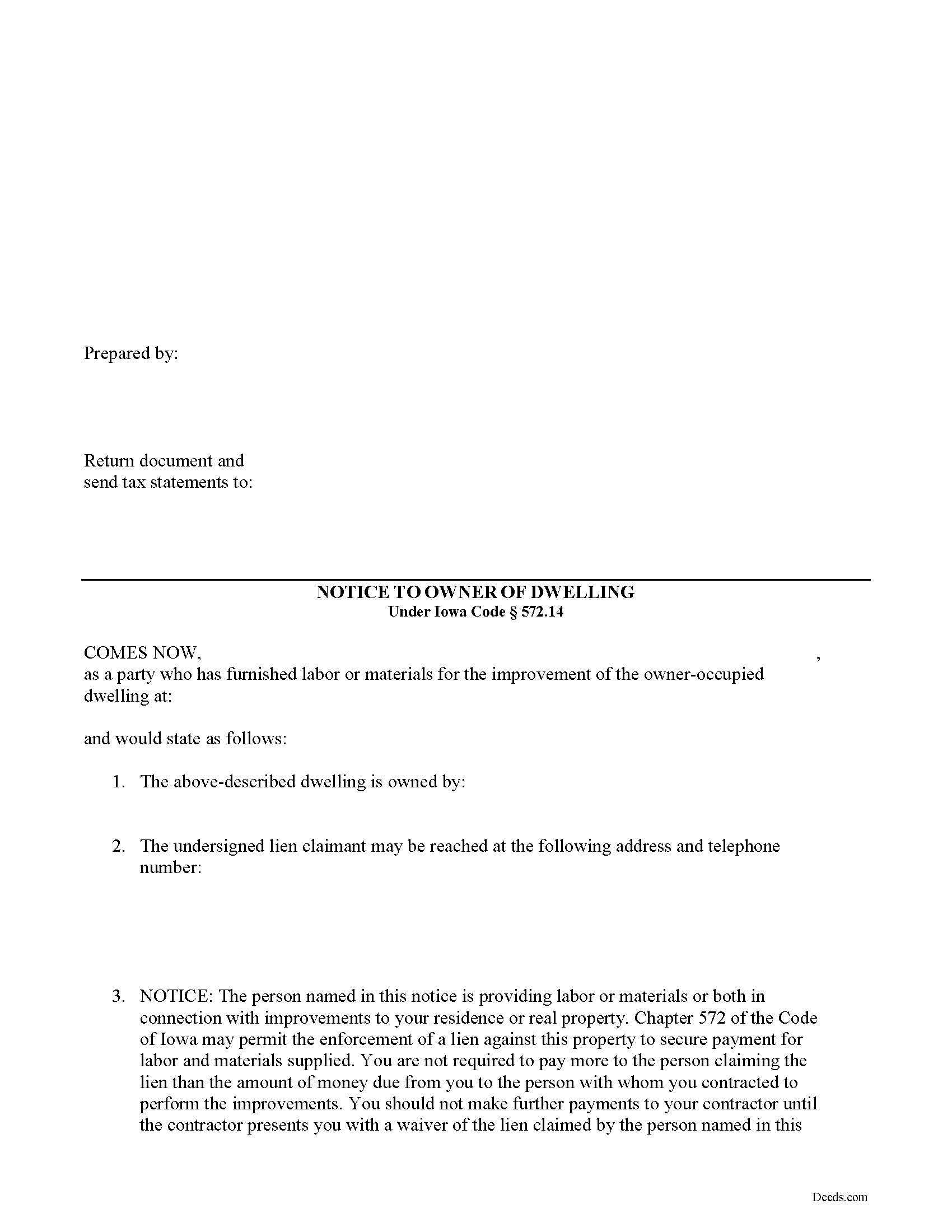

Marshall County Subcontractor Notice to Owner Form

Marshall County Subcontractor Notice to Owner Form

Fill in the blank Subcontractor Notice to Owner form formatted to comply with all Iowa recording and content requirements.

