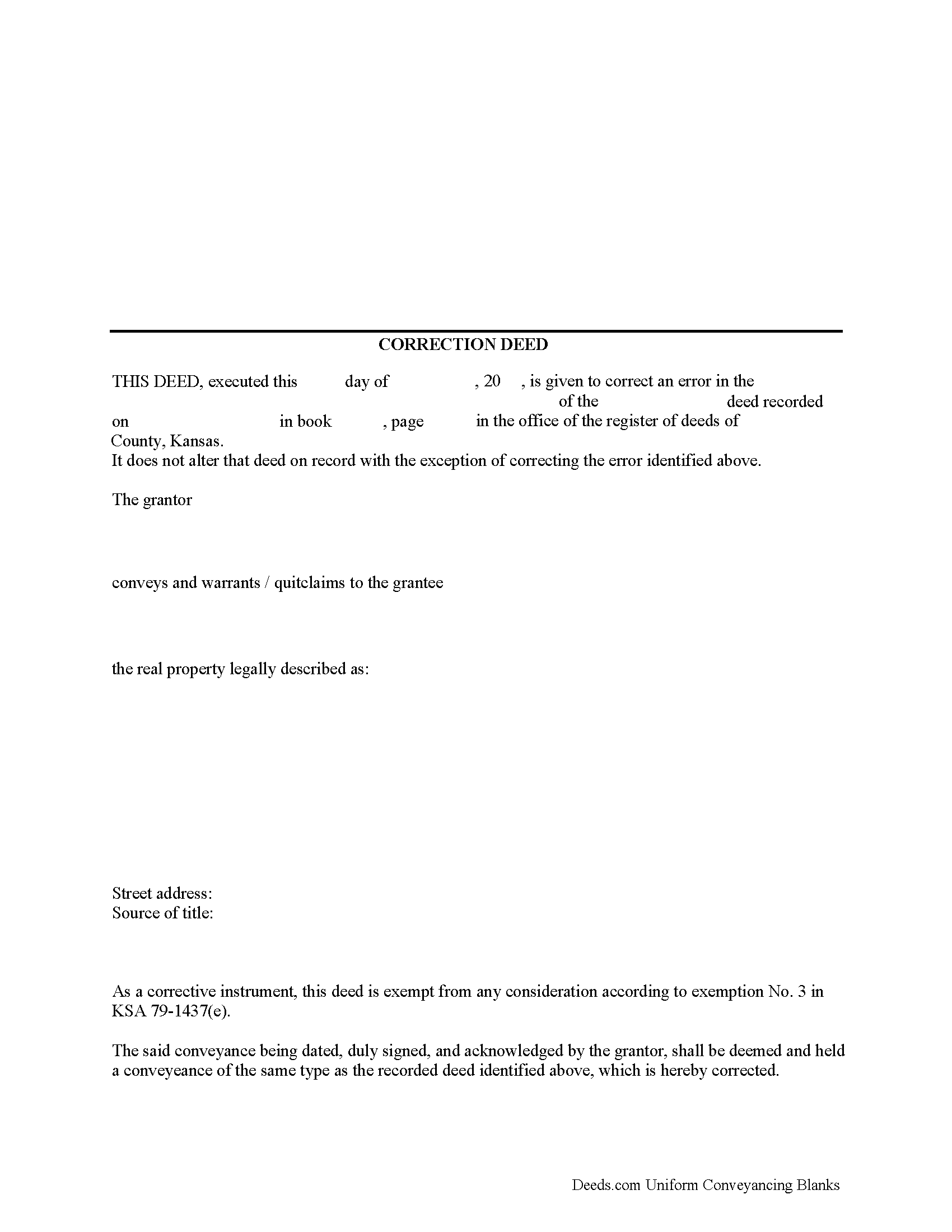

Morris County Correction Deed Form

Morris County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

