County Recorder

Howard County Courthouse 137 N. Elm ST., Cresco, Iowa 52136

Hours: 8:00am to 4:30pm.Monday through Friday

Phone: 563-547-9210

Local jurisdictions located in Howard County include:

- Chester

- Cresco

- Elma

- Lime Springs

- Protivin

- Riceville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Howard County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Howard County using our eRecording service.

Are these forms guaranteed to be recordable in Howard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Howard County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Howard County that you need to transfer you would only need to order our forms once for all of your properties in Howard County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Iowa or Howard County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Howard County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Iowa Code 558.19 provides the statutory form of a quitclaim deed. The minimum statutory contents are the names and addresses of all grantors and grantees, the consideration (usually money), and a complete legal description of the property. 561.13 adds the requirement for both spouses' signatures when conveying a property identified as a homestead, regardless of whether or not both have an ownership interest in the land. The grantor must sign the deed and all signatures must have the signor's name typed or printed underneath, and be acknowledged by a notary or other court-authorized individual. 331.606B lists the information that must be on the first page of every document submitted for recording. These include the name, address, and telephone number of the individual who prepared the quit claim deed, the name and address of the person to whom future tax statements should be mailed, a return address for use after recording, the title of the instrument (in this case, "Quitclaim Deed"), tax parcel ID, and a document number or book/page information for the conveyance that transferred the land to the grantor.

Recording:

Iowa Code 331.606B lists the statutory document formatting standards.

* The pages should not be permanently bound or connected to each other. Do not clip or attach anything to pages.

* Use minimum 10-point text in permanent black ink for all printing.

* Print all documents on minimum 20-pound weight, plain, white paper.

* All signatures should be original, and in permanent dark blue or black ink.

* Format the first page with a three-inch top margin, with " margins on the left, right, and bottom. All other pages should have " margins all around.

Iowa follows a "notice" recording statute, which is defined in Iowa Code 558.41. The statute states, in part, that an "instrument affecting real estate is of no validity against subsequent purchasers for a valuable consideration, without notice . . . , unless the instrument is filed and recorded in the county in which the real estate is located." 558.11 identifies the index of deeds, in which correctly recorded conveyances are listed, and which serves as formal constructive notice. So, a "notice" recording statute basically invalidates unrecorded deeds. For example, the grantor quit claims his/her interest in the property to grantee A for value, who fails to record the deed, and the grantor then quit claims the same property to grantee B for value, who records as directed by the statute. In most cases, grantee B retains ownership of the real estate. In short, recording the quit claim deed as soon as possible after it's executed is a simple and effective way to preserve everyone's interests.

(Iowa Quitclaim Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Howard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Howard County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory C.

March 17th, 2022

All of these forms should be downloadable in .zip format - having to do 8-9 downloads is ridiculous, respectfully.

Thank you for your feedback. We really appreciate it. Have a great day!

David Y.

March 10th, 2020

Really great forms. Did the quitclaim, everything was perfect, recorded with no problems at all. Thanks!

Thank you!

Andrew F.

May 25th, 2020

Must admit, I have not really had the chance to search site. Seems to be able to provide good info.

Thank you!

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

April K.

October 27th, 2020

Thank you so much! Quick and easy. Received it in under 5 minutes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

harriet l.

June 21st, 2019

Worked very smoothly and got the job done

Thank you for your feedback. We really appreciate it. Have a great day!

Kelli W.

October 5th, 2022

Fantastic documents! Easy to complete, looked great after I filled them in and printed them. No problems with the notary or recorder (recorder clerk actually said they see deeds.com documents all the time and they love em cause it makes their job easier). Highly recommend!!

Thank you for your feedback. We really appreciate it. Have a great day!

Evelia G.

January 4th, 2019

I love this guide. Thank you for having this available.

Thanks so much for your feedback Evelia, have a fantastic day!

LORIN C.

April 24th, 2019

This site and service is the best and most easily navigated that I've seen; I'm 80.....and I need...EASY!

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine O.

February 23rd, 2021

Love the fact that you can buy a form instead of a subscription. I would highly recommend this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Lois B.

December 13th, 2018

It works pretty well, had trouble with the word December. It printed out Decedmber with weird spacing but I think it will be ok.

Thank you for the feedback. We will take a look at the date field to see if there are any issues. Have a great day!