Barton County Contract for Deed Form

Barton County Contract for Deed Form

Fill in the blank Contract for Deed form formatted to comply with all Kansas recording and content requirements.

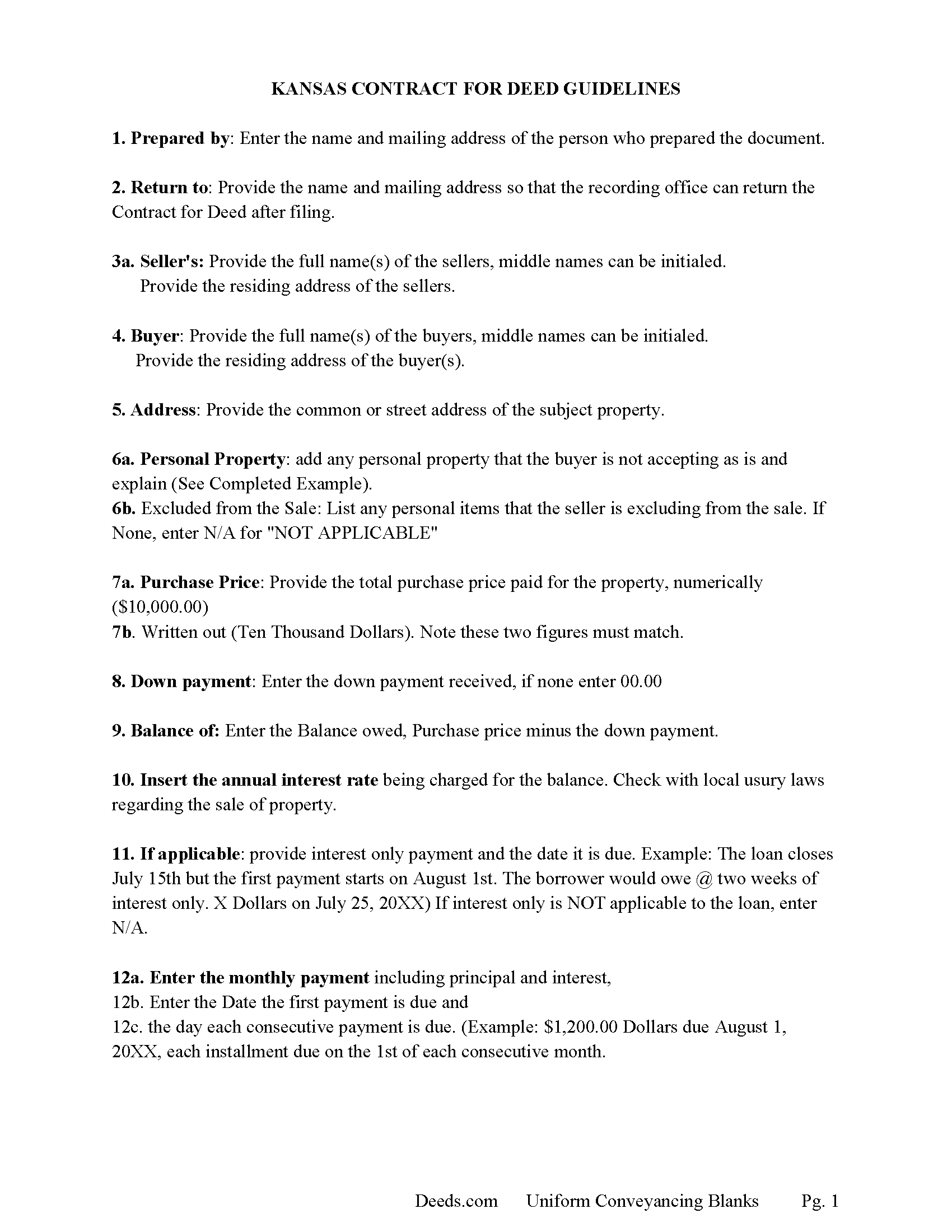

Barton County Contract for Deed Guide

Line by line guide explaining every blank on the Contract for Deed form.