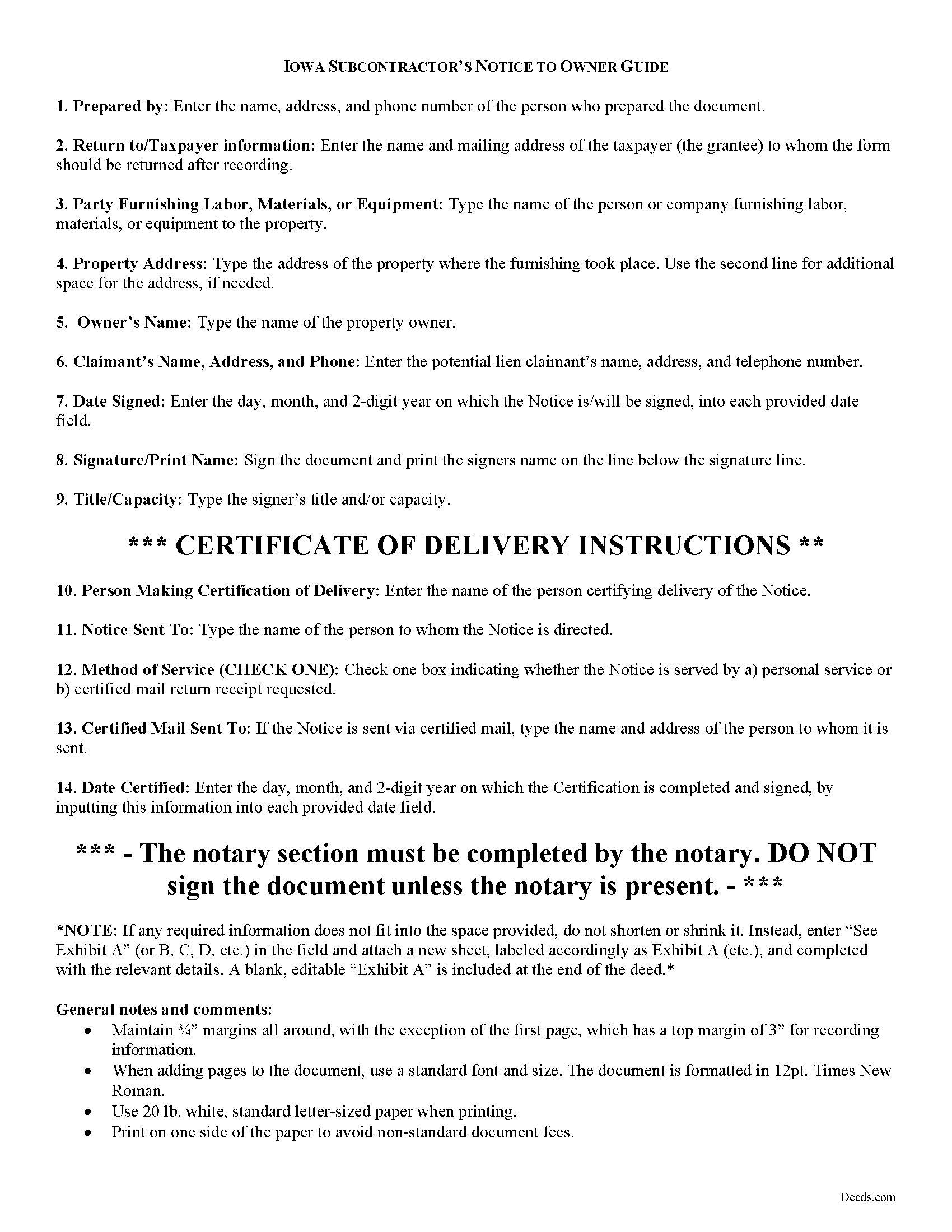

Marshall County Subcontractor Notice to Owner Guide

Line by line guide explaining every blank on the form.

