Jewell County Correction Deed Form

Jewell County Correction Deed Form

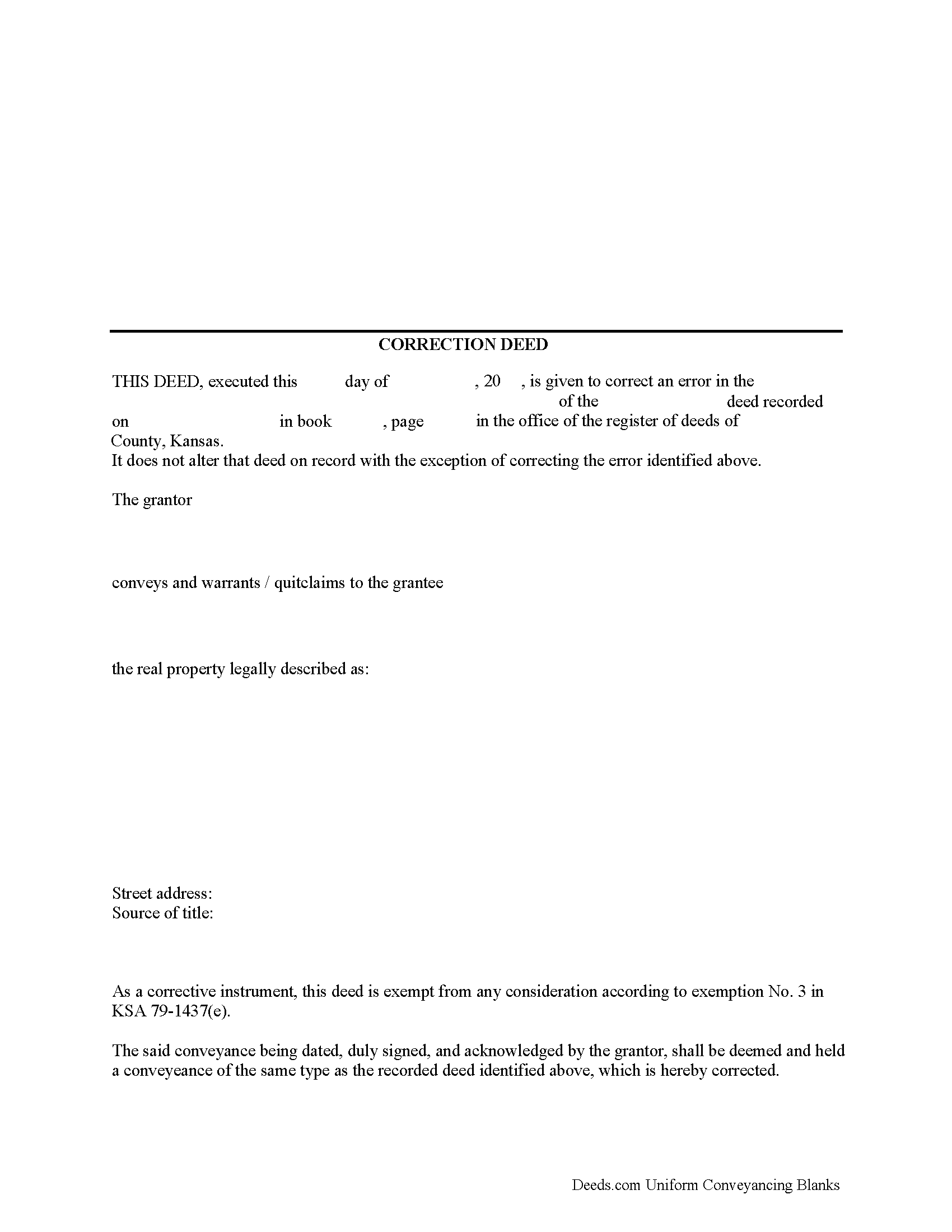

Fill in the blank form formatted to comply with all recording and content requirements.

