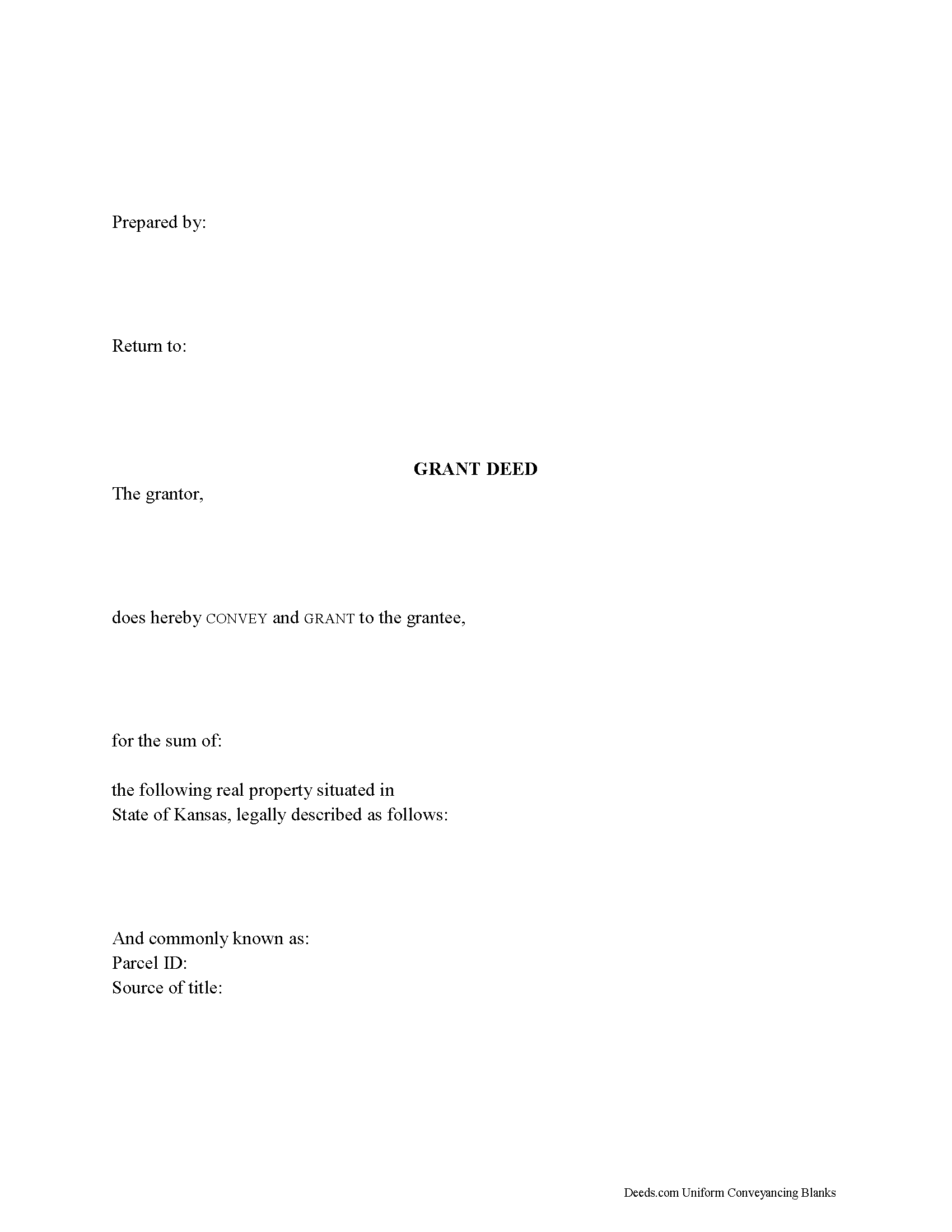

Linn County Grant Deed Form

Linn County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

