Butler County Limited Warranty Deed Form

Butler County Limited Warranty Deed Form

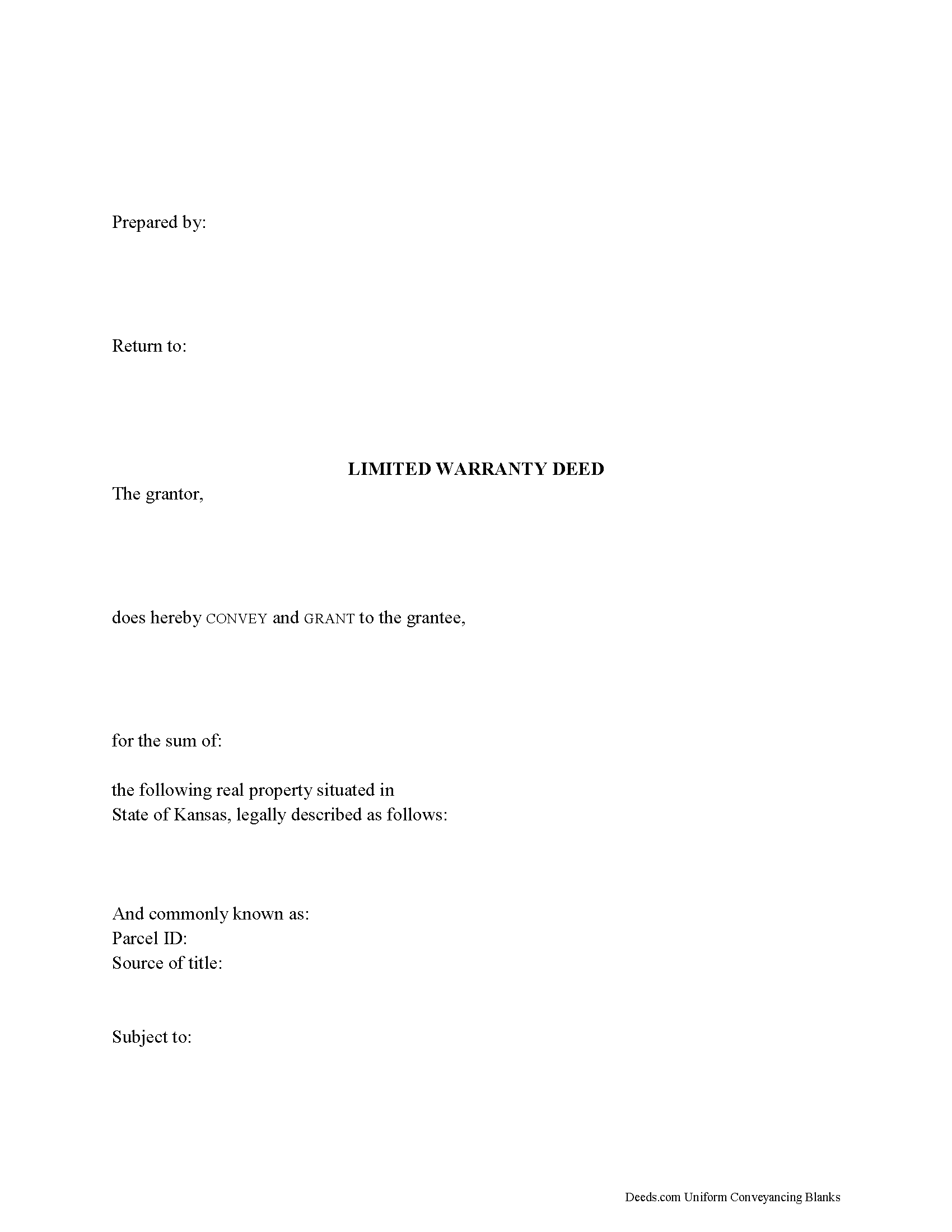

Fill in the blank form formatted to comply with all recording and content requirements.

