Pratt County Administrator Deed Form

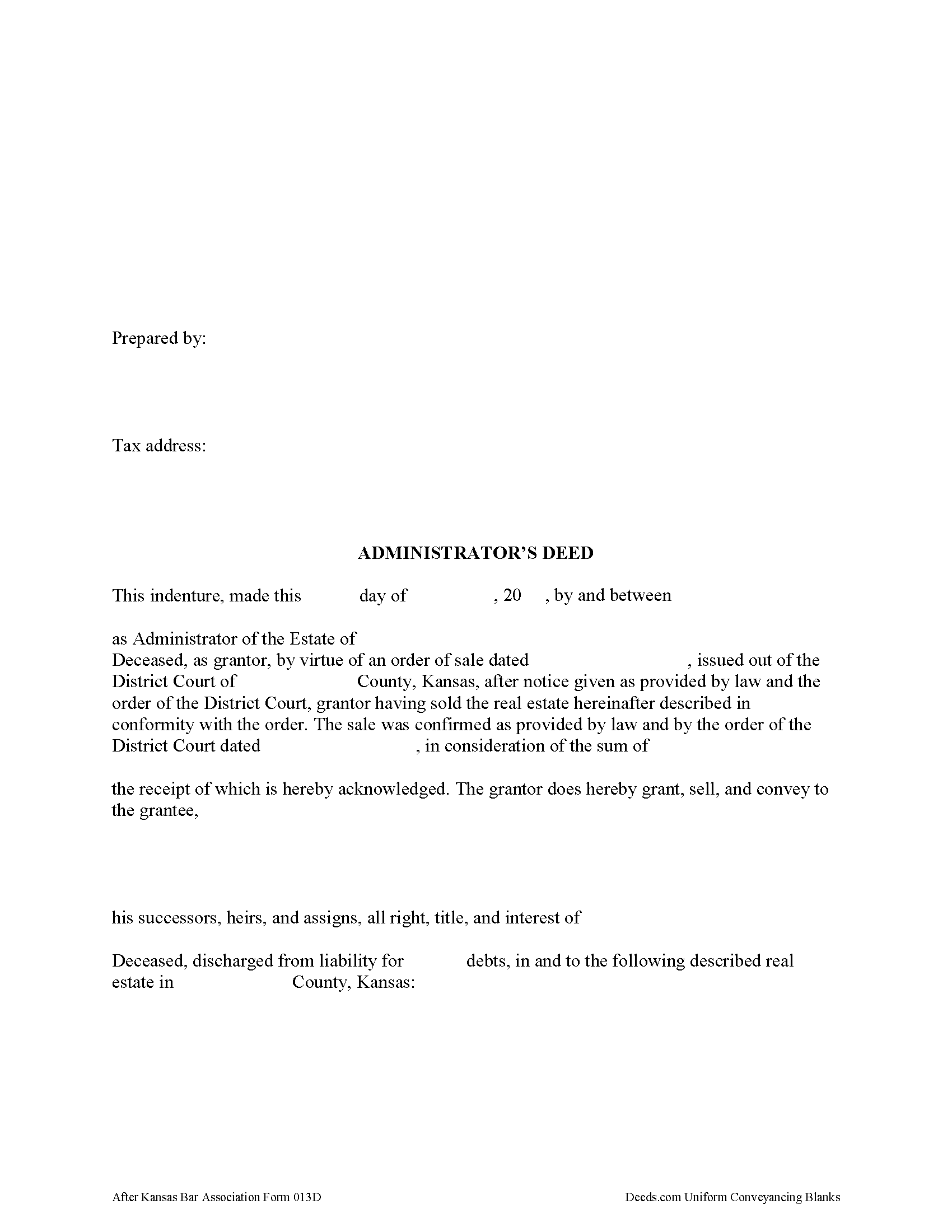

Pratt County Administrator Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

