Elk County Executor Deed Form

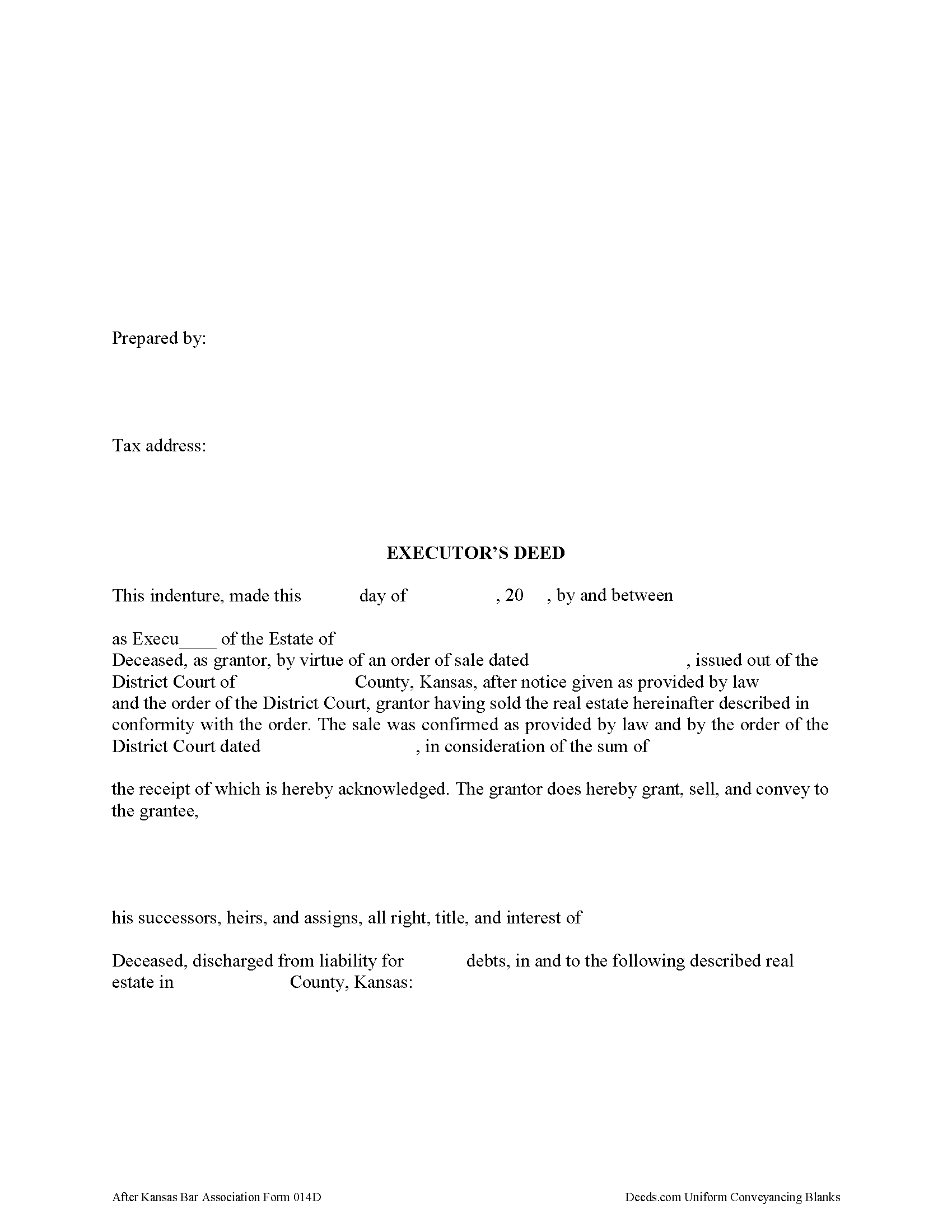

Elk County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

