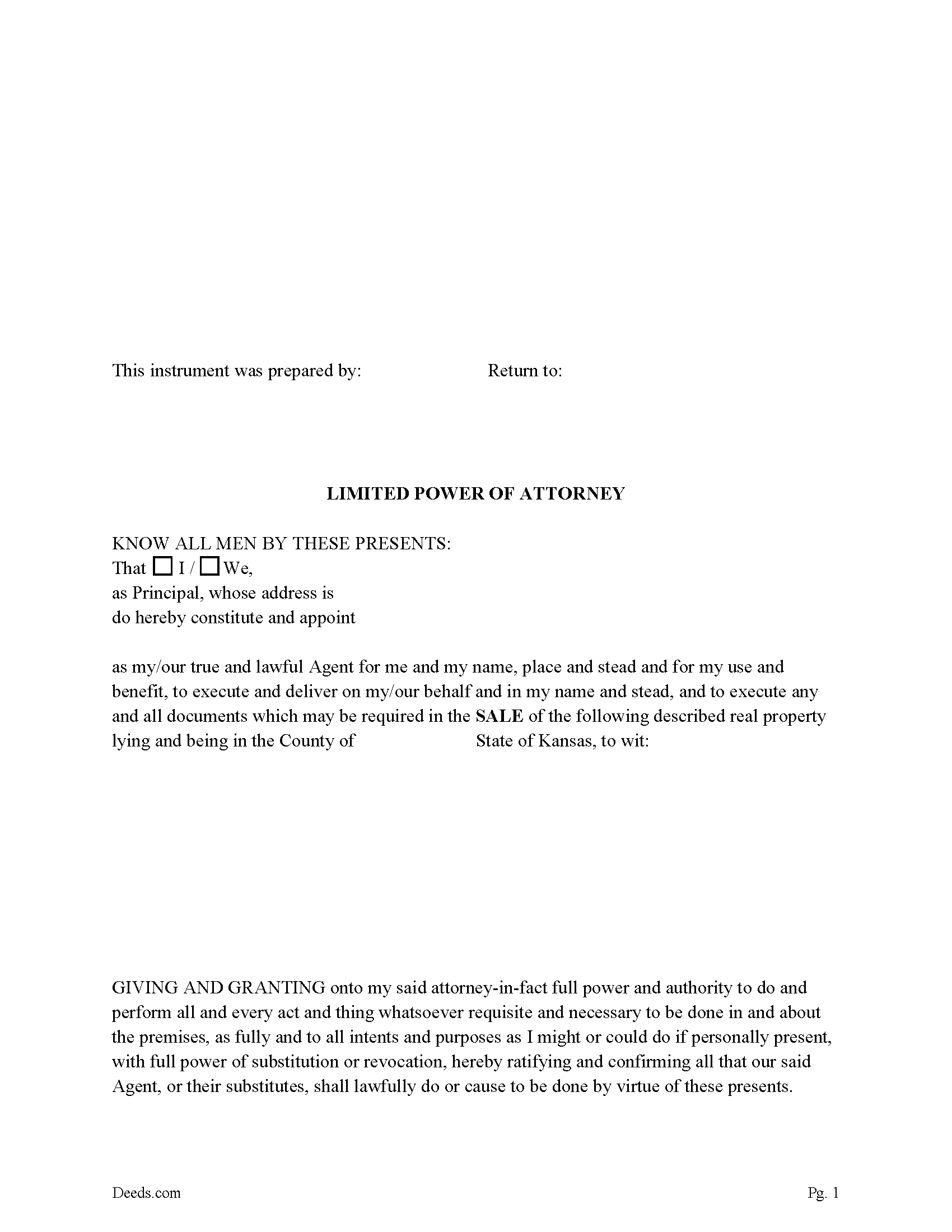

Marshall County Limited Power of Attorney for Sale Form

Marshall County Limited Power of Attorney for Sale Form

Fill in the blank Limited Power of Attorney for Sale form formatted to comply with all Kansas recording and content requirements.