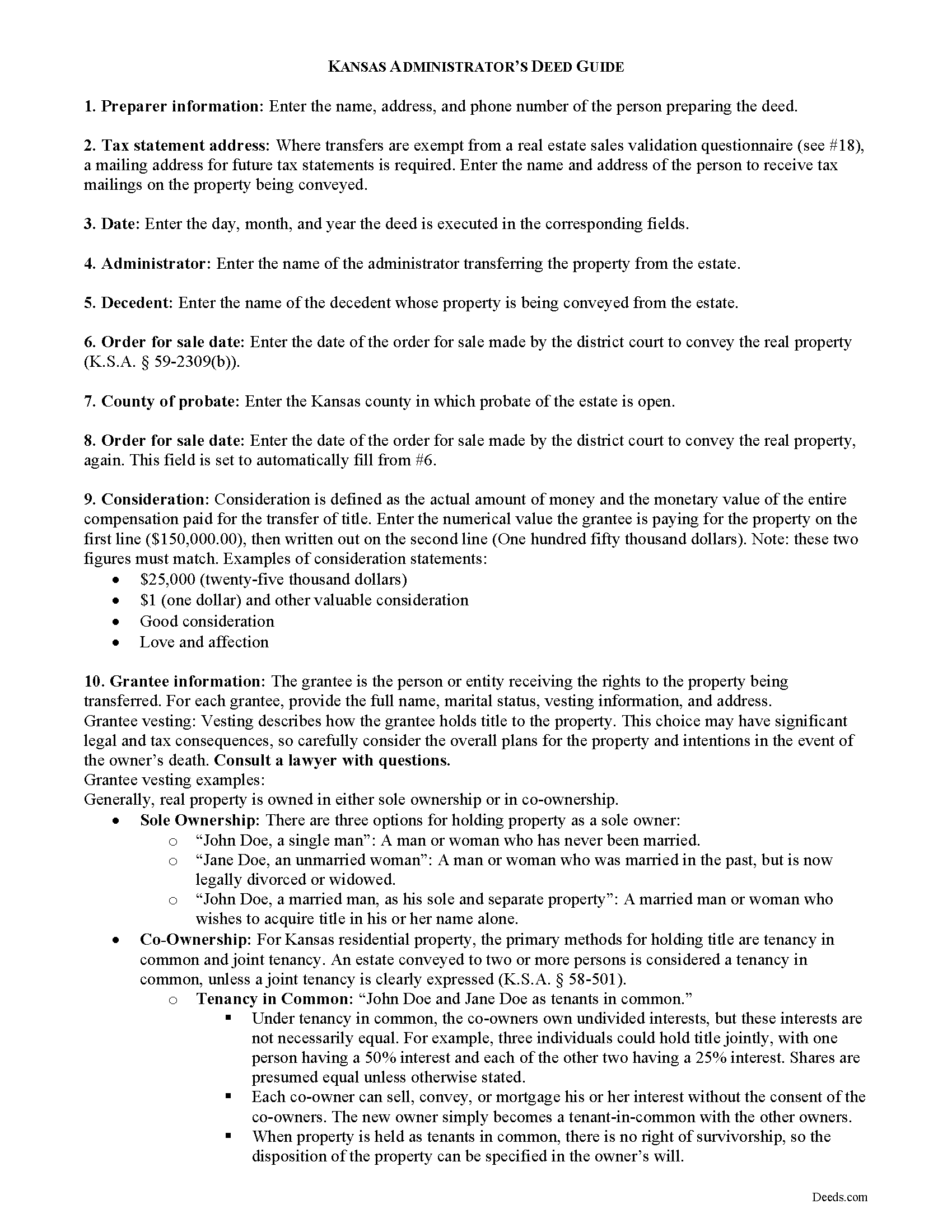

Pratt County Administrator Deed Guide

Line by line guide explaining every blank on the form.