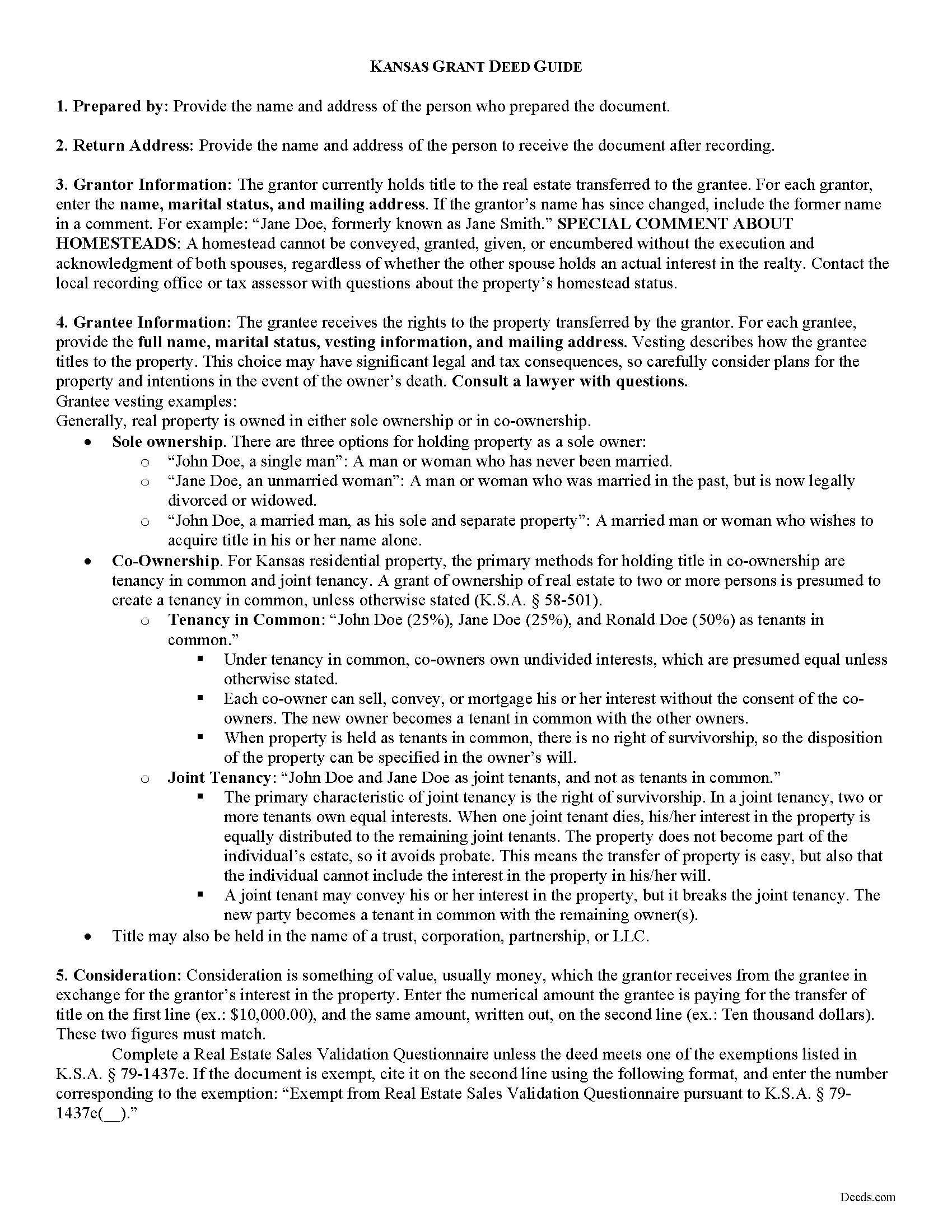

Linn County Grant Deed Guide

Line by line guide explaining every blank on the form.