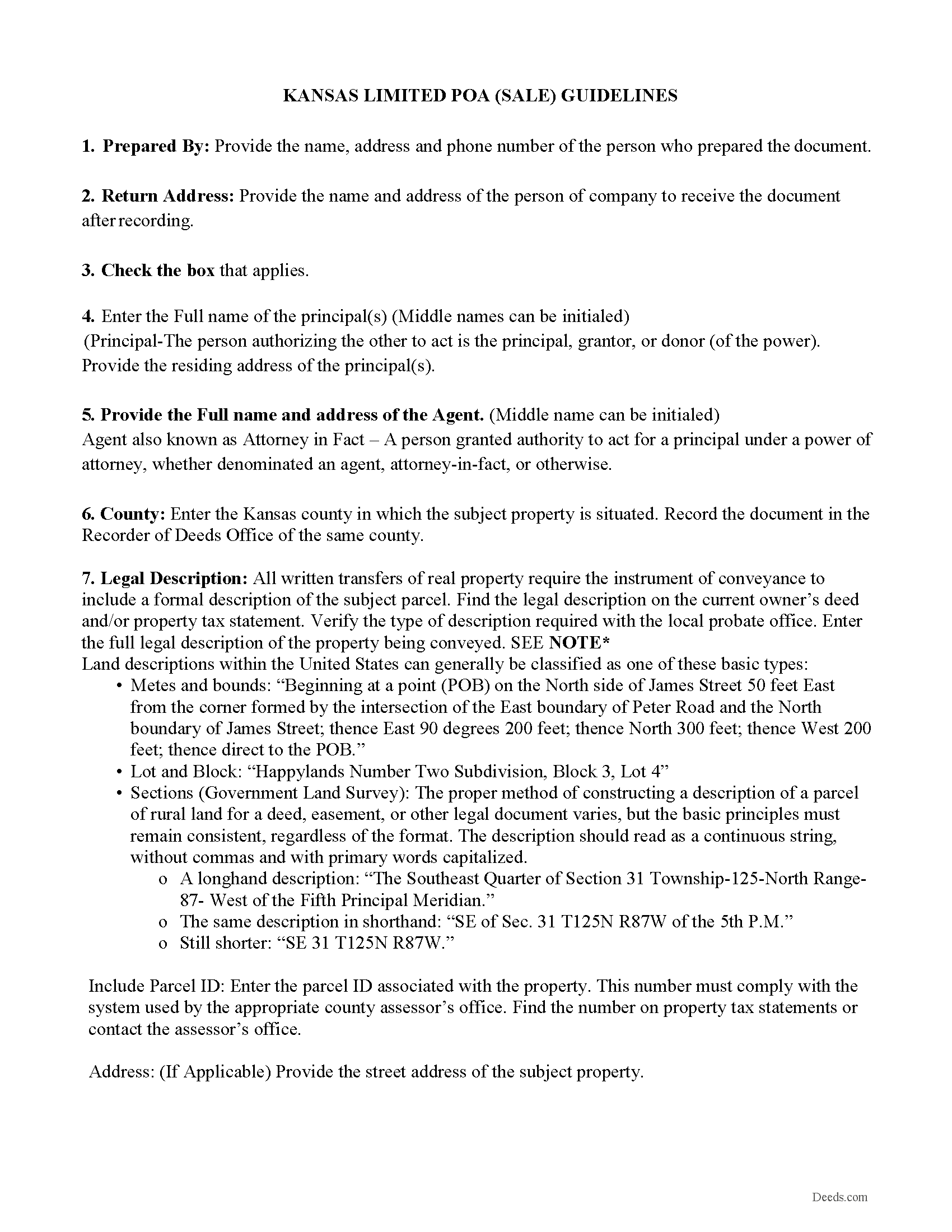

Marshall County Limited Power of Attorney for Sale Guide

Line by line guide explaining every blank on the Limited Power of Attorney for Sale form.