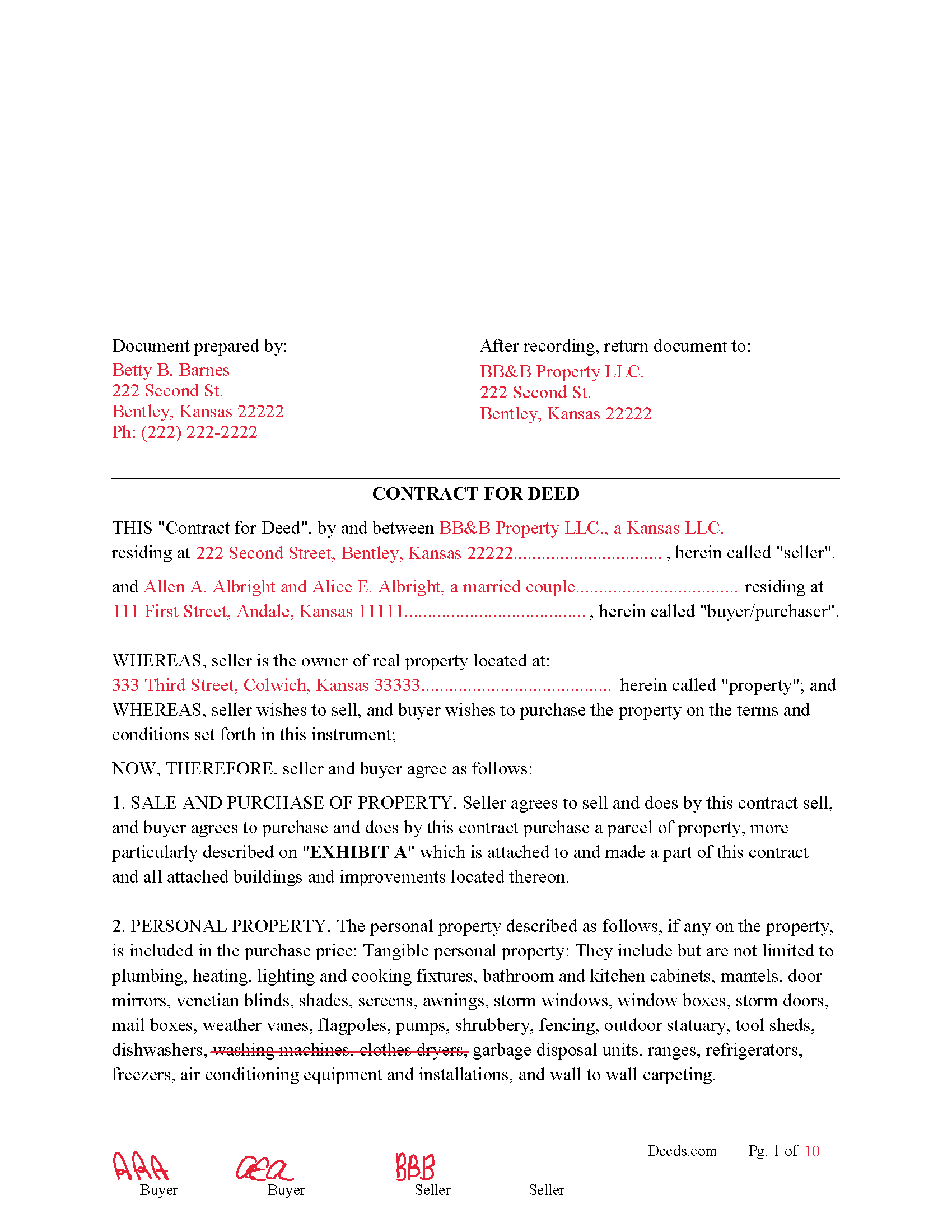

Barton County Completed Example of the Contract for Deed Document

Example of a properly completed Kansas Contract for Deed document for reference.