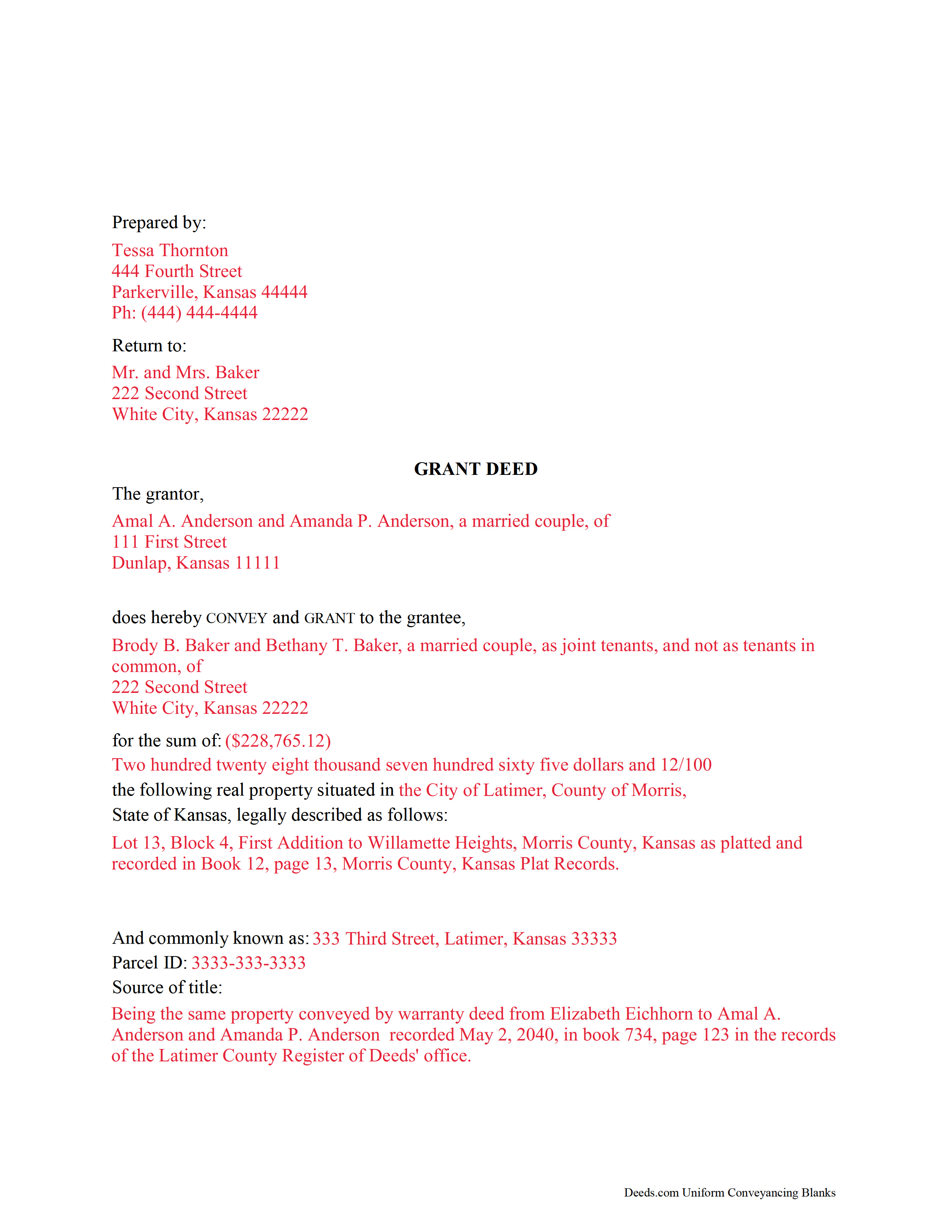

Linn County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Linn County documents included at no extra charge:

Where to Record Your Documents

Linn County Register of Deeds

Mound City, Kansas 66056

Hours: 8:00am to 4:30pm M-F

Phone: (913) 795-2226

Recording Tips for Linn County:

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Linn County

Properties in any of these areas use Linn County forms:

- Blue Mound

- Lacygne

- Mound City

- Parker

- Pleasanton

- Prescott

Hours, fees, requirements, and more for Linn County

How do I get my forms?