Butler County Limited Warranty Deed Guide

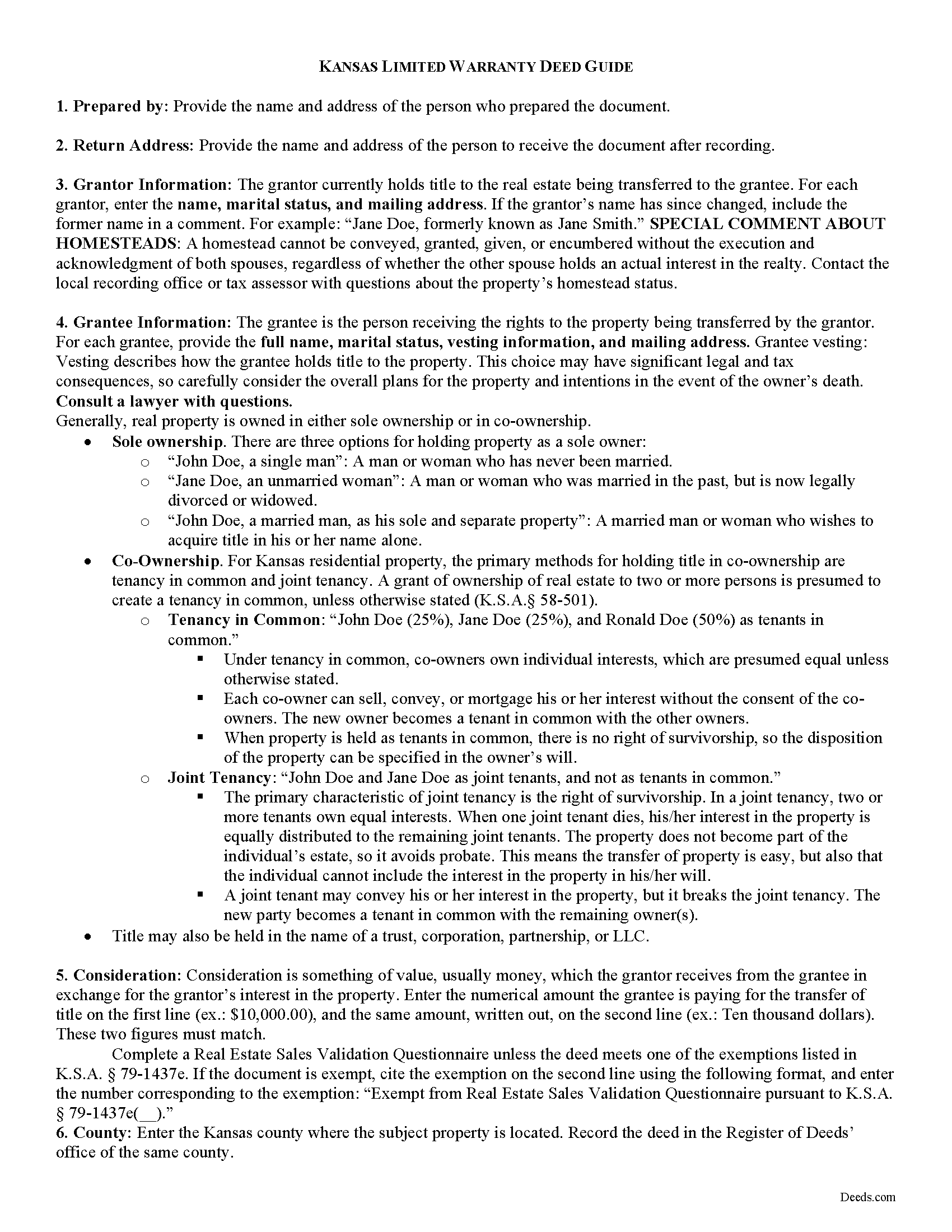

Line by line guide explaining every blank on the form.