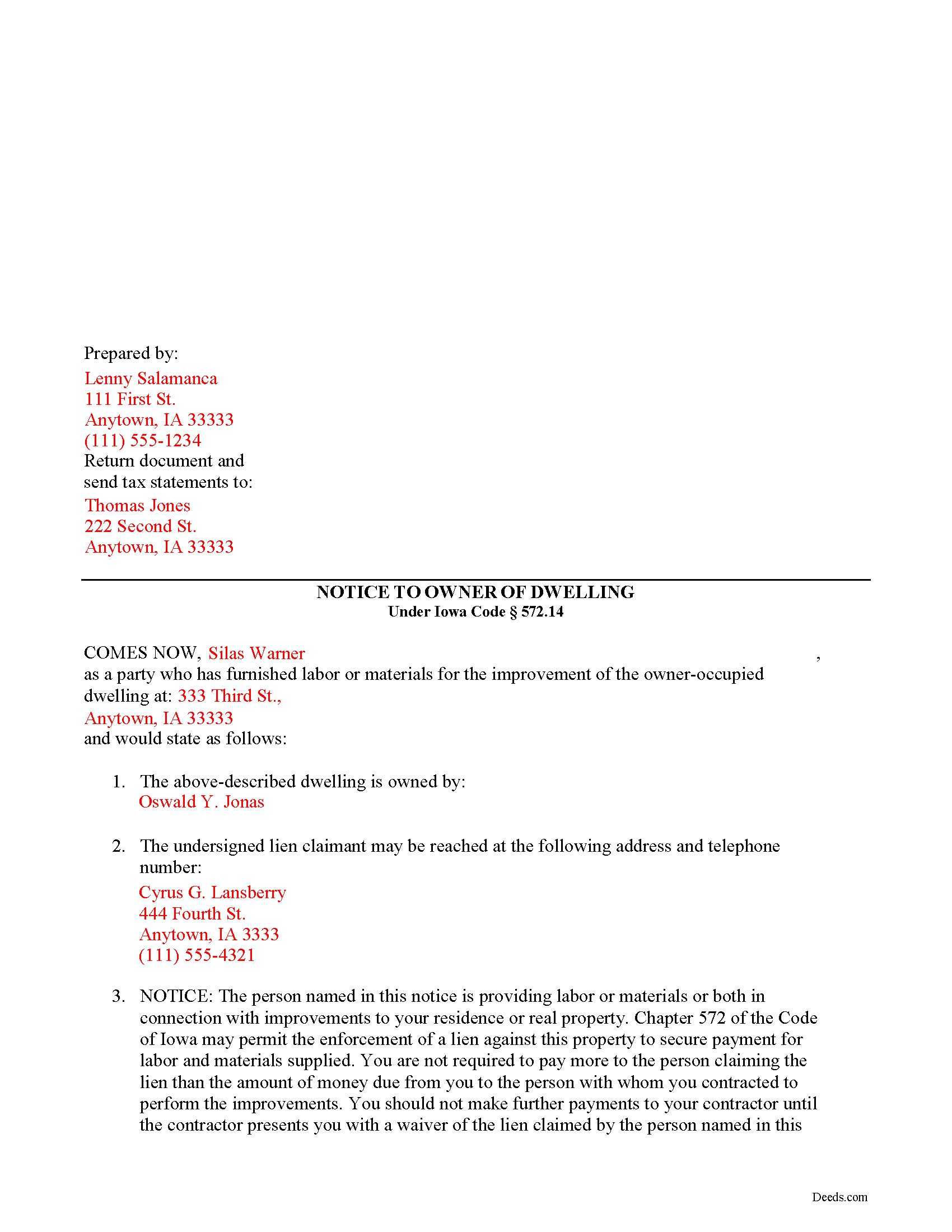

Marshall County Completed Example of the Subcontractor Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Recorder

Marshalltown, Iowa 50158

Hours: 8:00 a.m. - 4:30 p.m. Monday - Friday

Phone: (641) 754-6355

Recording Tips for Marshall County:

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Albion

- Clemons

- Ferguson

- Gilman

- Haverhill

- Laurel

- Le Grand

- Liscomb

- Marshalltown

- Melbourne

- Rhodes

- Saint Anthony

- State Center

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (641) 754-6355 for current fees.

Questions answered? Let's get started!

Subcontractors on a construction job occasionally need to fight for payment from the prime contractor. Many property owners are unaware of the participation of lower-tiered contractors on the job. These subcontractors can claim mechanic's lien rights against the property owner even if the owner paid the contractor in full. However, this right only exists if the owner is served proper notice. In turn, after receiving the notice, the owner can rightfully withhold payment from the contractor to ensure these other parties are paid as to avoid any liens against the owner.

A payment to the original contractor by the owner of any part or all of the contract price of the building or improvement within ninety (90) days after the date on which the last of the materials was furnished or the last of the labor was performed by a subcontractor, does not relieve the owner from liability to the subcontractor for the full value of any material furnished or labor performed upon the building, land, or improvement if the subcontractor files a lien within ninety (90) days after the date on which the last of the materials was furnished or the last of the labor was performed. I.C. 572.14(1).

In the case of an owner-occupied dwelling, a mechanic's lien is enforceable only to the extent of the balance due the principal contractor by the owner-occupant prior to the owner-occupant being served with the notice specified in subsection. I.C. 572.14(2).

This notice may be served by delivering it to the owner or the owner's spouse personally, or by mailing it to the owner by certified mail with restricted delivery and return receipt to the person mailing the notice, or by personal service as provided in the rules of civil procedure. Id.

The Notice to Owner contains: 1) the name of the owner, 2) the address of the property charged with the lien, 3) the name, address and telephone number of the lien claimant, and 4) a statement that the individual serving the Notice may have lien rights. I.C. 572.14(3).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Subcontractor Notice to Owner meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Subcontractor Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

SHANE P.

March 26th, 2021

Easy to use.

Thank you!

Kristen N.

October 3rd, 2023

Very easy to use, helpful instructions and examples. I also like the chat feature and the erecording. So much better than other DIY law websites out there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

suzanne m.

April 9th, 2020

Finding what I needed was quick and easy.

Thank you!

Steve R.

June 17th, 2023

Hopefully filling out and filing the paperwork is as easy as this was.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

ANA I p.

December 14th, 2020

Wow this was nice that I could used the service . Love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!

Jack B.

January 26th, 2020

All worked out well.

Thank you!

Barbara G.

May 12th, 2021

High rating, great site and forms were exactly what I needed. Thanks for being there for me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

June 22nd, 2021

This suited my purposes just fine. Instructions were clear and easy to follow. But,I would like to have had the ability to delete the many extra spaces on the final document ... for readability purposes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry J.

May 20th, 2019

we are hoping this is what we need. Thanks

Thank you!

George A. M.

August 10th, 2022

User friendly and fast to use. I was pleased with experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARK S.

February 28th, 2020

I filed my beneficiary deed today and it went off without a hitch. I really appreciated the guidelines and the example that came with the form The guide lines cleared up some questions I had regarding tenancy by the entirety which I had been trying to figure out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan P.

May 25th, 2021

Very easy to use, responsive help when the document was initially rejected and very fast service (recorded the deed within 24 hours).

Thank you for your feedback. We really appreciate it. Have a great day!

Stephanie G.

February 28th, 2019

Wonderful. Easier to fill out this form than I thought it would be.

Thank you for your feedback. We really appreciate it. Have a great day!