Jewell County Correction Deed Guide

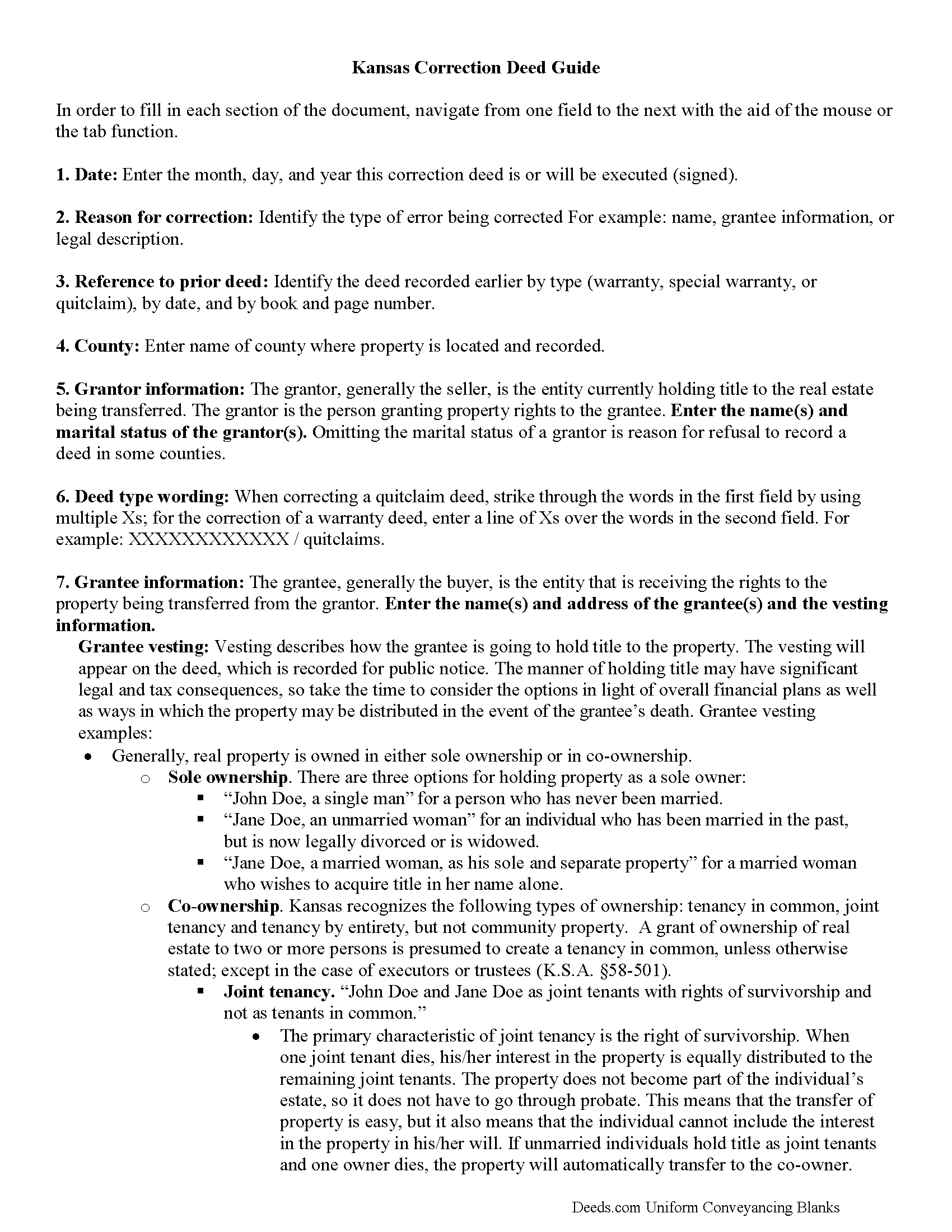

Line by line guide explaining every blank on the form.