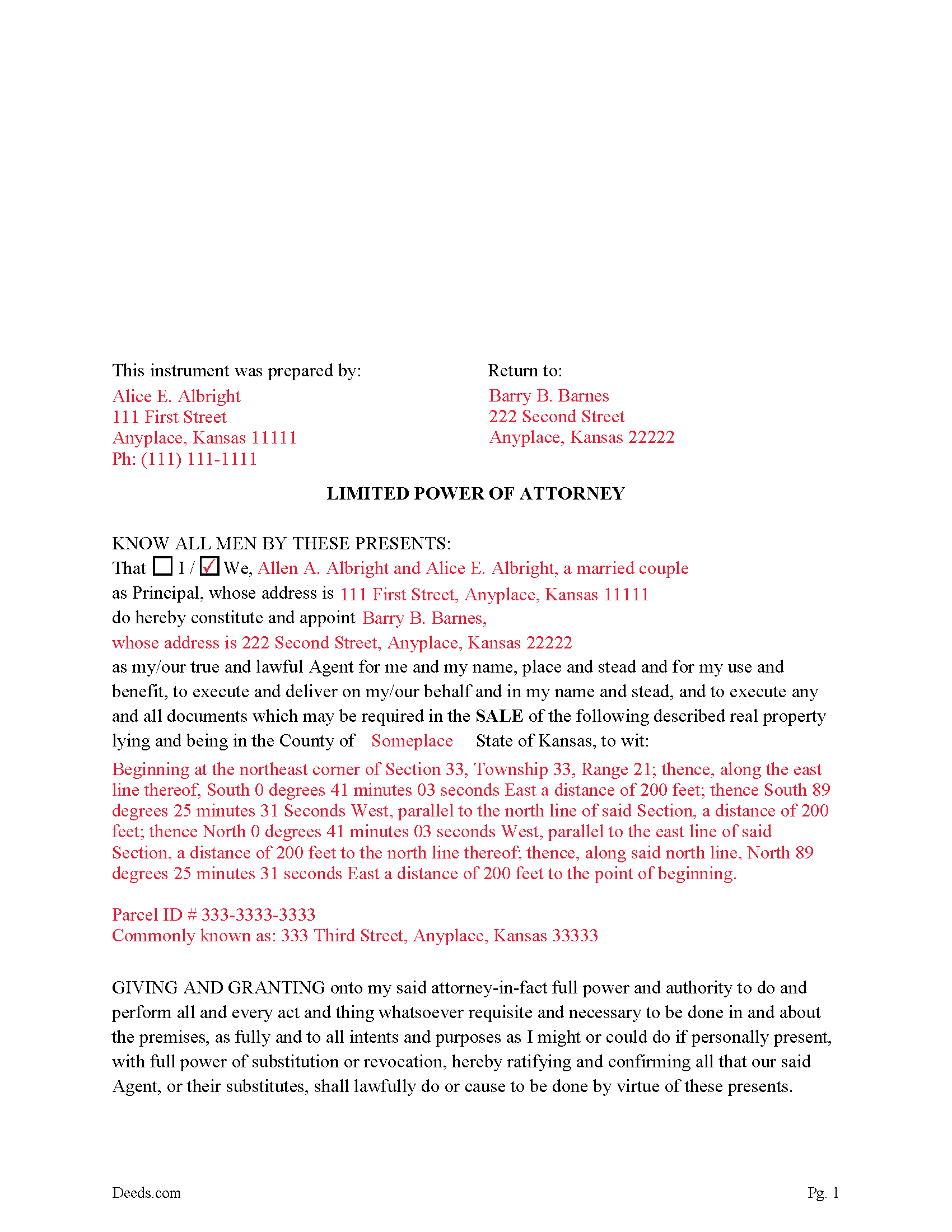

Marshall County Completed Example of the Limited Power of Attorney for Sale Document

Example of a properly completed Kansas Limited Power of Attorney for Sale document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Register of Deeds

Marysville, Kansas 66508

Hours: 8:30 to 5:00 M-F

Phone: (785) 562-3226

Recording Tips for Marshall County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Axtell

- Beattie

- Blue Rapids

- Bremen

- Frankfort

- Home

- Marysville

- Oketo

- Summerfield

- Vermillion

- Waterville

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (785) 562-3226 for current fees.