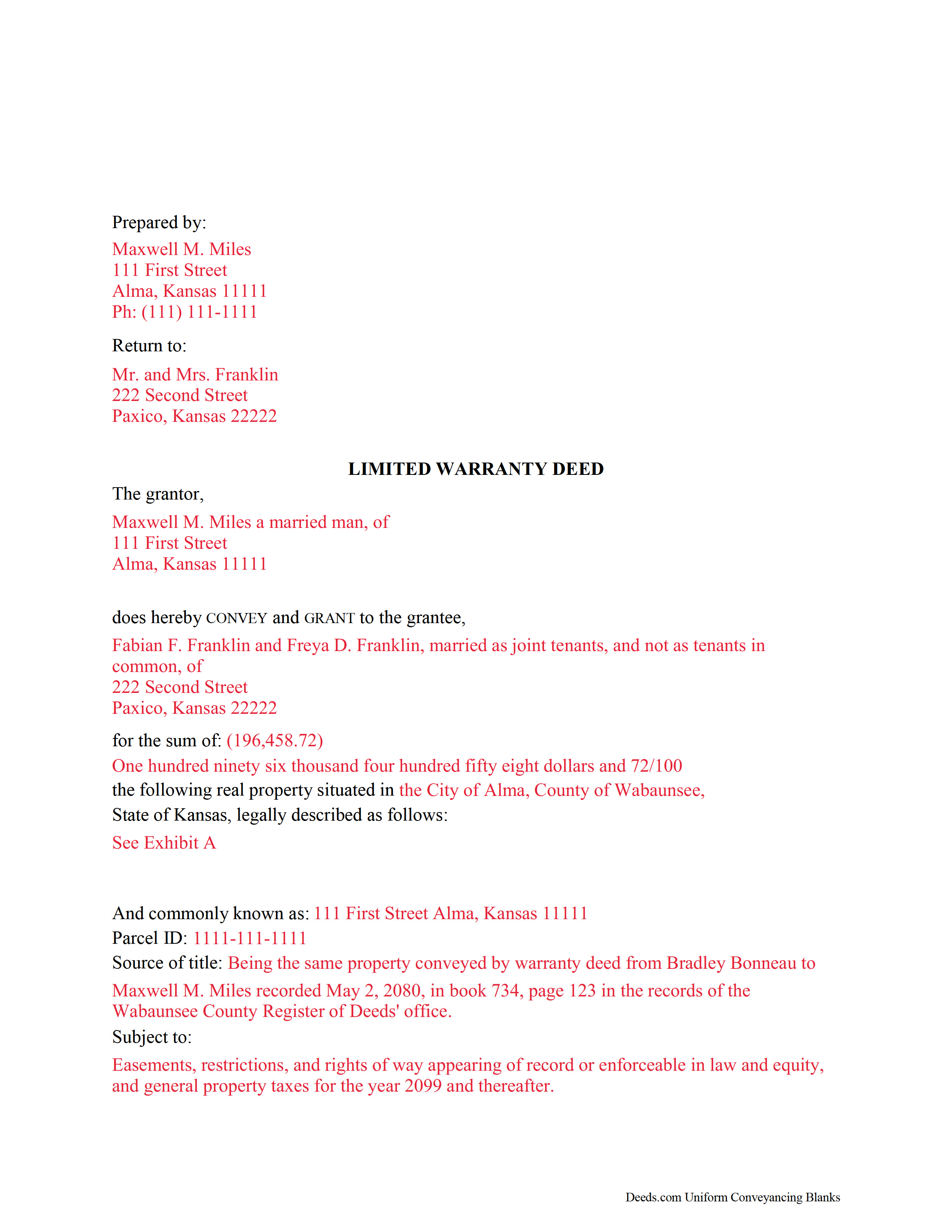

Butler County Completed Example of the Limited Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Butler County documents included at no extra charge:

Where to Record Your Documents

Butler County Register of Deeds

El Dorado, Kansas 67042

Hours: 8:00 to 5:00 M-F

Phone: (316) 322-4113 or (800) 822-6803

Recording Tips for Butler County:

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Butler County

Properties in any of these areas use Butler County forms:

- Andover

- Augusta

- Beaumont

- Benton

- Cassoday

- Douglass

- El Dorado

- Elbing

- Latham

- Leon

- Potwin

- Rosalia

- Rose Hill

- Towanda

- Whitewater

Hours, fees, requirements, and more for Butler County

How do I get my forms?