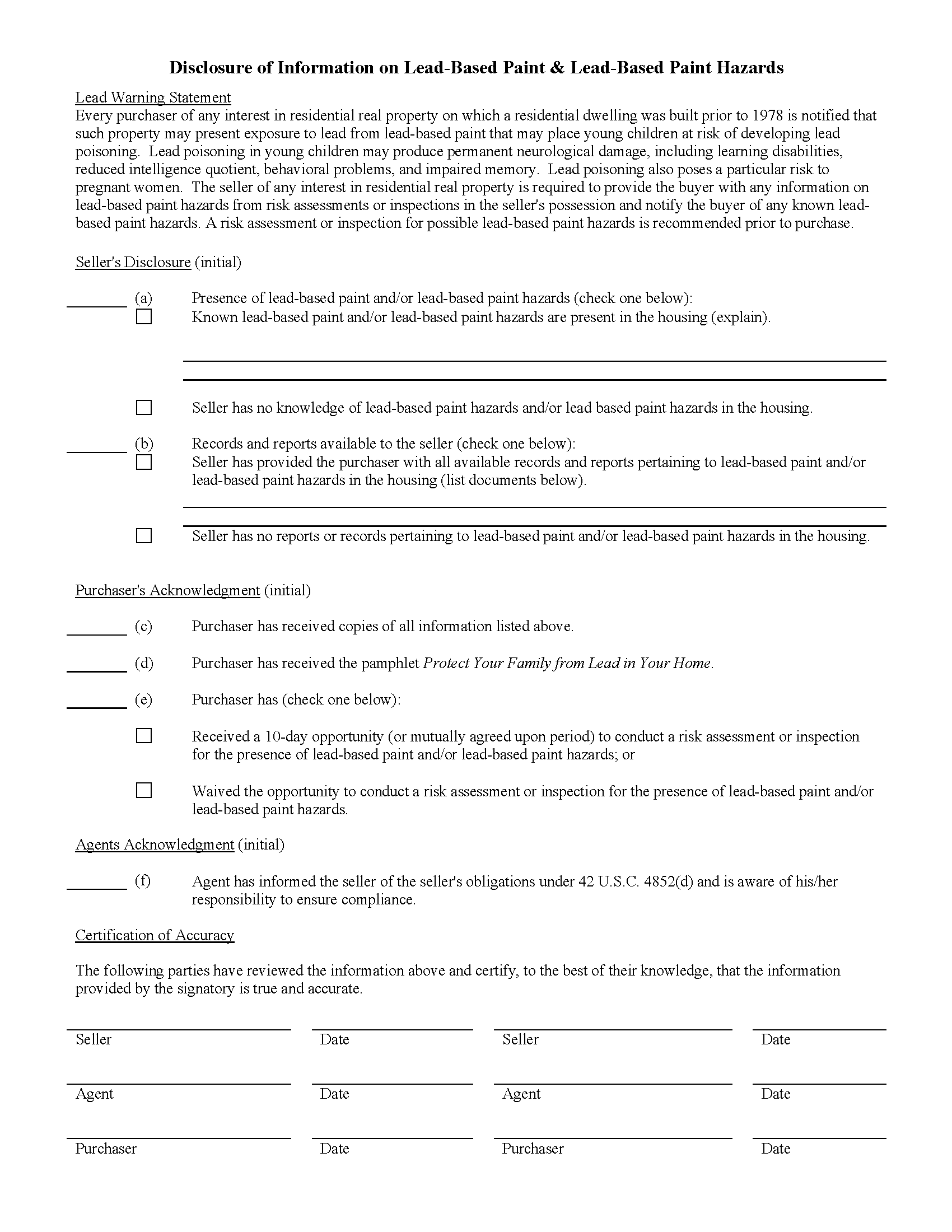

Barton County Lead Based Paint Disclosure Form

Disclosure form issued to buyer if applicable, typically residential property built before 1978