Questions answered? Let's get started!

In Kansas, a Limited Power of Attorney (LPOA) for the sale of real estate is a legal document that grants a designated person (the agent or attorney-in-fact) the authority to handle specific matters related to the sale of real property on behalf of the principal (the person granting the power). This power can include signing documents, handling transactions, and making decisions related to the sale. However, the statutes and legal requirements can be complex and are subject to change, so it's important to consult a legal professional for the most current and applicable advice.

General guidelines regarding a Limited Power of Attorney for real estate in Kansas:

Written Document: The power of attorney must be in writing. It should clearly state the principal's name, the agent's name, and the specific powers granted.

Durability: This document shall continue in effect during any subsequent disability, incompetency, or incapacity of the principal in accordance with the provisions of K.S.A. 58-650, et al.,

Acknowledgment: The document typically needs to be signed by the principal and should be notarized. This is particularly important for real estate transactions, as a notarized document is usually required for recording the deed or other documents in county records.

Specificity: Since it is a limited power of attorney, the document should specify exactly what real estate is involved and what powers the agent has regarding the sale of that property. This can include the power to negotiate and accept offers, execute documents, and handle closing procedures.

Recording: In many cases, the power of attorney document must be recorded with the county recorder’s office in the county where the property is located, especially if it will be used for executing deeds or other documents that will be recorded.

Effective and Termination: It is intended that this power of attorney is to become effective immediately upon execution and terminates upon the completion of the sale of the property.

Legal Capacity: The principal must be of sound mind and have the legal capacity to execute the power of attorney at the time it is signed.

Compliance with Other Laws: Ensure that the document complies with other relevant Kansas laws and any specific requirements of the county where the property is located.

(Kansas Limited POA for Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Limited Power of Attorney for Sale meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Limited Power of Attorney for Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Mildred S.

November 8th, 2021

This was an excellent service to amend a deed. It was a little frustrating at first, but well worth it, as they review your documents before submission to your "Recorder of Deeds" to make sure they are not rejected. Would definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carrie A.

September 28th, 2020

Great service fast and easy.

Thank you!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Matthew D.

February 16th, 2019

Fantastic forms easy process couldn't be happier! Thanks

Thank you Matthew!

Randy R.

May 16th, 2019

Thank you So far everything worked great. Got my downloads so I'm off and running. I hope the rest of the paperwork goes this easy.

Thank you Randy, we appreciate your feedback.

David S.

March 7th, 2022

Very good website. All government should be that clear and efficient.

Thank you!

DARLA L.

September 8th, 2022

I was happy with the quick response to obtain the requested forms. Effective and easy website to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bobbi W.

February 16th, 2019

Site was super easy to use. After frustrating search for the item I needed I found it here!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris D.

December 10th, 2020

Easy and affordable. I would recommend deeds.com

Thank you!

CHARLES H.

December 3rd, 2022

Easy to fill-in forms, easy instructions, worth purchasing

Thank you!

Gina B.

June 26th, 2019

Super easy to use! Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matthew M.

February 15th, 2023

Needed copy of deed in trust. Found info here, paid on line and then printed the docs. Easy to use, no driving to city offices, No parking fees, no waiting in line. Done fast and easy. Love it.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!

John v.

April 7th, 2020

Process is well laid out, clear and concise. Check out is easy. Recommendations: * Assign names to the downloadable files that are meaningful, such as: WARRANTY DEED instead of the useless and cryptic 1420490866F11417.pdf. * Provide a ONE BUTTON DOWNLOAD for all forms ordered. It's aggravating to have to click on each of the 20 documents and download them individually.

Thank you for your feedback. We really appreciate it. Have a great day!

Martin E.

February 16th, 2021

documents and guidance need to properly comply with court

Thank you!