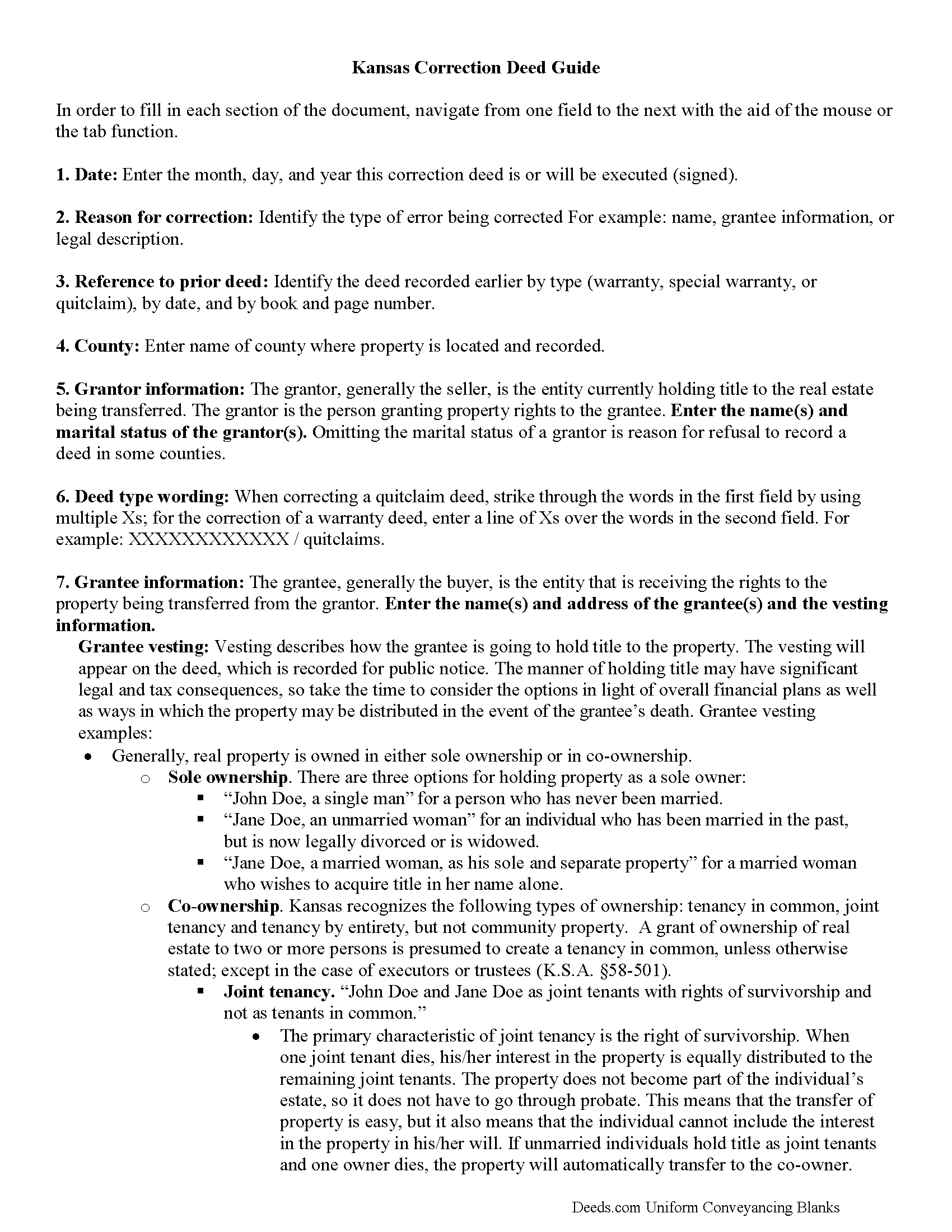

Morris County Correction Deed Guide

Line by line guide explaining every blank on the form.