Forms are available for immediate download after payment. The Butler County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Butler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Butler County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Butler County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Butler County?

Recording fees in Butler County vary. Contact the recorder's office at (316) 322-4113 or (800) 822-6803 for current fees.

Questions answered? Let's get started!

A limited warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). This type of deed provides significant liability protection for the grantor, and less protection for the buyer. In a limited warranty deed, the grantor only warrants against defects in the title during his or her ownership, and that he or she is authorized to sell the property. However, it does not guarantee freedom from claims on the title originating before the grantor owned the property.

A lawful limited warranty deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

As with any conveyance of real estate, a limited warranty deed must meet all state and local standards for recorded documents. It also requires a complete legal description of the parcel. Include the derivation of the grantor's title to the property to prove a clear chain of title, and detail any restrictions associated with the property.

Within Kansas, a deed must be acknowledged by a county clerk, register of deeds, or mayor or clerk of an incorporated city (K.S.A. 58-2211). Any deed that has been executed and acknowledged in another state before a person authorized by the Uniform Law on Notarial Acts will still be valid (K.S.A. 58-2228). The deed must be signed by the grantor, then acknowledged and recorded as directed by K.S.A. 58-2205.

Submit the deed for recording in the county where the property is located. Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording. Complete a Real Estate Sales Validation Questionnaire for the deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Contact the local recording office with questions.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Limited Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Butler County to use these forms. Documents should be recorded at the office below.

This Limited Warranty Deed meets all recording requirements specific to Butler County.

Our Promise

The documents you receive here will meet, or exceed, the Butler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Butler County Limited Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

David M.

August 9th, 2023

A real boon to those of us who are not attorneys but wish to protect our assets and avoid probate court issues. Thank you for a great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shirley W.

August 26th, 2021

I found the form easy to file out. But everything else was confusing with very little direction and help.

Thank you!

Kenneth H.

October 13th, 2021

The deeds.com website is incredibly easy to navigate and the nearly instantaneous chat function allowed me to quickly correct an entry error I made uploading a document. The day after enrolling and uploading the document I had a copy of the document properly filed. Very efficient; very effective.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet P.

July 30th, 2021

Extremely easy to use. The guide and sample were a great source of reference.

Thank you for your feedback. We really appreciate it. Have a great day!

David K.

August 9th, 2021

My 1st trip to your site. I give it a full 5-star rating! Thank you. I'll be back.

Thank you for your feedback. We really appreciate it. Have a great day!

Jack B.

May 2nd, 2020

The service was fast, but I didn't learn about the results until I logged in. I would have liked to get email when the report was finished.

Thank you for your feedback. We really appreciate it. Have a great day!

Shonda S.

April 5th, 2023

This is my first time using the site for business and I must say this site made it so easy for me. I was so lost, thank you so much.

Thank you!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

Jim D.

October 28th, 2020

A bit pricey for someone on a fixed income.

Thank you!

Adelola O.

April 28th, 2020

I called the county clerk office yesterday that i wanted to get a deed e-filed and recorded. I was told they are not accepting documents in person because of the COVID 19 pandemic that I have to mail it. I found Deeds.com online and in less than 24hrs i have my document. Thank you!!!!! $15....Totally worth it.

Thanks Adelola, glad we could help.

Scott S.

June 18th, 2021

Awesome service. I'm impressed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Klint D.

October 2nd, 2020

Quick and easy

Thank you!

Lara C.

September 14th, 2022

Love it! It was super easy. Will be back!

Thank you for your feedback. We really appreciate it. Have a great day!

Jerome R.

July 26th, 2023

Deeds.com handled my needs quickly and very economically. I would recommend them to anyone needing the services they offer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JoAnn T.

October 7th, 2022

Very happy! This was a very easy to use web site, the form came with directions and an example, both were very helpful. I will absolutely use Deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!