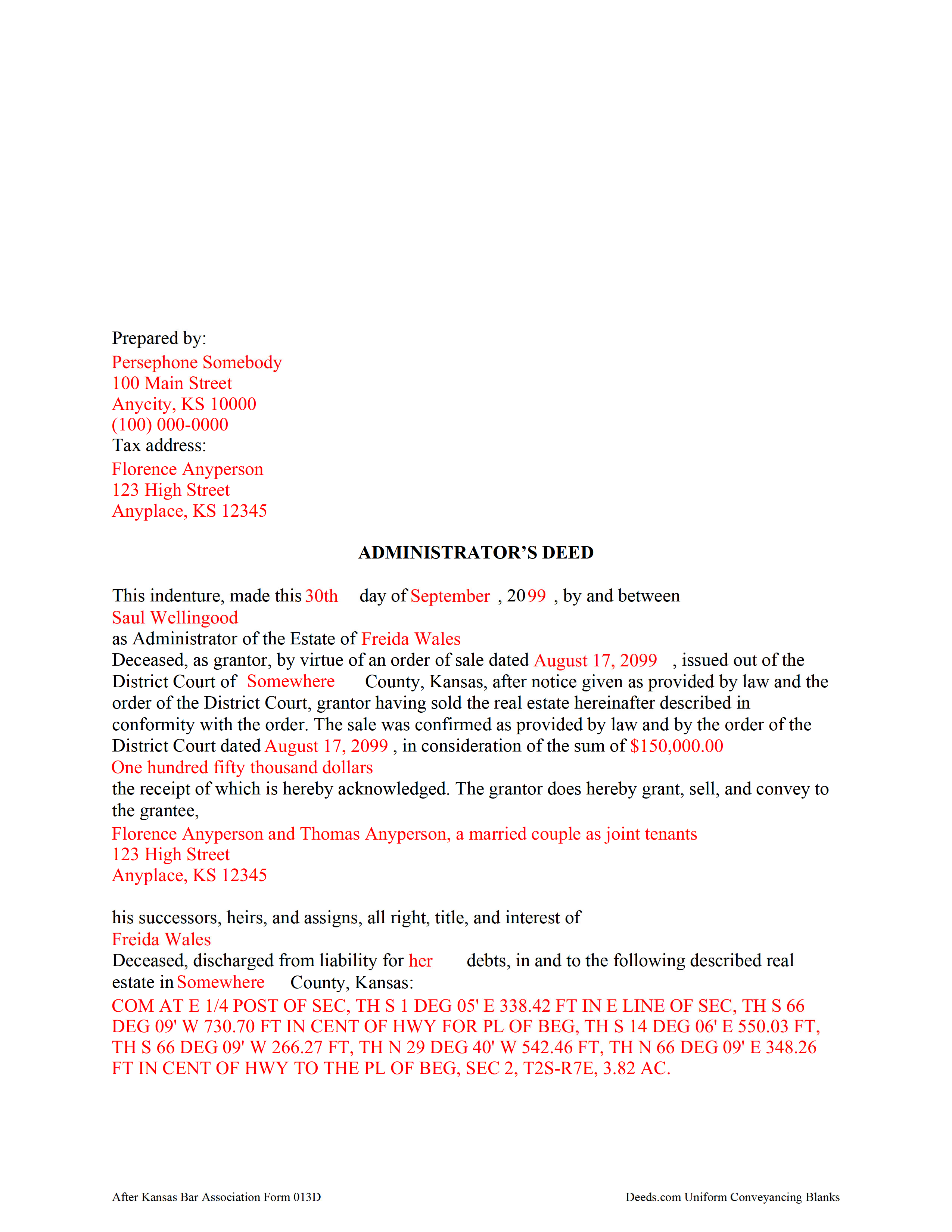

Pratt County Completed Example of the Administrator Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Pratt County documents included at no extra charge:

Where to Record Your Documents

Pratt County Register of Deeds

Pratt, Kansas 67124

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (620) 672-4140

Recording Tips for Pratt County:

- Make copies of your documents before recording - keep originals safe

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Pratt County

Properties in any of these areas use Pratt County forms:

- Byers

- Coats

- Iuka

- Pratt

- Sawyer

Hours, fees, requirements, and more for Pratt County

How do I get my forms?

Forms are available for immediate download after payment. The Pratt County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pratt County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pratt County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pratt County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pratt County?

Recording fees in Pratt County vary. Contact the recorder's office at (620) 672-4140 for current fees.

Questions answered? Let's get started!

When a decedent dies intestate (without a will), fails to designate a personal representative (PR) in his or her will, or the named PR is unable or unwilling to serve, the court appoints a PR called an administrator.

Use an administrator's deed after the district court has issued an order for sale of the subject real property to convey the property from the estate.

The deed must meet all state and local standards for content and form, and includes a recitation of facts concerning the administrator, the decedent, the order for sale, and the subject property being transferred. The PR signs the completed document in the presence of a notary public prior to recording.

Depending on the nature of the transfer, it may require supplemental documentation. Consult a lawyer with questions about estate administration in Kansas.

(Kansas Administrator Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Pratt County to use these forms. Documents should be recorded at the office below.

This Administrator Deed meets all recording requirements specific to Pratt County.

Our Promise

The documents you receive here will meet, or exceed, the Pratt County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pratt County Administrator Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Joseph E.

January 15th, 2023

At first I didn't trust all the 5 star reviews. So, I contacted lawyers to check their prices. The price being well over one hundred dollars made my mind up. I gave it a go, the form isn't hard and the directions are easy to follow. 5/5

Thank you for your feedback. We really appreciate it. Have a great day!

Rhobe M.

May 8th, 2023

Very user friendly site. I was able to get the information I needed fast.

Thank you!

Joe B.

August 29th, 2022

Fantastic service -- very clear

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marsella F.

May 20th, 2021

Thank you so much!! This is a fantastic tool!! Marsella F.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael B.

November 17th, 2020

I'm very pleased with the service provided by Deeds.com. After a format issue caused my scanner, it was a very smooth and speedy process. Highly recommended.

Thank you for your feedback. We really appreciate it. Have a great day!

Robin G.

August 28th, 2020

Easy to navigate! Will use your services again!

Thank you!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Rita M.

January 12th, 2019

Forget what I just wrote! I found it. Thank You! This is a very convenient service.

That's great to hear Rita, thanks for following up.

Lisa G.

January 4th, 2019

Rec'd downloads for quitclaim deed process in Florida. Recorded with the clerk of courts today and the form was done perfectly--she had no changes to make. Well worth the money--thanks

Glad to hear Lisa, we appreciate you taking the time to leave your feedback.

Ebony L.

July 14th, 2022

Very pleased with deeds.com. I highly recommend them to anyone, from clueless beginners like myself to the more advanced. Thank you for simplifying this process.

Thank you for your feedback. We really appreciate it. Have a great day!

Louise D.

October 21st, 2022

It was easy to complete the form and I appreciated the sample form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jany F.

November 8th, 2021

Great and quick service.

Thank you!

Jana H.

December 23rd, 2020

I love this recording service! They are so fast and let me know in advance if they think something is wrong and will be rejected! They are reasonably priced too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn M.

March 31st, 2022

Very helpful and informative. The online site walked you through step by step and if you had a question, which I did, I called with my question. Thanks again.

Thank you!

Scott W.

April 8th, 2024

Finding and downloading necessary forms, and especially the example forms, were tremendously easy and trouble free, and the fact the forms were updated recently was a big selling point. If other forms are needed, this is were I'm coming.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!