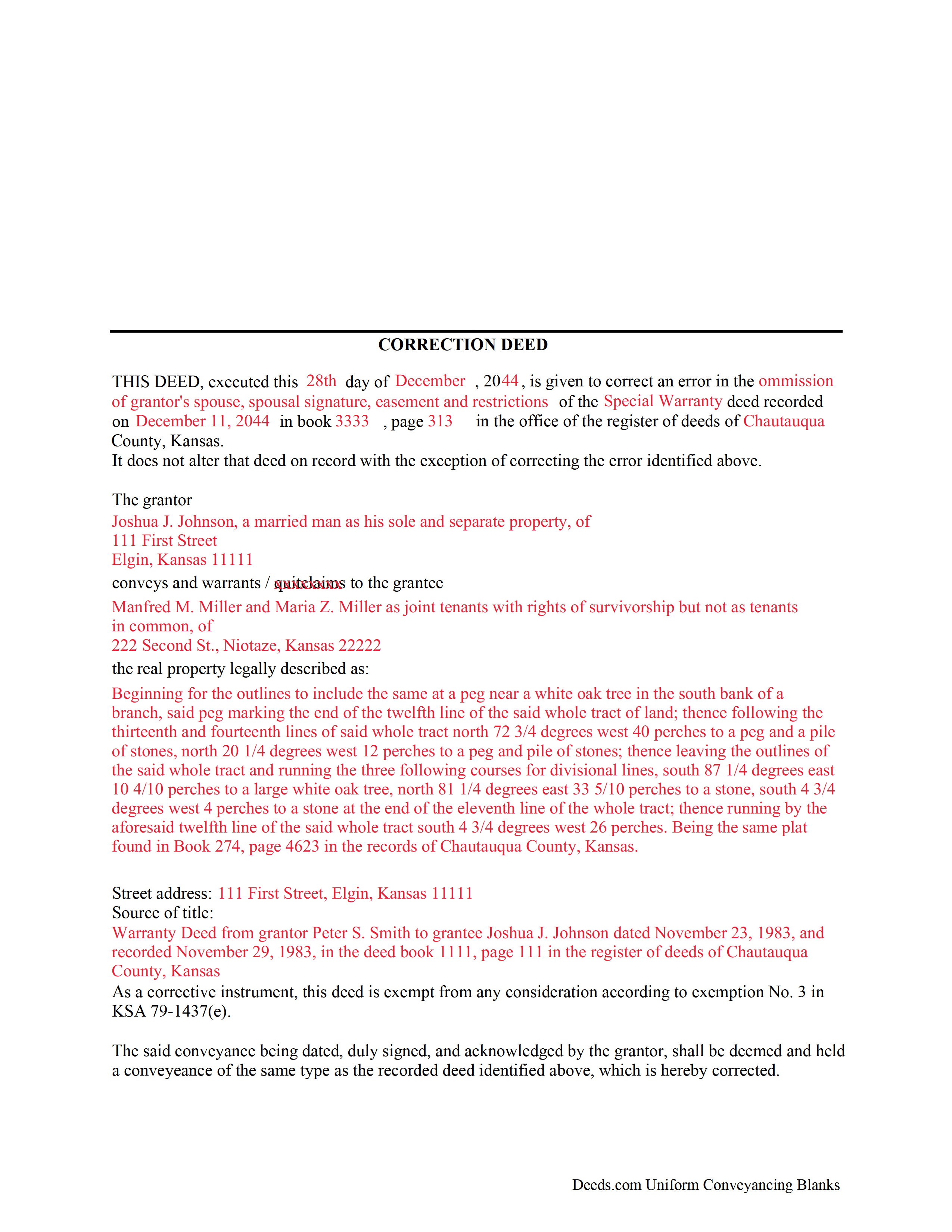

Morris County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Morris County documents included at no extra charge:

Where to Record Your Documents

Morris County Register of Deeds

Council Grove, Kansas 66846

Hours: 8:00am-5:00pm M-F

Phone: (620) 767-5614

Recording Tips for Morris County:

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Morris County

Properties in any of these areas use Morris County forms:

- Burdick

- Council Grove

- Dwight

- White City

- Wilsey

Hours, fees, requirements, and more for Morris County

How do I get my forms?