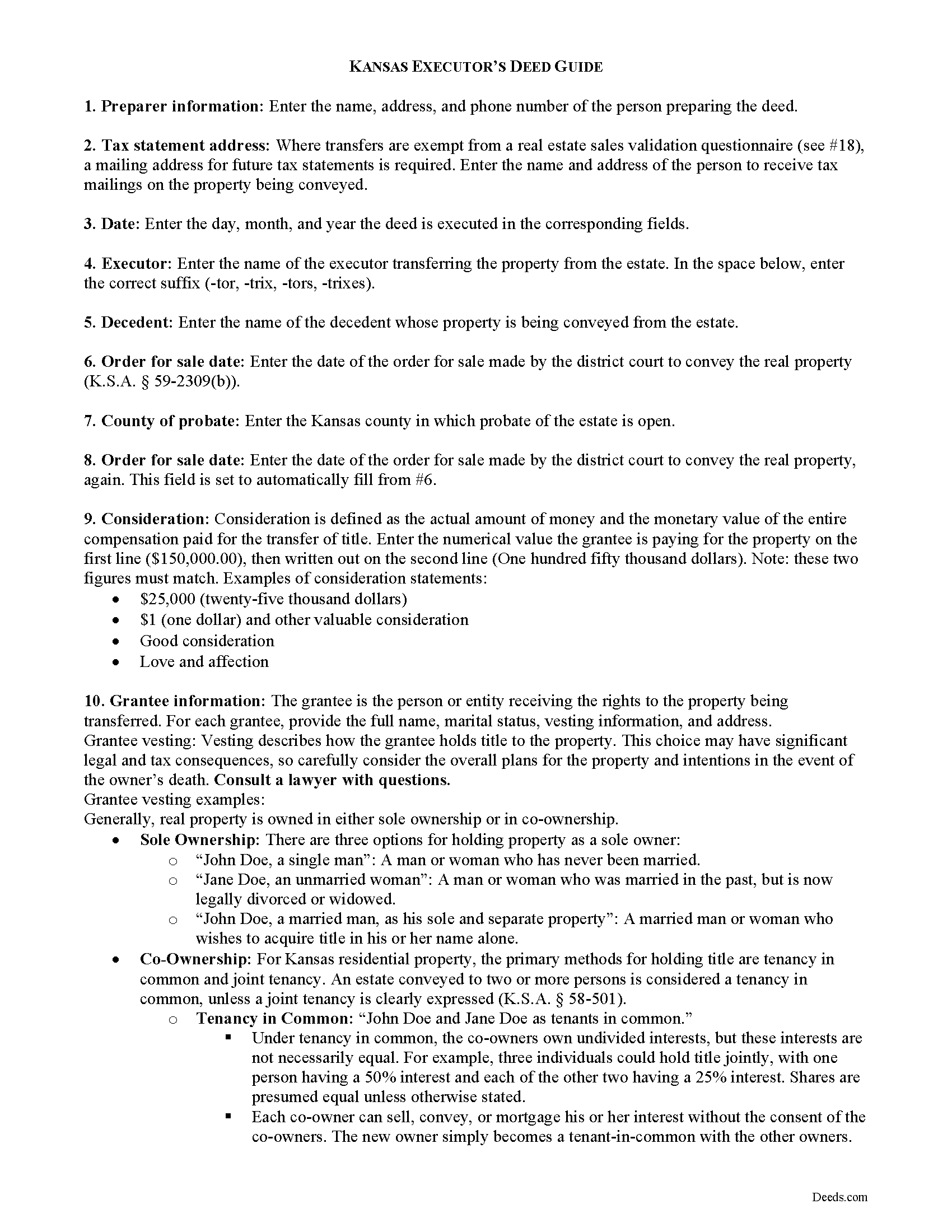

Elk County Executor Deed Guide

Line by line guide explaining every blank on the form.