Forms are available for immediate download after payment. The Linn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Linn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Linn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Linn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Linn County?

Recording fees in Linn County vary. Contact the recorder's office at (913) 795-2226 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Kansas are governed by Chapter 58, Section 22 of the Kansas Statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). A recorded grant deed imparts notice of this transfer to all persons, including subsequent purchasers or mortgagees (K.S.A. 58-2222).

Within the deed are covenants, or guarantees, that the grantor has not previously sold the real property interest now being conveyed to the grantee, and that the property is being conveyed to the grantee without any liens or encumbrances, except for those specifically disclosed in the deed. Grant deeds do not generally require the grantor to defend title claims.

A lawful grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

Include the complete legal description for the subject property, as well as its physical (street) address or common name and the derivation of title. Additionally, the form must meet state and local standards for recorded documents.

All deeds must be signed by the grantor, or by the party's lawful agent or attorney, and may be acknowledged or proved and certified in the manner prescribed by the Uniform Law on Notarial Acts (K.S.A. 58-2209).

The State Property Valuation Department requires a Real Estate Sales Validation Questionnaire with each deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Include the amount of consideration exchanged on the form (K.S.A. 79-1437g).

Submit the deed and any required supplemental documents for recording in the county where the property is located. In most cases, the deed will be returned to the grantee after recording. The register of deeds will forward the information to the county clerk, who will update records for mailing tax statements (K.S.A. 58-2221). Record the deed in the appropriate county to provide notice to third parties (K.S.A. 58-2223).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Linn County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Linn County.

Our Promise

The documents you receive here will meet, or exceed, the Linn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Linn County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

David W.

March 10th, 2021

Thanks to all of you. You provide a great service! Dave in Ca.

Thank you for your feedback. We really appreciate it. Have a great day!

Ping O.

September 5th, 2019

Thank you for making this easy!

Thank you!

Rebekah T.

February 8th, 2021

Easy to use especially with instruction page and examples. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Sara D.

September 25th, 2019

Would have been beneficial to have more information about the previous sale history of the property. The report was received in a very timely manner.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen P.

July 20th, 2021

Quick and Easy

Thank you!

Tim T.

June 8th, 2023

Very easy to find forms and good examples for filling out forms!

Thank you for your feedback. We really appreciate it. Have a great day!

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value. In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard R.

April 16th, 2021

Deeds.com got the job done. My deed was successfully recorded.

Thank you for your feedback. We really appreciate it. Have a great day!

Jon I.

May 27th, 2020

I liked the information I download. Just what I was looking for.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alex Q.

July 26th, 2023

The best people to work with! Thank you for all you do. We send documents from all states to Deeds.com to record for us. They are professional, keep us updated and always notify us if there is an issue with one of our documents prior to sending to recording and that saves us money and time! Thank you!!

Thanks for the kind words Alex. We appreciate you!

JOANNE W.

November 13th, 2019

Excellent product and so easily obtained. Well worth the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Wes C.

March 26th, 2022

The forms are easy to use and the examples and guidance are easy to understand and follow.

Thank you for your feedback. We really appreciate it. Have a great day!

Leticia A.

January 20th, 2020

Down to the point,covers every angle with great tips:Don't forget Probate.

Thank you!

Kristina H.

January 23rd, 2020

Everything I needed to complete my release of lien was easy to obtain from Deed.com - and the example and instructions were helpful as well. The website is simple and efficient. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DEBBY G.

January 12th, 2023

I was so confused on how to complete the form. But I followed the instructions and used the example and got it done.

Thank you for your feedback. We really appreciate it. Have a great day!