Barton County Protect your family from lead based paint

If applicable issue to buyers

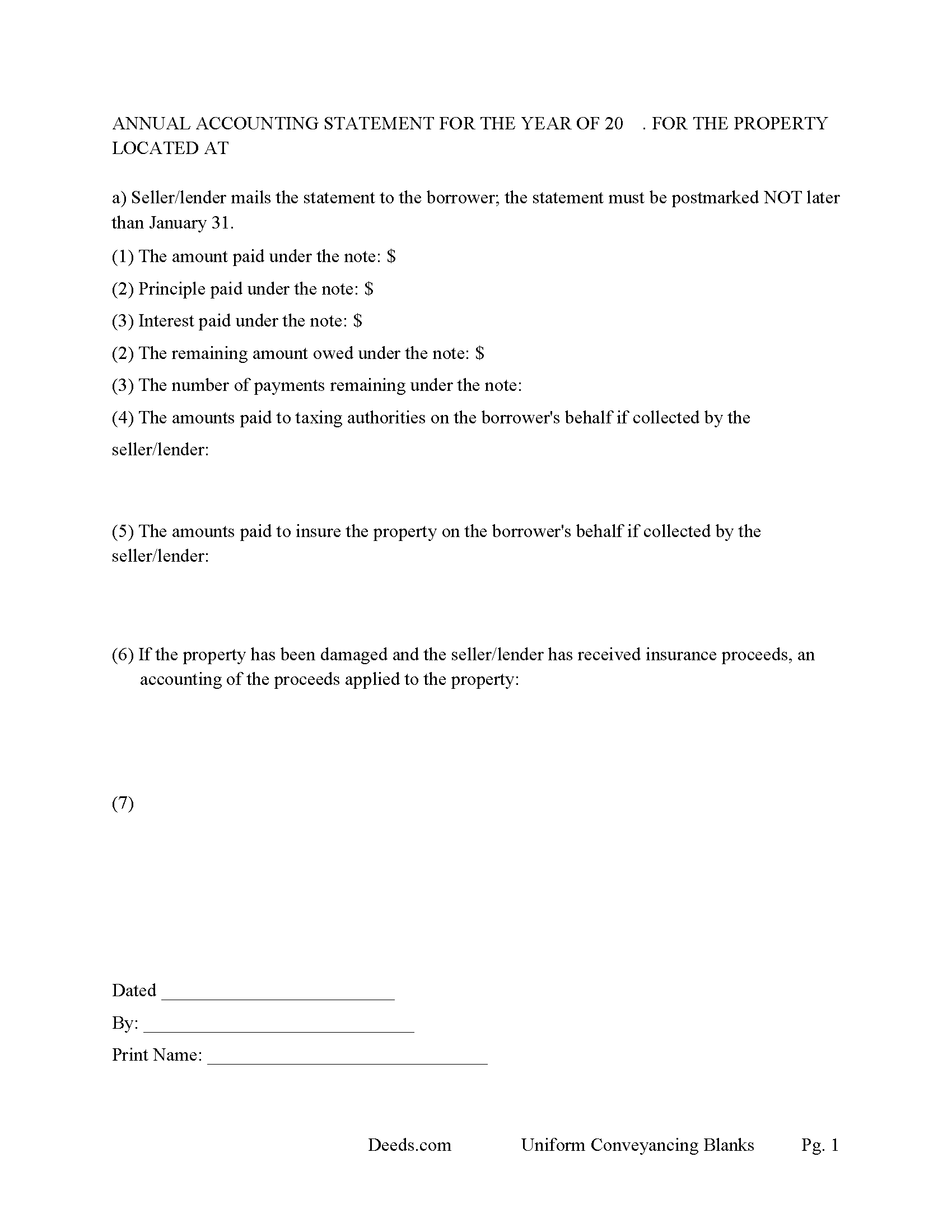

Barton County Annual Accounting Statement Form

Seller sends to Buyer for fiscal year reporting.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Barton County documents included at no extra charge:

Where to Record Your Documents

Barton County Register of Deeds

Great Bend, Kansas 67530

Hours: 8:30 to 5:00 M-F

Phone: (620) 793-1849

Recording Tips for Barton County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

Cities and Jurisdictions in Barton County

Properties in any of these areas use Barton County forms:

- Albert

- Claflin

- Ellinwood

- Great Bend

- Hoisington

- Olmitz

- Pawnee Rock

Hours, fees, requirements, and more for Barton County

How do I get my forms?

Forms are available for immediate download after payment. The Barton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Barton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Barton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Barton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Barton County?

Recording fees in Barton County vary. Contact the recorder's office at (620) 793-1849 for current fees.

Questions answered? Let's get started!

A "Contract for Deed," sometimes referred to as a Land Contract is a legal agreement in which the buyer of a property agrees to pay the seller the purchase price over a period of time. During this period, the buyer has possession of the property, but the seller retains legal title to the property until the full purchase price is paid.

Recording the Contract: In Kansas, it's usually a good idea to record the contract for deed or an Affidavit of Equitable Interest with the county register of deeds. This ensures public notice of the buyer's interest in the property and protects against subsequent claims.

Foreclosure Process: If the buyer defaults on a contract for deed, the seller may need to go through a judicial foreclosure process to regain possession of the property. Kansas law will specify the procedure, notice requirements, and redemption rights.

Equitable Title: Under a contract for deed, the buyer often holds equitable title to the property, meaning they have a right to obtain full legal title once the contract terms are fulfilled. However, until then, the legal title remains with the seller.

Rights and Obligations: The contract should clearly outline the rights and responsibilities of both the buyer and the seller, including payment schedules, property maintenance, tax obligations, and insurance.

Default and Acceleration Clauses: Contracts for deed commonly contain clauses that detail what constitutes a default and what happens in such a scenario, including the possibility of an acceleration clause which demands full payment upon default.