Forms are available for immediate download after payment. The Morris County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morris County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morris County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morris County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morris County?

Recording fees in Morris County vary. Contact the recorder's office at (620) 767-5614 for current fees.

Questions answered? Let's get started!

In Kansas, the correction deed is the most widely accepted instrument used to correct an error in a recorded deed.

Many counties require, or at least prefer, the filing of a correction deed when making any corrections to the original instrument. It can be used to correct a typographical or other minor error, for example in the names of the grantor or grantee, their marital status or type of vesting, or in the legal description or any other information about the property. Although some counties accept a re-file affidavit when correcting and re-recording a deed, executing a correction or corrective deed is the more common method and guarantees that the state's legibility requirements are met (KSA 28-115(e)). The correction deed must make reference to the earlier deed that has already been recorded by date and instrument number and needs to indicate its exemption status from resubmitting the Kansas Sales Validation Questionnaire (KSA 79-1437(e)). As is required with any deed submitted for recording in Kansas, a new address for tax statements must be furnished with the new deed (KSA 58-2221).

To make more significant changes, such as changing the way title is held (e.g. as joint tenant or tenant-in-common) or such as adding another owner to the property, it is best to record an entirely new deed instead of filing a correction deed. In order to release one name from a deed held in joint tenancy or tenancy in common, for example in case of separation or divorce, use a quitclaim deed.

(Kansas Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Morris County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Morris County.

Our Promise

The documents you receive here will meet, or exceed, the Morris County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morris County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Robson A.

June 15th, 2021

Very easy & efficient to use! I would have had to drive an hour to the county office. So glad this worked instead! You should advertise more....if I hadn't done research I would never have known about your service.

Thank you!

Beatrica G.

November 5th, 2019

Thanks for your service. I recieved my documents on time and package information as promise.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey W.

April 29th, 2020

One of the most user-friendly services I have used. HIGHLY reccomended.

Thank you!

Arthur M.

December 8th, 2020

A good service that saves a lot of time and precludes making a trip to the County Assessors Office. Valuable service.

Thank you!

Laurie D.

January 24th, 2024

Comforting that you include an example of a completed TOD Deed form. Just downloaded all forms for my state & county and I'm SURE this will save a paying for a massive attorney fee!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Joseph D.

November 14th, 2024

Easy to use and a quick turnaround Deed was recorded and retuned within 24 hours

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Patrick N.

August 15th, 2019

I was very satisfied with your service. Prompt, and thorough. Price was reasonable. Will use your service again when needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Giuseppina M.

October 24th, 2024

Fast, reliable excellent service

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jamie F.

February 13th, 2019

I purchased he Alabama Correction Warranty Deed Form to correct a mistake in the legal description. However, this form says it must be signed by all who previously signed the deed. One of these people is now deceased. Can I use this form? How would it be different? I would give you 5 stars but wish this issue had been addressed. Thanks.

Thank you for your feedback. From the product description: All parties who signed the prior deed must sign the correction deed in the presence of a notary.

Michelle M.

July 3rd, 2020

The website was easy to navigate and great communication on every step of the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Jon W.

September 16th, 2021

Useless for me. My deed could not be pulled. After investigation, I got a copy online directly from WV for $3. No one but editors of this will ever see this. Shame.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert R.

August 26th, 2025

Big savings and easy to use. Thanks so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rachelle S.

March 21st, 2021

Wow that was easy

Thank you!

Anita M.

March 10th, 2019

This was a very easy process to find the correct documents and download them. The price was also reasonable.

Thank you for your feedback. We really appreciate it. Have a great day!