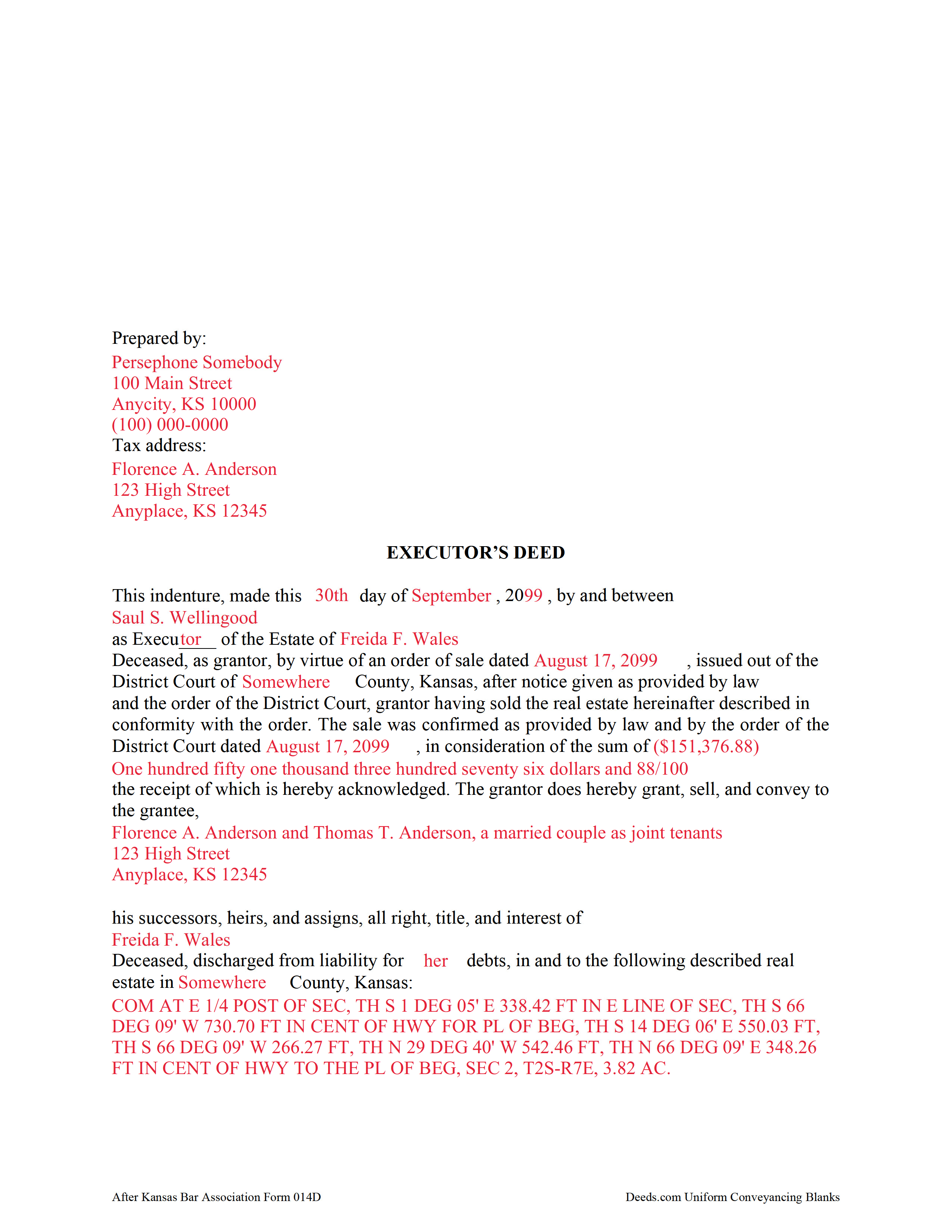

Elk County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Elk County documents included at no extra charge:

Where to Record Your Documents

Elk County Register of Deeds

Howard, Kansas 67349

Hours: 8:00am to 4:30pm.M-F

Phone: (620) 374-2472

Recording Tips for Elk County:

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Elk County

Properties in any of these areas use Elk County forms:

- Elk Falls

- Grenola

- Howard

- Longton

- Moline

Hours, fees, requirements, and more for Elk County

How do I get my forms?

Forms are available for immediate download after payment. The Elk County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Elk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Elk County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Elk County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Elk County?

Recording fees in Elk County vary. Contact the recorder's office at (620) 374-2472 for current fees.

Questions answered? Let's get started!

When the decedent dies testate (with a will) naming a personal representative (PR) of his or her estate, the PR is called an executor. An executor may need to sell the decedent's real property to raise money to pay the estate's debts or for other reasons in the best interest of the estate.

If the decedent's will includes a power of sale, a simple executor's deed may be used to convey real property from the estate. The deed requires a recitation of facts concerning the executor, the decedent, and the subject property being transferred, and must be signed in the presence of a notary public and is subject to requirements for conveyances of real property in Kansas.

Supplemental documentation, such as a real estate sales validation questionnaire, may be required, depending on the transfer. Consult a lawyer with questions about estate administration in Kansas.

(Kansas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Elk County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Elk County.

Our Promise

The documents you receive here will meet, or exceed, the Elk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Elk County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Kevin R.

November 24th, 2022

So far so good. Had an issue and customer service responded very fast by email.

Thank you for your feedback. We really appreciate it. Have a great day!

Delia C.

November 18th, 2019

Your service is a life saver! I'm a paralegal and new to lien releases especially in Platte Co., MO. The clerk was not helpful and I so appreciate your service in accomplishing this very important task!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John G.

October 4th, 2022

Fast turn-around, very efficient!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lacee G.

November 25th, 2019

Great real estate deed forms.

Thank you!

Brenda H.

March 25th, 2020

I purchased this thinking I would be able to complete the QuitClaim Deed myself because an example was provided, but you still need to be a lawyer to figure all the wording out. It was not worth the price I paid for it.

Thank you for your feedback. We really appreciate it. Have a great day!

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

Wayne T.

February 2nd, 2021

I was skeptical when I first came upon this website. Not sure why I had such a negative feeling, but after I received the printed deed I felt relieved and completely satisfied. This is a great website for everyone who wouldn't want to retrieve their deed in person and worth the reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Curley B.

January 6th, 2023

So far, I'm pleased. I am a first-time user, as most of my clients are in California. I look forward to working with you more in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

dean s.

July 23rd, 2019

Excellent work. Berry happy!

Thank you!

Alan E.

August 11th, 2021

I couldn't be happier with this service. They're helpful, quick and thorough. They make filing government documents very easy.

Thank you for your feedback. We really appreciate it. Have a great day!

MARK K.

June 18th, 2020

This is a great service. I submitted the information and the next day my deed had been recorded. Online recording during these times is the most sensible way to record deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anna L W.

December 19th, 2021

Was insecure about being able to access the information but pleasantly found that the site was easy to use. Seems that I can use it repeatedly to go back and reprint the forms once I paid.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jimmy W.

November 1st, 2024

Very thorough with plenty of instructions. Nice to be able to fill in the forms on my computer at my own pace and edit if needed. Jim

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael G. S.

January 3rd, 2019

The process was quite easy, following the instructional guide. I have yet to find out if the deed was accepted, but your site was very user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth C.

August 24th, 2020

Great forms, easy to use if you have at least a sixth grade education.

Thank you!