Jewell County Completed Example of the Correction Deed Document

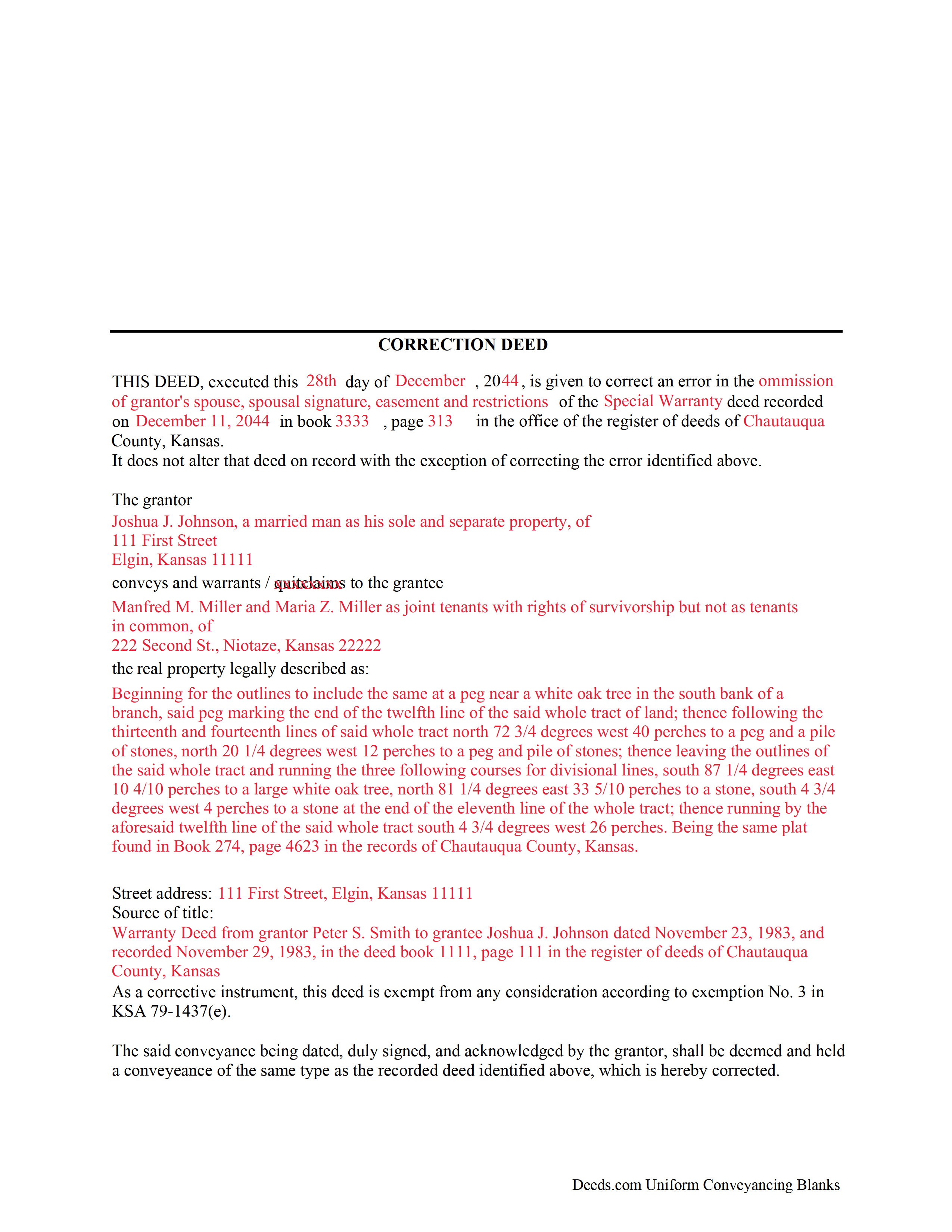

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Jewell County documents included at no extra charge:

Where to Record Your Documents

Jewell County Register of Deeds

Mankato, Kansas 66956-2093

Hours: 8:30-12 & 1-4:30

Phone: (785) 378-4070

Recording Tips for Jewell County:

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Jewell County

Properties in any of these areas use Jewell County forms:

- Burr Oak

- Esbon

- Formoso

- Jewell

- Mankato

- Randall

- Webber

Hours, fees, requirements, and more for Jewell County

How do I get my forms?