Annual Accounting Statement

Principal and Interest Breakdown: The statement should clearly show how much of the buyer's payments have been applied toward the principal balance of the property and how much has gone toward interest.

Remaining Balance: It should indicate the remaining balance of the principal after the year's payments have been applied.

Payment History: The statement might include a summary of the payments made during the year, including dates and amounts.

Taxes and Insurance: If the seller is responsible for paying property taxes and insurance from the buyer's payments (common in escrow arrangements), the statement should detail these payments.

Late Fees or Penalties: If any late fees or penalties were incurred during the year, these should also be documented.

Escrow Account Balance: If there is an escrow account associated with the contract, the statement should include the current balance of this account.

Legal Compliance: Ensure that the Annual Accounting Statement complies with any relevant Kansas laws and the specific terms of your Contract for Deed.

79-1437c. Real estate sales validation questionnaires;

required to accompany transfers of title; retention time; use of information. No deed or instrument providing for the transfer of title to real estate or affidavit of equitable interest in real estate shall be recorded in the office of the register of deeds unless such deed, instrument or affidavit shall be accompanied by a real estate sales validation questionnaire completed by the grantor or grantee or the agent of such grantor or grantee concerning the property transferred.

(Kansas Contract for Deed Package includes form, guidelines, completed example and sales validation questionnaire) For use in Kansas only.

Important: Your property must be located in Barton County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Barton County.

Our Promise

The documents you receive here will meet, or exceed, the Barton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Barton County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Stephen B.

August 21st, 2024

This was the first time to use the Deeds.com website for preparing my deed document. This was painless and easy to follow the instructions and sample package for filling in the blank boxes document. The city clerk was impressed to review my document and easily filed my deed record without questions. I would recommend anyone to prepare a legal form that is available from the Deeds.com website.

Your appreciative words mean the world to us. Thank you.

L B W.

January 22nd, 2021

Bottom line - it was certainly worth the $21 (+-?) I paid for the form and instructions, etc. Admittedly the form is a little inflexible in terms of editing for readability but I understand that offering greater flexibility would likely make theft more likely. So I'm happy with what I got. One suggestion - add more info about what's required in the "Source of Title" section.

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie C.

September 13th, 2023

I recently purchased online DIY legal forms, and I must say I was thoroughly impressed. The documents provided were accurate, comprehensive, and precisely what I needed. The accompanying guide was clear, instructive, and really bridged the gap for someone like me who isn't well-versed in legal jargon. What stood out the most, however, was the inclusion of the example. It served as a practical reference and made the entire process so much more approachable. Being able to see a filled-out sample made all the difference. Overall, this product has been invaluable in helping me navigate legal processes on my own.

Thank you for your feedback. We really appreciate it. Have a great day!

Dianne M.

June 30th, 2023

I find the resources on this website so helpful. The service is outstanding. Thank you.

Thank you!

Sonya B.

January 8th, 2022

Easy to order what I needed.

Thank you!

Alan C.

January 20th, 2024

The Transfer on Death Deed paperwork was easy to complete, as it included a detailed guide and a completed example. We encountered no issues recording the document with our County. Thanks to Deeds.com, we were also able to save time and money by utilizing a DIY approach for our situation.

We are delighted to have been of service. Thank you for the positive review!

Kathy R.

October 8th, 2022

I was very pleased with the quick turn around on a response to my inquiry. Further guidance was direct and I appreciate the professionalism from deeds.com.

Thank you!

David C.

January 22nd, 2019

My biggest complaint is I did not know when my document was ready until I got this survey. An email should be sent to say document is ready.

Sorry about that David. We will look into better email notifications. Hope you have a great day.

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thaddeus E.

January 5th, 2025

Quick assistance with same day recording. The tech identified barriers to successful Recordation such as image quality and worked with me to get them resolved for timely submission.

We are delighted to have been of service. Thank you for the positive review!

MARILYN I.

March 20th, 2023

Very pleased with your user friendly site.

Thank you!

Jesse C.

December 29th, 2018

I had a little problem understanding how to copie and use.

Thank you for your feedback Jesse. If you are having any issues please contact us so our customer care department can help you out.

Leonard N.

January 21st, 2021

Nice and clear. Can't wait to process the completed documents at the Recorder's Office

Thank you!

William H.

August 4th, 2025

Was easy to find forms I needed and download was quick.

Thank you for your positive words! We’re thrilled to hear about your experience.

Susan N.

July 29th, 2020

Very easy to use and I received the information in a timely manner. I will use this service again.

Thank you!