Forms are available for immediate download after payment. The Jewell County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jewell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jewell County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jewell County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jewell County?

Recording fees in Jewell County vary. Contact the recorder's office at (785) 378-4070 for current fees.

Questions answered? Let's get started!

In Kansas, the correction deed is the most widely accepted instrument used to correct an error in a recorded deed.

Many counties require, or at least prefer, the filing of a correction deed when making any corrections to the original instrument. It can be used to correct a typographical or other minor error, for example in the names of the grantor or grantee, their marital status or type of vesting, or in the legal description or any other information about the property. Although some counties accept a re-file affidavit when correcting and re-recording a deed, executing a correction or corrective deed is the more common method and guarantees that the state's legibility requirements are met (KSA 28-115(e)). The correction deed must make reference to the earlier deed that has already been recorded by date and instrument number and needs to indicate its exemption status from resubmitting the Kansas Sales Validation Questionnaire (KSA 79-1437(e)). As is required with any deed submitted for recording in Kansas, a new address for tax statements must be furnished with the new deed (KSA 58-2221).

To make more significant changes, such as changing the way title is held (e.g. as joint tenant or tenant-in-common) or such as adding another owner to the property, it is best to record an entirely new deed instead of filing a correction deed. In order to release one name from a deed held in joint tenancy or tenancy in common, for example in case of separation or divorce, use a quitclaim deed.

(Kansas Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Jewell County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Jewell County.

Our Promise

The documents you receive here will meet, or exceed, the Jewell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jewell County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Victor L.

June 2nd, 2021

In a subject that is overbearing, this site made it simple and understandable, all was explained well. Thank you.

Thank you!

Roy B.

January 30th, 2021

Convenient yes, expensive "big YES" and with what I paid to record a lien it cost me close to $50. That seems quite exorbitant in my estimation!!

Thank you for your feedback. We really appreciate it. Have a great day!

STANLEY F.

March 25th, 2019

Forms were spot on and able to save over $100 by not going to an attorney to complete the same documents. There were templates on how forms are supposed to be completed. You just need a notary to sign.

Thank you Stanley, we really appreciate your feedback.

Chris B.

March 3rd, 2023

Accurate information and easy to use website.

Thank you for your feedback. We really appreciate it. Have a great day!

Jason B.

July 19th, 2022

KVH provided excellent customer service (great communication was provided). I would differently use this service if needed in the further.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norma G.

May 9th, 2019

Thank you! This is very helpful

Thank you!

Craig H.

February 26th, 2022

Worked exactly like it was supposed to. No glitches

Thank you for your feedback. We really appreciate it. Have a great day!

janitza g.

July 31st, 2020

It was easy!!! The example for completing a quickclaim deed form was very helpful!!

Thank you!

Mary K.

October 25th, 2020

Fantastic way to record any deed! Done in less than a few hours, right to your inbox. Very small fee compared to driving to office or waiting for the mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Phyllis C.

January 7th, 2022

So far So Good. Ill come back and re review after it is all finished. I have downloaded all the documents. next I need to fill them out.

Thank you!

constance t.

December 30th, 2019

Excellent service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna r.

September 18th, 2020

Downloads were easy but I am pretty lost in filling out. Thought be more instructions

Thank you for your feedback Donna. If you are not completely sure of what you are doing we highly recommend seeking the assistance of a legal professional familiar with your specific situation.

Alice L.

October 21st, 2021

County accepted Quit Claim Deed without any issues! Saved money using Deeds.com - thank you!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Debby P.

April 2nd, 2020

First time user and the service was great.. I typically go to recording kiosk at the libraries. This was fast and easy.. I appreciate the great service

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

April 21st, 2021

This has been a lifesaver for me. Exactly what I needed. Forma are easy to fill in. Thank you for offering this instead of going thru a lawyer. faster and no wait time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!